Summary:

- Pfizer shares are now trading at pre-Covid levels, presenting a significant buying opportunity.

- The company has built up a strong cash reserve since Covid, allowing for accelerated R&D, the Seagen acquisition, and a robust product pipeline.

- Our DCF Model indicates a 100% upside for the stock. We wouldn’t be surprised if Pfizer goes above that.

- Pfizer now pays a quarterly dividend of $0.41 per share which is more than 5% in annual yield.

JHVEPhoto

Pfizer is a real bargain now

It hasn’t gone unnoticed that Pfizer (NYSE:PFE) shares have exhibited a major pullback. The company has made huge gains from its covid-related products Comirnaty and Paxlovid so far, and the market seems to believe that when Covid revenues fade out Pfizer will be back at square one. But that’s not the case. It takes money to make money, and Pfizer has made lots of it recently.

Covid has created a major opportunity for Pfizer to build up its cash reserves, with current assets not even near its pre-Covid levels. Pfizer has been building up a pile of cash that has made it possible to accelerate its R&D, acquire Seagen (pending approval) and swiftly advancing its current pipeline of drugs. So, how its share price can be back at pre-covid levels make no sense to us, not even considering recent rate hikes, geopolitical uncertainty and a potential recession. We don’t need the Covid revenues to justify an upcoming bull market. The cash from Covid is enough and will secure a strong product pipeline for years to come.

Growth Catalysts

Unique opportunity to reinvest profits

The company is working hard to reinvest its earnings to help catalyst growth in the coming years. We believe they will succeed. As Pfizer says, “we work tirelessly to translate advanced science and technologies into the therapies that matter most.” And they truly do. In the Covid pandemic, when it mattered the most, they put their brains together and delivered one of human times most important vaccine.

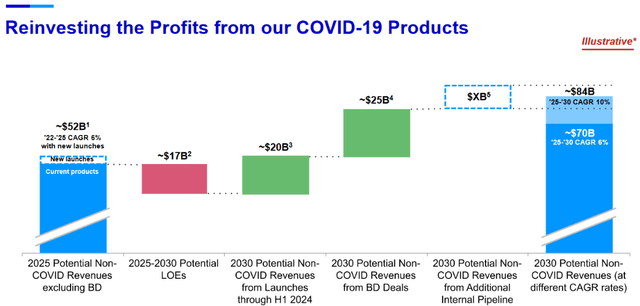

Pfizer posted ex-covid revenue growth of 5% YoY in Q2 2023. But by reinvesting their profits from Covid, they believe they may be able to ramp it up to a CAGR of 10% over the period 2025 to 2030. And we believe they are serious about it. The Loss of Exclusivity (LOE) is estimated to decrease annual revenues by $17 billion. But the pipeline of drugs to enter the market is predicted to add $20 billion in annual non-Covid revenues and with an additional $25 billion in non-Covid revenues from business deals we stand at a 10% CAGR.

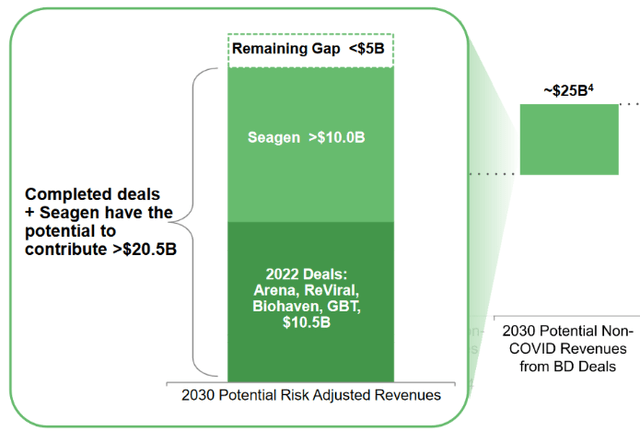

Pfizer’s largest BD deal is the acquisition of Seagen, a deal that just got approved by the European Commission and that is expected to settle in late 2023, early 2024 and bring in more than $10 billion in annual revenues by 2030. Seagen is specialized in the treatment of cancer and is key in Pfizer’s strategic ambition to become a leader in cancer therapy. This acquisition will strengthen Pfizer’s position significantly.

Pfizer’s pipeline of drugs

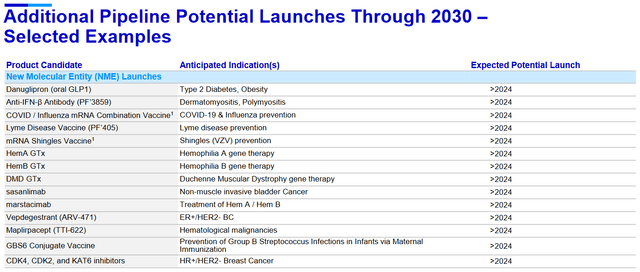

Pfizer launches a record 19 drugs over the next 18 months. Then there are more than 14 drugs in pipeline that will contribute to the $20 billion in non-Covid revenues by 2030. We notice that Pfizer has a well-diversified portfolio of projects. Meaning if one fails, there’s another one that will likely succeed. Diversification is key in finance and this is not an exception. This strong diversification is essential in decreasing the associated risk of holding its shares. Luckily, you don’t need to be a biologist to grasp this.

A glimpse on Pfizer’s latest additions

Elrexfio – a real revenue booster.

Also, worth mentioning is that just recently the company received FDA approval for its blood cancer therapy, branded as Elrexfio. The drug is used in patients with multiple myeloma that is hard to treat or has come back after receiving four or more prior lines of certain classes of treatments. Pfizer says this drug alone has the potential to generate peak year sales of $4 billion. Yes, that’s right – nearly 10% of Q2 2023 annualized revenues. Pfizer has the ambition to become a leader in blood cancer treatment.

Danuglipron – a game changer

Danuglipron, Pfizer’s next-gen GLP-1 drug for Type 2 diabetes and obesity, will be a game changer. If approved by the FDA, Danuglipron will be one of the first weight loss pills in the market with the effectiveness of injectables but at a potentially far lower cost. Furthermore, study data from Pfizer indicate that there is a dose dependence for Danuglipron, meaning the higher the dose, the better the efficacy in their molecule. Something not seen with other molecules.

Pfizer CEO says it’s a $90 billion market opportunity, and he see oral pills as a prime mover in that market. Also, according to market research made by Pfizer there is a clear preferential towards pills compared to injections.

Pfizer is currently studying Danuglipron in a 1,400-person trial for the treatment of both obesity and type 2 diabetes, as well as a smaller study in patients with obesity but not diabetes, which it expects to complete by the end of the year.

Danuglipron alone has been making headlines this year as Lilly, Novo battle looms.

How Covid reshaped Pfizer’s Financials

Recent years high revenues have resulted in improved financials for Pfizer, with its Debt-to-Equity ratio now down to 66% for the most recent quarter, compared to an industry average of 116%. Profitability has improved significantly, with an operating margin of 32% compared to a five-year average of 28% and a weak industry average of only 8%.

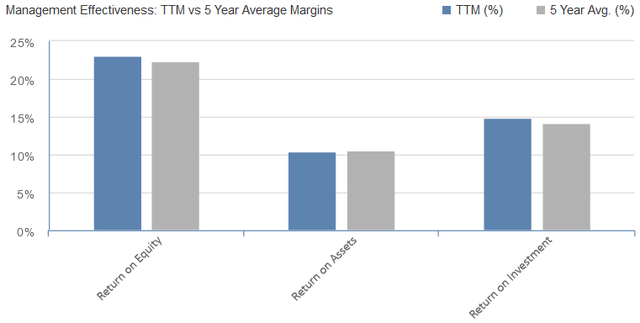

In the most recent quarter (June quarter, 2023) Pfizer holds a stunning $44.8 billion in cash compared to roughly $10 billion at the end of 2019. In other words, the company’s cash piles have quadrupled since the outbreak of Covid. Meanwhile, the company’s been paying off on its debt. We also see an increase in management effectivity with both ROE and ROI beating its five-year averages.

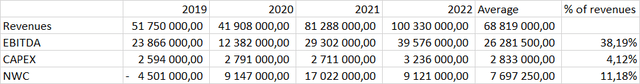

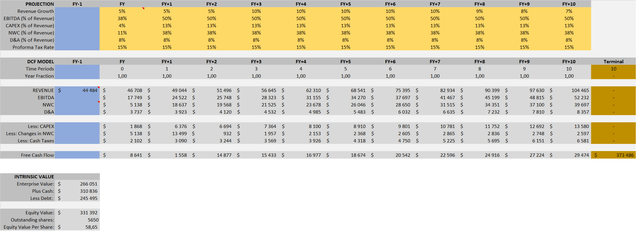

Valuation: DCF simulation using ex-Covid revenues

Pfizer’s profitability and financial health out beat the industry by far, while at the same time Pfizer’s P/E ratio is now down at depressed levels, currently at 8. We need to take into account that Covid revenues will fade out, so let’s see what our DCF Model say, excluding Covid revenues.

Using income, balance sheet and cash flow statements available at Yahoo Finance we produce our very own DCF model using the latest historical data as predictor for the next 5 years.

Assumptions made are as follows:

Revenue starting point: Q4 2022 annualized. Revenue Growth: 5% up to 2025, 10% up to 2030. EBITDA margin: 38% of revenue, 4-year average. Capex: 4% of revenue, 4-year average. Net working Capital:11%, 4-year average. Perpetual growth rate: 3%. Discount rate: 8%.

For our DCF model, we use Q4 2022 annualized ex-covid revenue data as our starting point. Pfizer’s revenue for Q4 2022 was $11.127 billion. We then add an annual growth rate of 5% up to 2025 and then 10% up to 2030, then successively decreasing growth to 7% as of 2033. Once we have our revenue predictions all set, we deduct and add to the revenue numbers using our above assumptions to estimate our Free Cash Flow and generate our target price. Based on our model, the target price for Pfizer is around $60 with a potential 100% upside.

The dividend yield is now above 5%

Like the upside wasn’t enough, Pfizer now pays a quarterly dividend of $0.41 per share which is more than 5% in annual yield. And please note that Pfizer offers a reliable dividend. There hasn’t been one cut since the Great Recession. For those looking for a dividend paying stock with a descent upside, it cannot get much better.

Summary

Amid the recent drop in Pfizer’s share price the stock is now trading at pre-covid levels and with a P/E ratio of 8 which is near its ten-year low. We believe the stock is heavily undervalued and that it holds for a major upside in the coming year. We set our target price for Pfizer at $60 but it wouldn’t surprise us if the stock goes above that.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.