Summary:

- Pfizer investors received disappointing guidance from management at its Q2 earnings call, as the company couldn’t commit to a firm outlook for its COVID franchise revenue next year.

- Despite that, there was no significant selloff, suggesting that negative sentiments have already been priced in.

- With Pfizer’s post-COVID headwinds likely bottoming out, PFE is attractively priced as the market looks past its near-term challenges.

- I make the case why PFE is near or already at peak pessimism, as the selling pressure has abated. Investors should capitalize aggressively while the market is ignorant.

- Comment and let me know whether you concur with my Strong Buy rating.

JHVEPhoto

Notwithstanding the significant battering Pfizer Inc. (NYSE:PFE) investors received at the hands of market operators this year, PFE still managed to underperform the S&P 500 (SPX) (SPY) since my pre-earnings update.

Is that justified, PFE Bulls may ask? Why has the market remained so negative on Pfizer’s forward outlook, despite the clarity of Pfizer’s medium-term pipeline strategies to deal with its loss of exclusivity or LOEs? As such, the substantial de-risking of Pfizer’s COVID franchise (Comirnaty and Paxlovid) has likely stunned bullish investors as they anticipate what’s next for CEO Albert Bourla and his team.

Management’s guidance at its recent second-quarter or FQ2 earnings release didn’t seem adequate to quell investors’ fears. To make things worse, Pfizer asked investors to give them time to assess its transition to the commercial market as they refine their pricing and volume strategies. If necessary, the company can execute “enterprise-wide” cost-cutting measures to lower its R&D and SG&A base, mitigating the impact on its operating leverage.

Therefore, I assessed that Pfizer’s guidance has thrown up more uncertainties than clarity, even though the company wanted to maintain its “transparency” to investors. I believe credit must be given to Pfizer for not trying to take investors for a ride, even as the company anticipates a positive inflection in COVID franchise revenue from FY24.

In other words, Pfizer isn’t sure (yet) what its COVID franchise revenue trends could look like moving ahead but is confident that FY23’s performance could mark a sustained bottom. Management updated that its COVID franchise is expected to deliver revenue of $21.5B for FY23. Pfizer’s modeling is based on its expectations of how its COVID franchise could follow the established flu vaccines market in a post-COVID world.

Therefore, investors still hoping for the pandemic modeling should revise their expectations. While we are living in a COVID-endemic world, we shouldn’t expect similar public health scares from COVID in the near term. I believe that’s what market operators have tried to reflect in PFE’s valuation, suggesting they have moved past its previous COVID modeling.

High-conviction investors who have confidence about COVID franchise revenue bottoming out in FY23 should find the current levels attractive. For its ex-COVID portfolio, management remains confident in reaching a midpoint revenue growth rate of 7% for FY23. However, it’s lowered from its previous midpoint guidance of 8%, suggesting unanticipated headwinds for its ex-COVID portfolio.

With PFE’s forward EBITDA multiple of 9.1x normalized to below its 10Y average of 10x, I assessed the pessimism as unjustified. It implies below-average confidence of the company in executing its medium-term strategies before the LOEs significantly affect its revenue growth from FY26. My observation is supported by PFE’s “A” valuation grade assigned by Seeking Alpha Quant, suggesting adding here isn’t considered aggressive.

However, given the market is forward-looking, it’s critical to assess whether market operators have shown signs of returning to support PFE’s bottoming process?

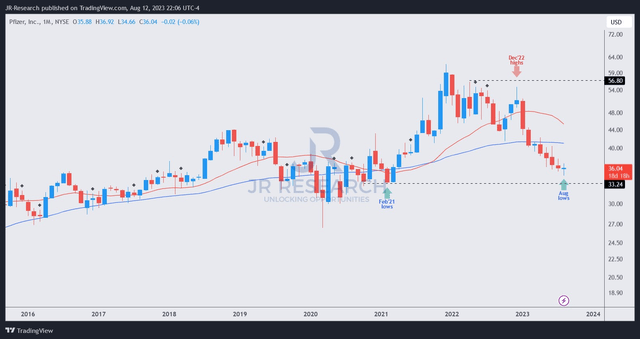

PFE price chart (monthly) (TradingView)

I assessed that PFE’s long-term chart shows signs of a significant slowdown in selling fervor through PFE’s August lows. As such, sellers have been losing momentum, as they failed to take out PFE’s February 2021 lows, a decisive support level.

Buyers seem to have returned to bolster buying sentiments at the current levels, supporting my thesis that PFE is close/already at peak pessimism. As such, I believe PFE holders looking to add more exposure while anticipating a growth inflection from FY24 should capitalize on PFE’s assessed bottoming profile.

Rating: Maintain Strong Buy. Please note that a Buy rating is equivalent to a Bullish or Market Outperform rating.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!