Summary:

- Today, I’m upgrading my rating for PFE due to several positive trends, both within the company and driven by broader market factors.

- The stock price dropped after the Q2 earnings release despite strong performance and an impressive full-year guidance upgrade, primarily due to a significant secular risk.

- My valuation analysis suggests that PFE’s valuation is sound and reflects a significant secular risk described in the article.

Alexandros Michailidis

Introduction

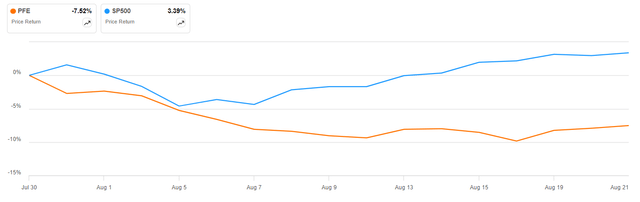

Pfizer’s stock (NYSE:PFE)(NEOE:PFE:CA) has notably lagged behind the S&P 500 index since I wrote my previous analysis in early May. I was extremely bearish and gave PFE a “Strong Sell” rating. I think I was partially right about PFE’s prospects since there is still a big risk for investors related to several stellar products losing their patent exclusivity over the next few years. On the other hand, the stock delivered positive returns to investors over the last three months, meaning that I was only partially correct.

Today, I want to upgrade my rating for PFE from “Strong Sell” to “Hold” because there are a few solid positive factors. The company’s financial performance is recovering faster than was expected by consensus, which is a positive sign. The management’s guidance is quite optimistic, and the current situation in the stock market can also benefit stocks with attractive dividend yield, like PFE. Moreover, expected interest rate cuts through the end of 2024 will also help valuations.

Fundamental analysis

PFE reached its 2024 peak by the end of June, but the stock price plunged after the Q2 earnings release. The pullback is surprising because PFE delivered a decent earnings report and raised the full year 2024 guidance. Revenue grew by 2.2% YoY despite continued decline in COVID sales, and there was a solid beat in non-GAAP EPS. Moreover, PFE raised full-year 2024 Revenue Guidance to a Range of $59.5 to $62.5 Billion vs $60.58B consensus and raised non-GAAP EPS guidance to a range of $2.45 to $2.65 vs $2.37 consensus. Despite solid earnings and guidance, the stock price declined by 7.5% since July 30.

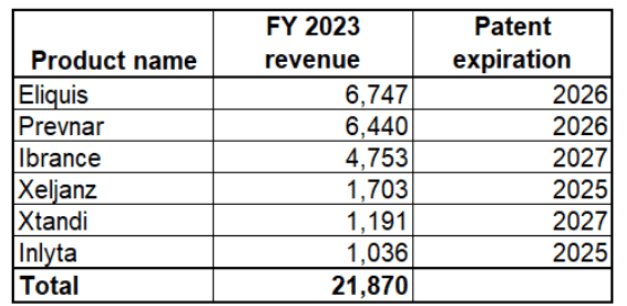

I think that investors are still cautious about PFE because several products will lose their patent exclusivity within the next few years. The table below illustrates the significant impact of key patent expirations expected between 2025 and 2027. PFE will require more than 4-5 blockbuster products to fully counterbalance this loss. This is a big secular issue that makes me remain quite cautious about PFE.

Calculated by the author based on the latest 10-K

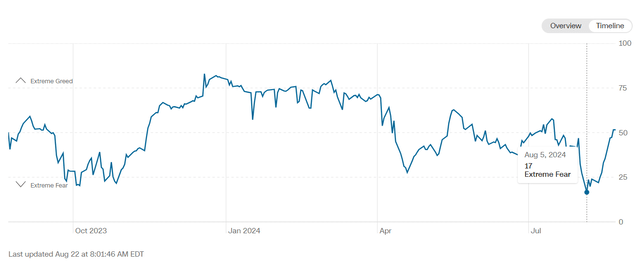

On the other hand, PFE investors might benefit from the current uncertain environment in the stock market. The Q2 earnings season was more or less in line with expectations. As a result, there were no big share price spikes after earnings releases. Just a few days after almost all tech giants reported their Q2 results, the stock market experienced “Extreme Fear”. This likely means that investors perceive current share prices in growth stocks at their peaks.

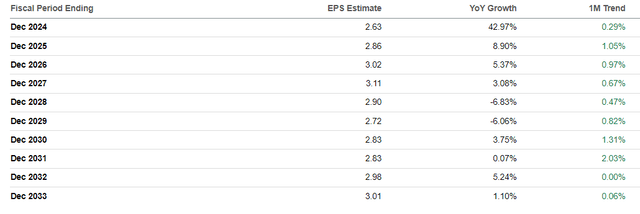

As a stable dividend machine with a 5.8% forward dividend yield, PFE might benefit from such a situation in the stock market. The current share price is close to the last decade’s lows, which will likely be a notable factor for investors seeking safe harbor. Moreover, the last month’s trend in long-term EPS revisions look quite positive with slight upgrades.

There are some positive developments around the new products pipeline as well. Pfizer’s gene therapy, fidanacogene elaparvovec, has received conditional marketing authorization from the European Commission for treating severe and moderately severe hemophilia B. It will be marketed as Durveqtix in the EU and was earlier approved by the FDA as Beqvez in the U.S. This information is quite positive since the global hemophilia drugs market is expected to observe a 6.6% CAGR between 2023 and 2030.

To wrap up fundamental analysis, I remain cautious about PFE due to a substantial risk of several stellar products losing their exclusivity by 2027. On the other hand, I have to admit that some of the recent developments are quite positive. Moreover, the situation in the stock market is likely to become more favorable for high-quality value stocks like PFE as sentiment around growth stocks is deteriorating.

Valuation analysis

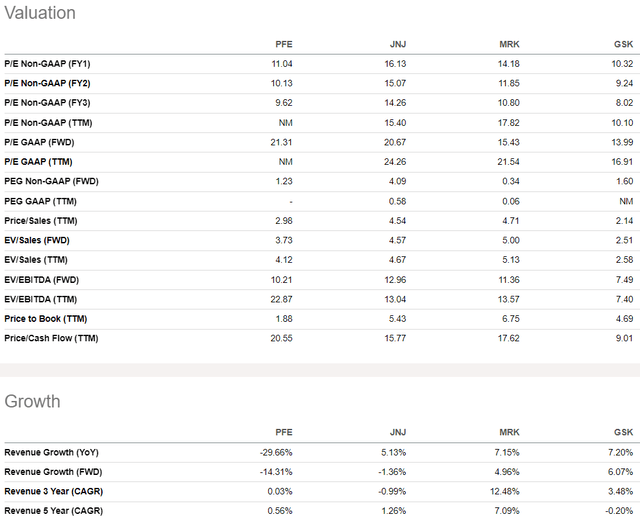

I have mixed feelings when I look at Pfizer’s valuation ratios compared to other large pharmaceutical names. The company’s multiples are mostly notably lower compared to peers. On the other hand, lower multiples might be fair given that Pfizer’s YoY and FWD revenue growth is deeply negative.

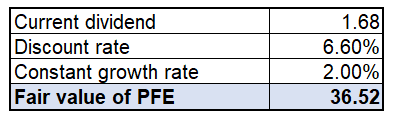

Looking at peer analysis of valuation ratios does not give answers to me. Therefore, I must update Pfizer’s dividend discount model (‘DDM’). Cost of equity is the discount rate and for Pfizer it is 6.6%. I think that projecting a 2% dividend growth rate is fair. The current dividend is $1.68.

Calculated by the author

My DDM analysis suggests that PFE’s fair value is $36.52 with a 2% dividend growth rate. Since the stock’s last close is closed at $29.03, there appears to be a 26% upside potential. I also want to show how the fair value changes if a 1% dividend growth rate is incorporated.

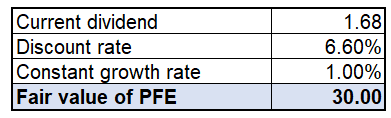

Calculated by the author

As we can see, even with a 1% dividend growth rate, the stock is fairly valued with a modest upside potential. Therefore, valuation appears to be quite attractive, especially considering the stock’s 5.8% forward dividend yield.

Mitigating factors

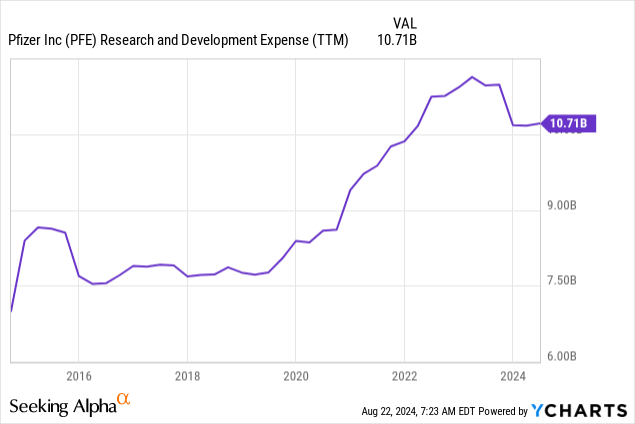

The main reason why I remain cautious about Pfizer is that the company’s several flagship products will lose their patent exclusivity over the next few years. Therefore, new stellar product releases will support the bullish sentiment around the stock. This will work against my cautious stance. Pfizer continues investing billions in R&D and there were 113 candidate products in the company’s pipeline as of July 30, 2024.

Management’s new cost-saving initiatives could serve as a positive catalyst for the stock. Additionally, Pfizer might exceed its announced $4 billion savings target. Given the direct impact of reduced expenses on EPS, achieving these savings could lead PFE to significantly beat consensus EPS estimates, provided revenue meets expectations. However, due to revenue pressures, there is a considerable risk that these savings could be offset by challenges on the topline.

Conclusion

I think that PFE deserves an upgrade to “Hold” rating. For me as an investor who believes only in fundamentals, improving financial performance with upgraded guidance is a strong bullish factor. The valuation also appears sound. On the other hand, let us not forget that products that generated $22 billion in sales during FY 2023 will face patent expirations within the next three years. Therefore, I remain cautious, but see some positive developments.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.