Summary:

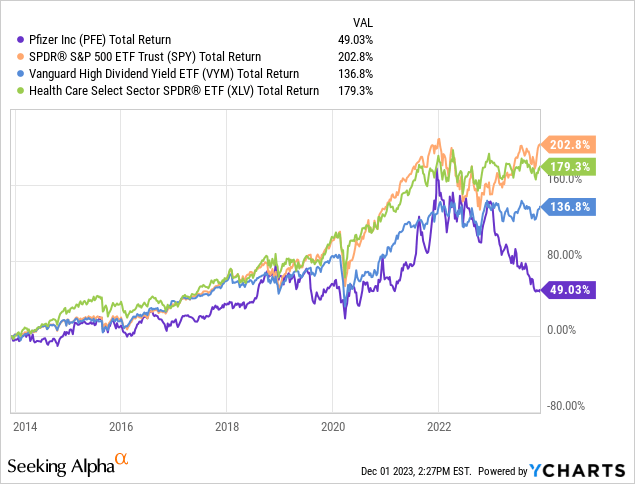

- Pfizer has underperformed the S&P 500, healthcare stocks, and high-yield stocks since 2013.

- The company’s weight-loss pill has faced setbacks and is not competitive with leading drugs from other pharmaceutical companies.

- Pfizer is adapting by focusing on a once-daily version of the weight-loss pill and exploring mergers to strengthen its position in the market.

Dan Kitwood/Getty Images News

Introduction

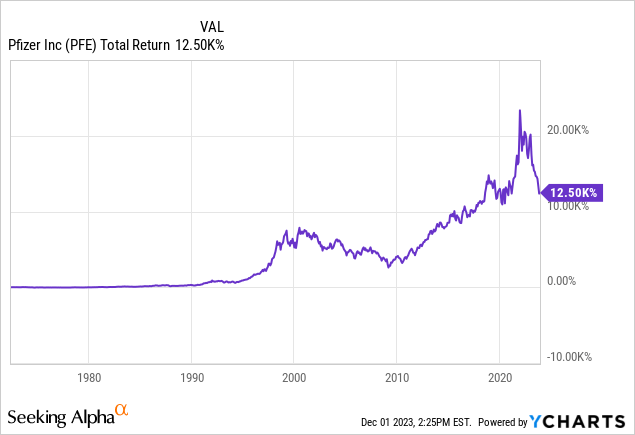

It’s time to talk about Pfizer (NYSE:PFE). Since the 1970s, the company has returned 12,500%, helping countless investors reach their financial goals.

When adding the many blockbuster drugs it had in the past, it’s truly one of the most iconic healthcare and dividend companies on the market.

The problem is that this pharma company has run into tremendous headwinds, ruining the total return picture for investors who bought the stock more “recently.”

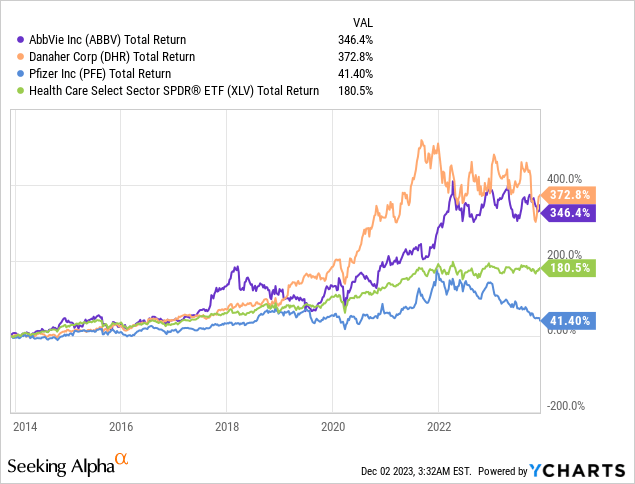

Going back to the end of 2013, Pfizer has underperformed the S&P 500, healthcare stocks (XLV), and high-yield dividend stocks (VYM) by a wide margin.

What bothers me a bit is that this isn’t just a random stock price decline.

We’re dealing with deeper issues that I’m addressing in this article.

After increasingly focussing on healthcare stocks this year, I believe there are a few categories of companies. I’m obviously painting with a broad brush, so please feel free to add to this in the comment section.

In this case, I’m excluding producers of medical devices and support services, as well as smaller biotech companies that wait for a major breakthrough or an M&A offer.

- Group one is biotech companies that have everything going in their favor. This includes a strong existing product portfolio as well as a promising pipeline. In this group, I would put companies like Vertex Pharmaceuticals (VRTX).

- Group two consists of biotech companies with weakness in their existing portfolio due to the loss of one or more patents. However, they have a strong pipeline of new products and promising M&A projects. In this group, I would put AbbVie (ABBV), which I have in my dividend growth portfolio.

- Group three are companies that have weaknesses in their current portfolio and elevated uncertainties regarding the potential success of their pipeline. I would put Pfizer in this group.

The biggest bull case would be a return to group one. That could come with a very high yield on cost for investors in the future and elevated capital gains.

Unfortunately, the latest news of its failed weight-loss pill news certainly didn’t help its case.

In this article, I’ll discuss these issues and explain what I think of the risk/reward going forward.

So, let’s get to it!

It’s All About Weight Loss Pills

If there’s one thing Pfizer has been known for, it’s the company’s role in the pandemic and the fact that it’s one of the few companies with a vaccine.

I have to be honest when I say that this vaccine was one of the reasons why I did not cover Pfizer in recent years, as the controversy was just too much.

Generally speaking, I tend to avoid “battleground” stocks.

With that in mind, while 2020 and 2021 were all about the race for the most successful COVID-19 vaccine, the post-pandemic years seem to be all about who has the best weight-loss drugs.

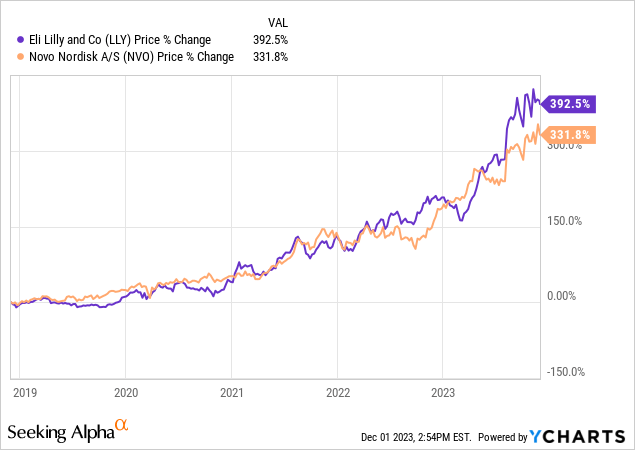

As reported by Bloomberg, weight-loss shots by Eli Lilly (LLY) and Novo Nordisk (NVO) have achieved substantial success, propelling them to high valuations and attracting other pharmaceutical companies.

Pfizer, AstraZeneca (AZN), and others plan to develop weight-loss pills to tap into a $100 billion market within seven years.

Unfortunately, things haven’t gone as planned.

Pfizer had anticipated that pills would capture a third of the obesity market, with danuglipron as a key player.

However, the company faced a setback earlier in June when another experimental obesity drug was discontinued due to safety concerns.

The recent trial of danuglipron revealed high rates of adverse events, including nausea in up to 73% of patients, vomiting in about 47%, and diarrhea in up to 25%.

Unsurprisingly, according to Bloomberg, analysts suggest that Pfizer’s pill does not appear competitive with leading drugs from Lilly and Novo Nordisk.

In other words, the market is now stomaching the news that the company’s aim to develop a pill that could generate a third of a $100 billion market in the future is failing.

As a result, the stock is suffering.

Having that said, it’s not all bad.

Pfizer Is Evolving – It Has To

Despite this setback, Pfizer plans to continue developing a once-daily version of danuglipron that may be better tolerated by patients.

So far, and according to Bloomberg, early-stage data from this pill is expected next year.

Analysts speculate that Pfizer may explore mergers and acquisitions to strengthen its position in the competitive obesity category.

The problem is that this adds so much more uncertainty to the company.

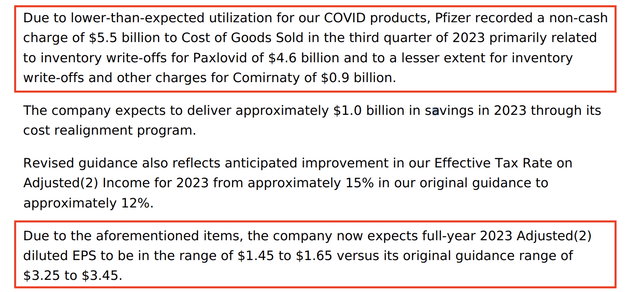

After all, the disappointment in obesity drug development comes as Pfizer seeks to fill a revenue gap left by declining pandemic-related sales.

The company recently revised its annual sales forecast, citing reduced revenue from COVID-19 shots and the Paxlovid pill, which is a co-packaged anti-viral medication for COVID-19 patients.

As we can see below, it was a very significant guidance adjustment.

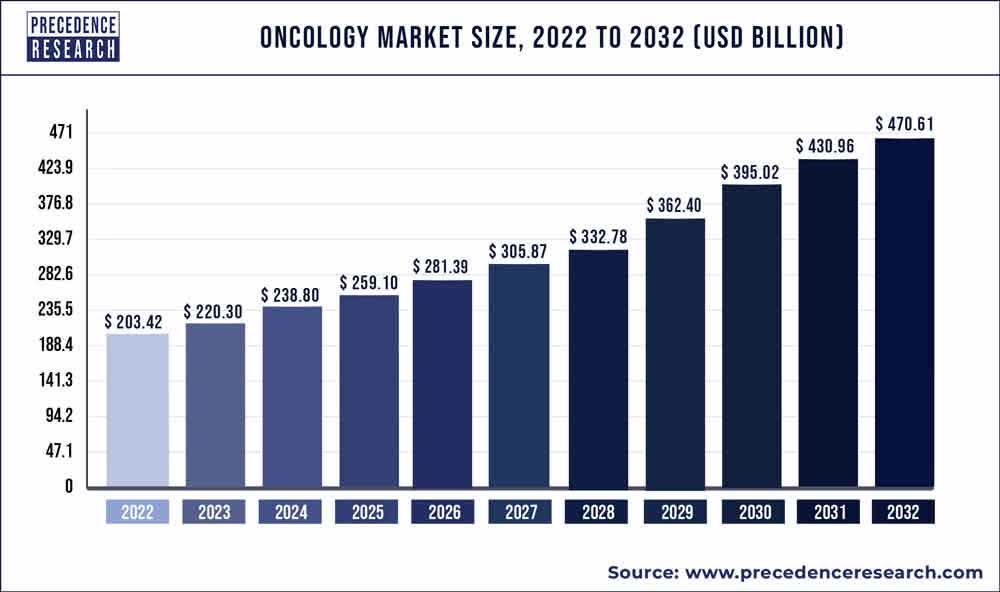

In addition to obesity, Pfizer is redirecting efforts toward cancer research, exemplified by its $43 billion agreement in March to acquire Seagen, a leading maker of antibody-drug conjugates in the oncology field.

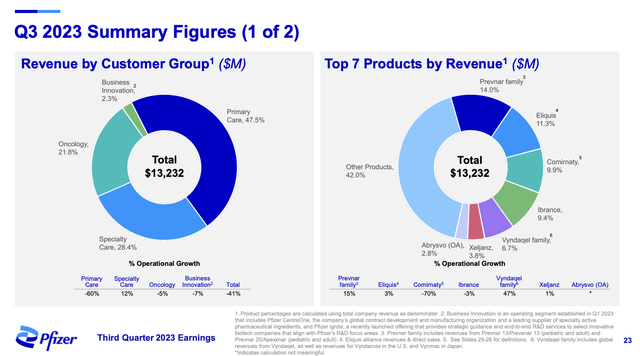

As of 3Q23, slightly more than a fifth of the company’s revenues came from Oncology, which may be one of the most fascinating areas in the healthcare sector, I think.

When it comes to Seagen, there’s good news.

Pfizer has successfully gained unconditional antitrust clearance from the European Commission for the acquisition. The company anticipates the transaction to close in late 2023 or early 2024, subject to customary closing conditions, including clearance by the U.S. Federal Trade Commission (“FTC”).

To facilitate the acquisition, Pfizer has raised $31 billion in acquisition financing.

The anticipated financial benefits include incremental 2030 risk-adjusted revenues exceeding $10 billion.

Additionally, cost efficiencies of $1 billion are expected to be realized by the end of year three post-close without adversely impacting any research and development programs.

By combining Pfizer’s capabilities with Seagen’s expertise in the field of cancer, the acquisition aims to create a powerhouse in oncology research and treatment, especially with a focus on ADC technology.

ADCs combine the specificity of monoclonal antibodies with the potency of cytotoxic drugs, targeting cancer cells more precisely.

If the company is successful, the collaboration is expected to yield a robust pipeline of ADC candidates, potentially addressing various types of cancer.

Not only is cancer a horrible disease that desperately needs better medication, but it’s also a rapidly rising market.

Estimates are that this market is growing at 8.8% per year through 2032, turning into a market of close to $500 billion.

Precedence Research

In general, M&A and business development are key to Pfizer’s strategy.

Hence, unsurprisingly, during the most recent Truist Securities Biopharma Symposium, the company highlighted that it employs a rigorous evaluation process for potential business development deals, with criteria centered around delivering genuine breakthroughs for patients, substantial revenue contribution, and adding tangible value.

While Pfizer is very upbeat about its future, it also acknowledges the challenges it may face between 2025 and 2030, particularly in managing the impact of significant patent losses.

According to PharmaVoice, the healthcare industry is expected to see 190 drug patent losses by 2030 – 69 of these drugs are blockbuster drugs. This could cause a 46% revenue decline for the world’s ten largest pharma companies over the next decade.

Pfizer’s deal with Seagen could help offset losses from patent expirations, including Eliquis, Ibrance, and Vyndaqel in 2027-2028.

Currently, these drugs account for 27.4% of its (3Q23) sales, which is a big deal! It also shows the importance of getting the right drugs on track.

This isn’t just about growing market share but protecting the existing business.

Where’s The Shareholder Value?

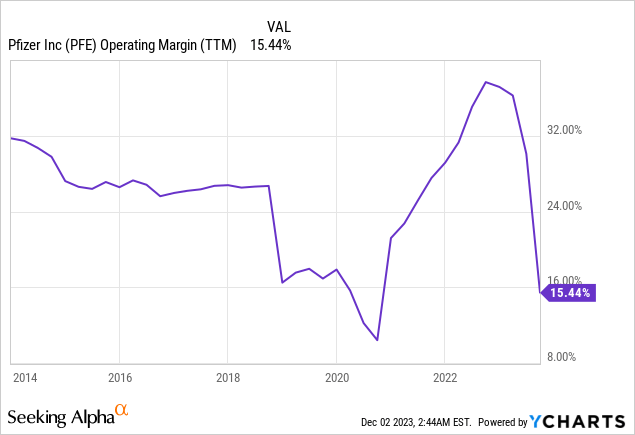

Because of lower pandemic-related demand and related struggles, the company’s margins have been under pressure.

As a result, Pfizer is working on a cost realignment program, which aims to achieve at least $3.5 billion in net cost savings by the end of 2024.

The targeted savings include $1 billion in 2023 and an additional $2.5 billion in 2024.

With that said, the company’s capital strategy is based on three pillars. I added emphasis to the quote below.

As discussed in prior quarters, our capital strategy is based on three core pillars. First is reinvesting in our business. Second is growing our dividends over time. And third is making value-enhancing share repurchases. In the first nine months of 2023, we invested $7.9 billion in internal R&D, returned $6.9 billion to shareholders via our quarterly dividend, and allocated approximately $43 billion towards the proposed Seagen acquisition. – PFE 3Q23 Earnings Call

When it comes to reinvesting in its business, I believe Pfizer is making the right moves. By protecting R&D and focusing on major M&A deals to offset patent losses and potentially capture a big share of rapidly growing markets, it’s reducing risks as much as possible without sacrificing long-term growth potential.

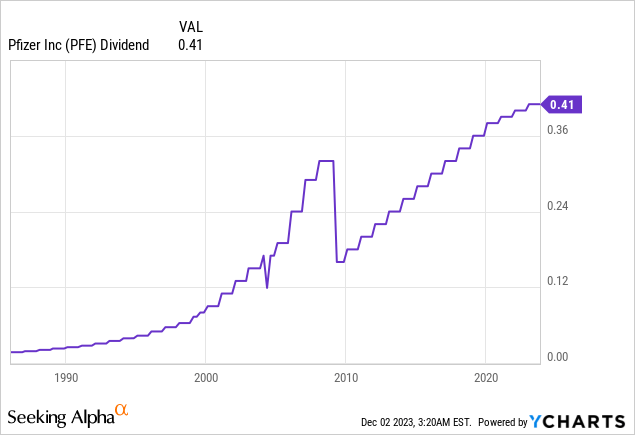

With regard to pillar two, the company currently pays $0.41 per share per quarter in dividends. This translates to a yield of 5.7%, which is one of the highest yields among S&P 500 members. According to my own numbers, it would make Pfizer the 17th-highest-yielding index member.

The five-year dividend CAGR is 5.0%. On December 9, 2022, the company announced a 2.5% dividend increase.

The company has hiked its dividend every single year since its dividend cut in 2009. Back then, it engaged in a $68 billion M&A deal to diversify its portfolio, which required a dividend cut to protect financial stability.

The dividend is protected by a 52% 2024E earnings payout ratio.

It’s also protected by Pfizer’s healthy balance sheet.

This year, the company is expected to end the year with $21.6 billion in net debt. That would be a significant increase from $13.1 billion in 2022. However, it still does not push its net leverage ratio above 2.0x EBITDA.

Next year, net debt is expected to fall to $14.2 billion, which would imply a sub-0.7x net leverage ratio. It has an A+ credit rating.

Bear in mind that Pfizer is a company that is expected to generate more than $18 billion in free cash flow in both 2024 and 2025.

This implies an 11% free cash flow yield, which covers its dividend, allows the company to quickly reduce leverage, and buy back stock.

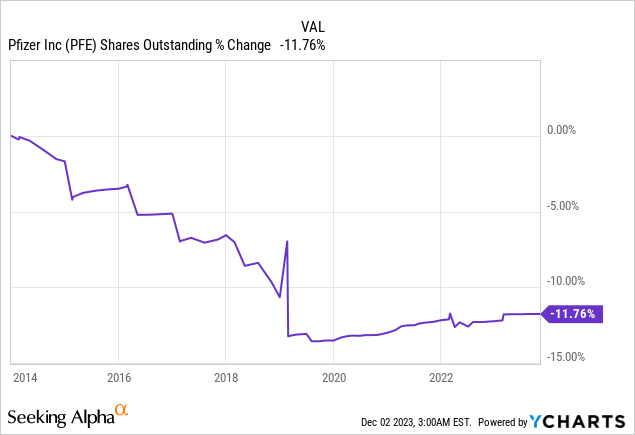

Over the past ten years, Pfizer has bought back roughly 12% of its shares.

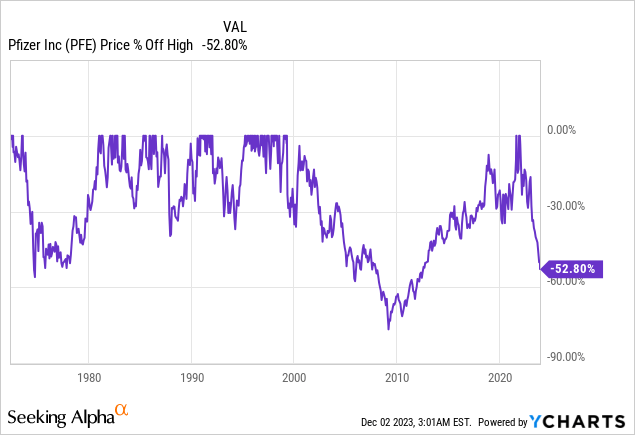

With all of this in mind, due to post-pandemic headwinds, patent loss risks, and what I believe to be general funding risk fears in the market due to elevated rates, the stock is currently trading more than 50% below its all-time high, making it one of the three worst sell-offs of the past fifty years.

This has made the valuation quite juicy – at least on paper.

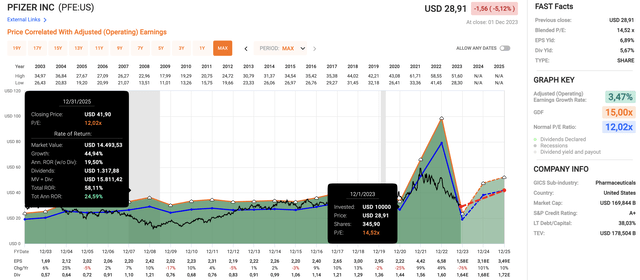

Using the data in the chart below:

- PFE shares currently trade at a blended P/E ratio of 14.5x.

- The normalized valuation multiple over the past twenty years is 12.0x.

- Although it may seem like Pfizer is trading at a premium, it is mainly caused by the post-pandemic impact on its earnings. 2023 EPS is expected to decline by 76%, followed by a 101% increase in 2024.

- In 2025, EPS is expected to increase by 10%.

If the company were to maintain its 12.0x fair valuation multiple, it could return (including dividends) more than 24% per year through 2025 until it reaches $42 per share, which is the current fair value based on its growth projections and current valuation. That number can also be seen in the chart above.

The $42 target is roughly 45% above its current price. The current consensus price target is roughly $40.

Although this is a theoretical number, I believe the value at current levels is quite attractive.

The question is how attractive Pfizer is for long-term investors. In this case, I’m hinting at ongoing patent loss risks and the risks that come with potential trouble in its existing pipeline. There isn’t much error for failure.

It won’t cause the stock to go under. It’s way too strong for that. However, I see elevated risks of prolonged underperformance.

Although I have put Pfizer on my watchlist, I still prefer companies with lower portfolio risks or companies that supply biotech research products.

For example, one of my core portfolio holdings is Danaher (DHR). While its sub-1% yield does not make it attractive for income-focused investors, it benefits from the general focus on R&D to avoid massive patent loss gaps in the healthcare sector. It has pricing power and a different risk profile, as it sells equipment to a wide range of biotech and healthcare companies.

Furthermore, I prefer stocks like AbbVie. Despite the high likelihood that Pfizer may have a higher return over the next three years, I’m more comfortable with its product pipeline and existing portfolio.

I’m not saying this to get people to sell Pfizer and jump into stocks that I own but to explain what is going on in my head when I assess Pfizer’s risk/reward.

On the one hand, I believe that Pfizer has the potential to do really well. If it gets a breakthrough in cancer research and succeeds in filling patent loss gaps through 2028, it could come back much stronger in four to five years.

On the other hand, new headwinds, like trouble with its weight-loss pill, could keep the company from turning into a long-term growth stock.

In light of these risks and opportunities, investors have the company’s dividend going in their favor.

If I were to accept longer-term risks, I could get paid close to 6% while waiting for the company to get back on track!

Hence, I give Pfizer stock a Buy rating.

Takeaway

Pfizer faces challenges with its weight-loss pill setback, impacting its stock performance.

Despite this, the company is adapting by focusing on a once-daily version of danuglipron and exploring mergers for competitiveness.

Pfizer’s shift towards oncology, highlighted by the Seagen acquisition, aims to offset declining pandemic-related sales.

The company’s dividend remains robust, boasting a 5.7% yield, supported by a healthy balance sheet and a commitment to shareholder distributions.

While Pfizer’s current valuation appears attractive, potentially prolonged underperformance raises caution.

Investors must weigh the risks and rewards, considering Pfizer’s potential in cancer research against uncertainties in its pipeline and patent losses.

Meanwhile, the dividend offers a 6% yield, providing income while awaiting a potential turnaround.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV, DHR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.