Summary:

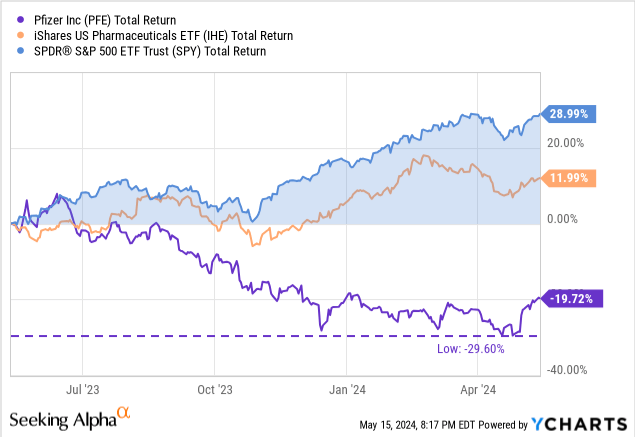

- Pfizer shares have lagged behind the pharma rally due to inflated expectations, one-time losses, write-offs, and the Seagen acquisition.

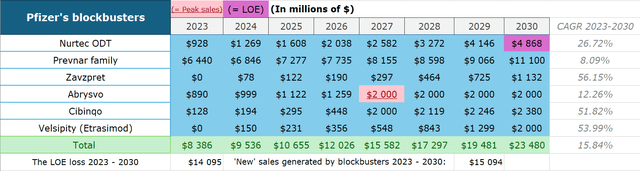

- The company is expecting an LOE wave with 6 names facing patent expirations, leading to a $17 billion sales decline from 2025 and $15 billion from 2023 to 2030.

- However, Pfizer has other 6 future blockbuster drugs that I expect to completely offset the patent cliff.

- The company’s non-COVID portfolio is growing at a record pace.

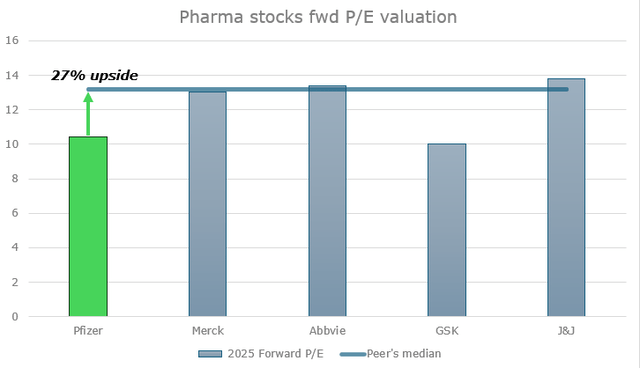

- Pfizer offers attractive dividends and sliding valuation as forward P/E 2025 is at 10x, suggesting almost a 30% upside.

Editor’s note: Seeking Alpha is proud to welcome Wavelength Research as a new contributing analyst. You can become one too! Share your best investment idea by submitting your article for review to our editors. Get published, earn money, and unlock exclusive SA Premium access. Click here to find out more »

Alexandros Michailidis/iStock Editorial via Getty Images

Main thesis

Despite a recent bounce, Pfizer (NYSE:PFE) shares are still far behind the pharma rally as inflated expectations, one-time losses, write-offs, and the Seagen acquisition have pressured the company. At first glance, the future doesn’t look bright either because at least six names are expected to lose their exclusivity in the next five years, and it should be difficult to find a decent replacement for the cash flows from these drugs. However, I see massive opportunities in the portfolio as six new potential blockbusters (drugs with annual revenue potentially greater than $1 billion) can become a new cash-generating machine offsetting the patents’ expiration.

I believe financial metrics have already bottomed last year as the main stage of revenue decline has passed, since the company’s non-COVID portfolio is growing at a record pace. At the same time, Pfizer’s pipeline creates a solid foundation for a turnaround story with sliding valuations and a 6% yielding dividend.

Company’s profile

Pfizer is the 9th largest pharmaceutical company with a market capitalization of $160 billion. It was founded back in 1849 and, since then, has gradually transformed into a pharmaceutical giant that produces and sells more than 80 drug names. Pfizer has dozens of manufacturing sites around the world and sells its products in 180 countries.

The company operates in five key areas:

- Internal Medicine (metabolic and cardiovascular diseases)

- Inflammation and Immunology

- Oncology

- Rare diseases

- Vaccines

The LOE wave

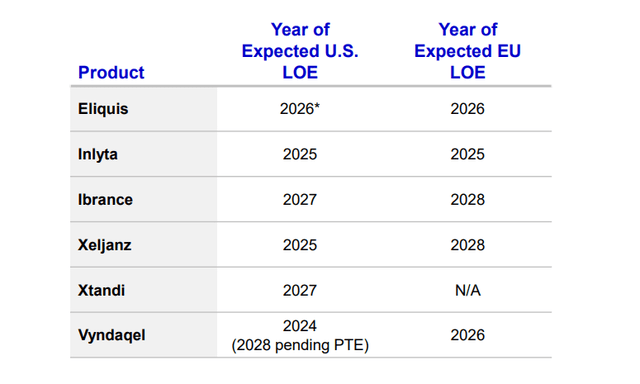

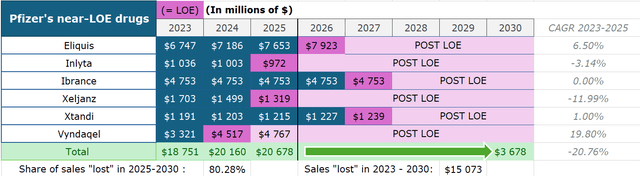

At least six products’ patents will expire in the 2025-2029 period: Eliquis, Inlyta, Ibrance, Xeljanz, Xtandi, and Vyndaqel. Pfizer management expects a $17 billion decline from 2025 to 2030 from these drugs. So, if we calculate 2025 baseline revenues for these products, we can estimate an impact from the coming LOE (loss of exclusivity).

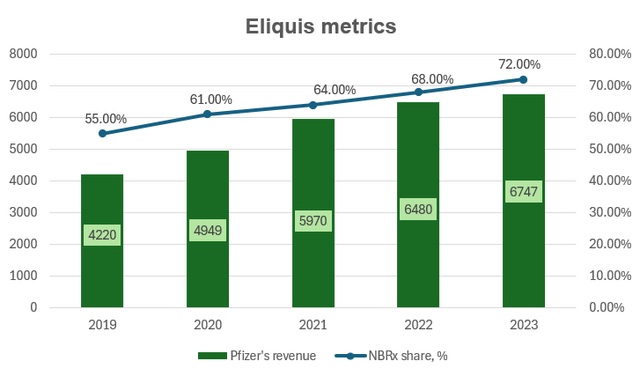

Eliquis (apixaban), a direct Factor Xa inhibitor, brought $6.7 billion to Pfizer in 2023 as the drug continues to dominate the anticoagulants market with 72% of all new-to-brand prescriptions (NBRx). It has been proven to cause less major and minor bleeding compared to peers and doesn’t require frequent complex monitoring and dosing adjustments while showing superior overall efficacy. As Bristol-Myers Squibb (BMY) (Pfizer’s partner) expects Eliquis’ “continued strong growth” in the future, even if the NBRx share gain each year would be lower than the historical average of 3 percentage points, then the US sales CAGR would still be at 9-12% in the US through 2026 thanks to anticoagulants market growth. However, although the general LOE is only expected in late 2026, this growth would likely be offset by earlier generic erosion in Europe, which accounts for 20% of sales (I project developed Europe revenue to drop at a similar level to the 2023 CAGR of -8%). All in all, this means product revenue growing at a CAGR of 6.5% for the next 3 years.

Source: Wavelength Research, Bristol-Myers Squibb data

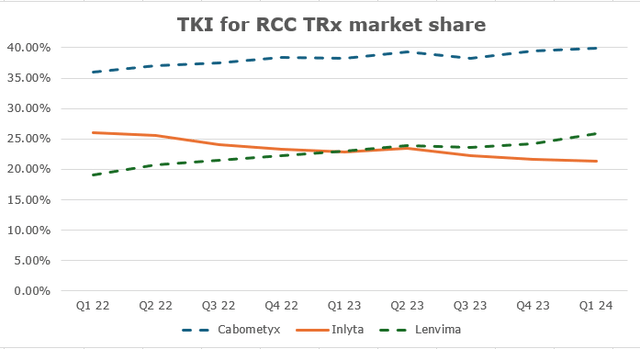

Inlyta (axitinib) is a TKI (tyrosine kinase inhibitor) approved for advanced RCC (renal cell cancer). Its market share is largely formed by I-O/TKI cocktails like Keytruda-Inlyta and Bavencio-Inlyta. Over the past four years, there have been a lot of new entries in that market, causing the share to slowly slide. For instance, Keytruda-Lenvyma and Opdivo-Cabometryx show similar or even higher efficacy in cutting the risk of tumor growth, disease progression, and death, compared to Keytruda-Inlyta. Keytruda-Lenvyma is an exceptional threat to Pfizer since Merck (MRK) owns Keytruda and collects 50% gross profits from Eisai’s (OTCPK:ESALF) Lenvyma, so it slowly pushes Inlyta out with pricing control. Inlyta’s market share has been falling by 2.1% each quarter on average (or 0.5 percentage points). Expecting a similar dynamic, the 2025 market share would be 18.5%. Nature analysts expect RCC drugs market growth at a CAGR of 5.1%, so Inlyta’s sales would only slightly decline to $972 million.

Source: Wavelength Research, Exelixis data

Ibrance (palbociclib), a CDK 4/6 inhibitor, is approved for HR+/HER2- metastatic breast cancer. Just as in Inlyta’s case, it is now being pressured by smaller competitors, Kisquali and Verzenio. In 2022’s PALOMA-2 trial, Ibrance showed only a 4% lifespan improvement compared to hormone therapy vs 19.6% and 24% for both competitors respectively, although all three show similar progression-free survival rates. However, these cross-trial studies always raise questions due to the difference in patient populations as the industry still lacks important head-to-head data. Pfizer still holds the leadership when it comes to the toxicity profile and the company has a VERITAC-3 trial in Phase 3, which tests Ibrance in combination with vepdegestrant (another Pfizer’s product) as well as the Ibrance+Verzenio program. In 2023, Pfizer has lost around 20% of its monthly TRx, but thanks to new projects, the corporation’s CEO expects stabilization in sales in H2 2024 and further.

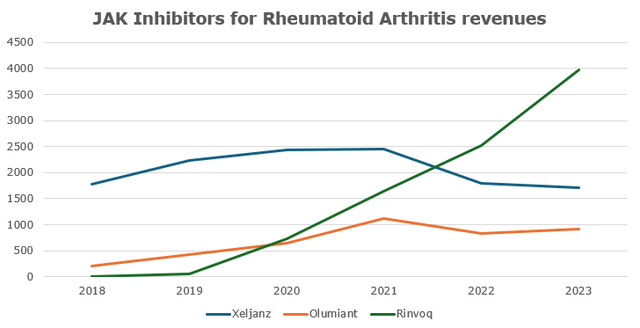

Xeljanz (tofacitinib) is a JAK inhibitor approved for the treatment of RA (rheumatoid arthritis), PsA (psoriatic arthritis), UC (ulcerative colitis), and ankylosing spondylosis. In 2021 the FDA issued a warning label for Xeljanz saying it has higher risks of thrombosis, MACE, lung cancers and many other rare symptoms compared to other JAKs. As a result, its NBRx share and revenue has been sliding for the last three years as Pfizer’s management continues to blame the label for poor performance. A stiff competition from Rinvoq and Olumiant which have higher efficacy in RA and a broader coverage spectrum of UC (Rinvoq is approved for both moderate-to-severe UC and CD) with no new potential indications in the future should drive Xeljanz’s market share down. With steady demand, Rinvoq and Olumiant are the only real JAK beneficiaries in this market. With that, I project Xeljanz’s sales to decline at about the same pace since the warning was published (CAGR of -16%).

Source: Wavelength Research, Companies’ earnings reports

Xtandi (enzalutamide) is an ARI (androgen receptor inhibitor) approved for different types of metastatic and non-metastatic prostate cancer, developed in collaboration with Astellas (OTCPK:ALPMF). Xtandi sales jumped 23% in Q1 2024 due to the FDA label expansion, but Astellas management projects only 1% growth in 2024 and until the LOE as the initial peak sales estimate of “over ¥700 billion” has almost been reached.

Vyndaqel/Vyndamax (tafamidis) is the only drug to date approved for the treatment of ATTR-CM, which is a rare heart muscle disease. The product is set to lose exclusivity this year with BridgeBio’s (BBIO) acoramidis would likely be the first to challenge the monopoly in 2025, although Pfizer’s agent is still estimated to keep the 60%+ market share after the LOE. I project the market to grow organically at a similar historical average rate of 36%, but given a 40% loss of market share in the US (the LOE in Europe is in 2028; US accounts for 56% of total sales), 2025 revenue comes down to $4.7 billion.

New potential blockbuster candidates

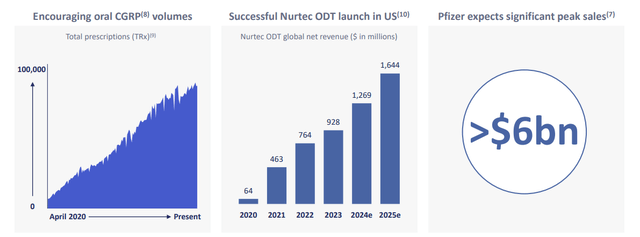

Nurtec ODT/Vydura (rimegepant) is a migraine acute and preventive treatment agent. The main driver here would be overall oral CGRPs sales growth in a migraine market as they are already gaining positions against triptants and topiramate. Nurtec ODT is the only product that’s approved for both acute treatment and prevention, which gives an edge over its competitors, AbbVie’s (ABBV) Qulipta and Ubrelvy. That results in the highest total prescriptions among rivals.

At the same time, Qulipta has recently been taking away market share from Nurtec as it has been approved for chronic migraine prevention, a label that Nurtec doesn’t carry. However, Zavzpret (zavegepant) intranasal has recieved FDA approval as the first CGRP with intranasal formulation for acute treatment of migraines with or without aura. Moreover, Zavzpret oral, which is now in Phase 2 trials, is indicated for the prevention of chronic migraines. Thus, it would make Pfizer the first and only company to cover the whole spectrum of the migraine market, as AbbVie’s projects are not as advanced. GlobalData estimates $725 million in sales for Zavzpret through 2029 (CAGR of 56%) and the company projects total peak migraine products revenue of $6 billion, meaning $1.13 billion for Zavzpert (assuming the same 2029-2030 CAGR) and $4.86 billion for Nurtec ODT in 2030.

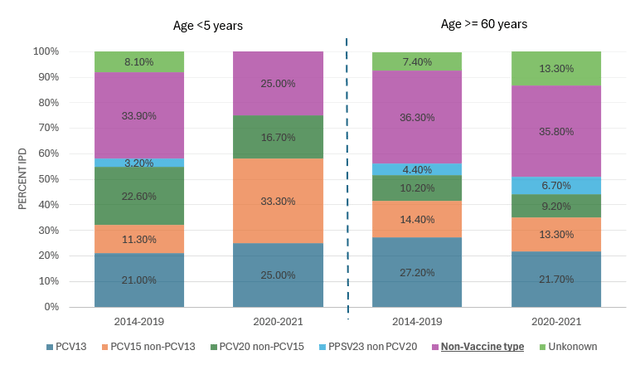

As for Prevnar family, since Pfizer has made an early entry in the PCV (pneumococcal vaccine) market with Prevnar-13 and later with Prevnar-20, it has captured a significant 96% adult market share. Prevnar-20 covers all 13 Prenar-13 serotypes plus 7 additional ones, which account for a great proportion of IPD (invasive pneumococcal disease) cases. At the same time, many hospitalization and death cases in both the adult and pediatric market are caused by serotypes that are not covered by any existing vaccine today (see the chart below), so there is major unsatisfied demand for the next-generation PCV that would cover a wider spectrum of serotypes but would not be a subject of severe carrier suppression.

Pfizer’s 4th generation vaccine is in the first stage with the FDA fast-track status and is said to work with “considerably more than 20” serotypes. Merck ((MRK)) is also developing their solution. Merck’s V116 is an adult-only 21 valent PCV in phase 3 that showed superior effectiveness in covering 10 of 11 unique serotypes compared to PCV20 and a similar safety profile. The company is also taking positions away from Pfizer with VAXNEUVANCE (PCV15), which in combination with PPSV23 is recommended as an alternative to Prevnar-20.

Given overall increasing competition and possible Merck’s earlier V116 launch, I estimate Prevnar’s adult market share dropping around 10 percentage points a year (V116 is a direct PCV20 competitor; I project V116 and Pfizer’s new product splitting unsatisfied demand 50/50) with positions in pediatric staying stable (as with new-gen vaccine launch, there would be only minor competitive pressure there). This would leave the pharma giant with 77% of the $14.35 billion market (both adult and pediatric) in 2030 resulting in sales of $11.1 billion and a CAGR of 8%, meaning the new vaccine would generate $4.6 billion.

PCV serotype coverage by cases (Source: Wavelength Research, Connecticut Department of Public Health)

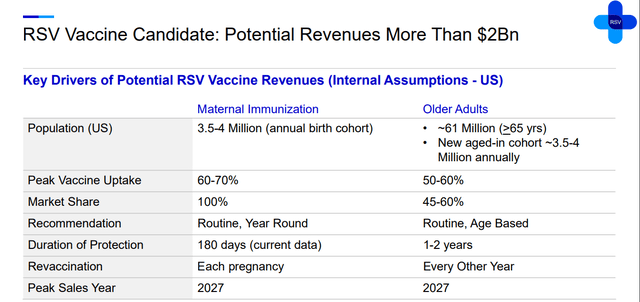

Abrysvo (RSVpreF) is an RSV vaccine that’s approved for adults over 60 years old and pregnant women (32-36 weeks) to protect infants. The product has worse efficacy results in the 60+ years old category compared to GSK’s (GSK) Arexvy when it comes to severe RSV-LRTD treatment (77.8% vs 84.6% in season 2 for Abrysvo and Arexvy respectively) and non-severe RSV-LRTD (55.7% vs 77.3%). However, there is a Phase 3 trial for adults within 18-59 years of age, which is a group of high RSV risk due to higher concentrations of chronic conditions. The company published positive data on its MONeT trial, saying the product has met primary endpoints. To date, there is no RSV vaccine for this group, so this gives Pfizer an opportunity to extend the coverage of Abrysvo. The pharma giant expects peak sales of $2 billion in 2027 and strong performance after. Thus, given the RSV market’s expected rapid growth in this decade, I’ve decided to keep Abrysvo’s performance flat during 2027-2030.

Cibinqo (abrocitinib), a JAK inhibitor, is approved for adults and adolescents with moderate-to-severe atopic dermatitis. The product demonstrates superiority in effectiveness compared to biologics such as Dupixent and Adbry/Adtralza and almost matches the effectiveness of Rinvoq. Moreover, Cibinqo and Rinvoq show much better results than Olumiant in the treatment of severe AD. Abrocitinib has a higher probability of adverse events occurrence, but no exclusive warning label has been issued by the regulator as in Xeljanz’s case. The management expects the atopic dermatitis market to grow at a CAGR of 25% in G7 countries through 2030 due to large unmet demand, as biologic therapy options often fail to achieve clear non-itchy skin within 16 weeks of treatment and cause facial redness. Pfizer sees a $3 billion opportunity in peak sales, which would fall on 2034 (the LOE year) and SVB Leerink analysts estimate $2 billion in revenue by 2027.

Velsipity (Etrasimod) is one of the two S1P receptor modulators approved for the moderate-to-severe UC treatment of adults. TheS1P treatment class satisfies significant unmet demand for non-JAK oral treatment, which is free of a boxed warning. In the ELEVATE studyVelsipity showed a 25.4% remission rate edge over placebo vs BMS’ ((BMY)) Zeposia’s (its only S1P competitor) 19%. Moreover, Velsipity can be taken biweekly, compared to Zeposia’s weekly treatment, and it doesn’t require any dosing titration. Market opportunities here are big, as many advanced treated patients fail to retain long-term remission. Spherix Global records a significant advantage of Pfizer’s drug in the first 3 months over Zeposia’s start and estimates that its market share may reach 2.2% in H2 2024 (Zeposia’s share is 4.3%). Leerink Partners forecasts $1 billion in sales for Velsipity from UC indications in the US alone by 2031, which, given BMS’ geographical revenue distribution (US accounts for 60%), comes to ~$1.7 billion in 2030 in UC prescriptions, growing at a CAGR of 47%, which matches the company’s projections. Pfizer also has two Phase 2 trials for Crohn’s disease and Eosinophilic Esophagitis which should add around 15% to the total TRx volume, so the revenue should be around $2 billion.

All in all, the revenue model should look something like this:

Thus, Pfizer is expected to completely offset the LOE cliff wave with just 6 new products.

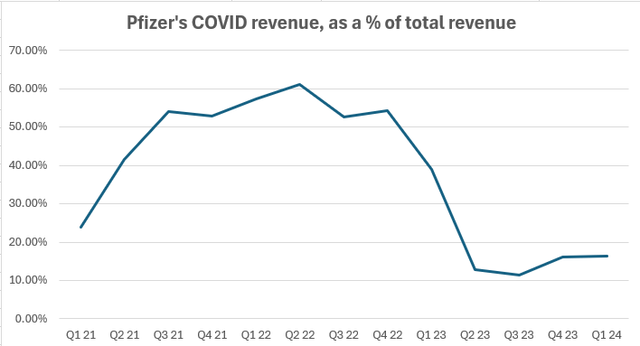

The COVID issue

Pfizer has become the main beneficiary of the coronavirus pandemic, so its end led to a sharp decline in the company’s cash flow, which reached sky-high levels in 2021-2022. Comirnaty and Paxlovid once accounted for 60% of total quarterly revenue, reaching $17 billion in Q2’22, but the share plummeted to 15.6% in Q1’24.

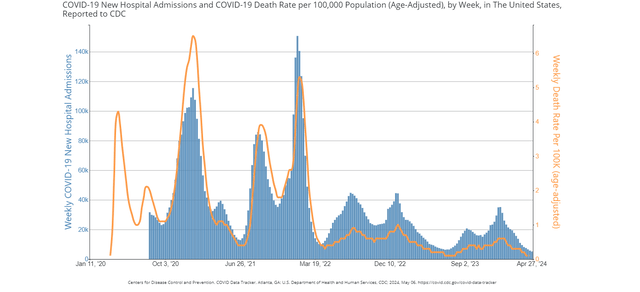

I don’t see a disaster here though. The market has known full well this has been coming but still panicked last year when Pfizer missed its initial guidance on overall sales.

Firstly, as for Comirnaty, although most of its revenue now comes from long-term contracts with governments made several years ago, the demand is still at a relatively high level. With thousands of hospitalizations and deaths from the disease still occurring each week in the US, vaccination remains a pressing issue. The US Centers for Disease Control and Prevention (CDC) now recommends getting updated shots for Americans over 6 months of age. The winter Gallup poll showed that just 29% of adults have already gotten the new version of the vaccine, while 20% are interested in getting it before the end of spring.

As for Paxlovid, Pfizer began the commercialization of the product in 2024 for privately insured customers, which is likely to keep sales at steady levels.

The management expects $8 billion from the COVID segment in 2024 (-36% YoY).

COVID-19 New Hospital Admissions and Death Rate (Source: CDC)

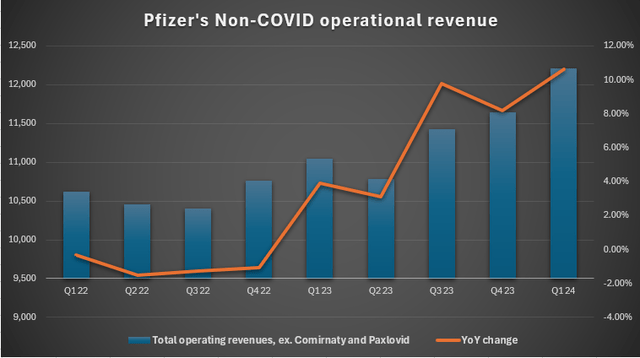

Secondly, while the coronavirus segment is losing positions, other segments are already accelerating as they rose 6% YoY in 2023 and 10.6% YoY in Q1 2024. Over the past years, the company has made massive strategic acquisitions and widened its pipeline. And although revenues returning to a 2021-2022 level seems like an impossible scenario for this decade, the portfolio of new potential blockbusters may provide double-digit growth in the long run.

Pfizer estimates an 8-10% growth of non-COVID sales this year.

The years of fighting COVID have not been in vain for Pfizer. The corporation provided itself with a stable huge cash flow machine for two years, which was spent on massive acquisitions of Seagen, Global Blood Therapeutics, Biohaven, Arena Pharmaceuticals, and Trillium Therapeutics with a total M&As value of $69 billion since 2021. These deals unlocked new cash-generation opportunities that should offset the ‘COVID cliff’ in the long run.

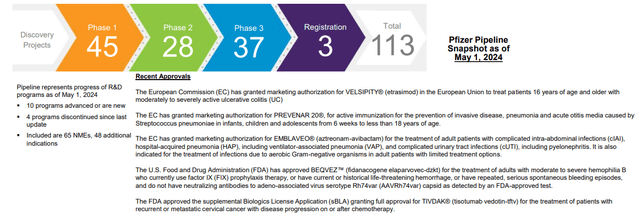

Pfizer now has one of the most diversified product lines in the pharmaceutical sector, covering a wide range of specialized areas. Not a single non-COVID product accounted for more than 15% of revenues in 2023. The pipeline is one of the strongest and most diversified in the biopharmaceutical sector and includes many promising products that could become blockbusters when they hit the market in the coming years. The pharma giant’s experimental pipeline includes 113 research programs, containing 37 in the final third phase of clinical trials and 3 drugs at the registration stage. The management projects to get at least $25 billion from M&A deals through 2030 with Seagen alone bringing $10 billion.

Source: Pfizer

Dividends & debt

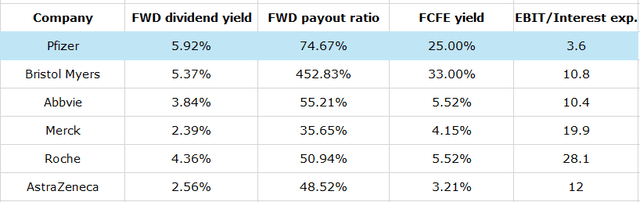

The company is known for its stable dividends that have been increasing for the past 14 years. As shares are now 52% down from all-time highs, the dividend yield has more than doubled to 5.92% and PFE is one of the highest-yielding stories in S&P 500.

In the pharmaceutical sector, no one except struggling Bristol-Myers Squibb even comes close to Pfizer’s payments. Its FCFE (free cash flow to equity) yield is at 25% since net borrowings increased massively last year, which has led to a higher dividend base.

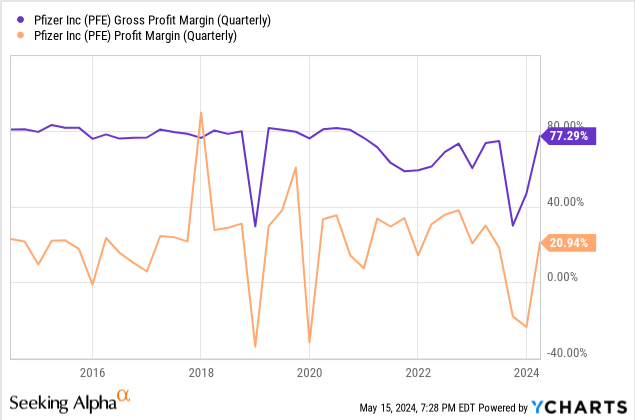

At the same time, a $70 billion debt on the balance sheet is concerning, as EBIT coverage of interest payments is barely at a comfortable level of 3.6x. I don’t see a disaster here either. The profitability is still recovering from multi-year lows due to non-cash revenue decline and Seagen acquisition expenses. The corporation’s CEO announced a $4 billion net cost savings plan, $2 billion of which is expected to be saved this year. Thus, after a big M&A streak, Pfizer is ready to improve margins with the help of cost-cutting and new products coming from these deals. CEO Albert Bourla said he sees no major M&A activity this year, so the debt growth would likely start its slowdown. Thanks to expense reduction and a more favorable sales mix, gross margin has almost recovered to pre-COVID levels bringing net profit margin along and the guidance suggests it is going to stay at the 70%+ level in 2024 with acceleration in 2025 and 2026.This would increase much-needed cash flow to keep raising the dividend and covering debt.

Valuation

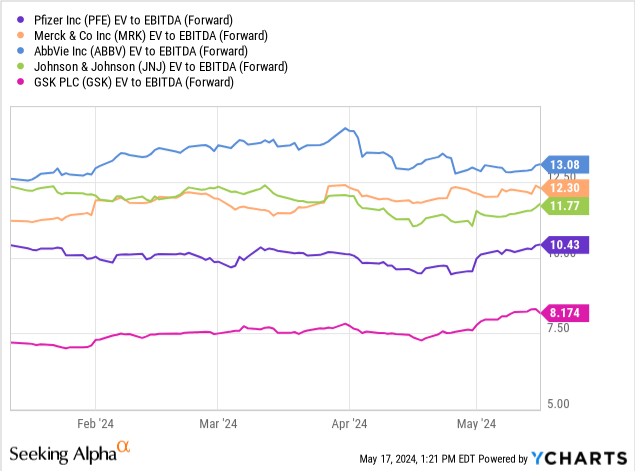

Seeing a 20% shares drop this year, Pfizer’s valuations now look not only attractive compared to its historical figures, but also compared to its peers, which have performed well all this time. In terms of forward EV/EBITDA, the corporation is the cheapest in the group with only GSK ((GSK)) falling behind, mainly due to a weaker pipeline.

If we compare these companies by 2025 forward P/E (as per Seeking Alpha), the situation also looks favorable for PFE. The median forward P/E value of the four companies listed below is 13.4x vs Pfizer’s 10.5x; that suggests a 27% upside to the peers’ median ($36.2 market share price).

Risks

On the other side of the medal, the thesis risks are mainly connected to poor potential blockbuster drug candidates’ performance, as their success relies on new clinical trial results. A recent gene therapy Phase 2 study testing fordadistrogene movaparvovec for DMD caused 2 deaths. Similarly, a new Prevnar product, for instance, can fail to meet primary endpoints in treating pneumococcal disease, despite the company’s strong portfolio and experience in that area.

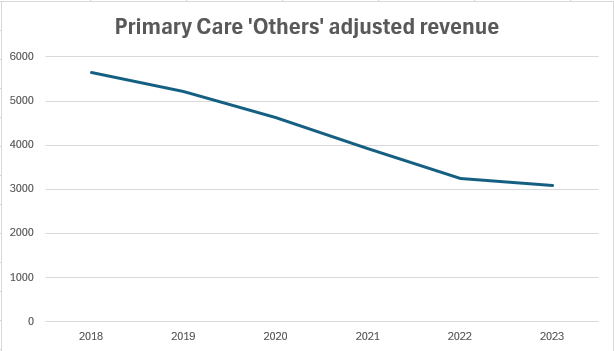

Moreover, looking at the bigger picture, there are concerns about old post-LOE drugs like Premarin, BMP2, Trumenba and TicoVac that are hidden in the ‘all other’ section. Primary Care ‘Others’ segment’s revenue has been falling at a CAGR of 11% since 2018. However, this section does not account for more than 10% of total sales.

Source: Pfizer, Wavelength Research

Conclusion

Summing up, Pfizer looks all set to continue the recent rally. Just like many other pharma firms, it faces massive LOE problems. However, if Merck and Bristol Myers, for example, struggle with finding a decent replacement for their top drugs, the COVID giant is already generating cash with new potential blockbusters and expects more to come.

Given a complete patent expiration offset, rapid growth of the non-COVID portfolio, 6% yielding dividend, and low valuations, PFE is a steal at current levels, in my opinion.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.