Summary:

- PFE has underperformed the S&P 500 after forming its December highs.

- The market is likely still concerned with Pfizer’s execution in a COVID-endemic world, coupled with its loss of exclusivity worth $17B.

- Management is confident it has a viable route to a de-risked $25B revenue stream.

- With its Q4 earnings release slated for January 31, we believe investors will assess its forward COVID vaccine revenue guidance carefully first.

JHVEPhoto

Pfizer Inc. (NYSE:PFE) stock has underperformed the S&P 500 (SPX) (SPY) since forming its mid-December bull trap highs. It posted a decline of nearly 14% (in price-performance terms), compared to the SPX’s 4.5% downtick.

Market operators likely took the opportunity to shake out some weak holders who anticipated PAXLOVID (Pfizer’s COVID anti-viral) could continue playing a critical role in China’s COVID fight.

However, CEO Albert Bourla highlighted at a recent conference that its price negotiations with the Chinese authorities have not panned out yet. Accordingly, the Chinese government was looking for a price lower than what Pfizer had in mind, as Bourla articulated:

So they want it lower than the lowest of the middle, and we didn’t agree. They are the second [largest] economy in the world. And I don’t think that they should pay less than [El] Salvador, right, which is a poor country. So this is where we are now. What are the consequences of that? All the way to April, nothing, we will continue selling. When this is applicable in April, unless something changes, which is one of the possibilities, and we are back in discussions with them, we will continue with the private market in China, which is significant. (JPMorgan Healthcare Conference)

As such, Pfizer could lose access to China’s massive $420B state medical insurance program by the end of March. However, as Bourla highlighted, the game is not lost yet, as they are still in negotiations.

However, it might not be in time for the company to revise its outlook for FY23/24 at its upcoming Q4 and FY22 earnings release on January 31.

PFE has struggled to regain its upward momentum above its July highs. We assessed that market operators are likely still concerned over the company’s $17B loss of exclusivity (LOE) for several products occurring from 2025-30.

While the company has presented a credible roadmap worth $25B through 2030 through 19 new products, questions remain about its execution risks. Coupled with the progressive decline in COVID revenue even as Pfizer moves into the private market, investors need to assess whether the revenue runway from its COVID franchise is sustainable.

Moreover, Bourla articulated that the company’s 70% global market share is unlikely to increase. Also, the global governments’ stock of their COVID vaccines stockpile will need to be exhausted before Pfizer can make further headway into the private market. Hence, we believe the market is likely discounting higher execution risks in 2023/24 even though Pfizer believes COVID will unlikely “disappear.”

As such, Wall Street’s estimates suggest that Pfizer’s COVID hangover could drag further into FY26, with its adjusted EBITDA projected to fall to $27.79B from FY22’s estimated $44.33B. Accordingly, it implies a 4Y CAGR of about -11%.

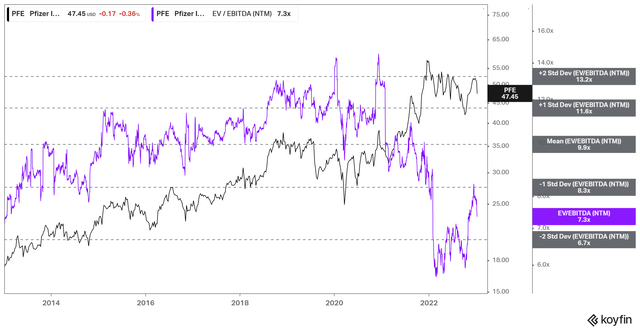

PFE NTM EBITDA multiples valuation trend (koyfin)

Hence, it could explain why the market “refused” to re-rate PFE from its recent valuation lows, as seen above, likely assessing that Pfizer’s earnings could suffer over the next four years.

As such, we believe it makes sense for investors to demand a more considerable valuation discount against its 10Y average of 10x EBITDA. However, PFE last traded at a FY26 EBITDA multiple of 9.6x, hardly a discount.

Notwithstanding, we postulate that PFE’s October lows look robust, as Pfizer’s execution prowess has been proven. A deeper pullback closer to its October lows could be capitalized to add exposure, down nearly 13% from the current levels.

Bourla also highlighted his frustration with the market; as we assessed, he thinks the market is not valuing the company’s COVID portfolio. He stressed:

We will try to do our best to explain [our guidance], but people eventually will have to put their assumptions into test and see if this is a revenue stream that needs to be given [1x] multiple or revenue stream that needs to be given the normal multiple that everybody is getting. (JPMorgan conference)

While we have the utmost respect for Bourla and his team and their execution, we believe investors should accord a higher discount against its forward valuations to improve their reward/risk. However, we could be interested if a deeper pullback occurs.

Rating: Hold (Reiterated)

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!