Summary:

- Pfizer’s stock reached an all-time high in 2021 due to high demand for its COVID-19 vaccine but has since declined by 45% year-to-date.

- The company has revised its financial guidance for FY24, expecting significantly lower sales and profits.

- Declining COVID-related sales, uncertainties surrounding existing products, and negative sentiment suggest that now is not the right time to invest in Pfizer’s stock.

- Although a 5.7% dividend yield might appear attractive, a highly leveraged business and a company paying out more than 100% of its FCF exposes underlying issues.

- Despite the drop in stock price, with the revised guidance Pfizer is not trading at a discount, and I would be interested only below $23.65.

SweetBunFactory

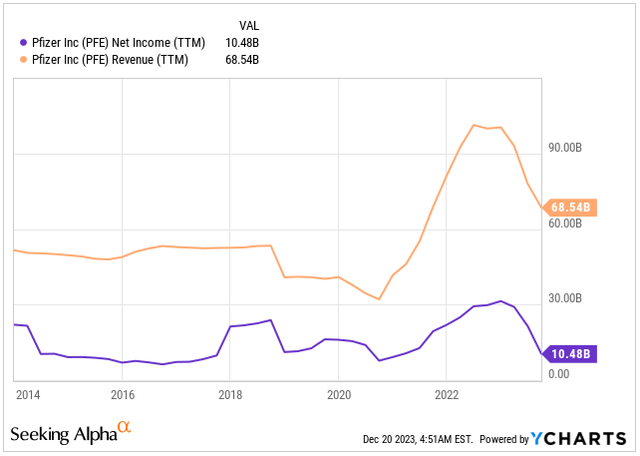

Amidst the pandemic in 2021, Pfizer’s (NYSE:PFE) stock price hit its all-time high of $61.71. A year later, Pfizer reported a record revenue of $100.33 billion, driven by the demand for its vaccine.

Revenue & Net Income (Seeking Alpha)

Today, as the pandemic is mostly over and vaccine-related sales have largely evaporated, Pfizer’s stock is down 45% year-to-date, currently trading at around $28.16.

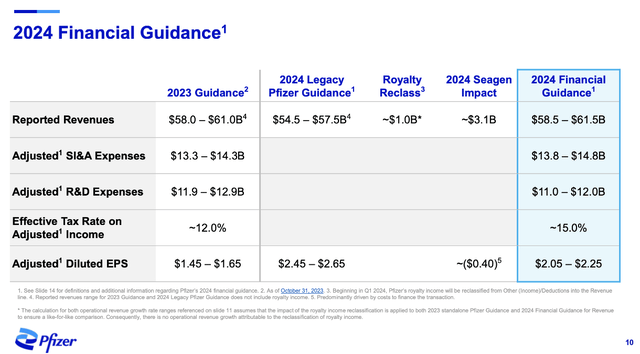

In the midst of another disappointing move, Pfizer has revised its financial guidance for FY24, now expecting full-year sales between $58.5 billion and $61.5 billion and adjusted profits ranging from $2.05 to $2.25 per share.

Amidst the negative sentiment, declining COVID-related sales, and uncertainty surrounding existing products, I am initiating a neutral view of the stock. I anticipate continued underperformance in 2024 and believe it’s not the right moment to add to the stock until we have more clarity.

Another Hard Pill To Swallow

Pfizer’s stock plummeted in mid-December following a disappointing 2024 outlook issued by the Covid vaccine maker, just ahead of the completion of its Seagen takeover.

This isn’t the first instance of Pfizer adjusting its guidance. Back in October, the biopharma slashed estimates for 2023 after amending a supply agreement with the U.S. government for Paxlovid and reducing forecasts for Covid vaccines.

Pfizer currently anticipates full-year 2024 sales between $58.5 billion and $61.5 billion, with adjusted profits ranging from $2.05 to $2.25 per share. This projection includes the addition of Seagen’s business, expected to contribute $3.1 billion in sales in 2024, and a $1 billion royalty reclassification shifted to the revenue line.

These figures widely missed analysts’ expectations of $62.66 billion in sales and $3.13 per share in profit. While the revenue seems relatively consistent with the current year, the fact that the Seagen deal brings in positive revenue highlights Pfizer’s guidance for a 2.6% decrease in revenue from its core business at the midpoint of the guidance.

FY24 Financial Guidance (Seeking Alpha)

Pfizer expects a significant leap in EPS to around $2.55 for next year, thanks to cost cuts of up to $4.0 billion projected by the end of 2024. This estimate marks a substantial increase from the anticipated $1.55 in 2023. However, the incorporation of the Seagen business is anticipated to reduce this estimate by $0.40, resulting in a targeted EPS of $2.15 for 2024.

To put it into perspective, at the beginning of the year, Pfizer had predicted total revenues reaching as high as $70 billion. Consensus estimates aligned with this, foreseeing revenues remaining around the $70 billion mark in the upcoming years. The forecast accounted for a gradual decline in Covid-related sales, balanced by a 3% to 5% growth in operational revenue outside of Covid-related drugs.

The discouraging guidance coincides with a drop in demand for Covid vaccines, impacting not only Pfizer but also its partners BioNTech (BNTX), Moderna (MRNA), and Novavax (NVAX). Sales of the Covid shots Comirnaty and the antiviral pill Paxlovid significantly fell short of already lowered expectations in the third quarter.

Adding to this, Pfizer postponed the release of its mRNA-based flu shot by a year due to its effectiveness against A strains but limited impact against B strains. Moderna faced a similar setback.

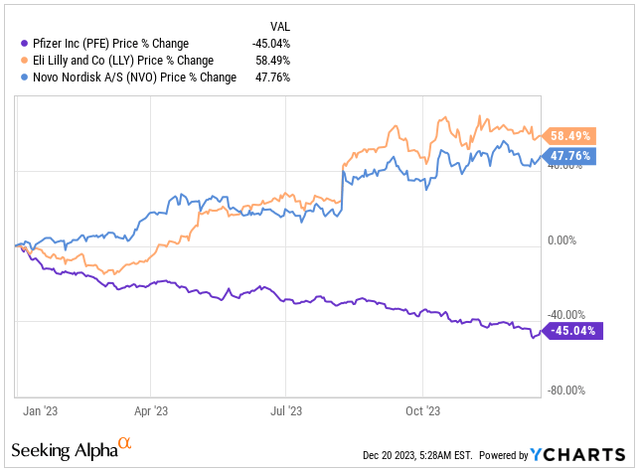

In another blow, Pfizer halted the development of once-daily and twice-daily pills for type 2 diabetes due to unexpected side effects during testing. The company now shifts focus to another once-a-day pill, aiming to compete with Novo Nordisk (NVO) and Eli Lilly (LLY), current leaders in the market for these GLP-1 drugs.

The buzz surrounding weight loss drugs in the biotech arena highlights Pfizer’s absence of a suitable alternative in the market. This gap underscores Pfizer’s lag in the competition, likely impacting sentiment around Pfizer and its performance in the next 12 months.

YTD Performance (Seeking Alpha)

For the current year, Pfizer anticipates adjusted earnings ranging from $1.45 to $1.65 per share and sales between $58 billion and $61 billion. At the midpoint of these estimates, earnings are expected to plummet by 76%, accompanied by a 41% decline in sales.

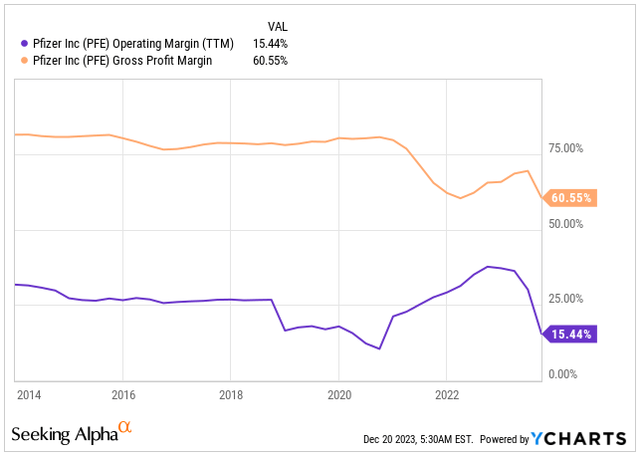

Traditionally regarded as a stable and secure company with consistent profit margins, Pfizer’s current situation presents a shift. The diminishing gross and operating margins underscore more significant concerns for the company beyond the decline in Covid-related sales.

Profit Margins (Seeking Alpha)

The Dividend Is Not As Safe As You Might Think

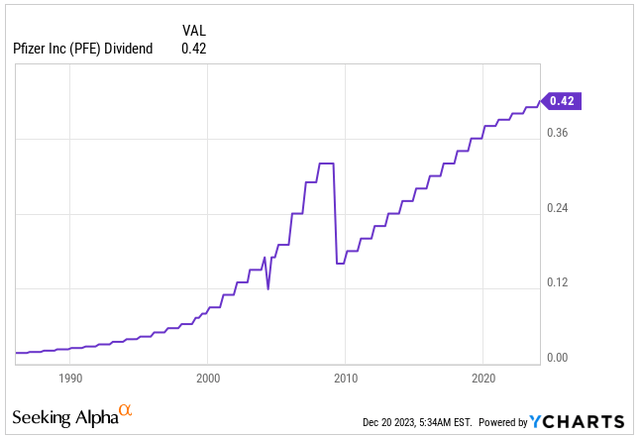

Throughout history, Pfizer stood out to me as a company offering a reliable dividend, a boon for retirees or those seeking consistent income.

However, times have shifted. There are fundamental issues surfacing in its core portfolio, including declining Covid-related sales and increased debt stemming from the Seagen deal. The math doesn’t quite align, especially considering Pfizer’s staggering $43 billion investment in the oncology pipeline.

This move is set to bulk up the balance sheet with net debt at a time when financial stability has notably deteriorated. With the company no longer relying on a robust Covid profit engine to help offset debt from the Seagen deal, I have concerns.

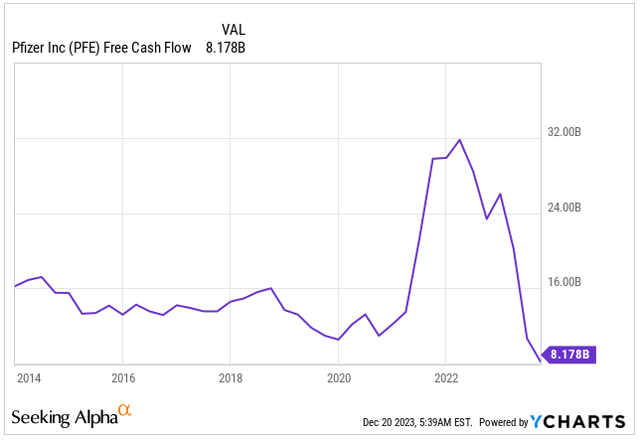

Adding to this, Pfizer presently offers a $0.42 dividend, equating to a 5.67% dividend yield. This means the yearly dividend payout of approximately $9.5 billion will consume 116% of this year’s free cash flow. This significant payout severely curtails Pfizer’s ability to swiftly tackle its debt in the immediate future.

FCF (Seeking Alpha)

I don’t think cutting the dividend is on the table at the moment. The free cash flow to dividend ratio should get better next year. But if things worsen for Pfizer’s core businesses, they might have to either take on additional debt or cut the dividend in the future.

Dividend Per Share (Seeking Alpha)

Valuation

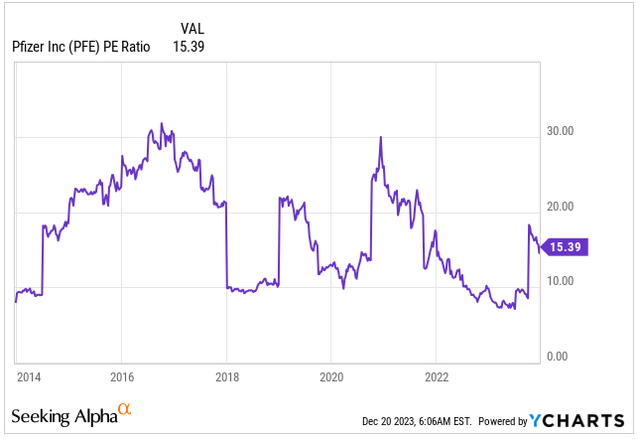

Given the 45% year-to-date decline in the stock price, many might see it as an opportunity to buy due to a presumably favorable valuation.

I disagree.

The drop in stock value mirrors declining sales and profit margins, impacting the overall valuation. Even the Seagen deal fails to counterbalance these issues; in fact, it’s projected to negatively impact earnings per share by -$0.40 in FY24.

Presently, the stock trades at 15.39x its FY23 earnings, aligning closely with the five-year average of 15.54x.

PE Ratio (Seeking Alpha)

Looking ahead to next year, if we consider the adjusted EPS midpoint of the guidance at $2.15, at today’s stock price of $28.16, we arrive at an adjusted PE of 13.1x for its FY24 earnings.

At first glance, this might seem attractive, but it’s actually quite close to the historical average forward PE of 14.74x. Essentially, the stock isn’t trading at a discount, and the disappointing guidance cut, along with the subsequent stock dip, reflects Pfizer’s reality.

Given these factors, I don’t believe it’s the right time to invest in Pfizer’s stock.

Considering the uncertainties surrounding its core business, I’d prefer the stock to trade around 11x forward earnings before starting a new position, implying a stock price of $23.65.

Takeaway

Pfizer is weathering a stormy period with declining COVID-related sales and underperforming core operations. They’ve revised their FY23 and FY24 guidance downward, signaling a significant core business decline that falls well short of analysts’ expectations, especially with the Seagen deal finalizing in December.

The company faces negative sentiment, shrinking profit margins, and a lack of year-over-year growth. Adding to this, the substantial increase in net debt due to the Seagen acquisition makes Pfizer’s dividend precarious, currently at 116% of its free cash flow.

While there’s an expected slight recovery in free cash flow next year, Pfizer confronts a tough reality where paying off the added debt might be challenging. Further deterioration in its core business could force the company into additional debt or necessitate a dividend cut in the coming years.

Despite a year-to-date decline in share price, Pfizer isn’t trading at a discount. Given the uncertainty, I’d recommend waiting for a better entry point, perhaps around $23.65 if you would like to play the potential reversal.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.