Summary:

- Pfizer Inc.’s technical indicators have shifted from bullish to bearish, with the stock now trading below its 30-week EMA and showing bearish momentum.

- Volume analysis indicates recent institutional selling, and relative strength has deteriorated, underperforming the S&P 500 since July 2024.

- Pfizer stock is in a consolidation phase, potentially setting up for a bull run if it can recapture its 30-week EMA and show bullish volume.

- Use a stop loss below $24 to manage risk, as PFE’s current position offers a higher reward-to-risk ratio within the consolidation phase.

georgeclerk

The major pharmaceutical maker Pfizer Inc. (NYSE:PFE) recently reported its 2025 guidance on December 17th, so I thought I would take another look at PFE from the technical analysis approach. My most recent article about PFE is located here and in that piece, I stated I was bullish on PFE. In this article, I will use the same approach of looking at price action, momentum, volume, and relative strength to see if anything has changed. Pfizer, as most know, is in the health care sector of the economy and operates in the pharmaceutical industry. This article will not focus on the 2025 guidance release, as that is not my area of interest.

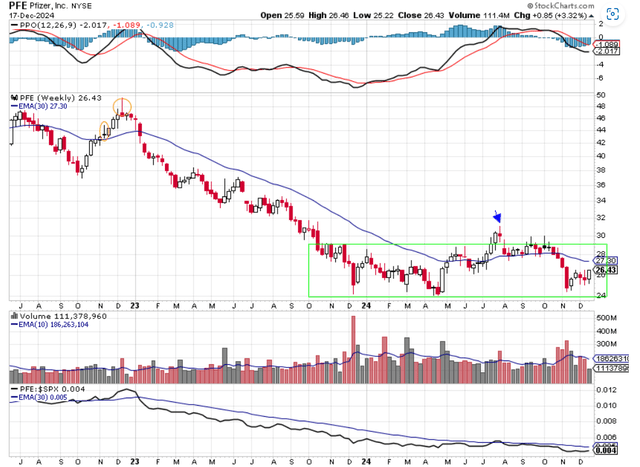

Chart 1 – PFE Weekly with 30-week EMA, Momentum, Volume, and Relative Strength

Looking at Chart 1 above, you can see the blue arrow in late July 2024. That is when my previous article came out and, in that article, I was bullish about PFE for several reasons. PFE was trading above the 30-week exponential moving average (EMA), it had bullish short-term and long-term momentum, its volume picture looked bullish, and the relative strength was just peaking above its 30-week EMA. There was a lot to like technically about PFE, and I was bullish. It also had, and still does have, a high yield.

So, what has changed since then? Just about everything. PFE now trades below its 30-week EMA. If you have seen some of my other articles, you know that I prefer to buy stocks that are trading above their 30-week EMAs. This demarcation point helps me define which stocks are in a bull trend and which stocks are in a bear trend. Stocks above their 30-week EMAs are in bull trends in my opinion. Using this simple metric, PFE is not in a bull trend. I wouldn’t say it’s in a bearish trend, either, though. PFE is trading inside the green box, which appears to be an area of consolidation that has lasted for over a year. That could be considered positive. Stocks move from bases of consolidation, to sustained uptrends, to areas of distribution, and then to sustained downtrends. That is the stock market cycle in a nutshell, and it also applies to individual stocks. You can see that PFE was trading in the upper $40s back in July 2022 and has declined steadily to April 2023 when it reached its low of $24.10. That exemplifies a sustained downtrend. PFE has stayed inside the green box, except for the breakout in July, since October 2023. Is this area of consolidation a base from which a sustained bull run could emanate from? Perhaps, but PFE has some work to do. I want to see PFE recapture its 30-week EMA, and I would like to see the 30-week EMA start to trend higher as well. Then I would like to see PFE break out of the area of consolidation defined by the green box. If PFE can do those things, then I think a sustained bull run could take place, and I’d be inclined to add to my position. Yes, I do own some shares of PFE inside a portfolio that I manage for income.

The momentum of PFE has changed from bullish to bearish as well. When I last wrote about PFE, the Percentage Price Oscillator (PPO) was displaying both short-term and long term bullish characteristics. Now it is the complete opposite. The black PPO line is below the red signal line, which identifies short term bearish characteristics. Additionally, the black PPO line now has a reading of -2.017 which identifies long term bearish characteristics. If you are bullish on PFE, you can take comfort in that the black PPO line looks to be flattening out and could be headed higher. That means a PPO bullish crossover could happen soon and indicate short term bullish momentum. PFE bulls are going to need momentum to push the stock higher over a sustained period of time.

One way to get momentum is to have institutional money managers buy the stock. Back in July, volume analysis indicated that there was some institutional buying, which was displayed by the spiking black volume bars. Black bars show the volume during weeks of advancing prices. Red volume bars show the volume during weeks of declining prices. I want to own stocks that are advancing with high black volume bars because that means that the smart money is buying the shares. They would only do that because they think PFE is undervalued at current prices. A noticeable difference in the volume pattern is that the three weeks around the election, noticeable selling took place in PFE, which helped drive the price lower. Now the volume picture leans bearish or at best neutral in my opinion.

I want to see PFE advance with big black volume bars. Maybe that will happen now that 2025 guidance has been released. Due to this announcement, I expect a higher-than-normal volume bar for this week, but I don’t know what color it will be. Only time will tell.

Lastly, relative strength has deteriorated as well since my last article. PFE has underperformed the SP 500 since July 2024. The good news is that PFE has traded about even with the SP 500 since early November, as shown by the flat relative strength line over the past two months. What I want to see is the relative strength line move higher, indicating that PFE is outperforming the SP 500.

My bullish thesis in July 2024 proved incorrect. PFE has lost about 14% since my article was written. I did mention the importance of having a stop loss in my article, and that is why I advocate for using a stop loss. My analysis is not always spot on.

Looking forward, there are some technical reasons why there is a bull case for PFE. The first is that PFE is still trading inside the green box, which is the area of consolidation. It’s also on the lower side of the green box, meaning you have a higher reward to risk ratio if you use the stop loss discussed below. If the cycle concept of the stock market makes sense to you, PFE could be considered to be in the consolidation time of the cycle, right before it begins a sustained bull run. The black PPO line is flattening out and may be headed higher, which means there could be a positive shift in momentum. Volume is unclear currently, but this week could show some institutional buying. If there is a big black volume bar at the end of the week, that would add to the bullish thesis. PFE has decidedly underperformed the SP 500 index for a couple of years now. However, the relative strength line has flattened out recently and that is positive, but not outright bullish.

If you decide to buy shares at this level, use a stop loss. A stop loss I would use here would be a close below the green box. If shares closed below $24, that would indicate a further decline in my opinion. The stop loss may prevent you from losing a great deal of your capital. I would rather take a small loss and reassess the situation than stay in a stock that loses 20-50% of its value. Look at Chart 1 again, starting in January 2023 when PFE closed below its 30-week EMA. Using the simple stop loss technique of closing your position when the stock closed below the 30-week EMA would have saved an investor a lot of capital and mental capital as well.

Just to be clear, I own shares of PFE in a portfolio that is managed just for income purposes and not for capital gains. I would consider buying additional shares of Pfizer Inc. stock if PFE can close above its 30-week EMA.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.