Summary:

- Pfizer’s stock is undervalued with a 48% upside potential, supported by robust product pipelines, strategic initiatives, and a high 5.94% forward dividend yield.

- Recent pipeline developments, including new cancer treatments and promising vaccine results, highlight Pfizer’s commitment to innovation and strategic partnerships.

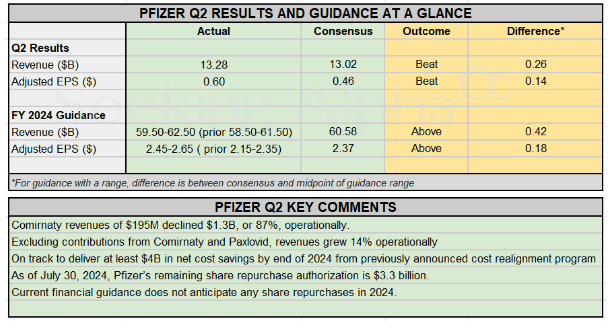

- Q2 results exceeded expectations, with revenues of $13.28 billion and an adjusted EPS of $0.60, leading to an increased FY2024 revenue guidance.

- Despite risks from patent expirations, Pfizer’s substantial R&D investments and history of innovation position it well for future growth and new product development.

JHVEPhoto

My thesis

After publishing a bullish thesis on Pfizer (NYSE:PFE) on June 5, the stock initially rallied, climbing to over $30 per share by the end of July. This surge seemed to validate the optimistic outlook. Pfizer’s initial momentum, unfortunately, didn’t last. The stock price dropped sharply following the Q2 earnings report release. This decline was particularly notable given the broader market context. While the overall stock market grew by 3% during this period, Pfizer’s stock went against the trend. In the end, investors saw a negative return of 2% on their Pfizer holdings.

Despite the recent pullback in PFE’s price, my updated stock analysis suggests that there are several positive indicators that reinforce the company’s potential. Key factors such as robust product pipelines, cost control initiatives, and ongoing innovations continue to position Pfizer favorably in the market. The current stock price offers good value. It’s an attractive opportunity for investors seeking a safe, high-dividend yield. These positive signs support my Strong Buy opinion. Pfizer’s fundamentals and future prospects remain aligned with a bullish outlook. There’s no need to downgrade the recommendation.

PFE stock analysis

Developments around Pfizer’s new products pipeline are quite positive. The European Commission approved a new cancer treatment. It combines Merck’s (MRK) Keytruda with Pfizer’s Padcev. This is for the first-line treatment of a type of bladder cancer. The approval covers all 27 EU member states and additional regions. This wide geographic reach is a significant positive sign for Pfizer’s investors.

Moreover, Pfizer’s collaboration with BioNTech has shown promising results in their vaccine pipeline. Pfizer’s combined COVID-19 and flu vaccine had mixed Phase 3 results. It didn’t meet all primary objectives. However, it showed higher influenza A responses. COVID-19 responses were comparable. Additionally, Pfizer’s second-gen trivalent flu vaccine showed promise. Its Phase 2 trial demonstrated robust responses to influenza A and B. These results indicate ongoing progress in Pfizer’s vaccine development efforts.

Lastly, Pfizer’s collaboration with Quotient Therapeutics marks another promising development in its pipeline. Pfizer’s partnership analyzes patient tissue mutations. It aims to find new targets for heart and kidney disease therapies. This is promising, as the kidney disease market is forecast to grow 7.5% annually by 2027. The cardiovascular drug market is also substantial. It is expected to reach $232 billion by 2030. These trends bode well for Pfizer’s strategic focus.

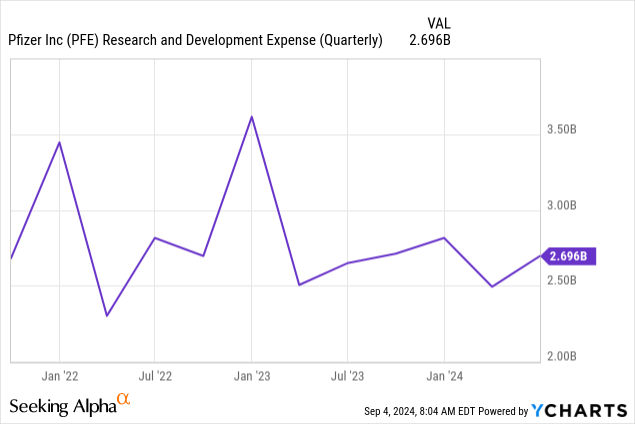

From a strategic perspective, these pipeline developments highlight Pfizer’s commitment to innovation and strategic partnerships. Pfizer invests heavily in research and development. They spend between $2.5 billion to $3 billion each quarter. This investment boosts their chances of creating new, profitable products. The company had 113 candidates in its pipeline as of July 30, 2024.

The company’s recent performance also deserves bullish comments. Their Q2 results exceeded expectations from consensus. Q2 revenues reached $13.28 billion, surpassing the $13.02 billion consensus estimate. The adjusted EPS was $0.60, beating the expected level of $0.46. What is also crucial is that Pfizer’s outlook is positive, as the management have raised their revenue guidance for FY2024. The new range is $59.50-62.50 billion, up from $58.50-61.50 billion. This increase shows confidence in their operations and strategies.

Seeking Alpha

The optimism is also backed by the commitment to control costs, which is crucial for sustaining its attractive forward dividend yield of 5.94%. By implementing strategic cost realignment programs and optimizing manufacturing processes, Pfizer aims to achieve significant savings, targeting at least $4 billion in net cost savings by the end of 2024. This disciplined approach not only supports the company’s financial health but also ensures that it can continue to provide compelling payouts to shareholders.

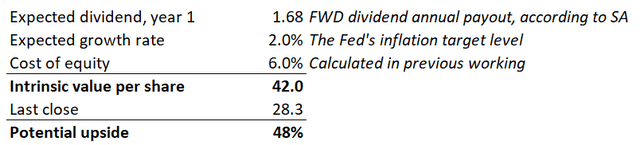

Intrinsic value calculation

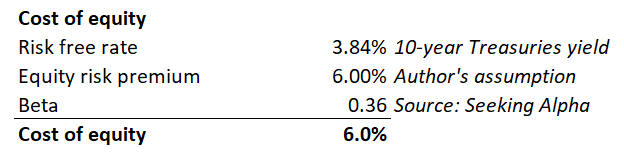

Figuring out the discount rate is the starting point of my intrinsic value calculation. For the dividend discount model (DDM) approach, the cost of equity is the discount rate. In the below working, I outline how I calculated Pfizer’s cost of equity, including comments regarding the sources of the input data.

DT Invest

The discount rate is 6% for PFE’s DDM. Since all other assumptions for the DDM are relatively easily available, I can calculate PFE’s intrinsic value straight away. DDM assumptions and sources where I got them are also described in the next working below.

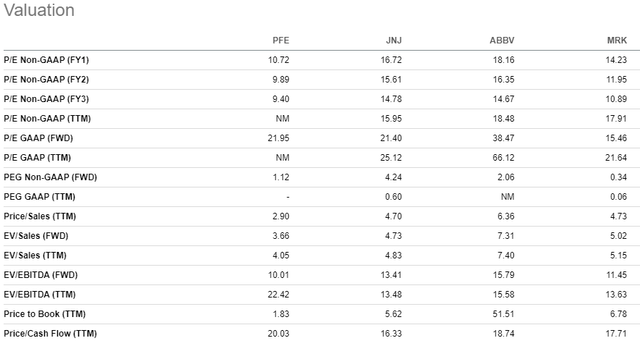

PFE’s intrinsic value is $42. This value is 48% higher than the last close, meaning that PFE is extremely chap. Moreover, comparing Pfizer’s valuation against close rivals also suggests undervaluation. PFE is almost the same in terms of revenue as AbbVie (ABBV) and Merck. However, its market cap is around twice lower than ABBV and MRK. PFE is also much cheaper than peers from the price-to-book ratio point of view.

A massive discount for a stock like PFE is not normal, and there is a big reason for that. Pfizer is extremely cheap for a reason, which I explain in my next passage.

What can go wrong with my thesis?

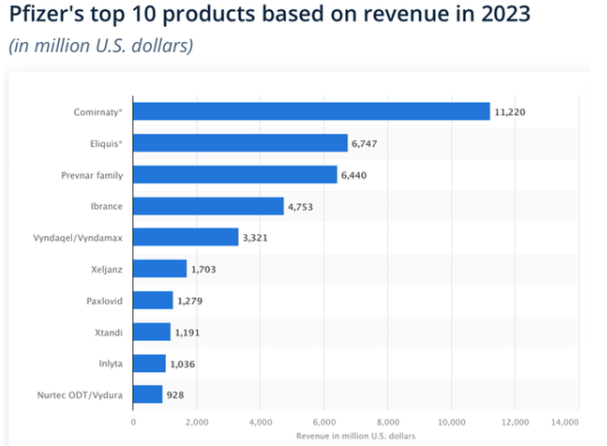

According to long-term consensus projections, Pfizer’s revenue and EPS are expected to show very low growth over the next ten years. Such a cautious forecast from Wall Street analysts is explained by the approaching patent expiry of the two stellar products. In the below chart, we can see that Eliquis and Prevnar generated around $13 billion in 2023 revenues together, and their U.S. patents are both expiring in 2026. There is a significant risk that Pfizer will be unable to substitute in full revenue from these big products by 2026.

Statista

Pfizer has a rich history dating to the 19th century. The company has weathered many cycles. Top products have lost exclusivity, but new leaders emerged. According to the latest annual report, 2023 was a banner year for Pfizer’s FDA approvals. Their R&D budget remains substantial. This increases the likelihood of developing high-demand new products. Pfizer’s adaptability and innovation continue to drive its success in the pharmaceutical industry, which means that fears are likely exaggerated here.

Summary

I think that Pfizer’s stock is extremely cheap. There is a risk of the company’s several big products patent expirations, but developments around new products pipeline are quite positive, and the company invests loads of money in R&D. There does not guarantee success, but Pfizer has a vibrant history and experienced several cycles of stellar products losing their exclusivity and the new ones taking over the crown. Therefore, I remain very optimistic. Almost a 6% forward dividend yield is also very hard to ignore.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.