Summary:

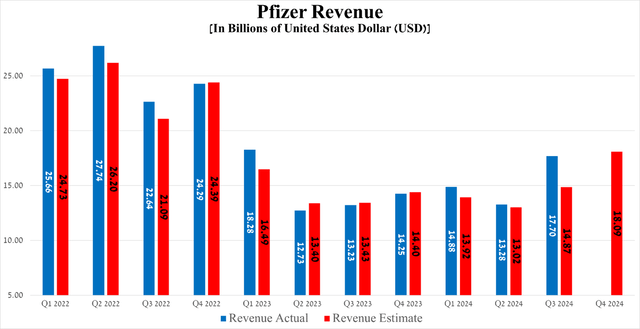

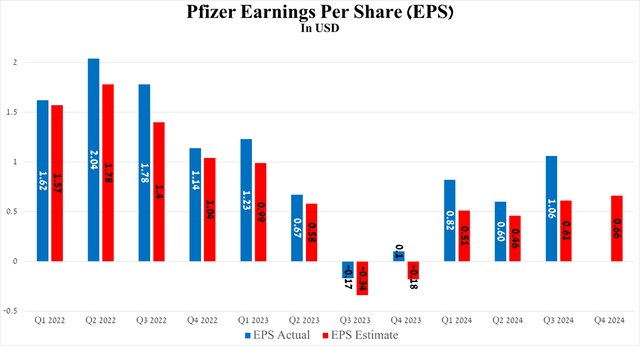

- Despite today’s fall in Pfizer’s share price, it beat my and Wall Street analysts’ expectations for the third quarter of 2024 by a large margin.

- Tafamidis franchise sales were $1.45 billion in Q3 2024, an increase of 9.4% quarter-on-quarter and 62.2% year-on-year.

- Meanwhile, sales of Padcev, approved for the treatment of urothelial cancer, amounted to $409 million for the three months ended September 30, 2024, an increase of 104.5% year-on-year.

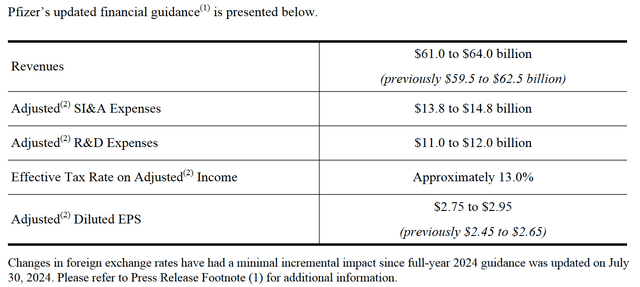

- Pfizer also raised its 2024 non-GAAP EPS guidance from $2.45-$2.65 to $2.75-$2.95.

- As a result, I continue to cover PFE stock with a ‘Strong Buy’ rating.

andreswd/E+ via Getty Images

On October 29, 2024, Pfizer (NYSE:PFE) reported financial results for the third quarter of 2024, which exceeded Wall Street analysts’ expectations and also pleased me with the progress made in recent months.

The New York-based company, led by its CEO Albert Bourla, was able to make significant progress in developing its vaccines, oncology, and neuroscience franchises in recent months, which ultimately allowed it to strengthen its balance sheet as well as lower the risks associated with a potential reduction in dividend payments in the post-COVID-19 era. I also believe that in the near future, this will help to offset the financial damage caused by the news of Oxbryta being withdrawn from the market due to fatal events and other side effects.

As a result, since the publication of my last article, “Tracking Well Above The Industry,” the company’s share price has not only broken out of the bearish trend but is slowly starting to form the long-awaited upward movement.

Investment thesis

Pfizer’s revenue was about $17.7 billion for the three months ended September 30, 2024, up 33.8% year over year, beating both my and analysts’ expectations, thanks to stronger sales of the tafamidis franchise, Zavicefta, Xtandi, Padcev, Adcetris, Nurtec ODT/Vydura and Tukysa, which also helped offset the decline in demand for its breast cancer treatment Ibrance, as well as Prevnar 13, a pneumococcal vaccine.

Meanwhile, the company’s non-GAAP earnings per share reached $1.06 for the third quarter of 2024, beating analysts’ consensus estimates by 45 cents. More importantly, it increased significantly year-over-year and quarter-over-quarter, even as R&D spending remained high [$2.6 billion in Q3 2024], primarily due to the ongoing conduct of several expensive pivotal trials aimed at evaluating the efficacy of Pfizer’s antibody-drug conjugates.

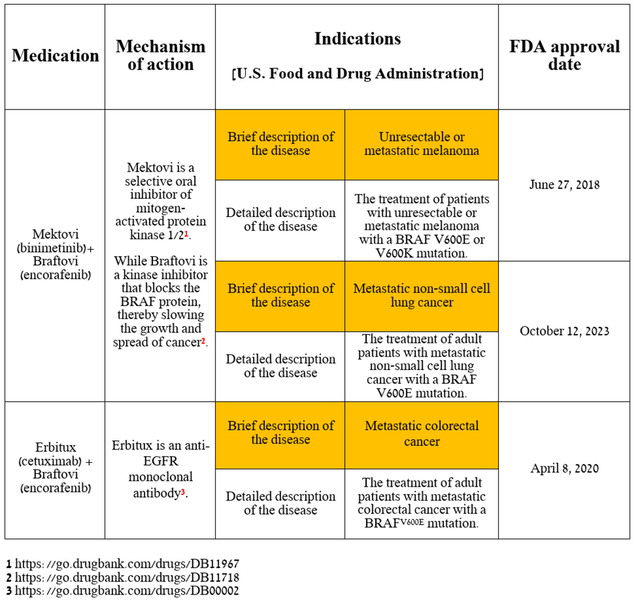

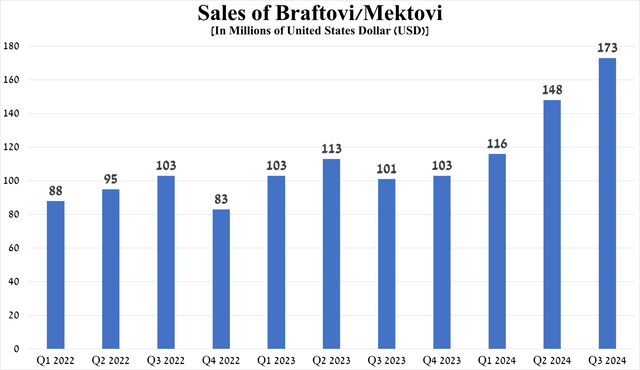

So, right at the beginning of the article, I want to note Mektovi/Braftovi’s performance, which, along with Padcev and Adcetris, remains a gem in the company’s oncology portfolio.

The Braftovi + Mektovi combination therapy is approved by regulatory authorities for the treatment of certain patients with unresectable/metastatic melanoma, as well as metastatic non-small cell lung cancer. Also, Braftovi, in combination with Erbitux, which in turn is an anti-EGFR monoclonal antibody, is approved for the treatment of metastatic colorectal cancer.

Source: table was made by Author based on Pfizer press releases

Its sales were $173 million in the third quarter of 2024, up 71.3% year-on-year and 16.9% quarter-on-quarter.

Source: graph was made by Author based on 10-Qs and 10-Ks

What are the reasons for the increase in demand for Mektovi/Braftovi?

In addition to the expansion of the global colorectal cancer and melanoma therapeutics markets, I highlight two other key factors that contributed to the acceleration of their sales growth in the second half of 2024.

First, on October 11, 2023, the Braftovi + Mektovi combination was approved by the FDA for people with advanced NSCLC that has a mutation in the BRAF gene called V600E. Eleven months later, at the end of August 2024, Pierre Fabre Laboratories, a Pfizer partner, announced that Europe’s regulator had also given the green light for the use of these two medications for this indication.

Secondly, I also want to note that on September 14, 2024, Pfizer revealed longer-term follow-up data from the PHAROS Phase 2 clinical trial. The published results once again confirmed the favorable safety profile of Braftovi+Mektovi and, more importantly, the excellent efficacy of this combination, which, in my opinion, strengthens its status as one of the best treatment options for adults suffering from this type of non-small cell lung cancer.

Dry figures and the cherished word for any financial market participant in the company’s press release “beat” the expectations of Wall Street analysts are undoubtedly important, as I have already said before. However, for me, as a Seeking Alpha analyst who continues to cover Pfizer with a ‘Strong Buy’ rating, it is more critical to determine the factors that contributed to this and also those that will have a significant impact on its financial position in the future.

Pfizer’s Q3 2024 financial results and outlook beyond 2024

First, I want to point out that Pfizer’s financial results for the third quarter of 2024 were encouraging and once again confirmed Albert Bourla’s ability to steer the pharmaceutical giant toward prosperity even in the face of sluggish demand for Comirnaty, the COVID-19 vaccine and less than satisfactory growth in sales of Eliquis, its blockbuster approved by regulators to prevent and treat blood clots.

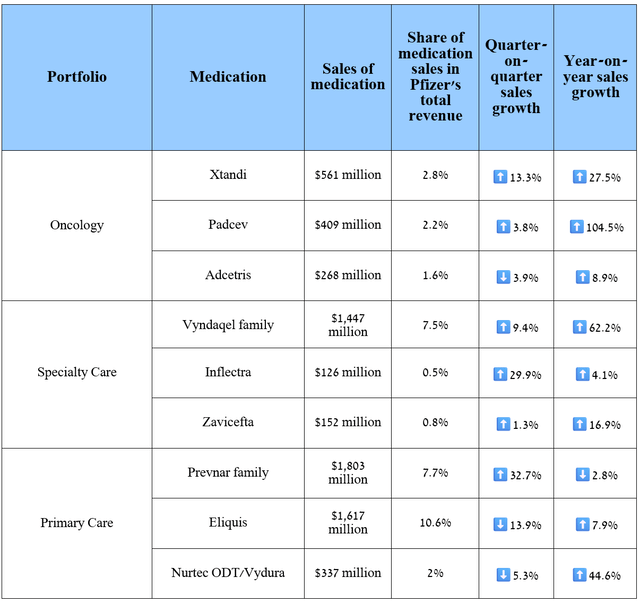

In addition to Mektovi/Braftovi, whose performance I discussed earlier, I want to highlight the sales, as well as the failures and achievements in clinical development, of some of the key products included in Pfizer’s business units such as Primary Care, Specialty Care, and Oncology.

The following medications have made and will continue to make substantial contributions to strengthening the company’s balance sheet in the future, as well as supporting increased investment in developing product candidates for the treatment of obesity, inflammatory disorders, and type 2 diabetes.

Source: graph was made by Author based on 10-Qs and 10-Ks

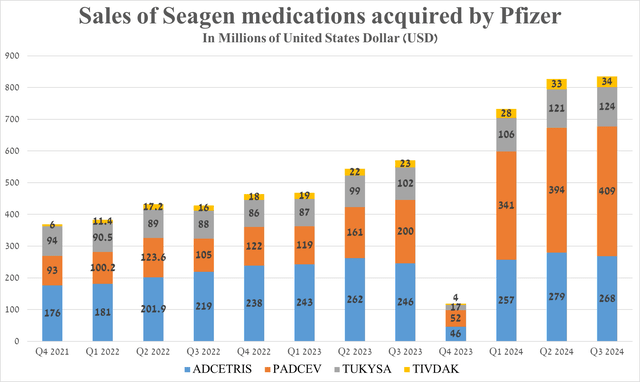

Let’s continue our journey with an analysis of Padcev sales, which is an antibody-drug conjugate [ADC] targeting nectin-4. In my estimation, it is a gem in Pfizer’s oncology franchise, partly because of its promising clinical data, partnership with Merck (MRK), and versatile mechanism of action, which potentially allows it to show efficacy in the treatment of locally advanced/metastatic solid tumors and bladder cancer.

Its total sales were $409 million in the third quarter of 2024, up 104.5% year-on-year and 3.8% quarter-on-quarter, driven in part by its approval in combination with Merck’s Keytruda [PD-1 inhibitor] for the treatment of advanced bladder cancer on December 15, 2023, in the United States and early September 2024 in Europe.

In addition to Padcev, in the chart below, I have noted the dynamics of sales changes of other Pfizer medications that were acquired as part of the deal with Seagen and which continue to please me, and I believe that it is becoming one of the leaders in the global cancer therapeutics market.

Source: graph was made by Author based on 10-Qs and 10-Ks

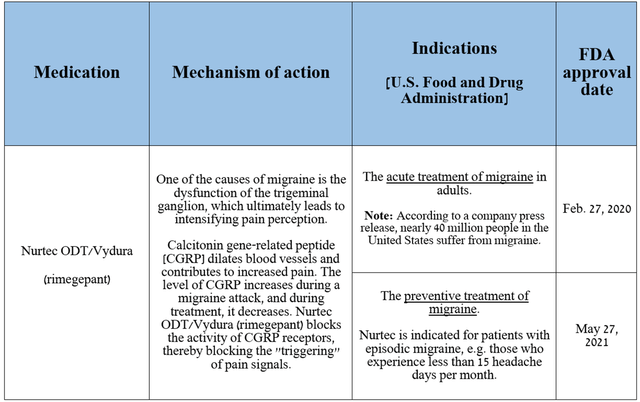

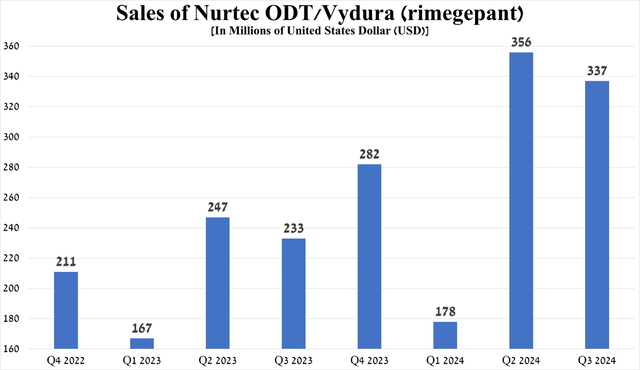

On the other hand, the key driver of revenue growth in the company’s Primary Care segment remains Nurtec ODT/Vydura (rimegepant), which, as I noted earlier, is a CGRP receptor antagonist.

Source: table was made by Author based on Pfizer press releases

Sales of the medicine, which is approved to prevent or treat migraines, totaled $337 million in the third quarter of 2024, up 44.6% year-on-year, driven by its launch in Canada and continued strong demand in the U.S. and Europe even as competition from Teva Pharmaceutical’s Ajovy (TEVA), Lundbeck’s Vyepti, Amgen’s Aimovig (AMGN) and AbbVie’s Ubrelvy (ABBV) intensified.

Source: graph was made by Author based on 10-Qs and 10-Ks

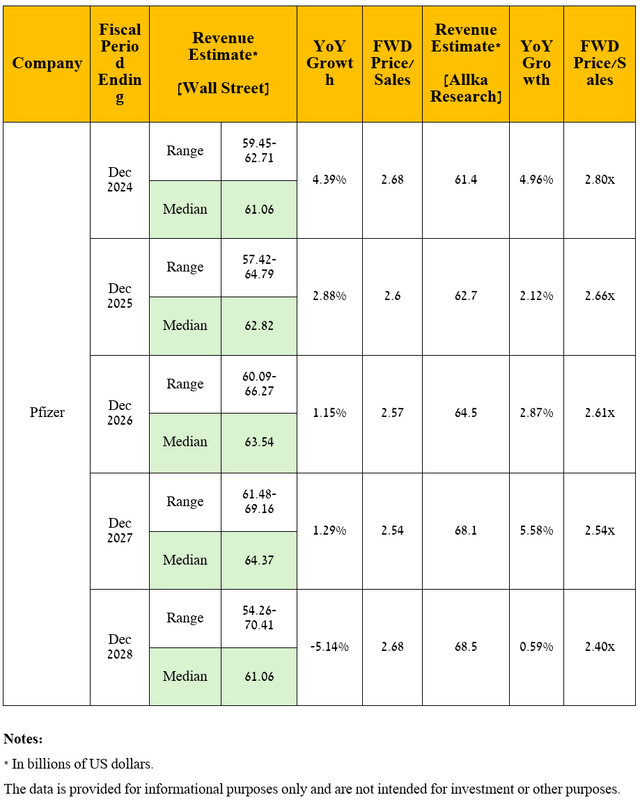

Seeking Alpha offers financial data, as well as Wall Street analysts’ forecasts for Pfizer’s revenue and earnings per share through 2028 and beyond.

So, Wall Street analysts expect Pfizer’s revenue for the fourth quarter of 2024 to be between $17.5 billion and $18.72 billion, which implies its growth of 30% year-on-year.

Meanwhile, its price/sales [FWD] ratio is 2.68x, which is not only 28.7% lower than the 5-year average but also lower than many of its Big Pharma peers, including Novartis [P/S ratio is 4.61x] (NVS), Merck [P/S ratio is 4.11x] and AstraZeneca [P/S ratio is 4.5x] (AZN), thus being the first of the factors that, in my opinion, indicate that the New York-based company is currently trading at a discount.

On a more global level, I expect Pfizer’s revenue to continue to grow in the coming years, including due to increased demand for Braftovi/Mektovi, Litfulo, its tafamidis franchise, antibody-drug-conjugates both through label expansions and improved uptake of these medications into clinical practice due to their promising results demonstrated in phase 2 and/or 3 clinical trials, as well as potential approvals of its product candidates including atirmociclib, dazukibart, and vepdegestrant by the FDA and EMA.

Also, in forecasting the company’s revenue and net income, I took into account the withdrawal of Oxbryta from the market, as well as the loss of exclusivity of its blockbusters including Inlyta, Xeljanz, Ibrance, and Xtandi, the impact of which on its financial position I discussed in detail in “The Pfizer Advantage: High Dividend Yield, JN.1 Variant, And Therapeutic Innovations.”

Overall, I anticipate its total revenue to be $68.5 billion in 2028, which firstly implies its average annual growth over the next five years by single-digit percentages, and secondly, it is in line with the expectations of 10 analysts [$54.26-$70.41 billion]. Accordingly, Pfizer’s P/S ratio will decrease from 2.96x over the past 12 months to below 2.5x by 2028.

Source: graph was made by the Author

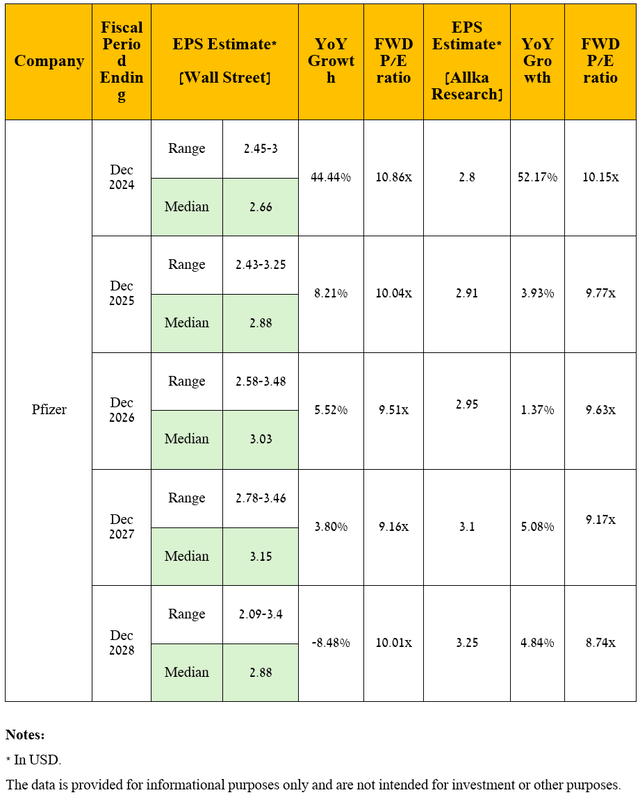

Dear Seeking Alpha readers, as I have noted in previous articles, let’s move on to a discussion of an equally important financial indicator, namely non-GAAP earnings per share [non-GAAP EPS].

Why?

This needs to be done because it is more accurately and comprehensively determines how effective the business strategies implemented under the leadership of Albert Bourla are.

So, Pfizer’s non-GAAP EPS is expected to be in the range of 49 cents to 94 cents in the fourth quarter of 2024, implying its growth of more than 5.5 times year-over-year.

Moving to a longer time frame, I anticipate Pfizer’s operating income growth trend to continue through 2028, driven primarily by the “cost realignment program,” rising prices for its vaccines and drugs, and increased sales of its oncology, migraine, and vaccine franchises.

Ultimately, with revenue growth under my forecast, which was noted earlier, I expect the company’s EPS to be $3.25 in 2028, which is firstly near the upper limit of the analysts’ range [$2.09-$3.4] due to my more optimistic expectations for Padcev and Abrysvo sales.

Source: graph was made by the Author

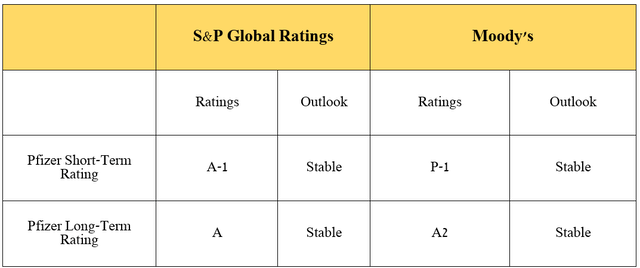

It is equally important to discuss debt, which, in my opinion, has become less of a threat to its financial position as it repays senior notes and loans in recent quarters. Moreover, given its year-over-year EBITDA growth, thanks in part to the factors I indicated in the article earlier, as well as management’s efforts to optimize general and administrative expenses, its net debt/EBITDA ratio fell below 6x by the end of September 2024.

I would also like to point out that Pfizer’s credit ratings from S&P Global Ratings (SPGI) and Moody’s (MCO) remain at investment grade.

Source: graph was made by Author based on Pfizer’s Form 10-Q

Risks

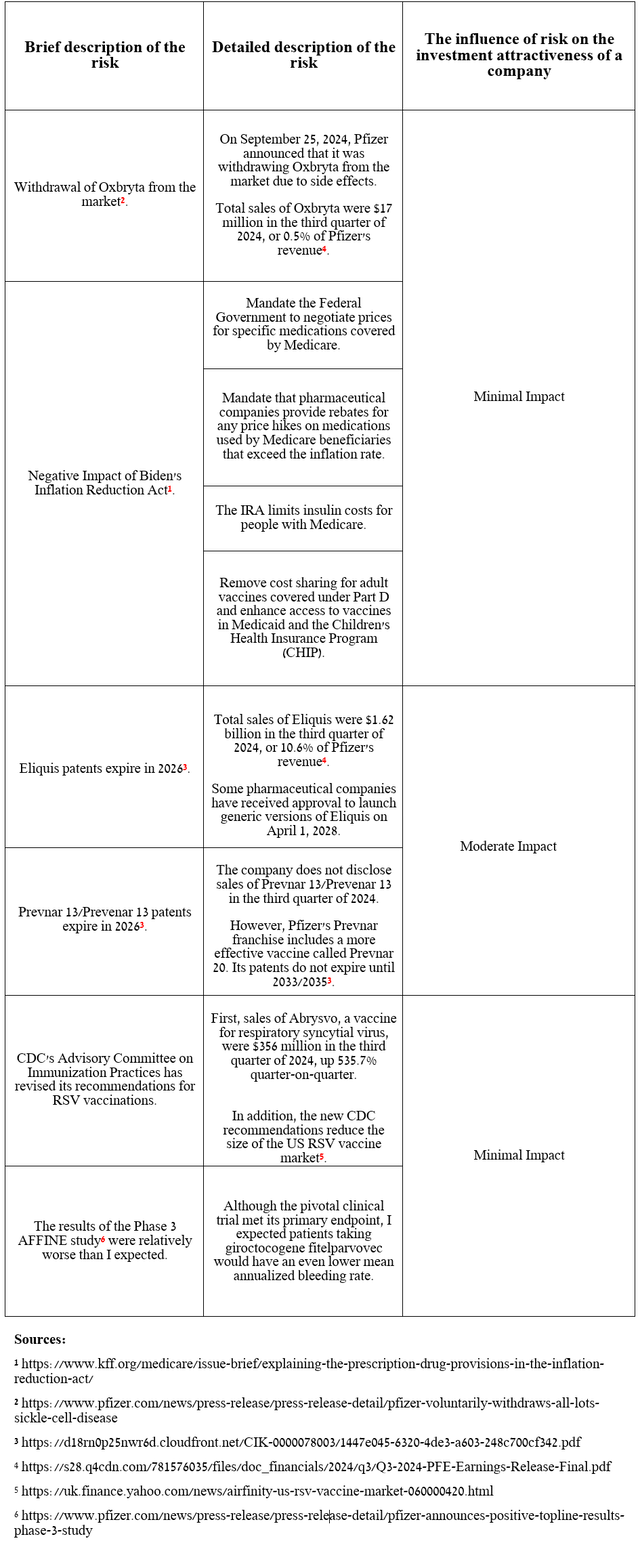

Eliquis’ slowing year-on-year sales growth rate, as well as the withdrawal of Oxbryta from the market, are additional risks that, in my opinion, will continue to have a negative impact on Pfizer’s share price.

Source: table was made by Author

Takeaway

Today, Pfizer, one of the key players in the healthcare sector, published financial results for the three months ended September 30, 2024, which, despite the sluggish reaction of financial market participants, pleasantly surprised me with the growth of sales of many of its key medications included in its oncology portfolio.

Moreover, its management again raised its full-year 2024 guidance.

Given this and the ongoing trend of publishing promising clinical data from its potential blockbusters, including Elrexfio, danuglipron, vepdegestrant, dazukibart, and other product candidates, coupled with a dividend yield exceeding 5.8%, I continue to cover it with a Strong Buy rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.