Summary:

- Pfizer’s stock appears undervalued with a high dividend yield of 6.8%, making it a potential long-term investment despite low growth expectations.

- The company reported strong Q3 results with 31.2% YoY revenue growth, driven by products like Paxlovid and Comirnaty.

- Despite high valuation multiples, a DCF analysis suggests Pfizer’s intrinsic value is $37.56 with 3% growth, indicating potential undervaluation.

- The health system’s potential changes could impact Pfizer, but the low stock price justifies a cautious “Buy” rating.

Massimo Giachetti/iStock Editorial via Getty Images

In my previous and first article about Pfizer Inc. (NYSE:PFE), I argued that the stock could be a bargain. In the meantime, the stock increased a little bit, but especially in the last few days, it declined again and is now trading about 12% lower than at the beginning of July when my previous article was written. In my conclusion, I wrote:

Pfizer is certainly not a high growth business, but with its high dividend yield and cheap stock price, it seems like a mistake to ignore Pfizer at this point. We should expect Pfizer to grow only in the low to mid-single digits over the long run, as it also had troubles growing in the past, and we don’t know if the growth stemming from acquisitions and the oncology business is enough. Nevertheless, Pfizer’s stock seems to be undervalued at this point and maybe a good long-term investment and a rather recession-resilient business.

A lot has happened in the last three weeks. Not only has Pfizer reported surprisingly solid third quarter results, but the recent election results and more specifically the potential impacts of a new Secretary of Health and Human Services are reasons to discuss Pfizer (and many other pharmaceutical companies) once again. But let’s start talking about the stock from a different point of view – the high dividend yield, which makes the stock tempting as a passive income play.

Dividend

Pfizer could be seen as one of the companies with a bond-like status. The company was founded 175 years ago and has been paying a dividend for decades. We should not ignore the dividend cut 15 years ago as management lowered the dividend during the Great Financial Crisis. But in the last 15 years, the company increased the dividend again every single year and although the dividend grew only with a CAGR of 4.25% in the last five years. Currently, Pfizer is paying a quarterly dividend of $0.42 resulting in an annual dividend of $1.68 and a dividend yield of 6.8%.

Of course, a high dividend yield is good for investors as it is usually leading to high returns on investment. But a high dividend yield is also seen as problematic in many cases as it can be a warning sign for a business in trouble. The reason here is quite simple: the stock price is declining faster than the business is collapsing, and management is usually trying to keep the dividend stable as long as possible. This is resulting in a high dividend and low stock price and therefore a high dividend yield. And there are certainly many examples where a high dividend yield was followed by a dividend cut.

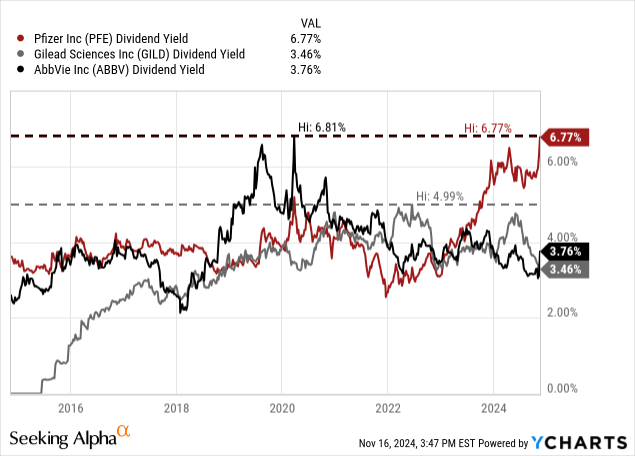

On the other hand, we find many different companies – especially in the pharmaceutical sector – with similar high dividend yields in the last few years and the business being stable, nevertheless. AbbVie, for example, had a similar dividend yield in early 2020 and the company (and stock continued to perform well). Gilead Sciences, Inc. (GILD) is another example. In early 2022, it had a dividend yield of 5%, but especially in the last few months, the stock was performing well again.

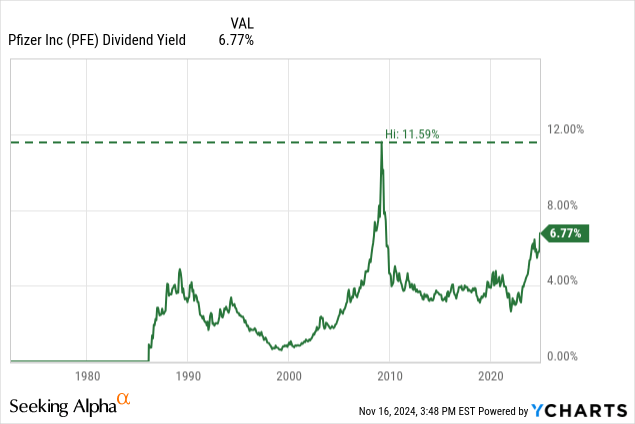

And when looking at Pfizer’s dividend yield in the past decades, we saw much higher dividend yields in the years and quarters around 2009. While we should never buy a stock only due to a high dividend yield, we also should not avoid a stock simply because of a high dividend yield – such an analysis would probably be too simplistic.

Shattering Norms or Autopoiesis?

One news item that seemed to send the stock price lower and pushed the dividend yield higher was the announcement from President-Elect Donald Trump, nominating Robert F. Kennedy Jr. to be the head of the Department of Health and Human Services. And although this was not really news (as it was loosely reported already weeks earlier), several pharmaceutical stocks declined, with vaccine makers being hit especially hard.

I must be honest: I am only at the beginning of a long series of thought experiments that probably will take weeks or maybe months. We always make assumptions about the future – when talking about companies, industries or the entire economy we are making assumptions. We try to predict when a recession might happen, we try to make assumptions about GDP growth or the unemployment rate. When trying to analyze a company, we make assumptions about free cash flow and growth rates and so on.

But there are some underlying assumptions we automatically take for granted and don’t even think much about these assumptions. But these assumptions are still only assumptions – even if we often consider them as granted. Examples of such assumptions we take for granted are no expropriations happening in the United States (maybe a few well-selected exceptions) or shareholders having legal rights and – if they have the appropriate shares – voting rights.

One assumption we also take almost for granted is that people get vaccinated. Of course, different companies compete, and we never know how many people will choose to get vaccinated. And in my opinion, it is not up for debate if vaccines are effective and if they save lives. We constantly must check and search for scientific evidence, and of course, some vaccines are less effective than others.

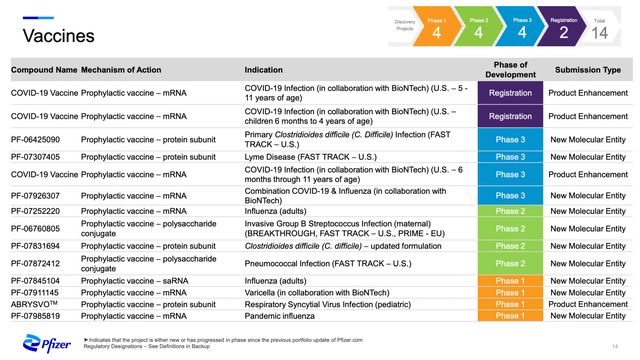

And for Pfizer, vaccines are playing a major role and not only are vaccines generate a substantial part of revenue, but its pipeline also consists of several vaccines and candidates in phase III or registration already.

Pfizer Pipeline Update

We know that norms will be not only challenged but shattered. They will be shattered again and again in the next few years. And in line with sociological system’s theory, I believe that systems try everything to maintain themselves – a process that is called “autopoiesis” and was described by the biologists Humberto Maturana and Francisco Varela and adopted by German sociologist Niclas Luhmann to describe social systems – like the political system, the economy or the health system. So, we can argue for business going on in a similar way with changes happening within a maybe broader range than usual. And we also find analysts arguing in a similar way. But on the other hand, revolution and radical change does happen. It is seldom, but it does happen and from time to time, systems break and every empire has come to an end at some point.

Trying to sum up these thoughts I think our analysis must be completely different in one way: We must expand the range of scenarios we are considering now as a possibility. And when scenarios we ascribed an extremely low probability to, suddenly seem more likely (i.e. the United States shifting the way it is vaccinating its population). This makes investing more difficult as stability and consistency is important and with the range of potential outcomes exploding, investing gets much more difficult.

Bankruptcies

And the following section is only a sidenote. But when making the argument that a much wider range of scenarios has to be considered as realistic, it is worth mentioning that one particular scenario is rather seldom among pharmaceutical companies. Big pharma is not often going bankrupt – aside from fraudulent behavior. And these companies seem to be very resistant. In line with overall bankruptcy numbers, which are increasing, more biotech companies filed for bankruptcy in 2023 than in any year since 2010. 2023 also incurred the highest number of Chapter 11 bankruptcies in the healthcare sector in the previous five years. (However, major pharmaceutical companies very seldom have to file for bankruptcy.)

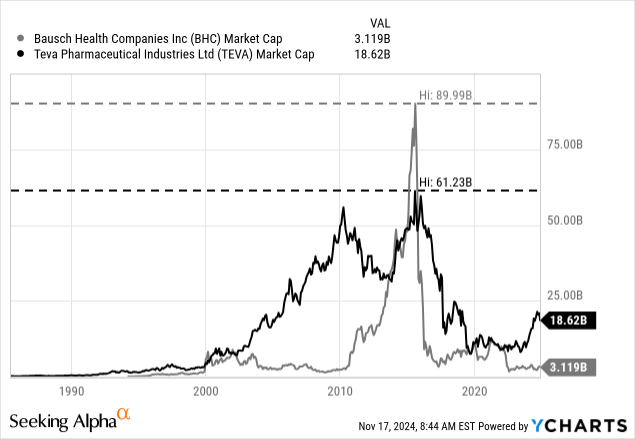

Of course, pharmaceutical companies are also struggling, and two examples are Valeant Pharmaceutical, which rebranded to Bausch Health Companies (BHC), as well as Teva Pharmaceutical Industries (TEVA). Those two companies once had a huge market capitalization and collapsed without being able to recover so far. When trying to find companies that actually collapsed, the most prominent (and only) example among major pharmaceutical companies in the recent past is Purdue Pharma, but it did not collapse for business reasons.

Summing up, I think it is safe to say that pharmaceutical companies are extremely resilient and major businesses in this sector are hard to bring to their knees.

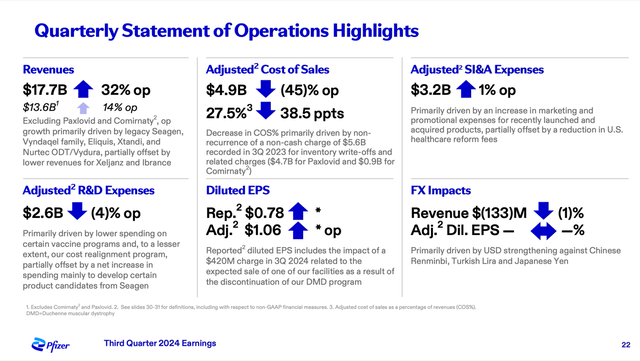

Great Third Quarter Results

I already mentioned above that Pfizer reported solid third quarter results. Revenue increased from $13,491 million in Q3/23 to $17,702 million in Q3/24 – resulting in 31.2% year-over-year growth. And instead of a loss from continuing operations of $2,388 million in the same quarter last year, Pfizer reported an income from continuing operations of $4,481 million in this quarter. Pfizer also reported $0.79 in earnings per share in Q3/24 compared to a loss per share of $0.42 in Q3/23.

Pfizer Q3/24 Presentation

When looking at the top line in more detail, product revenues increased from $11,587 million in Q3/23 to $15,417 million in Q3/24 and alliance revenues also increased from $1,645 million in the same quarter last year to $1,900 million this quarter. Additionally, all three segments contributed to growth: Specialty Care revenue increased “only” 14% year-over-year, Oncology grew revenue 30% year-over-year and Primary Care increased 44% in this quarter.

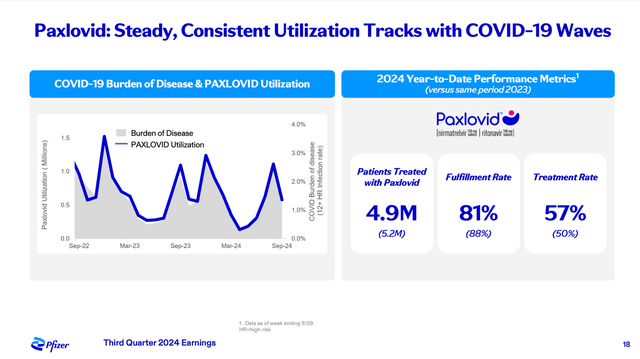

Growth in the Primary Care segment was mostly driven by Paxlovid, which generated $2,703 million in sales in Q3/24 (compared to only $202 million in the same quarter last year). Comirnaty generated $1,422 million in sales, which is still an increase of 9% year-over-year. And not surprisingly, Paxlovid sales track the COVID-19 waves and in the coming quarters (and maybe years) the situation will be similar. The one-time contractual delivery of one million treatment courses to the U.S. Strategic National Stockpile in the third quarter of 2024 also accounted for $442 million in revenue.

Pfizer Q3/24 Presentation

These are certainly not sales Pfizer should take for granted in the future – but COVID-19 seems to stay longer than we assumed.

Pfizer Q3/24 Presentation

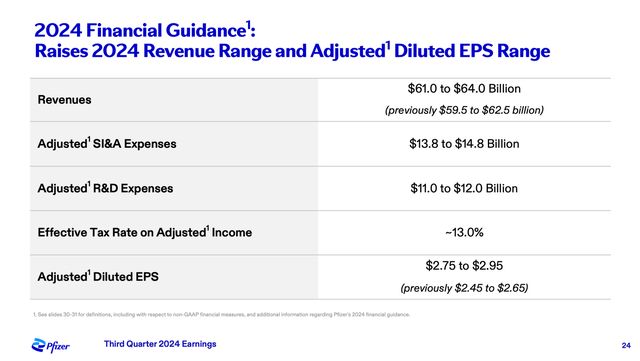

As consequence, Pfizer also raised its financial guidance and is now expected revenue to be between $61.0 billion and $64.0 billion (previous guidance was $1.5. billion lower). Adjusted diluted earnings per share are now expected to be between $2.75 and $2.95 compared to a previous guidance of $2.45 to $2.65.

Growth

Although these are rather one-time effects and should not have an impact on fiscal 2025 or any other following years, it seemed like analysts were getting a little more optimistic about the years to come. But despite getting a little more optimistic, analysts are not really expecting growth for Pfizer in the years to come. Earnings per share in the fiscal years 2024 till 2033 are expected to be in a range of $2.78 to $3.10.

And analysts are obviously assuming almost no growth and for these huge diversified pharmaceutical businesses it is not enough to have one or two (or maybe even a few) new pharmaceuticals that are driving growth as the business constantly must compensate pharmaceuticals losing patent protection.

In my last article I already explained that the oncology pipeline is very promising, and I already mentioned above that the oncology portfolio grew 30% in the third quarter with Xtandi, Padcev, Adcetris and Tukysa driving growth.

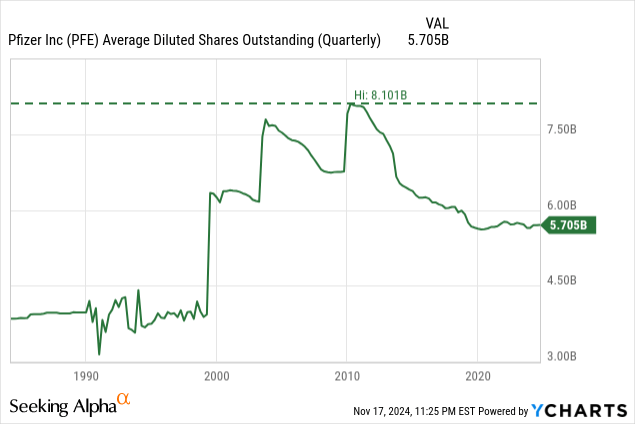

However, we should not only focus on top-line growth. Capital allocation tools like share buybacks can also lead to bottom-line growth for a business, and in the last 15 years – since Pfizer overcome the struggles during the Great Financial Crisis – the company bought back shares. In the last few years, share buybacks decreased with a CAGR of 2.3%. And with the current low stock prices, the free cash flow of $8.2 billion is enough to repurchase about 6% of outstanding shares. And this is ignoring that the free cash flow is rather low right now.

Of course, Pfizer can’t use its entire free cash flow for share buybacks as the company is also paying a dividend and has $9,699 million in short-term borrowings as well as $58,002 million in long-term debt it has to repay. Of course, we should also not ignore $1,092 million in cash and cash equivalents on the balance sheet as well as $8,860 million in short-term investments. But we can assume that Pfizer will continue at least modest share buybacks and if management is smart, it will try to buy back as many shares as possible for this low share price.

In my opinion, we can assume Pfizer to grow at least in the low single digits in the years to come. This might happen by share buybacks as well as very moderate top-line growth. And even when excluding the fluctuations during the COVID-19 crisis, we still see Pfizer growing slightly higher over the years.

Intrinsic Value Calculation

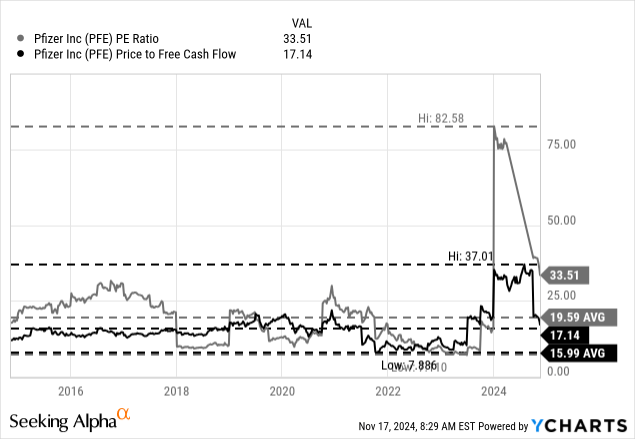

When only looking at simple valuation multiples like the price-earnings ratios as well as the price-free-cash-flow ratio, Pfizer does still not seem like a bargain. Pfizer currently is trading for 34 times earnings, which seems rather expensive. And it is trading for a more reasonable valuation multiple of 17.1 when looking at the price-free-cash-flow ratio. Nevertheless, the current P/FCF ratio is still above the average of 15.99 and rather high considering the troubles for Pfizer.

Simple valuation multiples, however, are not considering that the free cash flow right now is rather low and resulting in a much higher P/FCF ratio. Instead, when using a discount cash flow calculation to determine an intrinsic value, we can make more precise assumptions. And we could take the free cash flow of the last four quarters ($8,227 million) but it is not a reasonable description of Pfizer’s ability to generate free cash flow in the years to come. And in the last few years, free cash flow was fluctuating quite heavily, making an average of the last few years a good basis. In the last five years, Pfizer generated about $16 billion in free cash flow and $15 billion in free cash flow in the last ten years.

We are calculating with $15 billion and 5,705 million diluted shares outstanding, as well as a 10% discount rate. And if we are rather cautious and assume no growth for Pfizer (similar to analysts – see above), we get an intrinsic value of $26.29, and Pfizer would be slightly undervalued at this point. However, I don’t think zero growth is realistic, and we can assume at least growth rates in the low single digits for Pfizer. When assuming 3% growth, we get an intrinsic value of $37.56.

Conclusion

When assessing Pfizer by using “traditional” criteria, we have a business not being able to grow at a high pace. It is however a stock that seems to be undervalued and not only paying a rather high dividend yield but should also generate an annual return of at least 10% – making it a solid investment.

And despite being a systems theorist and believing that systems – including organizations and social systems – will preserve themselves as long as possible, systems can break down. The health system will not break down and will certainly preserve itself, but it seems possible that the health system in the United States has to deal with a huge level of “irritations” (to use the neutral and sociological term) it has to process in the next four years, and this might change the structures within the health system. What does this mean for Pfizer? I don’t know, but I still think the low stock price justifies a cautious “Buy” rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GILD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.