Summary:

- Pfizer investors are enjoying their recent run as PFE stock has outperformed its peers and the market.

- Palpable optimism is reflected in PFE’s upcoming Q2 earnings release.

- Investors have likely moved on from its COVID vaccine franchise into its oncology and weight-loss drugs growth prospects.

- PFE’s attractive valuation and solid dividend yield suggest the recovery is likely far from over.

- I argue why pessimism on PFE didn’t pay off for the bearish investors. Investors should keep riding on its recovery.

no_limit_pictures

Pfizer: Worst Likely Over

With palpable optimism, Pfizer (NYSE:PFE) investors are likely looking forward to the pharmaceutical leader’s upcoming earnings release. PFE delivered a disappointing 1Y total return of -11.5%, significantly underperforming the S&P 500 (SPX) (SPY). However, PFE has outperformed the market and its healthcare sector (XLV) peers since hitting its long-term bottom in March/April 2024. In other words, the worst in PFE is assessed to be over as improved buying momentum returns to the battered healthcare leader.

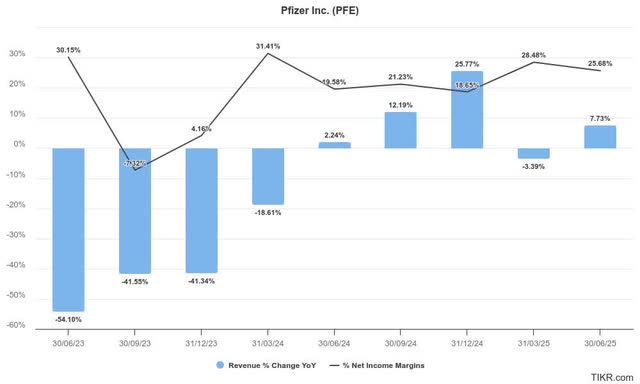

In my previous bullish PFE article, I underscored my optimism that its dramatic revenue reset from its COVID vaccine franchise has likely occurred, helping markedly with YoY comps. In addition, PFE’s robust dividend yield should also bolster income investor sentiments as they wait patiently for Pfizer’s turnaround predicated on its nascent oncology portfolio.

Consequently, I’m not surprised with PFE’s recent performance, as the market moves past the company’s past successes and fallout from its COVID vaccine franchise. The recent headwinds from the CDC’s narrower recommendation for RSV shots have also not markedly impacted PFE’s buying sentiments. While the stock suffered an initial decline following the announcement in late June 2024, the bearish sentiments have been decisively reversed as PFE surged past its June highs. Hence, it has given me a stronger conviction that the market is less worried about the challenges facing its fledgling RSV opportunity.

CEO Albert Bourla discussed Pfizer’s RSV prospects in a recent June conference. He highlighted that the company was “positively surprised by the RSV market’s size.” Despite that, he also cautioned that “market share was not as strong as desired.” Therefore, management seems ambivalent about whether it could be a significant growth driver in the near term. Bourla estimates that “90% of the vaccines that are respiratory driven are coming in the second half of the year.” Therefore, investors must closely monitor the company’s guidance at Pfizer’s Q2 earnings release on July 30.

Pfizer: Investors Looking To Oncology, Weight-Loss Drugs

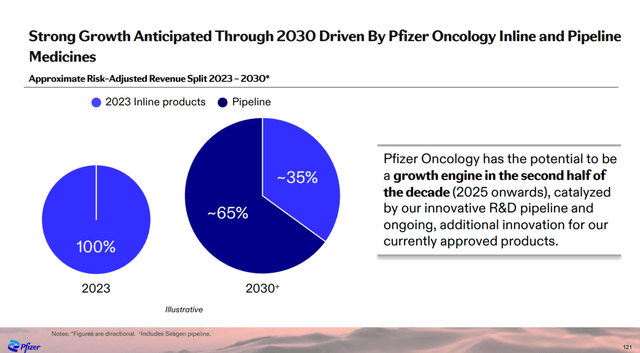

Pfizer revenue split outlook by 2030 (Pfizer filings)

Given the nascent developments in Pfizer’s oncology pipeline, investors must be prepared to wait patiently as Pfizer reengineers its revenue mix. As a reminder, Oncology is anticipated to be “a growth engine from 2025 onwards,” with several potential launches next year. Bourla also telegraphed his belief that Pfizer’s pipeline is a critical determinant of the company’s success, highlighting that “pipeline in a pharma is the most important driver of stock valuation.” As a result, investors must closely assess management’s commentary and outlook on its Oncology portfolio as we draw nearer to 2025.

I also assess PFE’s recent recovery as predicated on market optimism on its weight loss pipeline. Bourla lamented the lost opportunity to compete with the weight loss drug leaders due to the “setback with their previous obesity drug, Lotiglipron.” The missed opportunity has cost the company dearly, given the incredible outperformance by Eli Lilly (LLY) and Novo Nordisk (NVO) stock over its healthcare peers. Despite that, Bourla is confident about its weight loss drugs prospects. Notably, “Pfizer is developing three new weight loss drugs,” with two being GLP-1 agonists and the third based on a “different mechanism.”

In addition, Pfizer’s progress in its once-daily weight-loss pill (danuglipron) is notable. In the latest study, the company noted that one of the versions demonstrated a “favorable profile.” However, Wall Street is mixed about the results, suggesting a lack of “definitive conclusions” provided.

In addition, there are concerns about whether Pfizer’s more cautious approach could delay the timely commercialization of its weight loss drugs. The competitive landscape could be “crowded with competitors” based on a potential 2028 launch, lowering the peak revenue opportunity for PFE.

Analysts are also skeptical about whether competitors such as Pfizer can offer sufficiently “differentiated products to compete effectively” against the GLP-1 leaders. The early investments by NVO and LLY have afforded them a “strong moat around their supply chains.” Coupled with their “extensive investment in intellectual property and infrastructure,” PFE and its peers could find it challenging to outcompete the GLP-1 leaders.

PFE Stock: Clearer Earnings Visibility

Notwithstanding my caution, I assess that the market has likely re-rated PFE as it emerges from its disappointing 2023 business performance. As a result, we should expect a continued recovery in the company’s revenue growth momentum. It should also help stabilize the pharma leader’s adjusted net margins through 2025, providing more earnings clarity for income and value investors.

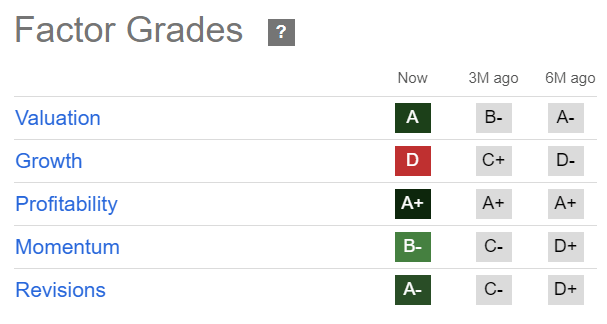

PFE Quant Grades (Seeking Alpha)

Compared to its healthcare peers, PFE seems to be significantly undervalued (“A” valuation grade). Buying momentum has also improved markedly from a “D+” grade to a “B-” grade, underscoring substantially enhanced investor confidence. In addition, analysts have upgraded Pfizer’s estimates, corroborating my thesis that the worst in the stock is likely to be over (meaning PFE has moved past its long-term lows).

Given its early business transformation toward its ambitions of being a significant oncology player, I must acknowledge that the stock’s “D” growth grade seems justified. However, PFE’s forward adjusted PEG ratio of 1.39 is nearly 30% below its sector median. Therefore, the market has arguably reflected significant execution risks in its valuation, justifying the recent outperformance.

Is PFE Stock A Buy, Sell, Or Hold?

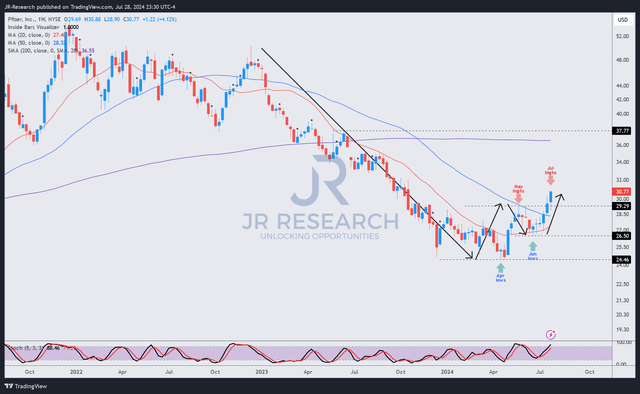

PFE price chart (weekly, medium-term, adjusted for dividends) (TradingView)

As seen above (adjusted for dividends), PFE hit “rock bottom” in April 2024, just above the $25 level. Its price action has demonstrated a potentially decisive breakout above its May 2024 highs, bolstered by the improved momentum metric I indicated earlier.

With a series of higher lows and higher highs in the stock’s price action, I assess it has opened up the opportunity for momentum investors to return more aggressively. I’ve identified the $38 level as the next potential consolidation zone for the stock, suggesting a possible upside of more than 25% from the current levels.

PFE’s forward dividend yield of 5.5% is highly attractive, much higher than its sector median of 1.34%. In addition, the Fed has moved closer to cutting interest rates, bolstering a potential reallocation from income investors looking to invest in high-yielding and profitable healthcare plays.

As a result, I assess that the risk/reward upside on PFE remains relatively attractive for me to maintain my bullish thesis. Investors are urged to capitalize on its recovery before it potentially rallies further.

Rating: Maintain Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!