Summary:

- Pfizer’s stock has struggled to recover since the pandemic, but its high dividend yield of 5.9% makes it an attractive option for income investors.

- The company faces risks from upcoming patent expiries and the impact of rising interest rates on its debt and ability to invest in research and development.

- Despite these challenges, Pfizer’s valuation metrics suggest it is attractively priced, and a dividend discount model estimates a potential upside of over 30% from the current price level.

JHVEPhoto

Overview

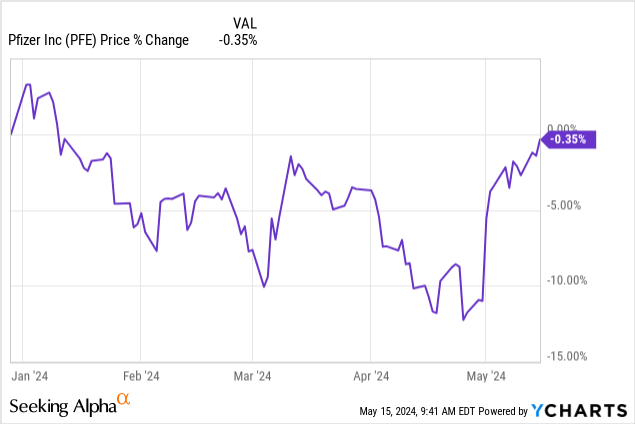

Pfizer (NYSE:PFE) (NEOE:PFE:CA) has struggled to gain any sort of recovery momentum since it suffered losses in revenue coming off the tail end of the pandemic. In addition, the upcoming patent expiries seem to be a source of concern for many investors here as we try to figure out how PFE will whether that storm. I previously covered PFE back in January and rated it a Strong Buy, and the total return since then has been mostly flat.

I wanted to take this opportunity to provide an update valuation analysis as well as cover the strong case for accumulation. The dividend yield still remains a highly attractive aspect of PFE and even if the company doesn’t hit a home run with their turnaround over the next decade, a slow recovery in price and modest growth of the dividend presents an opportunity to build a high-yielding income stream. The current dividend yield sits at a historically high 5.9%. For reference, the average dividend yield over the last 5 years has only been 4%.

In addition, I believe that the price is currently undervalued based on my dividend discount calculation. We have the opportunity to lock in potential large double-digit upsides and get paid a juicy dividend yield while we wait for the price to recover. However, I think it would be fair to first discuss some of the risks that the business must first overcome.

Risk Profile

There are some clear vulnerabilities with PFE that must first be acknowledged. Patient expiries that make up significant portions of their revenue are a challenge that they will have to overcome through additional product development or acquisitions. Taking a look at their latest 10K form, I compiled some of the more recent expiries that will take place over the next two years. Losing these patents means that other competitors can now produce similar medicines at much lower price points, which effectively takes revenue away from PFE.

| Product | US Expiration Year | Europe Expiration Year | Japan Expiration Year |

| Inlyta | 2025 | 2025 | 2025 |

| Xeljanz | 2025 | 2028 | 2025 |

| Prevnar 13 | 2026 | – | 2029 |

| Eliquis | 2026 | 2026 | 2026 |

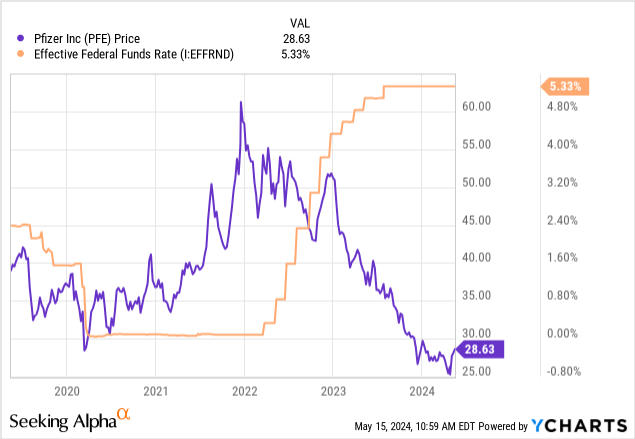

In addition, PFE has been vulnerable to the rapid rise of interest rates that started at the midpoint of 2022. When we take a look at the movement of the federal funds rate in relation to PFE’s price, we can see a bit of an inverse relationship. When rates were near zero after the pandemic, PFE was able to access debt capital at a much more affordable rate to fuel further growth through research and development initiatives. In addition, they pulled in heightened levels of revenue from their Paxlovid Covid-19 drug.

Conversely, when rates started to rise, the price of PFE immediately followed the opposite trajectory. Rates currently remain at the decade high and this makes it difficult to get access to affordable debt to drive further results. Simply put, higher rates can directly translate to being less inclined to take on new projects or investments.

On the topic of debt, PFE has approximately $61.5B of long-term debt at the moment. While the total has improved modestly from $61.8B at the end of 2023, this amount has almost doubled from the total long-term debt of $33.2B from the end of 2022. Ideally, the debt level should not get any higher and the main focus should be decreasing these amounts while rates are higher. Over the last earnings call, we did get some confirmation that the focus on debt is a part of their cash management. Paying down this debt should be achievable considering that PFE has about $8.58B in cash from operations.

We are committed to de-levering our capital structure with a gross leverage target of 3.25x, which we expect to achieve over time. In support of that goal, during the quarter we paid down approximately $1.25 billion in maturing debt and in May we will pay down another $1 billion of outstanding notes. And, importantly during the quarter, we began to monetize our Haleon stake through an initial sale of $3.5 billion which reduced our equity position in the company from 32% to approximately 23%. – David Denton, Chief Financial Officer

Dividend

As of the latest declared quarterly dividend of $0.42 per share at the end of April, the current yield sits at 5.9%. The dividend has been increased for over 13 consecutive years and has increased at a CAGR (compound annual growth rate) of 4.59% over the last 5 years. Zooming out to a longer time horizon of 10 years, the dividend increased at an even higher CAGR of 5.77%. This kind of growth is excellent for a stock that typically already had a yield between 4% – 5%.

This is the kind of dividend growth that is highly appealing to investors looking to add splashes of income to their portfolio. When I seek high yields, I often look to other asset classes such as REITs, Business Development Companies, or even Closed End Funds. However, those asset classes don’t typically distribute tax friendly income that’s classified as qualified dividends. The benefit of accumulating a high yielder like PFE is that the distributions you receive are tax-friendly and can be utilized in a regular taxable brokerage account.

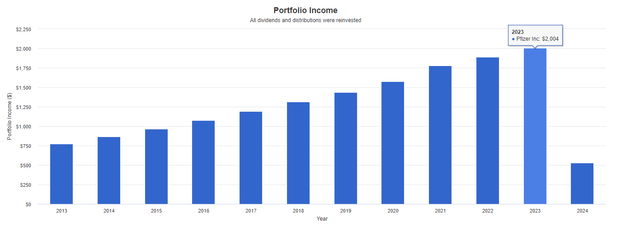

The dividend income growth over time is clear when using tools like Portfolio Visualizer to back test the data. Assuming an initial investment of $20,000 a decade ago, this would have resulted in a consistent level of dividend income growth. This calculation assumes that no additional capital was ever deployed, but dividends were reinvested every quarter. In 2013, your dividend income would have been $775 annually. Fast forward to 2023, and you would now be receiving over $2,000 annually in tax efficient dividend income without having to ever invest additional dollars into PFE.

But how sustainable is this growth? Well, the current payout ratio on Seeking Alpha is listed at 116% and would indicate that the dividend may be under threat of reduction. Looking at another source, we can see that the dividend payout ratio sits at 61.73%. However, over the last earnings call I gathered a bit more clarification on the sustainability. During the first quarter they returned $2.4B to shareholders as a dividend and invested an additional $2.5B in internal research and development.

The dividend is a sacred cow for us. Dividend, it is secured and we will continue our policy on dividend as we have promised repeating. And we don’t have to monetize things to be able to achieve that. The reason why we are looking at all our assets is because we want to maximize return on the capital. And of course, we will see opportunities, when it makes sense, like the ones that we described, there is serious now issue with the sterile capacity that people are looking to apply. – Albert Bourla, CEO

Valuation

In terms of valuation metrics, PFE does still look attractively priced despite the headwinds. For example, the current price to earnings ratio sits at 19.74x, compared to the sector median P/E of 27.48x. In addition, the current price to book value sits at 1.74x, which sits significantly under the 5-year average price to book ratio of 2.98x. Wall St. currently has an average price target of $31.94 per share, which represents a potential upside of over 11%. The highest price target sits at $45 per share, while the lowest sits at $27 per share. In order to get a better estimate of this range, I decided to run my own dividend discount model to see if I can find an estimated fair value.

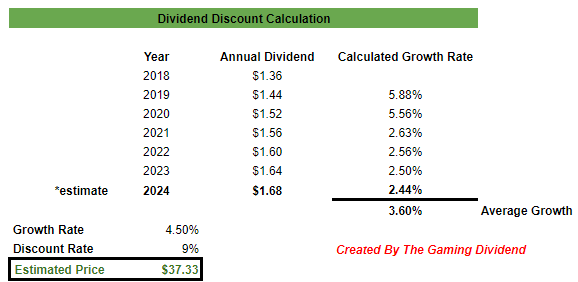

I first compiled all of the annual dividend payout amounts dating back to 2018. We can see that the dividend has increased at a CAGR of 3.6% since then. I then used an estimated annual payout of $1.68 for the full year of 2024 since the dividend was last raised by 2.4% for the first payout in March. An estimated growth is a bit tricky given the current headwinds, but I tried to use fair estimates here. The sector median EBITDA growth sits around 7.33% while the sector average year over year revenue growth sits at 6.73%.

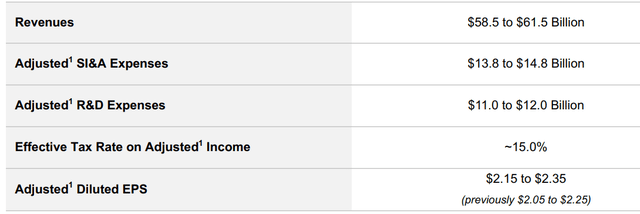

In addition, management recently raised their guidance outlook for the year by adjusted earnings per share of $0.10. This can be attributed to efficient capital management driven by cost savings. The new guidance range sits between $2.15 to $2.35 per share for FY24. As a result, I thought that a conservative growth estimate of 4.5% was fair.

Author Created

With these inputs in mind, I come to an estimated fair value of $37.33 per share. This represents a potential upside of over 30% from the current price level! When you combine this with the fact that the dividend sits at a historical high, we have the opportunity to lock in a position to capture both price appreciation and high income. Even if the price takes a few years to move back up to this level, you will be paid a high yield to sit back and wait while Pfizer regains their footing.

Financials

PFE reported their Q1 earnings at the beginning of May and the results were stronger than anticipated, which means that momentum may finally be shifting. Earnings per share came in at $0.82 for the quarter and beat estimates by $0.31 per share. This outperformance can be attributed to the focus on cost savings, where PFE is on a path to deliver at least $4B in net cost savings by reducing expenses related to operations. Revenue came in at $14.9B for the quarter, which was a near -20% decrease on a year-over-year basis.

While sales are shrinking, this has been offset by a decrease in cost of sales. Cost of sales decreased down to $3B, representing a 34% decrease. The bad thing about their cost savings initiative is that this also means they are allocating less money towards research and development. R&D spend decreased down to $2.5B, which represents a slight 1% change. This cost savings initiative also means that there are no share repurchases completed yet for the year, which would greatly instill confidence for shareholders. However, there is still a remaining repurchase authorization of $3.3B, but there is no expectation for this to be utilized throughout 2024.

Adjusted EPS guidance for the year has been raised to a new range of $2.15 to $2.35 for the year. Revenues are estimated to land between the $58.5B to $61.5B range. Contributing growth factors to help fulfill these revenue estimates consists of global revenues from legacy Seagen that was acquired in December of 2023.

In addition, the revenue from the Vyndaqel drug family, used to address nerve damage, has seen operational growth of 66% which was driven by greater demand throughout the US and Europe. Another contributing factor is Eliquis, a blood thinning drug that prevents blood clots and stroke, which saw a global increase of 10% operationally.

I believe that when interest rates eventually get cut, we will see an uptick in spend towards research and development. While rates are likely to remain unchanged for the next quarter, PFE should continue to focus on their cost savings initiative. Once rates do get cut, however, I think we will see a shift towards the development of new products and drugs since debt capital will be more affordable. This can contribute to the future growth of their portfolio before patient expiries kick in.

Takeaway

In conclusion, Pfizer still remains a strong dividend compounder that can deliver valuable growth from this price point now that the yield sits near all-time highs. From a valuation standpoint, PFE has to obtain a modest growth of 4.5% to make its way towards my estimated fair price of $37.33 per share. The high yield is appealing, but when combined with future dividend growth, PFE is a great option for dividend growth focused portfolios. The cost savings initiative has helped boost financial health, the eventually cut of interest rates should reverse the course from a defensive stance to a more offensive standpoint to fuel growth through new products and innovations.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.