Summary:

- A difficult period for Pfizer might be coming to an end, as serious setbacks and tough Y/Y comps are in the rearview mirror.

- The first quarter performance of the commercial business exceeded Street expectations, and the company maintained its full-year revenue guidance while slightly increasing the EPS guidance range.

- The new Chief Strategy and Innovation Officer may lead to changes in business development approach, although his hands may be tied by the debt burden in the near-term.

- The upcoming update on danuglipron in obesity should shed more light on Pfizer’s position and plans for this side of the pipeline.

no_limit_pictures

A difficult period for Pfizer (NYSE:PFE) might be coming to an end. The series of setbacks, such as the failures of the obesity pipeline during 2023, and the commercial underperformance that led to expectations reset with a “kitchen sink” guidance for 2024, are now behind us, and the COVID-19 franchise-led declines in revenues are finally in the rearview mirror. My share price bottom call from last year was premature, but I believe better times are ahead and that a return to growth led (among others) by the expansion of the oncology business that I covered in my March article, should drive the stock to higher levels in the following quarters and years.

We should also see an obesity pipeline update with new data from the phase 2 trial of the once-daily version of danuglipron, and what Pfizer plans to do next in this area, be it with danuglipron, other earlier-stage compounds, or with externally sourced assets through business development. Based on the tolerability and weight loss data of twice daily danuglipron, my expectations of this candidate are low.

Start of 2024 for the commercial business – so far, so good

2024 started well for Pfizer’s commercial business as the company posted a decent EPS and revenue beat when it reported first quarter results. The full-year revenue guidance was unchanged despite the Q1 beat, but the diluted EPS guidance range was increased from $2.05-2.25 to $2.15-2.35.

On the product side:

- Vyndaqel family (tafamidis) had a strong Q1 with 66% Y/Y growth to $1.14 billion.

- Seagen products and royalties contributed $742 million and they are on track to meet or exceed the full-year guidance of $3.1 billion.

- Eliquis rose 10% operationally.

- Some of the recently acquired products like Nurtec and Oxbryta disappointed with modest Y/Y growth and sequential (but largely seasonal) declines in net sales.

The RSV vaccine Abrysvo was recently launched and it generated $145 million in net sales in Q1. CEO Bourla was seemingly unhappy that the company only managed to capture one third of the market, with GlaxoSmithKline’s (GSK) Arexvy capturing the other two thirds, but he said this was a reflection of launch timing and GlaxoSmithKline capturing the retail part of the market due to better early coverage. He further stated Abrysvo’s product profile is better, that it has the “lion’s share market share” in physician offices, and that the situation should rectify itself in the second half of the year when 90% of the vaccinations are expected.

Pfizer is also pleasantly surprised by the early demand for Abrysvo and it looks like it will be a decent topline contributor in the second half of 2024 and in the following years and the positive phase 3 results of Abrysvo in adults aged 18 to 59 in April should help grow the addressable market and revenue growth in 2025 and beyond.

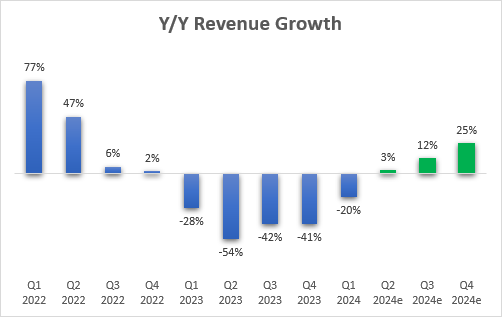

And while Q1 revenues declined 20% Y/Y, the good news is that this was the last quarter of tough Y/Y comps and that Pfizer is on track to return to Y/Y growth in the second quarter, and if it executes in line with the current guidance or better, the company will also return to growth for the full year. However, I should note that the growth rates this year are flattered by the addition of Seagen’s products.

Pfizer earnings reports, Seeking Alpha

Overall, a good start to the year for the commercial business.

Can danuglipron exceed very low market expectations?

It would be natural to assume that danuglipron is not a viable obesity candidate after last year’s unimpressive efficacy data of the twice daily version that was accompanied by very poor tolerability and very high trial discontinuation rates. Based on these data, Pfizer made the decision to discontinue the development of the twice daily version. I wrote about these results in my December 2023 article.

However, Pfizer was also working on a once-daily formulation of danuglipron and the company expects to provide an update on this program in the following weeks. My expectations are low considering the previous twice daily version’s data, but am open to change my mind if once daily formulation looks better.

Looking at the supply constraints obesity market leaders Novo Nordisk (NVO) and Eli Lilly (LLY) are experiencing with injectable versions of incretin drugs, I can imagine a scenario where well tolerated oral versions can get good market uptake even if efficacy is not near the injectable versions.

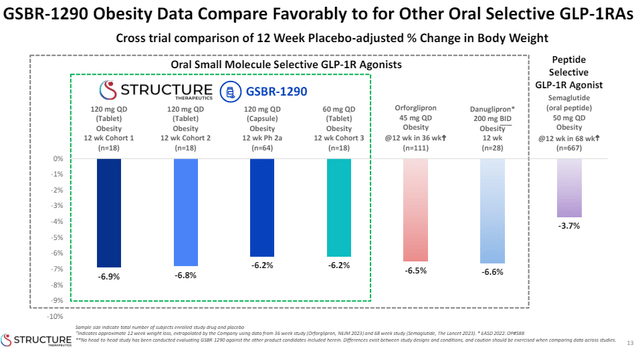

This slide from Structure Therapeutics’ (GPCR) recent data presentation shows where the oral GLP-1 market stands at the moment in terms of placebo-adjusted 12-week efficacy.

Structure Therapeutics investor presentation

As you can see, danuglipron is not too far in terms of efficacy, at least at week 12, but without good tolerability, I do not believe these candidates have a bright future. Shares of Structure Therapeutics rallied when it released the new phase 2 results of its obesity candidate, but I am not exactly sure why. Yes, efficacy is seemingly high compared to competitors, but it too had poor tolerability with 40% of patients needing to reduce the dose and with high incidence of nausea, vomiting, and constipation. My understanding is that Structure believes it can improve tolerability with “start low and go slow” titration schedule.

Going back to Pfizer, as I said, my expectations are low and I believe the company will have to look at its earlier stage compounds, or externally for new candidates. These external efforts include earlier-stage collaborations, including this week’s one with Flagship Pioneering’s ProFound Therapeutics to “identify novel protein therapeutics from the human proteome” leveraging ProFound’s proprietary discovery platform.

New Chief Strategy and Innovation Officer could lead to changes in the business development approach

Pfizer hired Andrew Baum as its new Chief Strategy and Innovation Officer in early May. Baum joined Pfizer from Citi where he was head of global health and managing director, equity research and he will manage the company’s long-term corporate strategic plan, conduct portfolio analysis, and he will be responsible for business development activities.

Interestingly, Baum was not in the Pfizer bull camp at Citi. The firm has a neutral rating on Pfizer and a $28 price target, which it reduced from $35 back in December 2023. This is what Baum said in March:

While no investor could ever describe us historically as a Pfizer bull (our last positive rating was 11 years ago), last week’s oncology meeting added to our confidence in our previously published view that the market undervalues PFE’s oncology pipeline.

The first part is key here – he is joining a company he has not been bullish on in the last 11 years. It seems that he believes he can contribute and bring about a positive change to the company.

And while there is not much Baum can do on the business development side in the near-term since Pfizer’s shopping spree ended with last year’s $43 billion acquisition of Seagen, there are ways he can contribute, especially in terms of bolt-on acquisitions and in-licensing opportunities. Given the company’s and the market’s high interest in obesity, I am most curious whether Baum will influence a change in direction on this side of the pipeline, because anything positive the company can do on this side would heavily influence future expectations and growth prospects.

Post-Seagen de-leveraging on track

Pfizer’s balance sheet is loaded with debt after the late 2023 acquisition of Seagen closed, and the next few quarters will be all about reducing the leverage ratio by generating cash flows, while maintaining the dividend.

Total debt stood at $61 billion at the end of the first quarter and cash and equivalents were $12 billion for a net debt position of $49 billion. $1.3 billion in debt was paid back during the quarter with another $1 billion repayment expected in May. The sale of Haleon (HLN) shares for $3.5 billion in March have also contributed, and Pfizer’s stake is down from 31% to 23%. The remaining stake was worth $8.7 billion at the end of March and provides additional balance sheet flexibility.

CEO Bourla said at the Goldman Healthcare Conference this week that the priorities are maintaining the dividend, de-leveraging the balance sheet by paying out debt and/or increasing EBITDA, followed by business development and potentially buybacks.

Even so, Pfizer may have some additional capacity to do a mid-sized deal if a really good one comes along, but I would only expect the company to do in-licensing deals or small acquisitions in the following quarters.

Conclusion

The headwinds for Pfizer’s commercial business are dissipating and the tough year-over-year comps are finally in the rearview mirror. With an expected return to topline growth, the addition of Seagen products and pipeline, and a healthy slate of recent and expected product launches, Pfizer is in a good position to deliver decent long-term shareholder returns.

The main risks in the near-term are the continued underperformance of the COVID-19 portfolio, but without the potential for an outsized negative impact on the company’s long-term performance since its total revenue contribution is down considerably. There is also some near-term risk of a negative reaction to a potentially negative clinical trial update of danuglipron in obese patients in a few weeks, but realistically, there are no real market expectations on the obesity side of the pipeline and I see the potential for significant upside revisions to long-term top and bottom line estimates if Pfizer finds a way to meaningfully participate in this rapidly growing market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article reflects the author's opinion and should not be regarded as a buy or sell recommendation or investment advice in any way.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.