Summary:

- Investors stampeded out of Pfizer stock this week, driving it to a 52-week low.

- A pivotal moment for investors emerged as they scrutinize the possible Seagen acquisition, presenting a golden buying opportunity.

- As COVID cases decline, Pfizer faces significant headwinds, with analysts revising their profitability estimates further downward.

- Investors are hit with another layer of concern as Seagen is projected to remain unprofitable in FY23.

- We discuss why PFE stock is now a Strong Buy.

JHVEPhoto

We turned bullish on Pfizer Inc. (NYSE:PFE) stock in early February, anticipating a near-term bottom from its steep pullback from its mid-December highs.

However, the stock went on to re-test its October 2021 and October 2022 lows, effectively taking out dip-buyers at those levels.

The move by the market operators to form a new 52-week low and shake out these holders is significant. Moreover, it has likely helped to reset the buying sentiments for PFE after the Wall Street Journal announced the company’s potential acquisition of Seagen Inc. (SGEN), which focuses on targeted cancer therapies.

Our assessment indicates a false downside breakdown, or bear trap, suggesting buyers returned late on Friday to lift PFE’s buying pressure back up. It was a notable move and one that PFE investors should follow.

So what happened that led to such a steep selloff in PFE that caused investors to lose confidence rapidly in two months? Notably, PFE collapsed nearly 30% in price-performance terms, likely stunning even the most fervent PFE investors forced to stomach such massive volatility.

We believe part of the move could be explained by Pfizer’s recent earnings release, which we presented previously, as the market adjusted to the company’s lowered outlook for its COVID franchise moving ahead.

As such, the consensus estimates over Pfizer’s forward adjusted EBITDA profitability have been revised significantly since then, as analysts grew increasingly concerned over Pfizer’s peak profitability.

Accordingly, Pfizer is projected to deliver a revised adjusted EBITDA profitability of $26.1B in FY23. However, that’s a steep markdown from early February’s estimates of $29.8B.

We believe it suggests analysts have likely penciled in more downbeat modeling implying that Pfizer could be forced to take more significant inventory charges as COVID cases could continue to decline. With that in mind, the market will need to price in higher uncertainties relating to its inventory, impacting its profitability further.

Furthermore, the potential Seagen acquisition also brings in another riddle for investors to solve. The market had already reacted to WSJ’s exclusive, suggesting investors believe the deal could go through, despite a more hawkish FTC under Lina Khan’s leadership.

The lack of significant overlap between Pfizer and Seagen should see “few regulatory barriers” for Pfizer to consummate the deal. Moreover, Pfizer needs to spend its cash coffers while still generating significant free cash flow or FCF profitability.

Notably, the company needs to bolster investors’ confidence in its $25B “de-risked revenue” stream through 2030, and Seagen could provide the answer. Why?

Analysts’ projections indicate that Seagen’s revenue is expected to increase rapidly from $2.3B in FY23 to $6.4B by FY27, implying a 4Y CAGR of 29.2%. As such, it makes sense as Pfizer needs to generate significant topline growth to mitigate the $17B patent cliff and provide visibility for its revenue runway.

Despite that, Seagen is not expected to be profitable in FY23 (adjusted EBITDA margin of -22.4%). As such, the integration could be dilutive to Pfizer’s corporate profitability, suggesting investors will need to reflect the impact on its bottom line if the deal goes through.

We believe the reaction over the past week, as PFE notched a 52-week low, suggests that investors have priced in such headwinds ahead of time and expect the deal to be consummated.

Moreover, SGEN’s market cap is now worth nearly $34B. Hence, a deal between $35B to $40B (20% premium) could be likely. However, Pfizer can well afford it, as the company is still projected to drive more than $80B in FCF through FY26.

With that in mind, what does PFE’s price action indicate, as market operators likely forced out dip-buyers from October 2021?

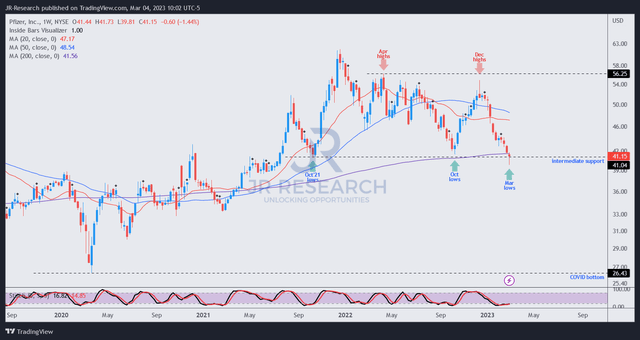

PFE price chart (weekly) (TradingView)

PFE re-tested its October 2021 lows, but buyers stormed in at the close of the week’s trading, forming a bear trap.

That price action is significant, supported above PFE’s 200-week moving average or MA (purple line), with its momentum already in the oversold zone.

Hence, the opportunity for a pivotal buying moment is here for PFE investors.

With that in mind, an upgrade to our previous rating is appropriate.

Rating: Strong Buy (Revised from Buy).

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking to strategically enter the market and optimize gains?

Unlock the key to successful growth stock investments with our expert guidance on identifying lower-risk entry points and capitalizing on them for long-term profits. As a member, you’ll also gain access to exclusive resources including:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!