Summary:

- Pfizer’s stock has underperformed the market due to declining revenue and profits on a YoY basis, but it is essential to understand that last year was an anomaly.

- The company’s recent earnings showed a decline in revenue but compared to pre-vaccination levels, revenue has increased by 8% and profitability metrics remain strong.

- The stock is undervalued and has a target price of $40 according to a dividend discount model, making it an attractive investment opportunity.

Aja Koska/E+ via Getty Images

Investment thesis

My initial bullish thesis about Pfizer’s (NYSE:PFE) stock did not age well because it significantly underperformed the broader U.S. market by declining 15% over the last quarter. The stock’s weakness was mainly due to several breaking headlines indicating the company’s massively declining revenue and profits on a YoY basis. But I prefer to ignore the noise and look at the context, which indicates that the previous fiscal year will highly likely be by far the most successful due to unique tailwinds related to the global COVID-19 vaccination. The company’s revenues are increasing compared to pre-vaccination levels, and that is the more suitable factor to be considered. The expected decline in Q3 profits compared to 2019-2020 Q3 also should not mislead investors since a couple of significant non-cash transactions are expected. My valuation analysis suggests that the stock is substantially undervalued. I reiterate my “Strong Buy” rating for PFE and would like to emphasize that the stock price is now very close to the March 2020 stock market dip due to the COVID-19 panic.

Seeking Alpha

Recent developments

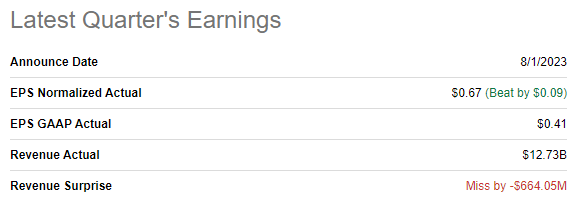

The latest quarterly earnings were released on August 1, when the company missed consensus revenue estimates but outperformed from the bottom line perspective. Revenue declined by 54% YoY since comparatives include revenue from COVID-19 vaccination. The adjusted EPS changed accordingly, with a significant drop from $2.04 to $0.67.

Seeking Alpha

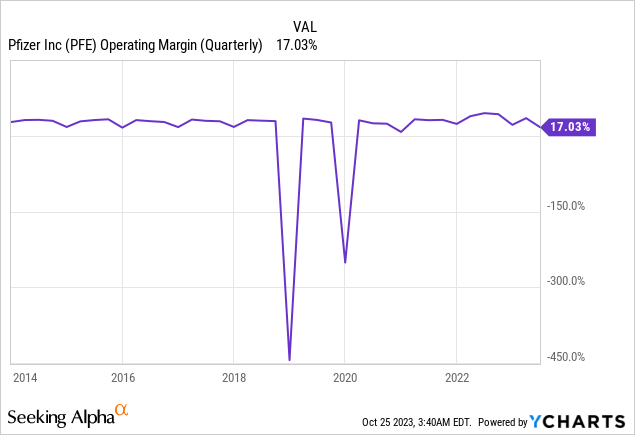

COVID-19 was a big positive disruption for Pfizer’s business as the company was one of the very limited group of players who were able to deliver vaccines against the virus. Therefore, it would be more correct to compare the last quarter’s financial performance to the latest quarter before massive vaccination contracts started, and it is Q2 of FY 2020. With this more fair comparison, we can see that revenue grew by a solid 8%. It is also important to keep in mind that the company’s profitability metrics are still in line with pre-pandemic levels.

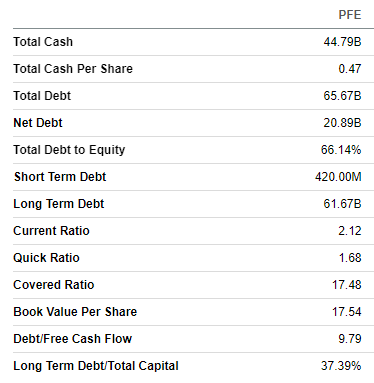

The company has been efficient in improving its balance sheet while absorbing massive COVID-19 tailwinds, and I consider the company’s financial position as a fortress. Despite massive debt, the company’s cash balance as of the latest reporting date was also huge. Moreover, the covered ratio is high, and short-term liquidity metrics are in excellent shape. Maintaining wide profitability metrics suggests the company’s balance sheet is safe and makes the company well-positioned to fuel further growth and innovation.

Seeking Alpha

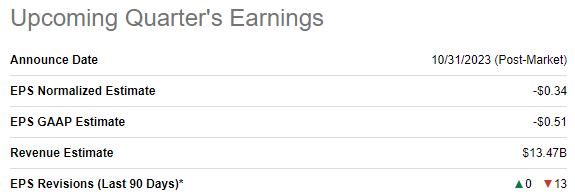

The upcoming quarter’s earnings are scheduled for release on October 31. Revenue is expected to rebound sequentially as consensus estimates forecast Q3 sales at $13.47 billion. It indicates a 41% YoY decrease due to the comparatives, including COVID-19 revenues. The adjusted EPS is expected to decline notably from $1.78 to -$0.34.

Seeking Alpha

Once again, I would like to ignore the comparison with the previous year’s Q3 and look at pre-vaccination revenue levels in Q3. Sales in Q3 FY 2020 were at $12.13 billion, which means the upcoming quarter’s revenue is expected to demonstrate decent dynamics compared to pre-vaccination performance with an 11% growth. The vast expected weakness in the adjusted EPS should not mislead readers because the company recorded two significant non-cash transactions, including a $4.2 billion revenue reversal and a $5.5 billion charge related to COVID-19 inventory write-offs. If we assume that the total number of shares outstanding is about 5.6 billion, it means that the effect of these non-cash transactions on EPS is about $1.73. That said, with the effect of non-cash transactions eliminated, the adjusted EPS in Q3 should be about $1.39, which is a solid improvement compared to pre-vaccination levels.

As a long-term investor, I prefer to ignore the noise and consider only fundamental factors. Yes, revenue is falling sharply, but it makes no sense to compare current revenue to the year when there was a global once-in-a-century mass vaccination campaign. The company demonstrates solid revenue growth compared to pre-vaccination times, which is a significant positive factor. It is also crucial to underline that the management recently launched a vast $3.5 billion cost realignment program, a solid bullish sign for investors.

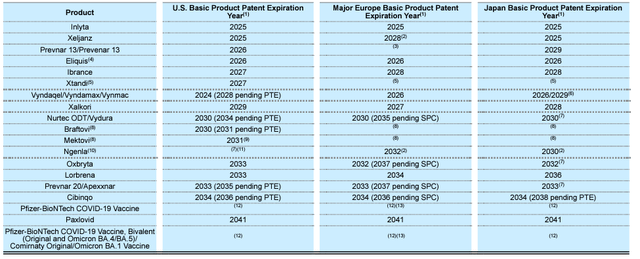

In the pharmaceutical business, it is crucial to have a solid portfolio of patents, and Pfizer is one of the strongest players from this perspective. The company has a broadly diversified portfolio of products, most of which have remote expiration dates. It is also important to keep in mind that, according to the latest earnings call, over the next 18 months, the company plans to launch 19 new products.

Pfizer’s latest 10-K report

Valuation update

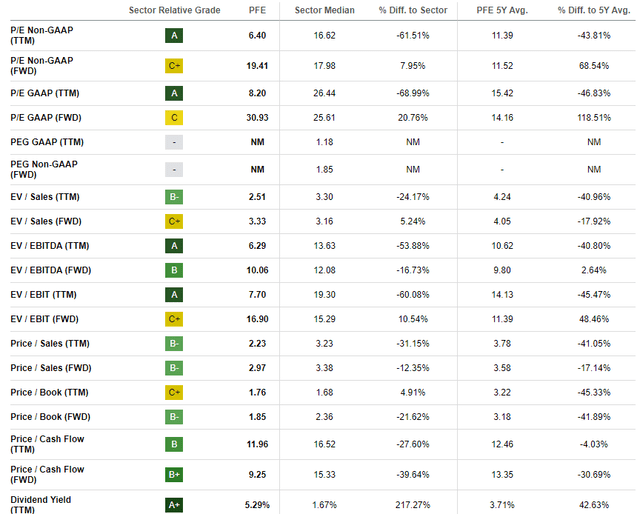

The stock price declined by 40% year-to-date, significantly underperforming both the broader U.S. market and the Healthcare sector (XLV). Seeking Alpha Quant assigns PFE a high “A-” valuation grade because ratios are mostly substantially lower than the sector median and historical averages. That said, the stock looks very attractively valued from the perspective of the ratios.

Seeking Alpha

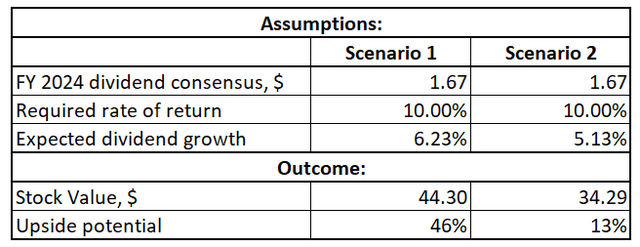

Pfizer has a rich history of dividend payouts and dividend growth, so I want to proceed with the dividend discount model [DDM]. I use a 10% WACC as a required rate of return. Consensus dividend estimates forecast FY 2024 payout at $1.67. I simulate two scenarios for dividend growth using dividend CAGR for the last decade and the last five years.

Author’s calculations

According to my DDM calculations, the stock is substantially undervalued under both scenarios. My target price for the stock is $40, which is approximately the midpoint between the two scenarios outcomes.

Risks update

As a pharmaceutical company, Pfizer faces substantial regulatory risks because the industry is heavily regulated by various government agencies around the world. Failure to comply with regulations could lead to adverse effects both on the company’s financial performance and its reputation.

The industry is rapidly evolving, and so are the challenges the global healthcare faces. While the company demonstrated stellar efficiency in utilizing the largest healthcare disruption of the past century, it is not a guarantee that it will be as efficient in addressing the changing environment. The risk looks remote to me, given the management’s focus on fueling growth and innovation, but the adverse impact can be massive if the company fails to address changes in the healthcare environment.

Bottom line

To conclude, PFE is still a “Strong Buy”. Recent weakness in the stock price due to breaking headlines should not mislead long-term investors seeking deep value and solid dividend yield. From the secular perspective, the company’s financial performance is improving, and massive pandemic tailwinds enabled Pfizer to build up a fortress balance sheet. A strong financial position makes the company well-positioned to fuel innovation and build long-term value for shareholders

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.