Pfizer: Ignore The Dead Cat Bounce

Summary:

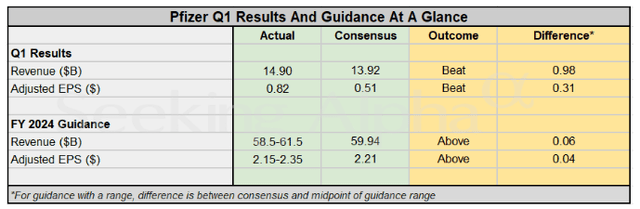

- Pfizer’s Q1 earnings release showed strong performance, beating revenue estimates and providing positive guidance for FY 2024.

- However, secular weaknesses such as declining operating margins and the need for new products to replace expiring patents persist.

- The company’s highly leveraged balance sheet and overvaluation after a recent rally led to a downgrade to ‘Strong Sell’.

no_limit_pictures

Introduction

I had a bearish thesis about Pfizer (NYSE:PFE) in February, but the stock price increased by 3% since then. Overall, my thesis kept up well, but the stock rallied by almost 8% last week after the last week’s earnings release. Today, I want to explain why Q1 earnings release is unlikely to be an inflection point. Despite solid Q1 performance, there are several secular weaknesses and PFE’s highly leveraged balance sheet limits the management’s ability to turnaround. Moreover, the stock became overvalued because of the recent rally, which made me downgrade PFE to ‘Strong Sell’.

Fundamental analysis

The most important event that happened with Pfizer recently was the Q1 earnings release. The company delivered a strong quarter, beating revenue consensus estimates by almost a billion USD and demonstrating adjusted EPS above expectations. Investors’ positive reaction to PFE’s earnings was also backed by the FY 2024 guidance coming out above consensus.

SA

PFE’s Q1 revenue fell by around 20% YoY and the decline is mostly explained by the significant drop in COVID-19 products like Comirnaty and Paxlovid. On the other hand, PFE demonstrated growth across other categories. According to the press release, excluding contributions from Comirnaty and Paxlovid, revenues grew 11% operationally. The bottom-line strength is also explained by cost savings, as the management shared an insight that PFE is on track to deliver at least $4 Billion in net cost savings by the end of 2024.

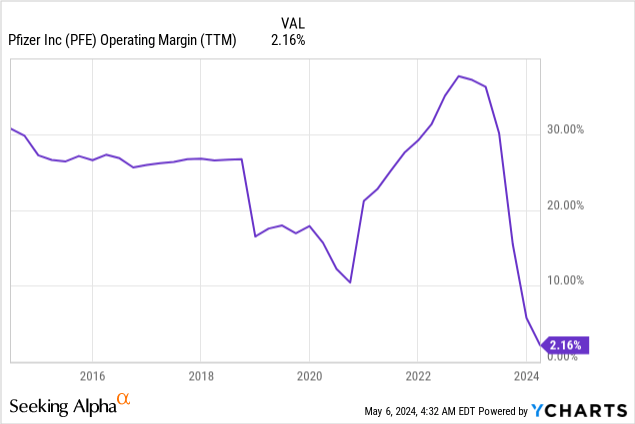

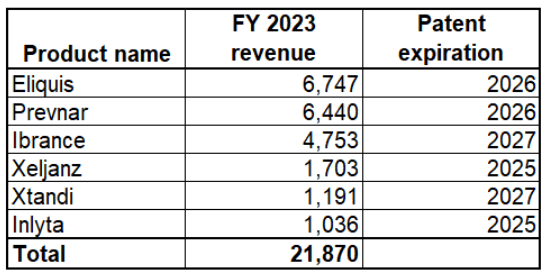

Despite delivering a strong Q1 performance with positive outlook, I think that secular issues still persist. As demonstrated in the below chart, the road to recover PFE’s operating margin to pre-pandemic levels still appears to be long. Moreover, please let me remind readers that products with patents expiring in 2025-2027 generated $22 billion in FY 2023 revenue for PFE. That said, the company needs to invest in R&D aggressively to release new products within the next couple of years which will replace revenue from superstars like Eliquis and Prevnar (both expiring in 2026). Therefore, I expect the pressure on PFE’s operating margin to persist.

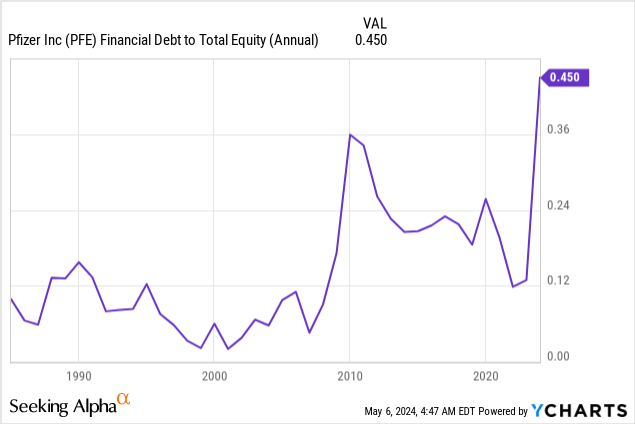

Another warning secular factor that I see is that the company’s balance sheet is currently the most leveraged than ever. Pfizer’s net debt position is above $62 billion, mostly due to the acquisition of Seagen to expand its presence in the cancer treatment industry. This acquisition not only bears significant merger risks for the company and its investors, but also significantly limits Pfizer’s financial flexibility to finance new prospective ventures.

To add context, prior to the Seagen acquisition, Pfizer’s net debt ranged between $10 billion to $44 billion over the last decade. The substantial net debt position together with the expected necessity to boost R&D spending to offset revenue from products which will lose patent exclusivity over the next three years make me doubtful about the sustainability of Pfizer’s 6% forward dividend yield.

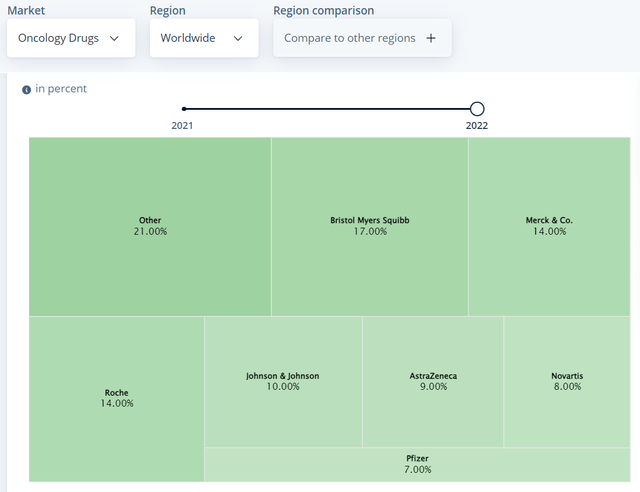

In addition to the substantial increase in leverage because of Seagen acquisition and massive integration risks, I also want to underline that Pfizer is nowhere near being a major player in the oncology drugs industry. I could have strategically understood this move if Pfizer had become the number one player in the industry after this acquisition, or it would have fortified its leadership. According to Seagen’s latest available 10-K report, this company generated less than $2 billion in revenue in FY 2022. According to Statista, the whole industry was worth $188 billion in 2023. That said, consolidating Seagen’s revenue to Pfizer’s revenue will add about one percent market share to PFE. That said, I think that paying more than $41 billion for Seagen acquisition to move up from sevenths to sixth place in the industry does not seem justified.

Statista

From what we can observe, there are quite a few significant long-term issues at play, and I don’t believe that robust Q1 earnings alone should overshadow these strategic concerns. My outlook on PFE remains pessimistic, mainly because its balance sheet isn’t as robust as it once was pre-pandemic. The company is facing pressure to introduce new blockbuster drugs to compensate for the inevitable loss of tens of billions in revenue due to key patents expiring. This situation will likely force PFE to ramp up its R&D spending, thereby putting a strain on its operating margin.

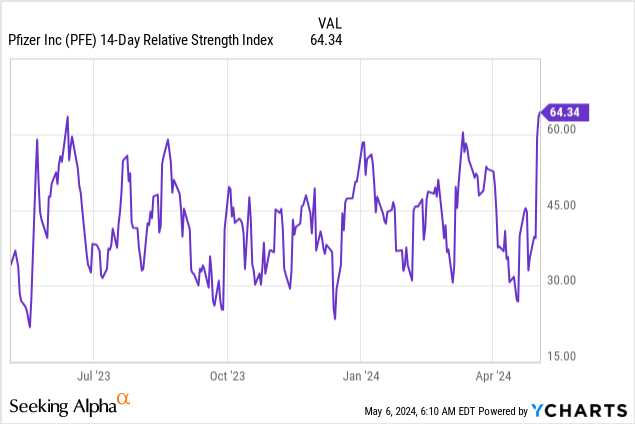

Apart from fundamental reasons, I also shall underline that the stock appears to be extremely overbought after last week’s rally. The stock’s 14-day relative strength index (‘RSI’) is at its highest over the last twelve months, which might likely indicate that profit-taking is approaching.

Valuation analysis

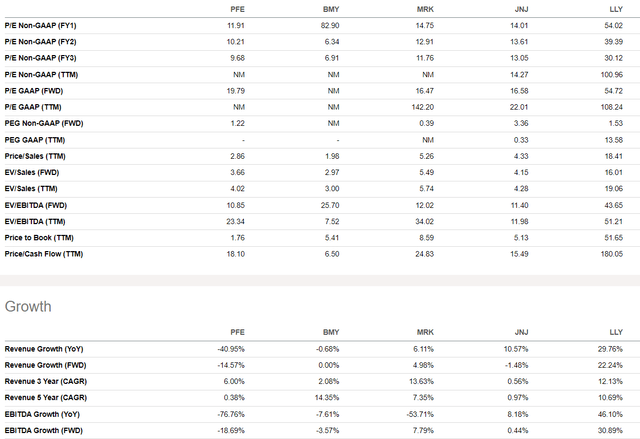

Pfizer appears to be notably cheaper than other prominent pharmaceutical companies across various valuation ratios. On the other hand, we should not forget that cheaper multiples are justified if we pay attention to the fact that Pfizer’s revenue delivered the worst-in-class CAGR over the last five years and forward metrics also do not add much optimism.

SA

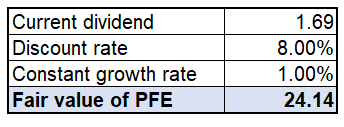

Therefore, PFE’s low multiples appear to be fair considering all the secular weaknesses I have described and due to almost no revenue growth over the last five years. To cross-check, I must calculate the dividend discount model (‘DDM’) equation. Pfizer’s cost of equity is 8% and considering all the challenges I have described in ‘Fundamental analysis’, I do not expect constant dividend growth to be higher than 1%. The current dividend is $1.69.

Calculated by the author

My DDM analysis suggests that PFE’s fair value is $24.14. Since the stock closed at $27.8 after the earnings release, it appears overvalued by around 13% at the moment.

Mitigating factors

Since my bearish thesis emphasizes significant risks of losing revenue after Pfizer’s bestsellers like Eliquis and Prevnar lose their exclusivity in 2026, any new stellar products releases might work against my thesis. News regarding Pfizer getting FDA approval for a new promising drug might lead to a rally in the stock. However, I want to emphasize here that releasing one or two new stellar products is unlikely to be enough for PFE to offset the effect of losing legacy patents. In the below table, readers can assess the extent of the effect of losing key patents in 2025-2027, and PFE will need more than 4-5 new stellar products to offset this effect.

Calculated by the author based on PFE’s 10-K

The management’s new potential cost-saving initiatives also might be a positive catalyst for the stock price. Moreover, Pfizer might move ahead of the announced $4 billion cost saving plan. Since the company’s expenses have a direct positive impact on the EPS, moving ahead of the savings plan might help PFE to notably surpass consensus EPS expectations, in case revenue performance is at least in line with expectations. However, due to the pressure on revenue, there is also a notable probability that PFE’s cost-cutting might be offset by topline challenges.

Conclusion

I would recommend my readers to ignore last week’s rally, which I consider to be the dead cat bounce. I must admit that Q1 financial performance was solid, but secular weaknesses persist. This means that Q1 recovery in the company’s financial performance does not signal an inflection point, but is just an outlier. The fact that the stock became overvalued after last week’s rally made me downgrade PFE to ‘Strong Sell’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.