Summary:

- Pfizer’s COVID franchise outlook faced another disappointing downgrade, leading to a ten-year low in PFE. The market is right.

- Wall Street analysts are increasingly concerned about downgrades to Pfizer’s COVID-related revenue, as they failed to anticipate its COVID outlook accurately.

- Pfizer assured investors there’s still enough juice left in its COVID franchise, but the market likely de-risked its COVID outlook significantly to account for heightened risks.

- I argue why PFE is at a pivotal support level underpinning its long-term uptrend. As a result, robust buying support is still expected, given Pfizer’s robust earnings capability.

- With PFE remaining committed to maintaining its dividend and posting solid profitability, the risk/reward looks increasingly enticing at the current levels.

DNY59

Pfizer Inc. (NYSE:PFE) has been one of the most frustrating companies in my coverage, as my previous bullish thesis on the leading biopharma leader hasn’t panned out. The company’s outlook on its COVID franchise has proved to be more challenging than anticipated, leading to over-optimistic Wall Street estimates. As a result, I believe the market has gotten on point, as it battered PFE to a 10-year low.

Accordingly, Pfizer de-rated its guidance again, which followed a downgrade after its third-quarter or FQ3 earnings release. As a result, Wall Street analysts were palpably concerned with the company’s modeling in its recent conference call discussing the review of its guidance. Notably, Pfizer highlighted that its previous 6% ex-COVID revenue CAGR from 2020-25 “seems challenging to achieve” if the company doesn’t include business development revenue. As a result, it called into question that Pfizer investors might need to deal with anemic topline growth rates as the COVID headwinds continue to rear their ugly head.

An analyst on the recent call didn’t disguise his disappointment, highlighting that “2025 will have a tough comp because of the acquisition, so another sluggish year.” As a result, analysts are becoming increasingly concerned about whether there could be further downgrades to Pfizer’s COVID-related revenue. At the same time, the company is attempting to scale up its Seagen acquisition, which closed recently.

Management indicated it wasn’t ready to call a “trough” in its COVID revenue outlook downgraded to $8B for 2024, with $5B attributed to Comirnaty and $3B to Paxlovid. However, it indicates a significant downgrade from Wall Street estimates of $13.8B, suggesting a significant forecasting error in projecting Pfizer’s COVID outlook. As a result, it seems possible that management has realized its mistakes in trying to project a more optimistic outlook on its COVID franchise previously. In the recent call, management accentuated its “intent to provide a realistic and conservative estimate for COVID revenue.” The company stressed the challenges in trying to “model with certainty,” suggesting the market has likely de-rated its COVID franchise to account for much higher execution risks than anticipated.

Notwithstanding the near-term caution, Pfizer attempted to assure investors that its long-term forecasts on Seagen remained on track and did not communicate a deviation. Management highlighted a $0.40 near-term dilution on its FY24 adjusted EPS to account for financing costs related to the acquisition. However, Pfizer maintained its expectation of achieving $10B in revenue from Seagen by 2030. Seagen is expected to accrue to Pfizer’s topline in 2024, contributing an estimated $3.1B. As a result, it should help to mitigate Pfizer’s COVID headwinds, although the market could remain concerned about further de-rating risks related to its $8B forecasts. Given how off-the-mark management’s outlook has been related to its COVID franchise, I expect the market to have sufficiently de-risked its 2024 outlook.

With the battering in PFE over the past year, the critical question is whether it has likely formed its long-term bottom? Seeking Alpha assigned an “A-” valuation grade, suggesting relative appeal compared to its sector peers. However, given the unpredictability of its COVID-related revenue estimates, its “F” growth grade should have been considered with more caution. As a result, I believe the market’s focus on its growth prospects is correct, notwithstanding its relatively attractive valuation grade.

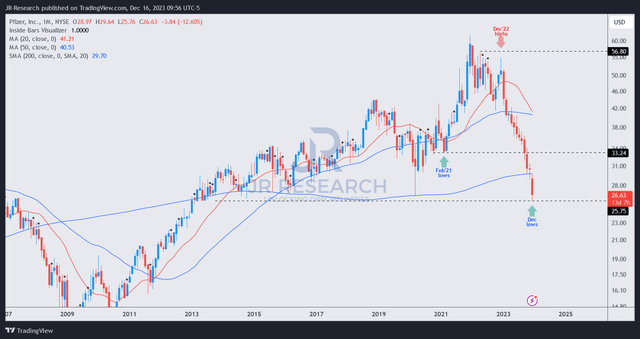

PFE price chart (monthly) (TradingView)

PFE’s long-term price chart remains bearish and seems to have broken below its 200-month moving average or MA (purple line). As a result, PFE could continue to struggle for momentum unless dip-buyers return over the next three to four months to help defend against a further slide.

I assessed that a bear trap could still occur at the $26 level, as investors over the past ten years likely capitulated. Given PFE’s steep plunge over the past year, it seems to have dropped into peak pessimistic levels, as the $26 level was a highly critical support zone that underpinned its long-term bottom.

As a result, I believe it’s not unreasonable for me to remain bullish at the current levels. However, more conservative investors should consider waiting for confirmation about a possible bullish reversal.

Takeaway

Pfizer’s steep collapse over the past year took out a ten-year low and wiped out all the gains since it bottomed out after its 2020 COVID lows. As a result, the market seems to have disregarded the benefits of its COVID franchise, which bolstered its balance sheet and allowed Pfizer to continue making its dividends and business development activities.

Management also highlighted that it remains committed to paying dividends, with its forward yield surging to 6.2%, well above its 10Y average of 3.7%. Coupled with a more dovish Fed, which looks primed to cut rates from 2024, income investors should be more assured about a well-battered PFE stock that still received a “B-” dividend safety grade from Seeking Alpha Quant. As a result, I believe it demonstrates the sustainability of Pfizer’s robust earnings quality, rated with a best-in-class “A+” grade.

Consequently, I believe it’s unreasonable for investors to ignore the benefits of Pfizer’s COVID franchise, as it last traded at a forward EBITDA multiple of 9.2x, markedly below its 10Y average of 10x. Therefore, I assessed that the pessimism on PFE has likely hit rock bottom, as it re-tested its $26 critical support level, bolstering a capitulation thesis for long-term buyers to add more exposure.

Rating: Maintain Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!