Summary:

- Pfizer remains a strong investment opportunity with a diverse product portfolio and solid financials despite a decline in revenue due to the end of the pandemic.

- The company has demonstrated resilience and growth in its non-COVID products, with a 7% year-to-date operational growth in 2023.

- Pfizer’s financial outlook for 2024, including cost-saving initiatives and the acquisition of Seagen, positions it for continued growth and a potential upside in stock value.

- PFE offers a dividend yield of 5.8% and has grown the dividend for over 15 consecutive years.

JHVEPhoto

Overview

I’ve always preferred to invest with a data-driven long term outlook. Therefore, I look for quality opportunities where I can grow my income and capture a superior total return. With some entities, where you start an initial position really matters most. I think the price level of Pfizer (NYSE:PFE) is one of these opportunities based on the dividend coverage and growth, valuation metrics, and future growth outlook. The current price under $30/share offers an opportunity to lock in potential double-digit gains throughout 2024 while also collecting a safe 5.8% dividend.

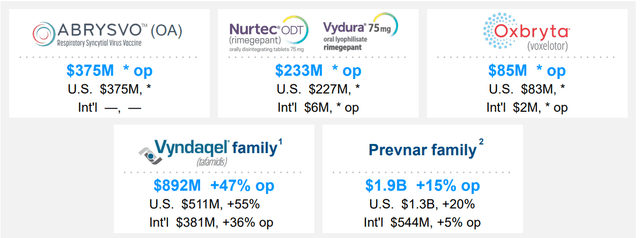

Pfizer is a global biopharmaceutical company engaged in the discovery, development, manufacturing, and distribution of a diverse range of medicines and vaccines worldwide. The company’s product portfolio spans various therapeutic areas as well as and COVID-19 prevention and treatment. Notable brands include Abrysvo, Nurtec ODT/Vydura, and Paxlovid. I think their non-Covid portfolio of products will see improved growth and help reach the projected revenue goals.

Post Pandemic

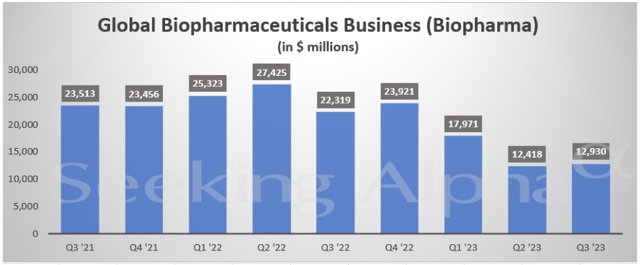

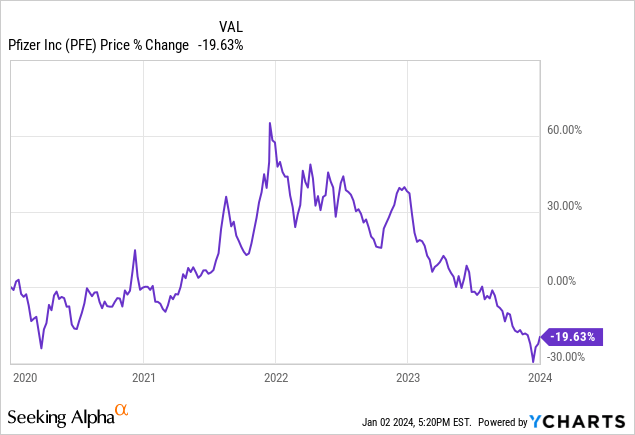

Despite a significant decline in revenue and profitability since the peak of the pandemic, Pfizer remains highly profitable with a robust balance sheet. Shares traded as high as $60 during the tail end of 2021 and have now fallen over 50% since those highs. It seems that the general consensus is that PFE is no longer the company to be invested in now that the combative need against Covid has essentially come to a stop. Still, I think PFE is a strong buy because they have a portfolio of non-covid related products that remain profitable and growing. Hence, I will be accumulating a position as the price remains under $30/share.

Pfizer has demonstrated commendable resilience and growth, evident in its operational performance, with a solid 7% year-to-date operational growth for non-COVID revenues during the first three quarters of 2023. I think that this accomplishment underscores the company’s ability to navigate challenges and capture opportunities within its diversified product portfolio of drugs not related to Covid.

Moreover, Pfizer is charting a promising trajectory towards meeting its full-year 2023 operational revenue growth targets. They are set to report their Q4 earnings on Jan 30th so we will have to wait until then to get the final numbers. I plan to circle back on my outlook once they report earnings. PFE remains on track for achieving the projected 6-8% operational revenue growth excluding COVID-related products by the end of the fiscal year.

Financials

Pfizer had a tough Q3 report, marking its second time missing revenue expectations. This happened because fewer people needed PFE’s Covid products as the pandemic impact lessened. The company’s stock hit a new low during trading in the afternoon as it reported its first loss since 2019. However, PFE has a much larger portfolio of drugs that are growing in revenue, so I am not worried about this.

In the same Q3 earnings, Pfizer reported revenues of $13.2 billion. Despite the setback from the decreased need of Covid-related drugs, there was a positive offset with a 10% operational upswing in revenues from Pfizer’s non-Covid products. The reported diluted loss per share for the quarter stood at $(0.42), while the adjusted diluted LPS was $(0.17).

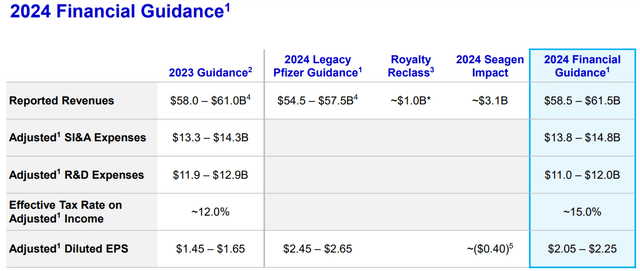

Pfizer initiated an enterprise-wide cost realignment program to heighten operational efficiency. This program targets achieving annual net cost savings of at least $3.5 billion, with an expected realization of approximately $1.0 billion in 2023 and an additional $2.5 billion in savings in 2024. This strategic cost-saving initiative is exactly what’s needed and it shows that management is actively trying to combat the slowing revenues in my view. Additionally, PFE’s refined cost realignment program is expected to realize around $4.0 billion in combined operational expenditure reductions by the end of 2024, representing a $500 million increment in expense reductions.

Looking ahead to 2024, Pfizer’s guidance is effected by pivotal factors such as with the inclusion of Seagen. PFE completed the acquisition of Seagen quite recently and I think this will boost the revenue potential going forward. Seagen is a biotech firm specializing in cancer medicines. The strategic move aims to advance breakthroughs in cancer treatment, leveraging Seagen’s leading Antibody-Drug Conjugate technology alongside Pfizer’s capabilities. The operational revenue growth (excluding Comirnaty and Paxlovid) is anticipated to fall within the 8-10% range. Excluding Comirnaty, Paxlovid, and Seagen, operational revenue growth is forecasted to be in the 3-5% range.

The final 2024 guidance estimates reported revenues to be around $58.5 – $61.5 billion, which represents a slight $500 million increase potential due to the cost savings initiative. Also, adjusted research and development expenses are estimated to decreased by about $1 billion. Lastly, the adjusted diluted EPS is estimated to rise from the prior year’s guidance range of $1.45 – $1.65, up to $2.05 – $2.25 for 2024.

Dividend

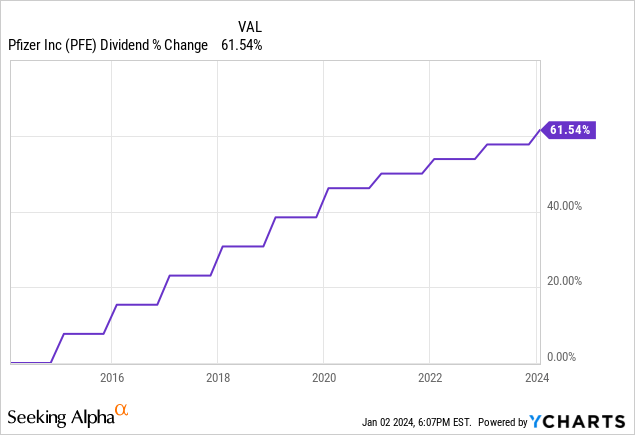

As of the latest declared quarterly dividend of $0.42/share, the current dividend yield sits around 5.8%. PFE has raised their dividend payouts for 15 consecutive years. The current payout ratio sits at a comfortable 57% so I do not see any future cuts happening in the future. This is reinforced by the fact that PFE’s last announced dividend represented a slight 2.4% increase over the prior dividend of $0.41/share. The dividend has grown over 60% over the last decade.

The growth here has been solid as well. The five-year average growth rate of the dividend is approximately 5%. Zooming out to a longer time horizon, the average compounded growth of the dividend sits at 6.07%. This is slightly below the sector median growth of 7.72% over the same time horizon. However, I don’t think this necessarily brings anything to worry about, as I think the dividend growth will get strong with PFE as the rest of their portfolio continues to grow.

Valuation

The Wall St. price targets range from as low as $23/share to as high as $50/share. The average price target is $33.05/share, which represents a slight 11% upside from the current price level. For reference, the P/E sits at 15.7x in comparison to the sector median P/E of 33.18x. While this may indicate upside, we think running a quick DCF (discounted cash flow) model here would provide more insights in terms of valuation.

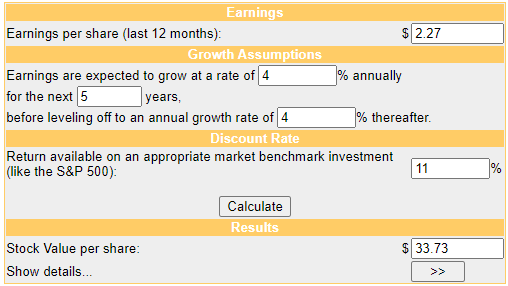

For 2024, the estimated EPS is 2.27x. In addition, the estimated growth of operating revenue is between 6% – 8% for FY2023. While we won’t know how PFE has performed until their next earnings to be reported at the end of January, we can use this as a placeholder for future growth throughout 2024. In addition, the sector median EPS growth is about 4% so we will use this as an input as well.

Money Chimp

Using these inputs, we can determine that a fair stock value for PFE is about $33.73/share. This closely aligns with the previously mentioned Wall St. target and would represent a potential short term upside of 13.45%. Combine this potential upside with the existing 5.8% dividend yield and you are looking at a probable double-digit return by the end of fiscal year 2024. This is why I plan to accumulate shares and collect the dividend while we wait for the price action to play out. I believe forward-looking catalysts will continue to be reported with growth in their non-covid related products.

Risks

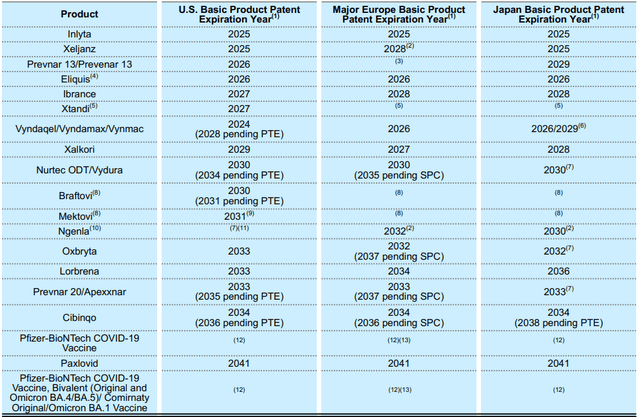

While Pfizer’s appeal as an investment is evident, there are risks worth mentioning. A risk for PFE is the upcoming expiration of key patents for some of its drugs in the next four years. When patents expire, generic or biosimilar versions become available, leading to increased competition and lower prices compared to the original branded drugs.

This loss of market exclusivity can lead to a substantial drop in sales for Pfizer’s once-profitable drugs. For example, Eliquis, a crucial medication preventing blood clots, faces the risk of declining sales as its patent expires in 2026, allowing generic alternatives to enter the market at lower prices.

In essence, patent expires pose a threat to Pfizer’s financial stability by diminishing its market exclusivity and subjecting the company to intense competition. The resulting lower pricing and decreased market share for these drugs can have a substantial impact on PFE’s overall revenue and profitability. Successfully managing this challenge is crucial for PFE to sustain its position in the pharma industry.

Takeaway

Pfizer is still a good investment, even though they earned less money after the pandemic. They’re still earning a lot of profit because they sell various non-COVID related drugs. In Q3 2023, their non-COVID drugs made 7% more money than before, showing that Pfizer can adapt and grow. Looking ahead, Pfizer’s financial outlook, 2024 plans, and a 5.8% dividend yield make it a good choice for investors. The expected stock value is $33.73/share, which also presents a bit of upside.

At the same time, though, there are risks to be aware of such as Pfizer’s important patents ending soon. This might be tough for their finances because others can make similar drugs, making PFE face more competition and lower prices. Handling these risks well is crucial for PFE to keep its strong position in the drug industry and keep growing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.