Summary:

- Pfizer scored a double beat on revenue and adjusted EPS, bolstered by the surprising performance of its COVID franchise.

- Despite that, the lukewarm post-earnings response suggests Pfizer needs to flex its muscles on its ex-COVID growth optionalities.

- PFE has likely moved past its long-term lows in early 2024, underscoring the market’s conviction that the worst is over.

- Pfizer has a well-diversified pipeline, with several late-stage assets to drive medium-term growth.

- Given its best-in-class profitability, I argue why PFE’s battered valuation seems too pessimistic.

georgeclerk

Pfizer: Q3 Earnings Beat Isn’t Enough For A Stronger Valuation Boost

Pfizer (NYSE:PFE) investors have continued to help the stock consolidate constructively as the leading biopharma company seeks to regain the market’s confidence for its long-term growth prospects. In addition, Pfizer raised its guidance, pushing back against the recent activist campaign launched by Starboard. However, I assessed that the campaign has likely not achieved its intended goal of “compelling” Pfizer to overhaul its strategy to improve shareholder value. While management concurred with PFE’s relatively weak total return, CEO Albert Bourla has maintained his optimism in the “transformational” deals under his watch.

In my previous bullish PFE article, I highlighted the market’s skepticism in its COVID franchise. Therefore, the market has de-rated PFE given the lack of significant near-term growth catalysts to bolster its tepid growth profile (“D”+ growth grade).

In Pfizer’s Q3 earnings release, Paxlovid outperformed expectations, posting $2.7B in revenue, well above last year’s $202M metric. Hence, it helped Pfizer to post a double beat on revenue and adjusted EPS in Q3, although it did little to bolster investor sentiments on PFE this week. The market’s lukewarm reception is apt, as investors are looking past Pfizer’s COVID franchise. As a result, it’s increasingly critical for Pfizer to demonstrate the effectiveness of its operational growth ex-COVID to investors while re-architecting its cost base to deliver a more robust margin accretion.

Pfizer: Upgraded Guidance Underpins Its Long-Term Bottom

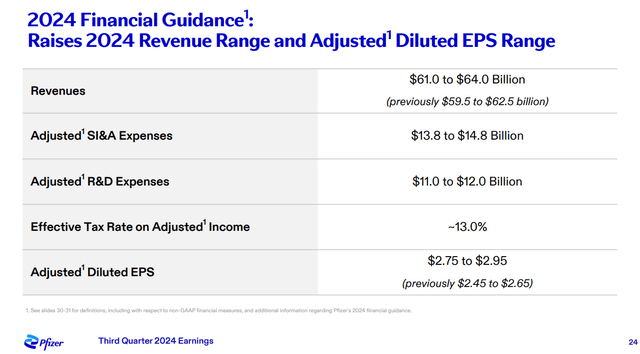

Pfizer 2024 guidance (Pfizer filings)

Wall Street’s estimates on PFE have also been upgraded, corroborating management’s optimism. Pfizer has made paying down debt and growing dividends, the centerpiece of its capital return framework. Hence, investors anticipating a more robust stock repurchase program could be disappointed, even though it still has $3.3B remaining in its authorization.

I assess the company’s capital allocation framework as appropriate since Pfizer’s target is to reduce its gross leverage to 3.25x, having lowered its debt by $4.4B in 2024. As a result, investors must scrutinize Pfizer’s pipeline progress to glean critical insights on whether it could drive a growth-driven valuation re-rating.

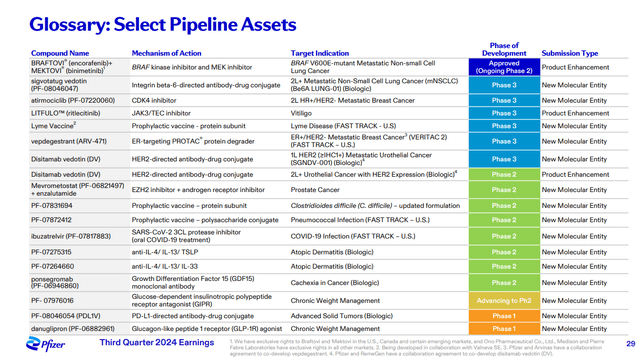

Pfizer’s select pipeline assets (Pfizer filings)

Pfizer has an enviable and well-diversified pipeline of leading assets across several categories. It also has a series of Stage three oncology pipeline, underscoring the potential near- and medium-term growth catalysts for growth-oriented investors.

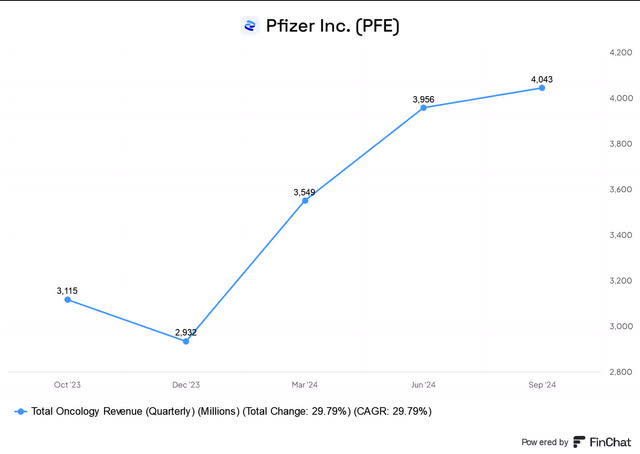

Pfizer oncology revenue (FinChat)

As seen above, Pfizer’s oncology segment has been instrumental in driving revenue growth in Q3. As a result, it played a significant role in helping the company post a 32% revenue increase in its biopharma business. Therefore, it should assure investors that Pfizer’s late-stage oncology pipeline should provide more constructive growth prospects in the medium term.

Furthermore, Pfizer’s entry into the weight loss drug market is still on track, although investors are likely looking for more proof points. Pfizer highlighted that it remains focused on Danuglipron as the “second oral treatment for obesity.”

However, the competitive landscape has intensified recently, as seen by the disappointing Q3 performance and lowered guidance by Eli Lilly (LLY) in its recent earnings release. As a result, investors have likely not reflected much optimism on Pfizer’s asset, behooving investors to pay close attention to its progress amid potentially stiffer competition.

Pfizer Is Still A Highly Profitable Company

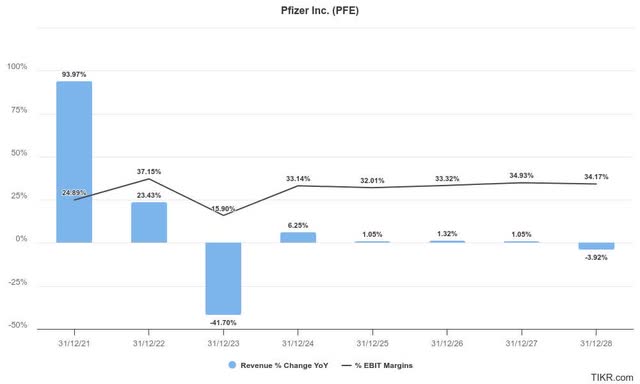

Pfizer estimates (TIKR)

Notwithstanding the improved Wall Street estimates, PFE’s revenue growth outlook through 2028 is expected to remain tepid. Hence, the market seems to lack conviction with CEO Bourla and his team’s efforts to rejuvenate its topline growth prospects.

Hence, investors must continue to be cautious about Pfizer’s pipeline progress as the market awaits more clarity on subsequent commercial launches from its late-stage assets. Despite that, Pfizer is anticipated to have moved past the worst of its COVID headwinds as growth rates have likely bottomed out.

Furthermore, income investors are expected to remain on board given the company’s focus and commitment to growing its dividends. Its profitability profile is also expected to recover and stabilize through 2028, affording much-needed clarity for income investors.

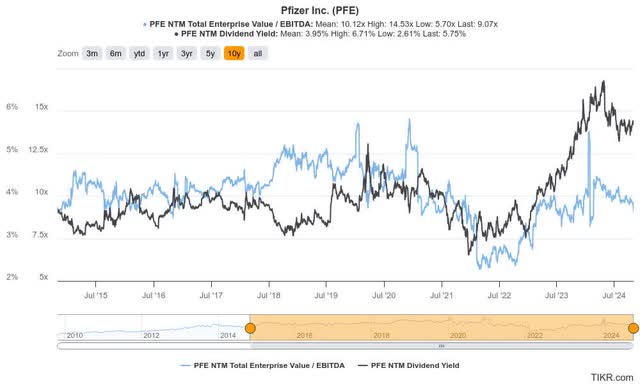

PFE valuation metrics (TIKR)

Accordingly, PFE’s forward adjusted EBITDA multiple of 9.1x remains below its 10Y average of 10.1x. It’s also below its healthcare sector (XLV) median of 13.6x, corroborating its relative undervaluation. Even when adjusted for its tepid growth profile, PFE’s forward adjusted PEG ratio of 1.2 is nearly 40% below its sector median. Hence, I assessed that the growth optionalities in Pfizer’s oncology assets seems too pessmistic, given the company’s best-in-class profitability (“A+” profitability grade).

Is PFE Stock A Buy, Sell, Or Hold?

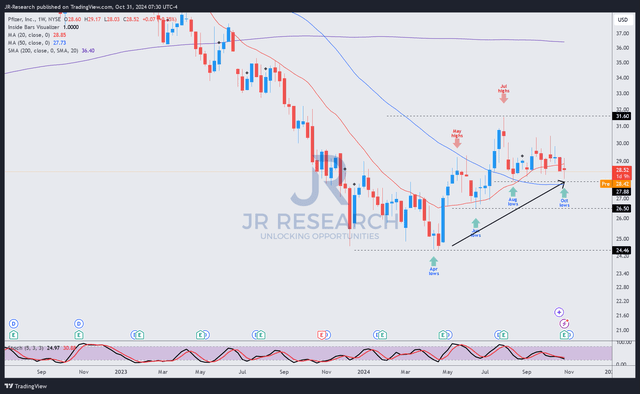

PFE price chart (weekly, adjusted for dividends, medium-term) (TradingView)

PFE’s price action remains constructive, showing that the stock has maintained several higher lows and higher highs over the past six months. Dip buyers have defended the stock’s $28 support zone since August, potentially providing more confidence for buyers to return with higher conviction.

PFE is also a model portfolio stock in my Ultimate Growth Investing service, helping our members capitalize on its turnaround thesis as a core tenet of the service’s value proposition.

In addition, PFE’s robust forward dividend yield should attract income investors looking to reallocate to high-quality healthcare stocks with a fundamentally strong thesis. Therefore, I assess that PFE’s bullish proposition remains appropriate, although investors must stay patient as the company executes its multi-year transformation growth optionalities.

Rating: Maintain Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!