Summary:

- Pfizer continues to transition to a strong future with reduced Covid drug sales.

- The biopharma has a strong lineup of new drugs whether via FDA approval or acquisition.

- The stock has a large dividend yield of 5.9%.

- Pfizer continues to trade at only 10x ’25 EPS targets.

no_limit_pictures

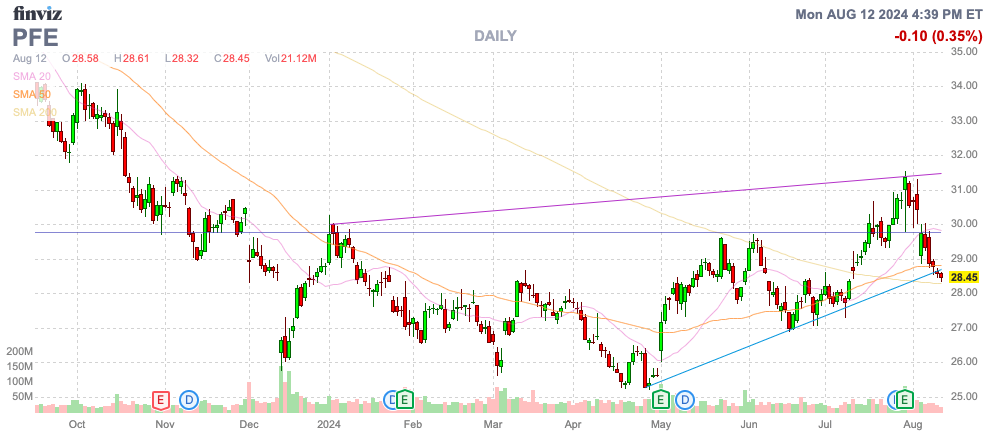

The key to 2024 for Pfizer Inc. (NYSE:PFE) is moving the business far beyond the Covid drugs dip in a transition year. The biopharma is back in growth mode, but the stock market still hasn’t caught on to the improving results under the surface. My investment thesis remains Bullish now on the stock trading back below $30.

Source: Finviz

Riding The Recovery

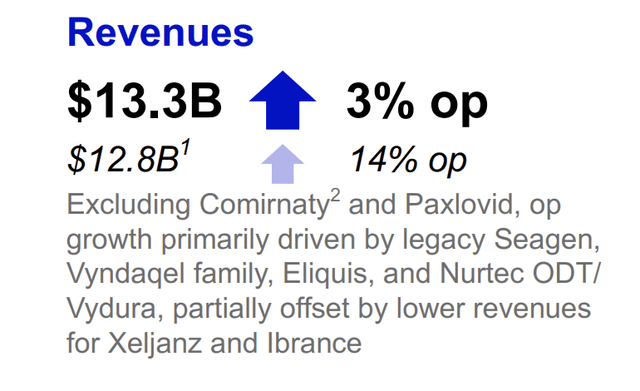

Pfizer recently reported a 3% increase in Q2’24 revenues to $13.3 billion, but the weak results came with a huge bonus to shareholders. The biopharma reported 14% operational growth when excluding the sales from Covid drugs.

Source: Pfizer Q2’24 presentation

Comirnaty revenues dipped 87% YoY from $1.3 billion last Q2 to only $195 million in the last quarter. Paxlovid sales actually nearly doubled to $251 million.

These Covid sales are still forecast to reach $8.5 billion for the year, or ~14% of sales for 2024, limiting the future impact to overall sales. Comirnaty and Paxlovid sales were $12.5 billion in 2023 after plunging from $56.7 billion back in the boom year of 2022.

The key here is that Covid drug sales have the potential to be flat to up going forward on a base of sales of $446 million in Q2. The whole investment story has been about moving beyond the Covid impacts.

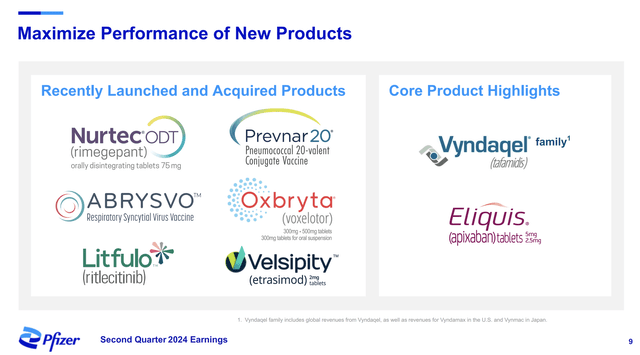

Pfizer has launched a whole host of new drugs in the last year, along with new drugs like Padcev from Seagen. The Covid drugs dip has hidden these big boosts, leading to 14% growth via either developing new drugs or buying drugs.

Source: Pfizer Q2’24 presentation

Key drugs like Eliquis and the Vyndaqel family are driving growth in drugs sales. The 2 key drugs accounted for ~$3.2 billion in Q2 sales, with over $0.65 billion in additional sales compared to last year.

In addition, Pfizer has the following drugs now generating revenues from the Seagen acquisition:

- Padcev – $394 million

- Adcetris – $279 million

- Tukysa – $121 million

- Tivdak – $33 million

Abrysvo is another drug with $56 million in Q2 revenues. The RSV drug is only ramping up now, providing a long list of catalysts for growth ahead.

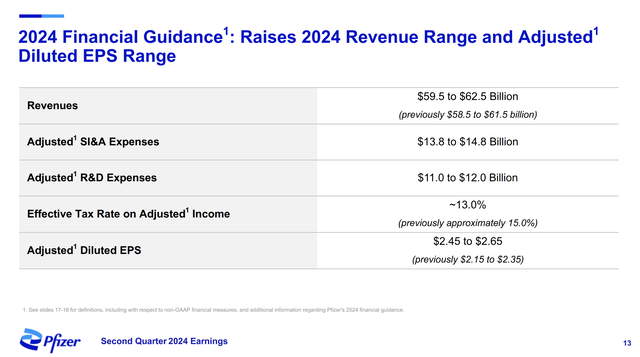

The better results have Pfizer boosting 2024 EPS targets to $2.55, up from just $2.25 prior. The company has boosted profits via a $4.0 billion cost reduction plan, and a new $1.5 billion manufacturing optimization plan will further cut costs through 2027. The biopharma will continue to boost profits, as Pfizer rightsizes the business for the sudden and massive drop in Covid revenues.

Source: Pfizer Q2’24 presentation

The consensus analyst estimates have EPS heading towards $3 in 2025/26 while the stock currently trades below $30. The current EPS guidance includes an anticipated $0.40 of earnings dilution from the Seagen acquisition, largely due to the higher financing cost from borrowing more money to pay the cash deal.

Pfizer is now spending an incredible $778 million in quarterly interest expenses, and quickly repaying debt will automatically boost EPS.

Capital Machine

The company has a massive cash machine now, and the conviction of a return to operational growth helps focus on capital allocation plans. The main key is Pfizer reducing the outstanding debt levels of $69.5 billion at the end of June, starting with repaying $2.3 billion of debt in Q2.

Pfizer ended the quarter with a cash balance of $7.1 billion, along with equity and long-term investments of $11.1 billion to provide some financial security from the large debt balance. The major negative is the company paying out $2.4 billion in dividend payments each quarter, amounting to a massive $9.6 billion in payouts for a company with a large net debt balance.

At 5.7 billion shares outstanding, Pfizer will produce $17.1 billion worth of annual profits from a $3 EPS. The company can use a lot of that cash to start whittling down the outstanding debt and immediately boost EPS.

The dividend yield is a very solid 5.9% with the stock at $28. An investor gets a mixed benefit here, with management not making any share buybacks due to the large debt loads and huge dividend payouts.

The consensus estimates only have sales rising to $63 billion next year for 3.6% growth. The operational revenue target has to be far higher with so many new drug approvals and the growing drugs from acquisitions, as Seagen revenues were targeted to reach $10 billion by 2030.

Pfizer only trades at 10x the 2025 EPS target of $2.86. The manufacturing optimization and the normalization of financing costs for Seagen will work as a combination to boost EPS by $0.60 over the next few years, on top of any boost from new drug sales.

Takeaway

The key investor takeaway is that Pfizer is far more appealing here at 10x forward EPS. The biopharma has a lot of debt to repay, but the company now has the pipeline to boost sales going forward, while Covid sales could actually stabilize around the current levels.

Investors should use this dip below $30 as another buying opportunity for a leading biopharma stock with a massive 5.9% dividend yield on top of the cheap valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start August, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.