Summary:

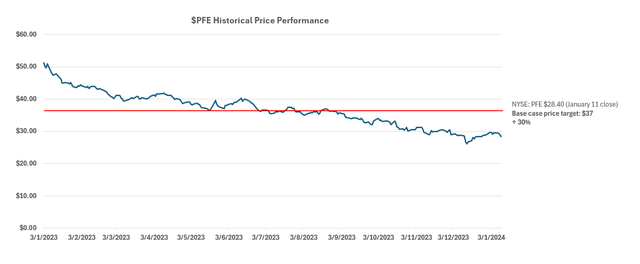

- Pfizer Inc. stock has been on a protracted, yearlong decline due to stronger-than-expected normalization in COVID product uptake rates in 2023.

- But management’s conservative 2024 guidance for COVID product revenues sufficiently de-risks for related headwinds in our opinion.

- With the “clearing event” now largely behind it, Pfizer is well positioned for accretive growth and margin expansion from both its internal pipeline and recently acquired forays in innovative medicine.

- Taken together with its valuation discount to peers, Pfizer presents an attractive opportunity to partake in solid appreciation in 2024 and an ~6% dividend yield at current levels.

JHVEPhoto

Pfizer Inc. (NYSE:PFE) stock has continued to reel from the exhaustion of COVID dollars. Specifically, the 2023 downturn has been primarily dragged by a faster-than-expected normalization of Comirnaty vaccine and Paxlovid COVID treatment uptakes. In addition to the $5.6 billion write-off on Paxlovid/Comirnaty inventory in Q3, management has also provided a weaker-than-expected guidance for said products in 2024. Specifically, management guides $8 billion in Comirnaty/Paxlovid revenue for 2024, underperforming consensus estimates of $14 billion.

The stock is now trading back at pre-COVID levels (~March 2020 low), despite improving operating margins, a higher EPS dollar, and sustained organic revenue (ex-COVID products and ex-Seagen) growth. We also view management’s conservative 2024 guidance for Paxlovid/Comirnaty as reflecting a sufficiently de-risked steady-state benchmark for relevant revenues going forward, leaving margin for incremental upsides. Meanwhile, recent acquisitions are also unlocking synergies to propel Pfizer’s commitment to innovation, complementing its organic launch pipeline.

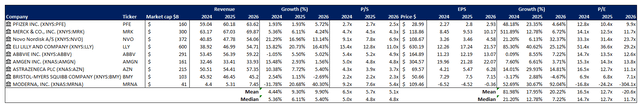

The stock now trades at about 2.7x NTM sales and 12.8x NTM earnings, compared to the peer group average of 6.5x and 16.5x, respectively. Taken together with Seagen’s post-close deleveraging, we believe that Pfizer stock offers a compelling opportunity for partaking in upside appreciation and locking in an attractive dividend yield at current levels.

Guidance Sufficiently De-Risked for Post-COVID Demand

Softer than anticipated demand for Pfizer’s COVID product portfolio in 2023 has been a burden on its fundamental performance. This, inadvertently, also became an imminent multiple compression risk on the stock. Specifically, Pfizer recorded a $5.9 billion write-off pertaining to Paxlovid and Comirnaty inventory in Q3. The write-off follows the amendment to its “U.S. government Paxlovid Supply Agreement,” fast-tracking the treatment’s trajectory to commercial distribution.

In the latest development, management has guided $8 billion in combined revenue for Paxlovid and Comirnaty this year, underperforming the average consensus estimate of $14 billion. The projection also underperforms the $10.3 billion in Paxlovid/Comirnaty revenues generated in the nine months through 2023. Yet management does not expect “COVID vaccination and infection rates to change materially in 2024 versus the prior year.”

As a result, we believe the comparatively lower revenue guidance for 2024 reflects a sufficiently de-risked scenario to compensate for inherent uncertainties to infection rates. 2024 also marks the first full year of commercial distribution for Paxlovid in the U.S., which typically provides greater clarity on the product’s revenue trajectory. This makes the $8 billion guidance also reflective of estimated steady-state demand for Pfizer’s COVID portfolio going forward.

We believe this conservative guidance sets up an appropriate margin for upside potential in the event of higher-than-expected infection rates in the year. More importantly, Pfizer’s robust respiratory vaccination portfolio also underscores the development of “combination products” in the pipeline, which would benefit longer-term COVID revenues.

For instance, the company has recently received indication for its ABRYSVO RSV vaccine for the elderly and maternal population. The product has shown a “70% co-administration rate alongside flu vaccinations” during 2H23, implying potential demand for a combination respiratory product in the longer term. This reinforces confidence that the eventual deployment of a “flu-COVID” vaccine, for instance, could be accretive to the steady-state estimate for Pfizer’s COVID portfolio.

Specifically, Pfizer is already in advanced development of “double and triple combination vaccines” that aim at providing protection against flu, COVID and RSV. For Flu-COVID, Pfizer has already reported positive Phase 1 and Phase 2 data demonstrating “improved immunogenicity against influenza B.” The product is now on fast-tracked advancement to Phase 3 trial in the U.S. within the next few months. Management estimates the novel combination respiratory vaccines will unlock Pfizer’s access to “nearly 50% annual flu vaccination rate in U.S. adults” alone. This accordingly reinforces Pfizer’s growth roadmap through 2030, and represents a key contributor to its target for $20+ billion non-COVID-specific revenues from launches in the internal pipeline through 2030.

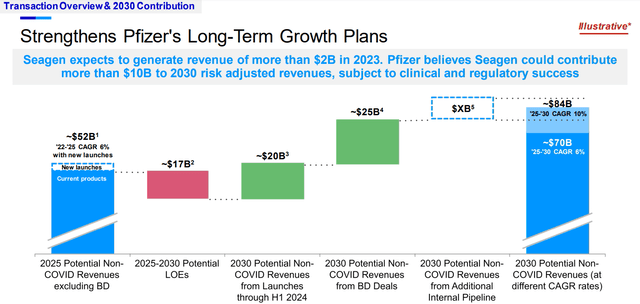

March 2023 Seagen Analyst Call Presentation

Impending Synergies in Innovative Medicine

As part of Pfizer’s refocus back onto its non-COVID portfolio, the company has made a series of acquisitions in recent quarters to reinforce its share of future growth accretive opportunities. These include:

- Biohaven, which is a leading provider of oral CRGP drug Nurtec;

- Global Blood Therapeutics (“GBT”), the maker of Oxbryta in treating sickle cell disease; and

- Seagen, which is innovating antibody-drug conjugates (“ADCs”) that target cancer cells, as opposed to traditional chemotherapy which also harms healthy cells.

The three recent acquisitions offer immediate growth opportunities that are accretive to Pfizer’s non-COVID operational revenues.

Biohaven

For instance, the acquisition of Biohaven effectively propels Pfizer’s participation in growing opportunities within oral CGRPs (Calcitonin Gene-Related Peptide Receptor) for treating migraines. Specifically, Biohaven’s Nurtec and Vydura remain well-positioned for significant growth headroom in the longer term. In the three full quarters since the acquisition, the drugs have already contributed close to 2% of Pfizer’s total revenues. Total prescriptions for Nurtec have continued at a high clip of +28% y/y in Q3. This corroborates the durability of Nurtec’s leading market share of 47.5% in oral CGRP treatments for migraine of 47.5%, and 46% in total new brand prescriptions reported in 1Q23. Nurtec was also the preferred treatment in 80% of new CGRP prescribers in 1Q23, which is sustained through 3Q23 with a 30% preference over competitors Ubrelvy and Qulipta of AbbVie Inc. (ABBV).

In addition to robust demand trends, Nurtec and Vydura also benefits from the structural transition away from Triptans to oral CGRP receptor antagonist treatments for migraine. Specifically, GCRP antagonist treatments are gepants designed to bind onto the “CGRP receptor” released by nerves that trigger migraines. Meanwhile, traditional Triptan treatments address migraines by “suppressing” the release of triggering CGRP. Oral CGRP treatments were designed to address the shortfalls of triptans, which include “recurrence and cardiovascular constriction effects”. Although the nascent treatment currently only represents about 17% of the migraine market, new prescriptions are accelerating. This accordingly corroborates further opportunities for Pfizer share gains in this primary care segment through Nurtec/Vydura.

GBT

The acquisition of GBT also catapulted PFE’s foray into treating sickle cell disease – a blood disorder that prevents red blood cells from carrying oxygen throughout the body, which could lead to adverse health implications (e.g., organ failure). Specifically, the active drug in GBT’s Oxbryta is Voxelotor, which is a key treatment for sickle cell disease. Voxelotor aims at ensuring hemoglobin within red blood cells, which are responsible for delivering oxygen through the body, stays oxygenated. It also reduces the “sickling” of red blood cells to prevent blockage in the vessels and ensure proper flow throughout the body. Taken together, the drug, while not a cure, helps to reduce the impact of sickle cell disease.

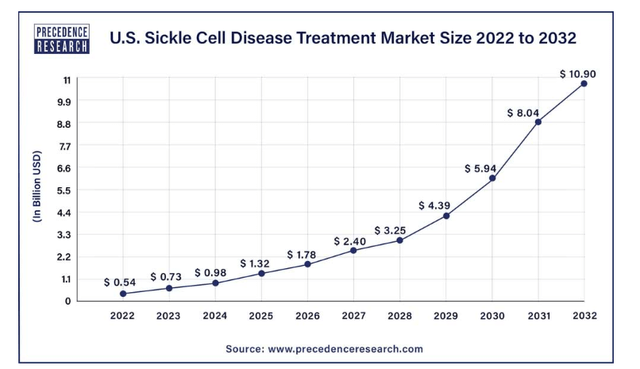

With Oxbryta, Pfizer is well-positioned to participate in the accelerating demand for sickle cell disease treatments – across all of North America, Europe and less developed regions where the disease is most prevalent. In the U.S. alone, the market for sickle cell disease treatments is expected to accelerate at a 10-year CAGR of 35.1% through 2032 and reach $11 billion.

The U.S. currently represents the largest market for sickle cell disease treatments, simply due to improved accessibility relative to other regions. Related treatments can be categorized into four segments: blood transfusion, bone marrow transplant, hospitalization, and specialty care. Oxbryta belongs to the specialty care segment, which focuses on “diagnosing, managing and providing specialized treatment for individuals with sickle cell disease”. This is expected to be the fastest-growing segment of the sickle cell disease treatment market, with a 10-year CAGR of more than 49.5%. And Oxbryta has performed accordingly. The drug contributed $85 million in revenue in 3Q23, which is 52% greater than the quarterly run rate of about $56 million reported by GBT prior to Pfizer’s 2022 acquisition.

To better capture the ensuing opportunities, Pfizer is currently in phase 3 trial for a pediatric indication for Oxbryta. The drug has already previously received FDA approval for age 12+ administration in 2019, and ages 4-11 administration in 2021. Pfizer has disclosed that the safety and effectiveness of Oxbryta administration to children below the age of 4 remains uncertain. This potentially highlights that the pediatric indication within its phase 3 product pipeline may be aimed at further expanding the opportunity for Oxbryta. This is also in line with GBT’s early 2022 Investor Presentation, which indicated phase 2 trial in the U.S. for Oxbryta administration in children ages 6 months to 4 years. Materialization of pediatric indication for Oxbryta is expected to complement the immediate opportunity, and drive further accretive synergies to the acquisition for Pfizer.

Seagen

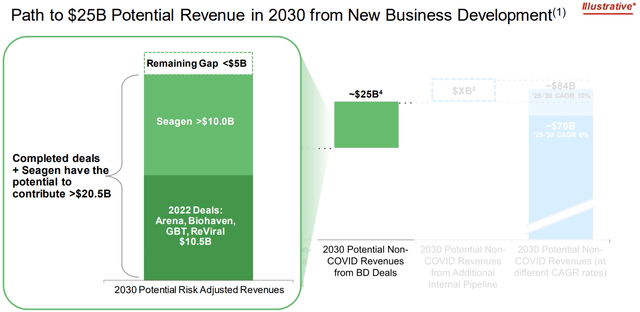

Pfizer has recently closed its high-profile acquisition of Seagen, a leader in antibody drug conjugates (“ADCs”) in oncology. The transaction came at a hefty price of $43 billion, or $229 per share, which was proposed at a 15% premium to Seagen’s market value at the time of proposal in early 2023. Management expects realization of $1 billion in total cost synergies by the third full year post-close. And Seagen is expected to play a critical role in contributing more than $10 billion to Pfizer’s revenue growth target through 2030. This represents about 40% of Pfizer’s $25 billion revenue target from business development deals through 2030.

March 2023 Seagen Analyst Call Presentation

Yet the acquisition has substantially increased Pfizer’s debt profile. The transaction was primarily financed through $31 billion in long-term debt issued in May 2023, supplemented by existing cash on balance sheet and short-term financing. Management has committed to immediate deleveraging post-close, which will be critical to bolstering Pfizer’s capital returns program, including restored share buybacks, in the future.

We expect to de-lever our capital structure following the completion of this transaction, and as we de-lever, we anticipate returning to a more balanced capital allocation strategy, inclusive of share repurchases.

However, the consolidation of Seagen is expected to be about $0.40 dilutive to Pfizer’s EPS in 2024, driven primarily by acquisition financing costs. And the incremental cost burden is not expected to normalize until the third or fourth full year post-close. This also coincides with the anticipated timeline for full realization of ~$1 billion in integration cost synergies.

But temporary cost headwinds aside, the Seagen acquisition represents a crucial piece to Pfizer’s sustained long-term growth strategy in oncology. As mentioned in the earlier section, Seagen is currently a leader in ADCs for treating cancer. The company presents an immediate revenue growth opportunity for Pfizer in the foray through ADCETRIS, PADCEV, TUKYSA and tivdak.

Specifically, ADCETRIS and PADCEV, which are used in treating lymphoma and urothelial cancer (a form of bladder cancer), respectively, are currently two of the best-selling ADCs. They currently account for the bulk of Seagen’s estimated $2.2 billion in annual revenue for 2023. Meanwhile, TUKYSA and tivdak, which are recently approved ADC treatments for breast cancer and cervical cancer, respectively, are also gaining traction. POLIVY, which is another ADC treatment for lymphoma manufactured by Roche Holding AG (OTCPK:RHHBY, OTCPK:RHHBF, OTCPK:RHHVF), also licenses Seagen’s proprietary technology.

This accordingly underscores the prospects of Seagen’s ADC portfolio, and the related synergies realizable in partnership with Pfizer’s scale and reach into oncology opportunities. It also represents an even bigger opportunity for reinforcing Pfizer’s competitive advantage in oncology over the longer term. Specifically, ADCs are expected to replace traditional “chemotherapeutics in the future for most cancer types” due to their more targeted treatment approach.

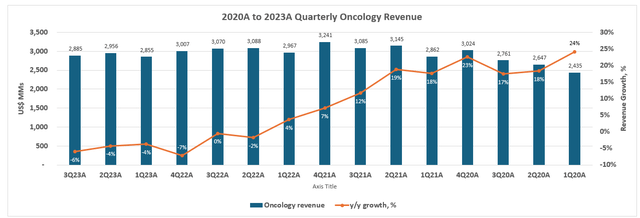

Looking ahead, Pfizer expects Seagen integration to contribute $3.1 billion to 2024 revenues. This would represent y/y growth of 41% on the estimated $2.2 billion in Seagen 2023 revenues, offering a refresh to Pfizer’s slumping oncology sales in recent years.

Author, with data from historical Pfizer filings

Taken together, ADCs are expected to represent a key pillar in Pfizer’s oncology R&D. This is corroborated by the company’s recent establishment of a new “oncology division” to dive into the deep end of emerging opportunities following its Seagen acquisition. With another 15 products and 60 programs currently in the development pipeline, the Seagen acquisition – though expensive – is expected to help reaccelerate Pfizer’s oncology portfolio and reinforce its longer-term growth trajectory. Furthering Pfizer’s foray in ADCs is also expected to complement its existing expertise in oncology medicines. This will be net accretive over the longer term, and compensate for the temporary incremental costs expected in the first three to four years post-close.

Fundamental Considerations

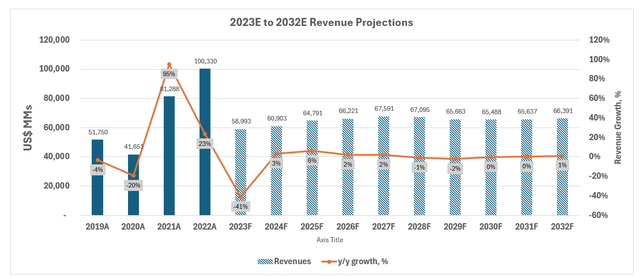

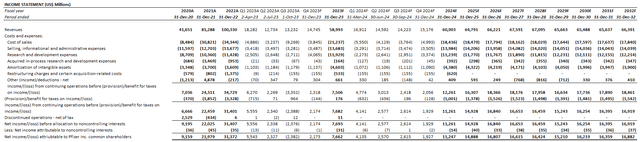

Considering the recent results and near-term prospects of Pfizer’s non-COVID and COVID products, our forecast estimates revenue growth of 3% in 2024 to $60.9 billion. We expect organic revenue growth ex-Seagen and ex-COVID contributions to be weighted in the second half of the year. This is in line with historical weakness in Q1 due to “annual copay reset dynamics” in the U.S. Our forecast compares with management’s revenue guidance of $58.5 billion to $61.5 billion, including $8 billion in contributions from Paxlovid and Comirnaty, and $3.1 billion in contributions from Seagen. Going forward, management has also reclassified previous royalty income reported through other (income)/deductions into revenue, which represents a $1 billion tailwind to the topline in 2024.

Net cost savings from the ongoing cost realignment program are expected to become more evident in the latter half of the new year, partially offset by Seagen-related financing cost headwinds. Our forecasts expects higher normalized cost of sales versus 2023 (ex-impairment charges) due to the integration of Seagen, offset by results of the cost realignment program. Specifically, management upward-revised Pfizer’s cost realignment program savings from $3.5 billion to $4 billion, with incremental efficiencies coming out of R&D without impacting its pipeline. We estimate a two-point reduction in R&D as a percentage of revenue through 2024, with a more balanced SI&A trajectory as a result of the guidance revision. Our forecast expects adjusted EPS of about $2 in 2024, which compares with management’s guided range of $2.05 to $2.25.

Pfizer_-_Forecasted_financial_information.pdf

Valuation Considerations

We believe Pfizer presents as an attractive opportunity at current levels. The stock remains underappreciated, in our opinion, for its longer-term prospects in innovative non-COVID medicine on both a relative basis to peers and an intrinsic basis.

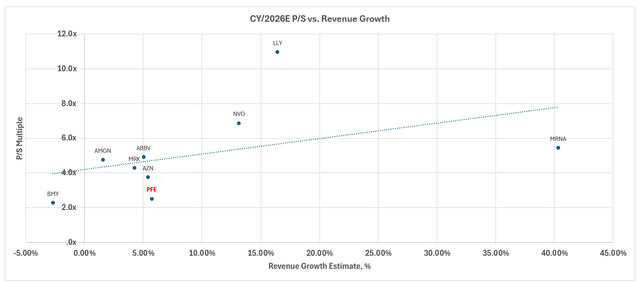

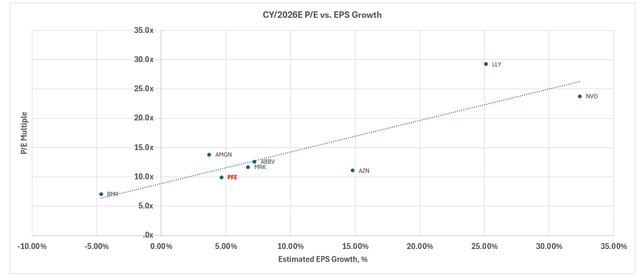

On a relative basis, Pfizer currently trades at 2.7x NTM sales and 12.8x NTM earnings, compared to the peer group average of 16.5x, respectively. When plotted against its peer group trendline, Pfizer is also underperforming peers with a similar lower-growth and earnings profile.

Data from Seeking Alpha Data from Seeking Alpha Data from Seeking Alpha

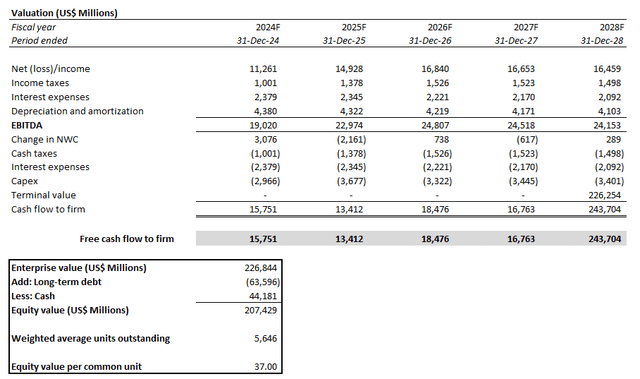

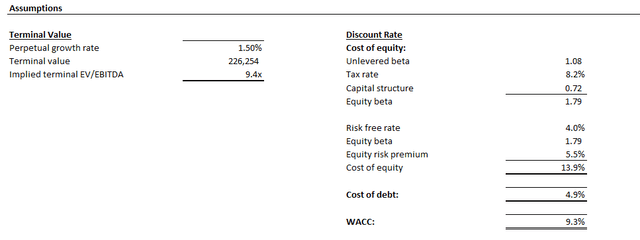

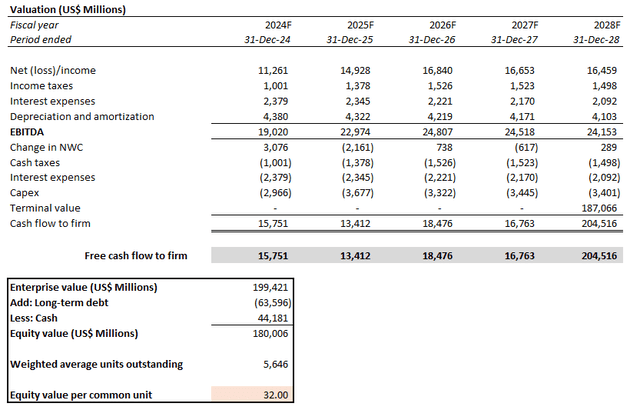

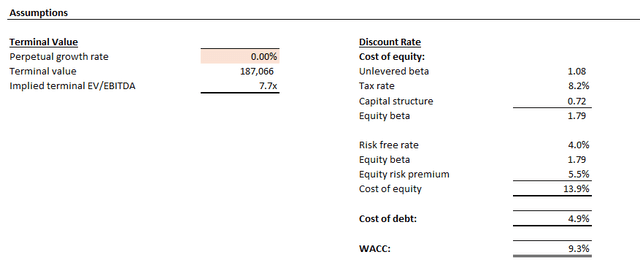

Meanwhile, on an intrinsic basis, Pfizer’s projected cash flows taken in conjunction with the above fundamental forecast imply an estimated equity value of $37 apiece.

This is computed using the discounted cash flow, or DCF, approach. An estimated perpetual growth rate of 1.5%, or 9.4x exit EBITDA, is applied, which is in line with Pfizer’s longer-term normalized pace of free cash flow, or FCF, expansion. The analysis also considers a WACC of 9.3%, which is consistent with Pfizer’s capital structure and risk profile.

The estimated base case price is equivalent to upside potential of 30% from the stock’s last traded price of $28.40 at the close of January 11. Even under the steady-state no-growth assumption (i.e., 0% estimated perpetual growth), the stock should trade above $30 apiece.

The stock also offers a dividend yield of close to 6% at current levels. This accordingly offers an attractive margin for absorbing potential downside risks in the near term (discussed further below). The dividends remain well preserved based on Pfizer’s growth portfolio and balance sheet in our opinion. Although the company has increased its leverage to fund the Seagen acquisition, the strategy ensures flexibility for participating in innovative long-term growth without sacrificing dividends critical to its income-focused investors. The integration of Seagen, and the continued ramp of Pfizer’s internal pipeline and business development deal launches also contribute to bolstering its longer-term self-sufficiency. This will ensure a sustained path to deleveraging its balance sheet, ensuring continued growth investments, and supporting a favorable capital returns program in the long run.

Risks to Consider

Delayed / Failed Launch of Key Pipeline Products

Although we believe Pfizer’s longer-term prospects remain underappreciated at the stock’s current valuation, closing the gap would require an adequate go-to-market timeline for its key pipeline assets. The company currently has 83 products in the pipeline, with 23 in phase 3 trial and 4 in registration. Most of which are innovations in oncology. This accordingly highlights the revenue stream’s impending transition into another growth cycle in the near- to medium-term, and its critical role in supporting Pfizer’s longer-term sales target. Others include trials in respiratory vaccines, anti-infectives, and other internal medicine developments critical in addressing high demand areas of healthcare.

But the inherent uncertainties to “clinical and regulatory success” remain the biggest overhang for Pfizer’s line of business. Failure to push key pipeline assets from development to market in a timely manner does not only delay cash flow realization, but also softens its competitive advantage to peers. Delays to key pipeline launches also increases Pfizer’s exposure to a weakening balance sheet, as it faces a $17 billion impending loss of exclusivity impact through 2030 amid increased leverage.

For instance, the concern and urgency are prevalent in the flurry of focus on the development progress of Pfizer’s Danuglipron (“Danu”) weight loss drug during the latest earnings call. Danu is a “glucagon-like peptide 1 analog” (“GLP-1RA”) type drug. Supposedly used in treating adults with type 2 diabetes, GLP-1 drugs are now used as a weight loss alternative by maintaining healthy blood sugar levels, while limiting a person’s appetite by slowing digestion. Eli Lilly and Company’s (LLY) Zepbound, and Novo Nordisk A/S’s (NVO) Ozempic and Wegovy are also injection GLP-1s that have gained a surge of interest from the weight loss community in recent years.

Pfizer’s danu has only recently concluded and reported results from the phase 2 trial. Adverse side effects and high discontinuation rates from the “twice-daily dosing of danuglipron” have likely resulted in the program being dropped. Pfizer will only be advancing the once-daily dosing of danu into phase 3 trial, which will conclude in 1H24.

While danu represents an opportunity amid increasing demand for GLP-1s, its delayed entry to market has likely softened Pfizer’s competitive advantage. Yet the company has offered a unique value proposition with danu by making it an oral GLP-1 drug. Oral GLPs are generally preferred over projections, can build combination with cardiovascular and respiratory treatments, and prolong maintenance of body weight at a low level. But danu’s uncertain timeline to market increases Pfizer’s exposure to risks of weakening share in the $100 billion weight loss GLP market opportunity by the day.

This is one example of how a delayed or failed launch of pipeline products could adversely affect Pfizer’s balance sheet. The ensuing waterfall effect would inevitably impact Pfizer’s deleveraging efforts, future growth investments, and funding for its capital returns program. Specifically, Pfizer’s free cash flow per share is already about 30% lower than pre-COVID levels. Although the stock is currently trading lower than pre-COVID levels, despite an improved trajectory of profitable growth, consistent FCF margin expansion would be a required catalyst for upside realization. This accordingly highlights the risk of inherent uncertainties on pipeline product launches to our optimism on Pfizer’s valuation prospects.

Medicare Price Renegotiations

In addition to inherent uncertainties on its key asset pipeline, Pfizer also faces the imminent risk of downside pressure from ongoing Medicare negotiations. As part of the Inflation Reduction Act that President Joe Biden signed into law in 2022, Medicare will be renegotiating prices on a series of drugs covered by the program. This includes Pfizer’s Eliquis blood thinner, which has been selected in the first round of price renegotiations.

The first round of renegotiated drug prices will be unveiled by September 1, and take effect in 2026. The program is expected to result in a 25% to 60% reduction in drug prices for the U.S. government. Drugs that have “been on the market longer,” more expensive, and with higher demand will likely get the biggest discounts. And Eliquis fits the bill for potentially bearing the brunt of the impact. Medicare spent $16.5 billion, split between Bristol Myers Squibb Company (BMY) and Pfizer, on the blood thinners in 2023, which accounted for the biggest share of government drug spending.

While Bloomberg Intelligence estimates average annual revenue declines of “1% or less” on affected companies, Pfizer is likely to experience a bigger impact given its large exposure to the government drug spending program. As a result, we have modelled slight deceleration and modest declines in Pfizer revenue near the end of the decade in our analysis. Given the subsequent valuation analysis yields an intrinsic value greater than the stock’s currently traded price, we do not expect the Medicare renegotiations to materially affect Pfizer’s upside potential.

The Bottom Line

Admittedly, Pfizer’s pipeline revenue and profit margin expansion prospects are expected to become more evident in the back half of the decade. But its current valuation remains attractive despite ongoing digestion of normalizing demand for COVID products.

Specifically, we believe Pfizer’s conservative guidance for COVID-related revenues in 2024 reflects a sufficiently de-risked level to complement sustained operational growth in its non-COVID portfolio. The series of recent acquisitions undertaken also deepens Pfizer’s foray in innovative medicine and future growth opportunities.

And these prospects remain underappreciated, as Pfizer stock continues to trade at a discount to peers with a similar growth profile. Pfizer also offers an attractive dividend yield at current levels, underpinned by sustained margin expansion through scale of new product launches and net savings realized through its cost realignment program. If Pfizer can continue to expand its FCF and make progress on deleveraging, the stock offers a compelling opportunity for investors to partake in both upside appreciation in 2024, and close to 6% dividend yield at current levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly, exclusive research content and ideas, and tools designed for growth investing, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to research coverage, exclusive ideas and complementary financial models

- Monitored and regularly updated price alerts for our coverage

- A compilation of complementary tools such as growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!