Summary:

- Pfizer presents a buying opportunity as value has deepened following weak price action due to post-pandemic revenue concerns.

- Aggressive yet speculative acquisitions demonstrate a commitment to pipeline diversification in an effort to grow into new and unique areas.

- Executives have suggested attention will turn to share buybacks and dividend growth as acquisitions slow down and capital returns flow in.

- A sustainable dividend, moderate undervaluation and high operational efficiency render a great position to build back up from.

Alexandros Michailidis

Investment Thesis

Pfizer (NYSE:PFE) presents an attractive Buying opportunity; weak share price action has revealed deeper value, as pipelines are bolstered through a speculative yet well diversified acquisition spree. As acquisitions halt, investment returns will likely be redirected towards shareholder rewards, improving sentiment and boosting share prices. In the meantime, sustainable yet impressive dividend growth will tide over investors amidst an uncertain FED environment.

Priming for Reversal

The share price of PFE has declined by almost 25% year to date, with pessimism fueled primarily by the concern regarding options for future growth following the pandemic, as well as seemingly sub-optimal and uncertain acquisition strategies. This, in our view, quietly neglects the deep and diverse pipeline enhancement PFE has been focusing so intently on.

Shareholders have perhaps become disappointed and lost confidence in recent times which has guided the share price to a 2-year low. PFE is not alone in this regard, as Moderna (MRNA) is down 27% year to date. Nevertheless, the bulk of the selling pressure seems to have cooled for now.

Looking forwards reveals exciting catalysts that could encourage a trend reversal. Firstly, there are several clinical trial results expected throughout the next couple of years, the results of which will undoubtedly have a tremendous impact on the viability of planned future revenue streams. Recent FDA approval for Abrysvo means that shots can roll out as early as Q3 2023.

As well as this, executives have promised to shift focus towards share buybacks and dividend growth, transitioning their capital allocation principles in the wake of slowing M&A commitments. The feasibility of new capital allocation schemes undoubtedly depends on the success of harvesting profit from business expansion, however a commitment to buybacks is key considering the number of outstanding shares. This may well mark the beginning of a reversal in sentiment.

Continued Pandemic Revenues

Investors are focusing on the strategy regarding the revolve away from pandemic revenues and diversifying future streams, however the FDA is holding an advisory meeting this month to discuss forthcoming shot strain targets. The growing situation in China is an indication that PFE can continue pulling in revenue for the foreseeable future.

Pfizer also agreed to lower minimum dose orders in an extended contract to supply the European Commission. Extended agreements will provide a stream of income despite the relative lack of vaccine demand compared to the highs of the pandemic and negative attitudes towards vaccination.

This also opens opportunity for PFE to continue benefiting from the new oral therapy (Paxlovid) to treat moderate reactions in those most vulnerable to the virus. The cash cow is certainly no longer what it once was, but it isn’t dead just yet.

Paying Premiums to Bolster Pipelines

In the aftermath of falling revenues from COVID products over the last couple of years, PFE have committed to a series of aggressive acquisitions, including Global Blood Therapeutics, Arena Pharmaceuticals, Biohaven Pharmaceutical Holding Company (BHVN) and most recently, Seagen (SGEN). There is clear intent here to continue strengthening unique non-pandemic related intellectual property to generate viable and sustainable sources of income.

The acquisition of SGEN is expected to close Q4 2023 or Q1 2024, a move that has been approved by SGEN shareholders with 99% in favor. Such a positive reaction, coupled with a purchase of $229 per share clearly indicates that Pfizer overpaid for this acquisition. However, this may not be all doom and gloom, since SGEN has been such a strong acquisition target of rivals, this could manifest into a solid strategic move to develop key oncology products; but it is far too early to draw conclusions.

There is also concern over the viability of such an acquisition, SGEN has posted negative income since September 2021, with a current net margin of -32%. To overpay for a prospect that is currently unprofitable certainly leaves questions regarding strategic management. This could give investors the impression that windfall profits are being bet on a series of unproven and unestablished companies.

Another point to account for is that this deal is it to be financed primarily using $31 billion in new long-term debt, a concern amidst higher costs of borrowed capital and the ongoing banking sector worries. This will likely double PFE’s current debt interest liabilities, potentially damaging the bottom line in the short term.

This leveraged commitment is forecast to become particularly accretive around 2030 and beyond, where it is expected that the acquisition will have become fully integrated such that key catalysts throughout 2027 can lead to risk adjusted revenues of around $10 billion. However, it must be noted that this crucially rests on the success of clinical development and necessary approvals. Investors may be left disappointed that share buybacks and debt reduction have not been prioritised, considering the high number of outstanding shares.

Nevertheless, we believe that all things considered these acquisitions will positively transform the business; the commitment to diversifying the pipeline has positioned PFE well to prepare against potential lost revenue streams as patents lose exclusivity in the coming years. Naturally, it will take time for new acquisitions to fully integrate into the wider business; but long-term this is certainly positive for PFE so long as the motivation behind each acquisition unfolds as management expects.

Eating into Weight Loss Markets

Obesity drugs have been a big topic of conversation following the development and approval of products offered by Novo Nordisk (NVO) and Eli Lilly (LLY). This is an area of pharmaceutical treatment that is still largely developing and is forecast to have a global market of $60 billion by 2032.

There is clear incentive for firms to cut into the dominant share of NVO and LLY. The growth of NVO and LLY across the past year is a clear indication of the market’s excitement towards this growing field, with NVO up 46% and LLY up 52% across the last year at the time of writing.

PFE have registered their interest in an effort to increase their exposure to the growing obesity drug market, with firms aside from NVO and LLY expected to grow up to a quarter of the obesity market within the next decade. Despite the clear opportunity present, it may likely be too early to cast any accurate forecast over how this will unfold in the coming years.

A Compelling Trifecta

Upon review of fundamentals, PFE presents an opportunity for investors from three unique angles; income, value and quality.

Sustainable Income

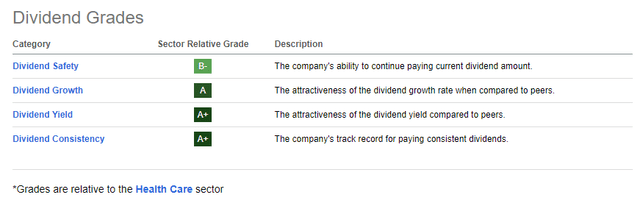

PFE currently offers an excellent forward dividend yield of 4.21%, representing a pay-out ratio of just 26%. This has been growing consistently for the past 12 years and possesses a 5-year growth rate above 5%. The result of this is a phenomenal yet sustainable blue-chip income investment opportunity at current prices, particularly important amidst FED volatility.

Dividend Ratings (Seeking Alpha)

The likelihood of continued dividend growth, as well as the strong possibility of capital gains from what seems like a near-floor price (discussed below) renders PFE an attractive Buy in our view.

Deeper Value

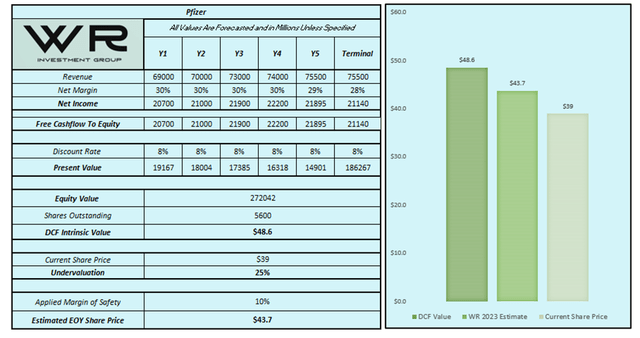

It is clear from Seeking Alpha’s valuation ratings alone that PFE appears a decent value investment at current levels, offering a favorable risk to reward ratio when considering all aforementioned factors. The trailing 12-month P/E ratio currently sits at one third of the sector median.

Following on from this, we have performed a relatively simple DCF valuation to estimate a fair value. From this, we estimate an undervaluation of around 25% and put our end of year target around the $44 mark. There are obviously several assumptions to this model, most notably a 0% terminal growth rate and 8% discount rate.

DCF Valuation (WR Investment Group)

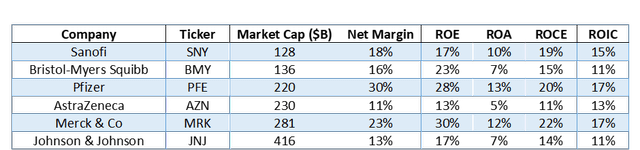

Quality Through Efficiency

This becomes particularly interesting when we compare key marginal and capital metrics between a handful of relevant large companies, shown below. It can be seen that PFE possesses some of the most impressive margins within the scope of companies compared, indicating great efficiency and superb use of capital. This is an effective display of quality in terms of profitability.

This may reinforce investor confidence that PFE is one of the most competitive companies in this sector, capable of capitalizing on market opportunities as they arise, which has been demonstrated across the last few years.

Key Metric Comparison of Relevant Companies (WR Investment Group)

Conclusion

In conclusion, PFE has seen disappointing price action over the last two years following decaying pandemic revenues; but as the selling pressure cools off, attention turns to future potential. There are several products undergoing final phases of clinical trials which have the potential to generate several unique revenue streams going forwards. COVID revenues, although dampened, can still tick over income until these products mature.

As well as this, there has been an aggressive spree of acquisitions, eating into the bolstered balance sheet that the pandemic provided. These acquisitions can be said to have been incredibly bold, as PFE may have overpaid for companies that are relatively speculative and unprofitable. This becomes more concerning when considering that recent acquisitions have been financed by taking on long-term debt.

Nevertheless, it is important to bolster and diversify pipelines in preparation for lost patent exclusivity and to plant roots into growing areas of pharmacology. As well as this, investors will be glad to hear that as acquisitions begin to slow, executives have suggested that a shift in focus towards share buy-backs and dividend growth will occur.

A sustainable yet competitive dividend above 4% renders PFE an attractive income investor opportunity whilst appearing to be undervalued when comparing financial metrics to companies within the same industry. As well as this, an independent DCF calculation estimates that PFE could present a 25% undervaluation.

The final cherry on top here is that key efficiency metrics demonstrate that PFE remains one of the most competitive companies in this sector for generating returns on capital, which will be key to maintaining an edge as new products are released and capital investment income streams flow.

When considering the opportunity for income, quality, and value investors, we place an end of year share price target of around $44 on PFE, justifying a Buy rating from our view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.