Summary:

- Pfizer is a multinational “big pharma” with deep scientific and commercialization expertise.

- While the COVID-related product tailwind has become a headwind of late, it still does not justify this low a valuation given the company’s strong pipeline.

- The COVID money basically gave Pfizer a “free” Seagen, who is the leader in ADC (antibody-drug conjugate) – the drug modality that every big pharma is trying to get in on.

- While some key drugs from Pfizer are facing a patent cliff, its diverse pipeline will compensate and then some.

Bloomberg/Bloomberg via Getty Images

0Pfizer Overview

Pfizer Inc. (NYSE:PFE) just celebrated its 175th birthday, and is one of the largest so-called “big pharma” in the world. The company became a household name in recent years due to its COVID vaccine (co-developed with BioNtech (BNTX)) and its COVID drug and how both played a key role in fighting the pandemic. In return Pfizer raked in ~$57 Billion USD in revenue as a result of its two COVID products in 2021 and 2022 alone. Yet since its height of $56.33 per share in the late 2021, it is now trading at a decade low of $26.93 per share. So what went wrong?

In this article, I will examine what went wrong for Pfizer and explain why it does not change the fundamentals of the company. I will also dissect its moat and come up with a fair value estimate which leads me to assign a “Buy” rating on PFE stock.

Why is the stock down 50+% since 2021?

The biggest driver for the stock’s steep decline is the rapid deterioration of Cominarty and Paxlovid sales. At the beginning of 2023 Pfizer put out a revenue guidance of $21.5 billion for combined Cominarty and Paxlovid sales, yet finished the year with only $12.5 billion, so $9 billion short. It also does not help to have such a stellar 2022 revenue to compare against, which leads to a whopping 41% decline in revenue in 2023 compared to 2022. Pfizer’s stock price is down 52%, mirroring the revenue decline. It then got even worse when the 2024 expected revenue for the Cominarty and Paxlovid were dropping even further. Essentially the windfall from these 2 drugs is quickly drying up. So they fired the CMO and let go some of the their employees due to excess capacity, and also admitted that the earnings guidance they gave were overly optimistic.

How’s Pfizer doing outside of COVID-related product?

Doing just fine. According to Pfizer’s Q4 2023 earnings report, ex-COVID products, Pfizer achieved 7% operational revenue growth for the full-year 2023 and 8% operational revenue growth in the fourth quarter alone. Also Pfizer won 7 FDA approvals in 2023, which is a new record in the industry, and more than double of any other drug company in 2023.

It is important that readers understand Cominarty and Paxlovid were not your traditional blockbuster drugs that took 10 years and $10 billion to get FDA approval, then sells for 10 or 20 years and hoped to get the money back and then some. It was a gamble that Pfizer took during the height of a once-in-a-lifetime pandemic, and that gamble paid off $60+billion and counting. The Highest Powerball jackpot is ~$2 billion, and this is like 30x of that. The fact that a big, inherently bureaucratic organization like Pfizer was able to mobilize that fast during the pandemic, and not only developed the vaccine but also found essentially a cure in such a short period of time, speaks to the agile management and scientific expertise the company possesses. Also the fact that Pfizer captured the majority of the market and supplied essentially the entire Western world, Pfizer was flexing its deep knowledge with the regulators as well as its superb manufacturing capabilities and know-hows.

Think about it like this. If instead of getting the $60 billion in 2 years (2022 and 2023), it raked in 6, 8, 10, 12, 12, 12 billion dollars in 6 years from 2022 to 2027, I really doubt the stock is gonna be at the current levels. Not to mention it is definitely better to rake in all the money early on than gradually over time, because there is time value in money, and much, much more so for bio-bucks. Why?

Because Pfizer bought Seagen with that money, and more

With the infusion of cash from COVID product sales, Pfizer went on a shopping spree and went ahead and bought Seagen for $43 billion, the undisputed leader in ADC (antibody-drug conjugate). ADC is the focus of the next stage of biologics revolution for cancer treatment, and the acquisition put Pfizer back in the game for top oncology biologics company and help mitigate Ibrance’s upcoming patent cliff in 2027. It really is a good strategic move as most Pfizer’s oncology programs are led by small molecules and they really do fall off a cliff after patent expiration. Biologics, because it is much harder to manufacture it is more resilient towards generic competitions, and ADCs are even harder to manufacture. Pfizer expects to grow Seagen’s revenue from ~$3 billion in 2023 to ~$10 billion in 2030, while it is very difficult to predict the exact revenue of anything in 7 years, I do think Seagen will benefit greatly from Pfizer’s expertise in business development, running clinical trials, dealing with regulators and manufacturing.

Pfizer Moat Source

First and foremost, its science know-how and various patents are the primary moat source. Pfizer has been in oncology, vaccine, immunology and many other disease areas for decades and have numerous blockbusters from each of those areas.

Experience dealing with regulators, health care plans, and commercialization. Pfizer is a multinational company and has dealt with almost every regulator in the world. It also possesses enormous knowledge negotiating with government healthcare plan officials, and they are good at selling drugs, evidenced by its dominance in the COVID mRNA vaccine market against Moderna (MRNA).

Business development acumen. I am not sure Pfizer is very well known for its internal R&D, but its business development through collaboration or acquisition is famous and mostly pretty good. The recent example being partnering up with BioNtech to take the lead on COVID mRNA vaccine. While the Seagen acquisition was by no means cheap ($43 billion for a $3 billion revenue company), they did took advantage of Seagen’s stock weakness due to management change, so good timing.

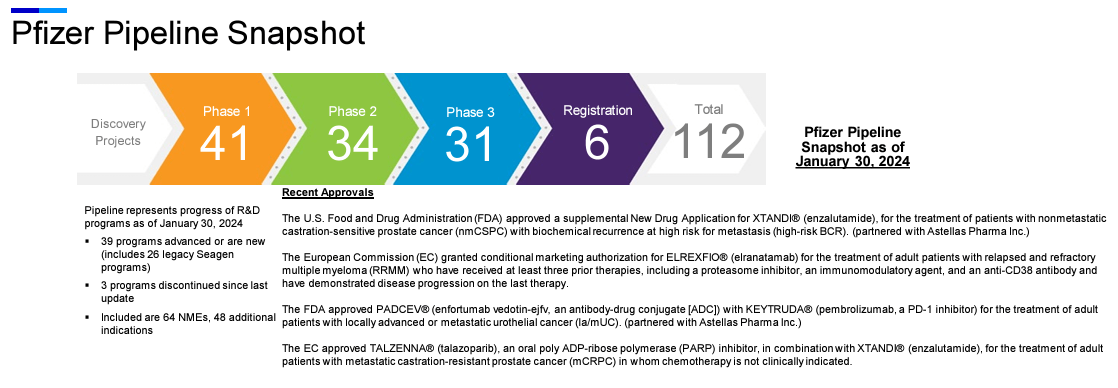

Strong and diverse pipeline. With 33 drugs in Phase 3 (Figure 1), Pfizer does not look anywhere close to a company that is phasing out. In fact, it might just be a new era for Pfizer where multiple modalities take the lead. Small molecules, Biologics, ADC, Gene therapy, etc., such diverse and novel modalities ensure that Pfizer’s pipeline to be relevant and even dominating in certain disease areas for the long run.

In my view, all of the moat sources above came out even “moatier” after the pandemic. In fact it is because of these moats that Pfizer was able to capitalize on the pandemic tailwind in the first place, where it really stood out against traditional vaccine giants like GSK (GSK), Sanofi (SNY), and Merck (MRK).

PFE Pipeline Overview 2024 (PFE Investor Presentation)

Potential Risks

There are inherent risks for failure associated with clinical trials with any drug developers including Pfizer. The recent phase 2 data on its oral GLP-1 candidate was an example, as it was nixed due to high rates of side effects. However, as a big pharma with a broad and deep drug candidate pipeline, Pfizer diversify its risk of clinical trial failures.

Organic growth is lagging. Pfizer is not really well-known for its internal R&D capability, as most of the recent blockbusters from Pfizer are almost all come from acquisition or collaboration. Even with the Covid vaccine from Pfizer, most of the R&D really comes from BioNtech, and Pfizer’s main role was in clinical trial and commercialization.

Missing out on new disease area. GLP-1 agonists which represent metabolic disease area, is the fastest growing drug market right now and into the foreseeable future. However, Pfizer never really had a strong presence in metabolic disease and are scrambling to have something in clinical trials so not to miss out, and yet their recent Phase 2 data was not good.

Pfizer Valuation

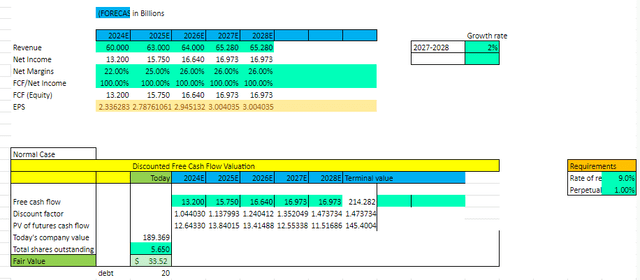

While Pfizer is at a crossroad as some of its main blockbusters are facing patent cliffs, the infusion of COVID cash and aggressive expansion of its pipeline makes me believe that Pfizer will not only compensate the revenue decline but fuel its revenue and profit growth. Using a medium P/E of ~15.5x for the past 10 years, and a current FWD P/E of 12.11x, Pfizer is worth about $34.55 today, implying a 22% undervaluation.

Using a DCF model, going out to 10 years from now with a rate of return at 9%, perpetual growth of 1%, and no margin expansion, I arrived at a fair valuation of $33.52, or 20% undervalued.

Final Verdict

“The market is always right”. As with all companies who were punished by stakeholders, Pfizer has issues and probably deserves the drop in its share price. However, the market is also emotional and irrational at times, which I think it is the case with Pfizer. The wrong guidance of COVID product sales led to its stock price decline, but one cannot ignore that fact that from a pipeline perspective which is the fundamental of a pharma company, the Pfizer today is stronger and more well-positioned than pre-pandemic by MILES. As a company with a wide moat and operating in a vast yet growing market with hard demand, i.e., healthcare, I rate Pfizer a Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.