Summary:

- Pfizer has generally paid high prices for M&A, above industry norms (20x vs 10x EV/Revenue deal multiples).

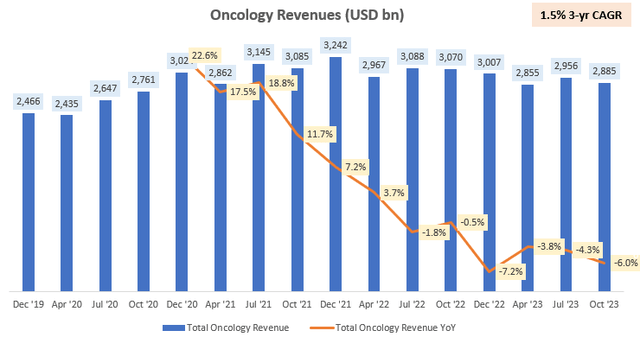

- Oncology has been a lagging business for Pfizer despite being a hot growth area (1.5% 3-yr CAGR for Oncology vs 4.5% 3-yr CAGR for non-COVID related revenues).

- Seagen may boost Oncology sales but the price paid is hefty (22.7x EV/Revenue, implied ~15x PE; 44% premium to sectoral 1-yr fwd PEs).

- Management’s execution record has been patchy; multiple guidance cuts and margin misses in FY23 due to overestimations of COVID-related sales.

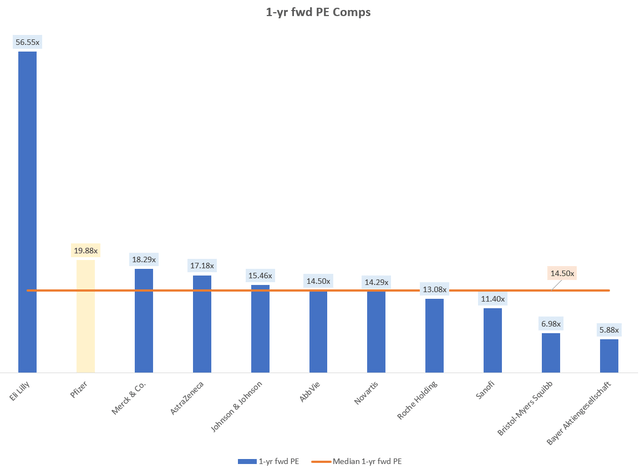

- Pfizer is relatively more expensive vs its peers (19.9x 1-yr fwd PE vs 14.5x 1-yr fwd PE of peers), reducing the margin of safety for buys.

nathaphat

Thesis

I was initially interested in buying Pfizer (NYSE:PFE) but after deeper research, I got more and more reluctant to pull the trigger. So I am rating it a ‘Neutral/Hold’ for now. Here’s my narrative for Pfizer:

- Pfizer needs new revenue streams in a post-COVID world with patent cliffs on the horizon

- Patent cliffs are a sector-wide issue for which M&A has been a tool to replenish revenues

- Pfizer has generally paid high prices for M&A, above industry norms

- Oncology has been a lagging business for Pfizer despite being a hot growth area

- Seagen may boost Oncology sales but the price paid is hefty

- Management’s execution record has been patchy

- Pfizer is relatively more expensive vs its peers

Pfizer needs new revenue streams in a post-COVID world with patent cliffs on the horizon

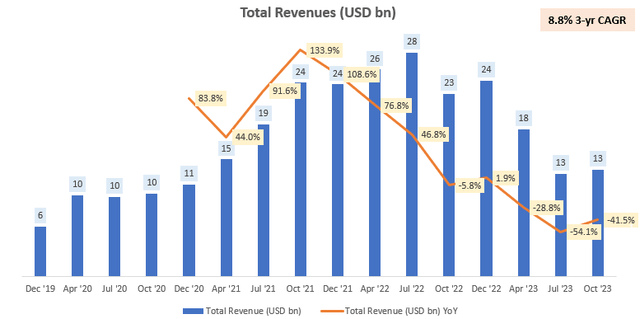

Pfizer’s revenues have been on a decline after a COVID-high:

Total Revenues (USD bn) (Company Filings, Author’s Analysis)

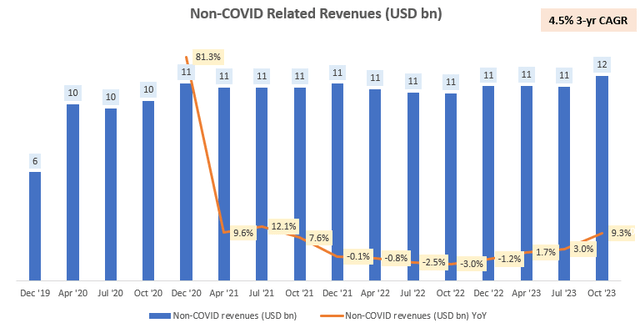

It’s non-COVID related revenues have grown at a paltry 4.5% 3-yr CAGR:

Non-COVID Related Revenues (USD bn) (Company Filings, Author’s Analysis)

Pfizer is also marching towards a patent cliff. I had discussed this in my SPDR S&P Pharmaceuticals ETF (NYSEARCA:XPH) article a year ago, estimating a $6.1bn revenue loss impact from patent expirations for Pfizer. Therefore, Pfizer needs to desperately find new revenue streams to replenish the drugs encountering loss of exclusivity (LOE), without reliance any COVID-related booster to revenues (pardon pun).

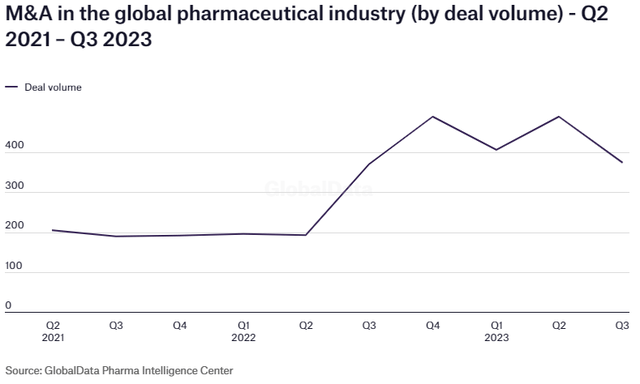

Patent cliffs are a sector-wide issue for which M&A has been a tool to replenish revenues

Top pharmaceutical companies are facing risks of losing up to 50% of overall revenues from patent expirations. This has led to a flurry of M&A activity in the global pharmaceutical industry as companies seek to replenish lost revenues. Notice the pickup in deal activity since 2022:

Pharmaceutical M&A Deal Volume (GlobalData Pharma Intelligence Center)

Industry research from consultancy firm PwC and investment bank Leerink suggests that 2024 is likely to see a continued rise in M&A activity, particularly large-deal activity:

Despite a challenging interest rate environment, PwC projects the sector to see deal values ranging from $225 billion to $275 billion.

At this point, let’s not forget that most M&A deals fail. And the larger the transaction, the more likely it is to fail. That said, M&A is often necessary and each deal as well as the deal-making style must still be assessed independently:

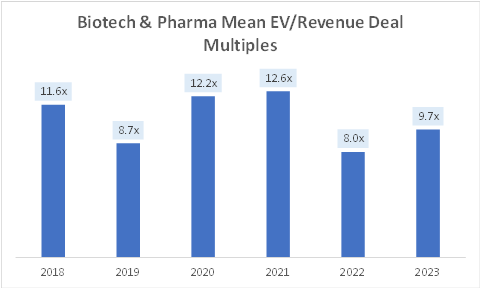

Pfizer has generally paid high prices for M&A, above industry norms

As is industry practice, Pfizer has bought smaller, unprofitable and sometimes even pre-revenue pharmaceutical companies. The price paid has generally been above 20.0x revenues:

Pfizer Recent M&A Record (Company Filings, Capital IQ, Author’s Analysis)

For context, according to the Institute for Mergers, Acquisitions & Alliances (IMAA), the mean EV/Revenue deal multiples in the Biotech & Pharma sector has been around 10x over the same time horizon (2019 – 2023):

Biotech & Pharma Mean EV/Revenue Deal Multiples (IMAA Institute, Author’s Analysis)

So Pfizer has generally paid much higher prices for its key acquisitions than industry norms.

Oncology has been a lagging business for Pfizer despite being a hot growth area

Pfizer’s Oncology business has lagged even non-COVID related revenues, posting a 3-yr CAGR of only 1.5%. This is despite Oncology being a hot growth area in the M&A transaction space.

Pfizer Oncology Revenues (USD mn) (Company Filings, Author’s Analysis)

Pfizer’s management is long-term bullish on Oncology as they have a sobering prediction about high cancer rates:

As a reminder, 1 in 3 people will be diagnosed with cancer in their lifetime. Cancer remains the second leading cause of death in the U.S., is a leading cause of death worldwide and is the largest growth driver in global medicine, improving the lives of patients with cancer will have enormous, unimaginable impact on human.

– CEO Albert Bourla in the December 2023 Analyst & Investor Call

For this reason, they bought cancer-curing company Seagen (SGEN), which I dig into here:

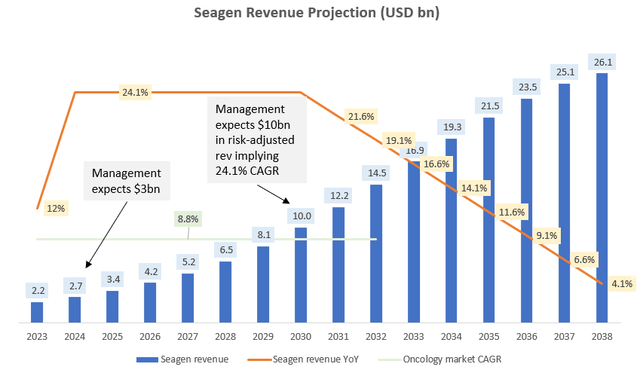

Seagen may boost Oncology sales but the price paid is hefty

Pfizer bought Seagen for $45 billion or a 22.7x EV/Revenue deal multiple.

Seagen Revenue Projections (USD bn) (Company Filings, Author’s Analysis)

Let’s establish an idea of base growth rates; the oncology market is expected to grow at a CAGR of 8.8% over the next decade. Last year, Seagen grew at 12% YoY. Management anticipates 2024 to contribute $3bn and $10bn in risk-adjusted revenues (meaning their base case estimate) by 2030. Using these markers, it implies a roughly 24% revenue CAGR for Seagen till 2030; much faster than the broader oncology market’s growth rates.

After 2030, I have assumed some moderation in the growth rates, back towards industry levels. I think this is reasonable.

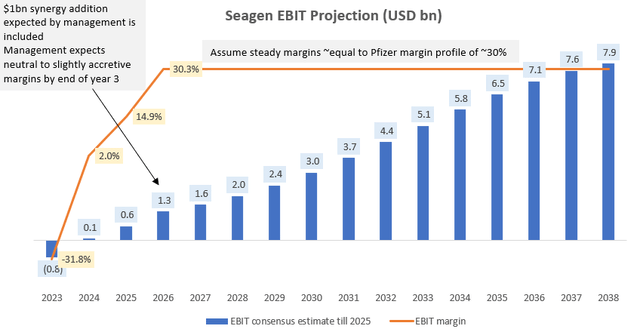

Seagen EBIT Projections (USD bn) (Company Filings, Author’s Analysis)

On the margins side, Seagen is currently unprofitable with an EBIT loss of $750.6 million over the last twelve months (LTM). Management expects $1bn in synergy benefits by the end of 2026, which I have straight-lined over 3 years. By the end of year 3 or year 4 after the acquisition, management expects neutral to slightly accretive margins, which is why I have targeted around 30% EBIT margins (my estimate of Pfizer’s longer-term average) in the year 2026. Since then, I have kept the margin profile constant.

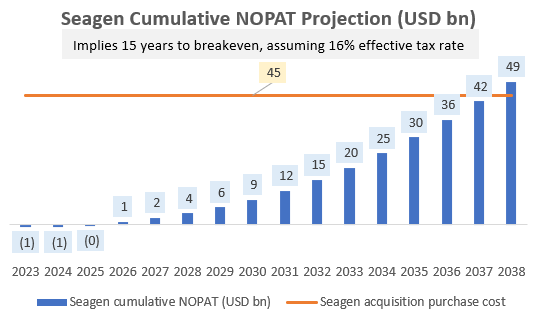

Seagen Cumulative NOPAT Projection (USD bn) (Company Filings, Author’s Analysis)

Assuming an effective tax rate of 16% (based on industry-wide data and Pfizer’s longer-term history), the cumulative NOPAT crosses the purchase consideration of $45 billion in 2038 meaning 15 years till breakeven on the acquisition. This implies a PE of ~15.0x. For context, the US Pharmaceuticals sector is trading at a 1-yr fwd PE of 10.41x. So the Seagen deal has occurred at a 44% premium to this value. Relative to Seagen’s trading price, Pfizer paid a 33% premium for the deal.

In this analysis, I have penciled in management’s own expectations and assumed what I believe are reasonable revenue and margin projections thereafter. Yet, the deal looks a bit expensive. Now, here’s a case for why management’s base case may be on the optimistic side:

Management’s execution record has been patchy

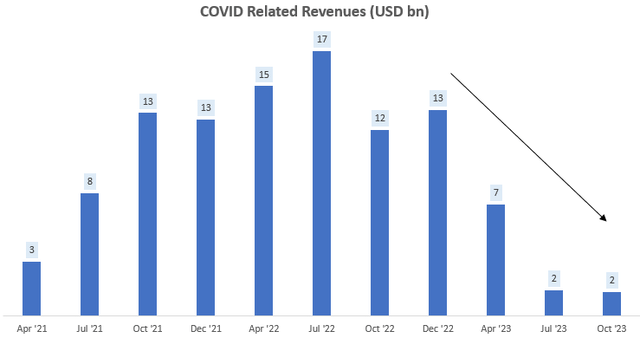

Management has grossly overestimated COVID related revenues, seeing a sharper fall than expected from $13 billion in Q4 FY22 to merely $2 billion in Q3 FY23:

Pfizer Non-COVID Revenues (USD bn) (Company Filings, Author’s Analysis)

In Q2 FY23, Pfizer cut sales guidance for FY23 by $9 billion due to lower-than-expected COVID sales; $7 billion sales cut in Paxlovid and $2 billion sales cut in Comirnaty. However, this revised expectation was still too optimistic. In Q3 FY23, Pfizer took:

$5.6 billion of noncash inventory write-offs of COVID-related inventories

– CFO David Denton in Q3 FY23 earnings call

Subsequently, company downgraded 2024 expectations on COVID-related revenues again in Q3 FY23 to $8 billion. Consensus estimates stood at $12.5 billion before that announcement.

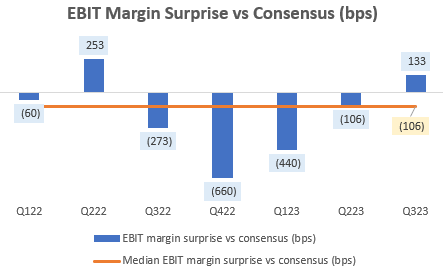

On the EBIT margins side, Pfizer has disappointed the Street for most of the last 2 years, with a median surprise of -106bps.

Pfizer EBIT Margin Surprise vs Consensus (bps) (Capital IQ, Author’s Analysis)

Overall, these misses on revenues and margins undermine my confidence in believing management’s word for how they expect Seagen to perform. The track record suggests that there is downside risk to their projections, which makes the acquisition seem even more expensive than it already seems.

Pfizer is relatively more expensive vs its peers

From a comparable valuations’ perspective, Pfizer is relatively more expensive than its peers, as it is trading at a 37% premium to the median PE of 14.50x:

1-yr fwd PE Comps (Capital IQ, Author’s Analysis)

Peer set includes Eli Lilly (LLY), Merck & Co. (MRK), AstraZeneca (AZN) (OTCPK:AZNCF), Johnson & Johnson (JNJ), AbbVie (ABBV), Novartis (NVS) (OTCPK:NVSEF), Roche Holding (OTCQX:RHHBY) (OTCQX:RHHBF) (OTCPK:RHHVF), Sanofi (SNY) (OTCPK:SNYNF) (GCVRZ), Bristol Myers Squibb (BMY), Bayer Aktiengesellschaft (OTCPK:BAYZF) (OTCPK:BAYRY)

Considering the high purchase price risk, the higher comparable valuations don’t help the argument for buys.

Takeaway

Pfizer is trying hard to replenish and revive revenue growth. With the Seagen acquisition, it has made a big bet on Oncology. However, my analysis on the M&A purchase price patterns and execution track record leads me to recognize an elevated risk for a capital allocation blunder here. As M&A in the pharmaceutical sector is expected to grow in 2024, I worry that Pfizer may make more risky deals. The stock is also not trading at a big discount relative to sector median multiples, reducing the margin of safety. Hence, I am reluctant to buy right now. I say let management prove that they can meet the revenue and margin milestones for the Seagen business. That can inspire more confidence for considering initial buys.

Rating: ‘Neutral/Hold’

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.