Summary:

- Pfizer’s Q4 FY2023 financials show a significant downturn in consolidated revenues, with a 93% decline in profit for the full year.

- Sales of Comirnaty and Paxlovid, Pfizer’s COVID-related drugs, fell by 70% and 93% respectively in FY2023.

- Despite the decline, Pfizer’s focus on innovation in oncology and cost-saving measures may help offset the effects of the drop in sales.

- I calculate the growth potential at 100%+ in 4-5 years – and this doesn’t even include the dividend yield of 6%+ that a potential investor can secure at today’s prices.

- I’ve therefore decided to upgrade PFE stock to “Strong Buy” today.

Michael M. Santiago

Introduction

On December 21, 2023, I wrote about Pfizer Inc. (NYSE:PFE) stock for the first time after a long hiatus since initiating coverage in November 2021. Last time, I wrote about PFE appearing oversold and undervalued due to likely underestimated EPS forecasts for FY 2025 and beyond. I urged not to panic, but to think about building a long position at the low price levels. Unfortunately, the PFE stock has since significantly underperformed the broader market:

Seeking Alpha, my previous article on PFE

However, a whole quarter has already passed since mid-December. During this time, the company managed to present its report for Q4 FY2023 and speak at the TD Cowen 44th Annual Health Care Conference. So what has changed in the relevance of my thesis during this time? Let’s find out together.

Pfizer’s Q4 FY2023: Financials And Prospects

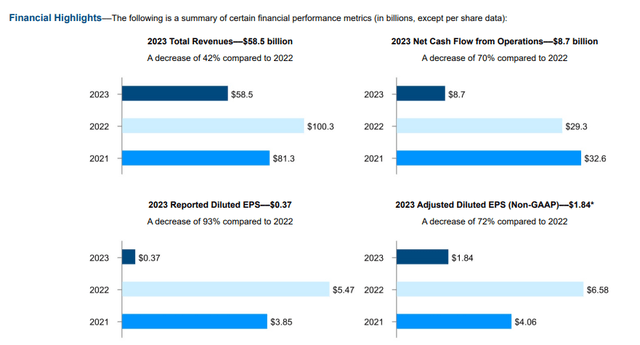

Straight from the press release, we see that Prizer is struggling in its post-COVID era, with consolidated revenues experiencing a significant downturn (-41% and -42% YoY for Q4 and full year 2023, respectively). Last quarter, the company’s reported bottom-line saw a notable shift from a profit of almost $5 billion in Q4 FY2022 to a loss of around -$3.4 billion in the same period of 2023, marking a substantial 93% decline for the full year. Similarly, reported diluted EPS dropped from $0.87 to a loss of -$0.60 in Q4 FY2023. The general trend for 2023 can be described as a “rapid fall after a lightning-fast rise”:

PFE’s 10-K

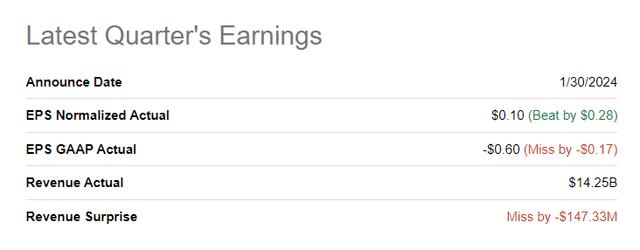

Of course, Wall Street had initially expected a decline, but Pfizer still disappointed, missing market expectations on a GAAP basis by missing on both profit and sales.

Seeking Alpha, PFE

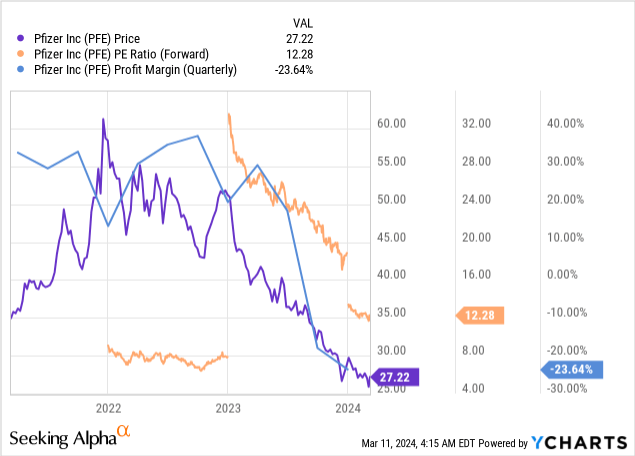

On the other hand, PFE beat EPS consensus on a non-GAAP basis quite significantly (+$0.10 actual vs. -$0.18 expected). But that was not enough, and the PFE stock went to test its 5-year lows after the results:

Seeking Alpha, TradingView

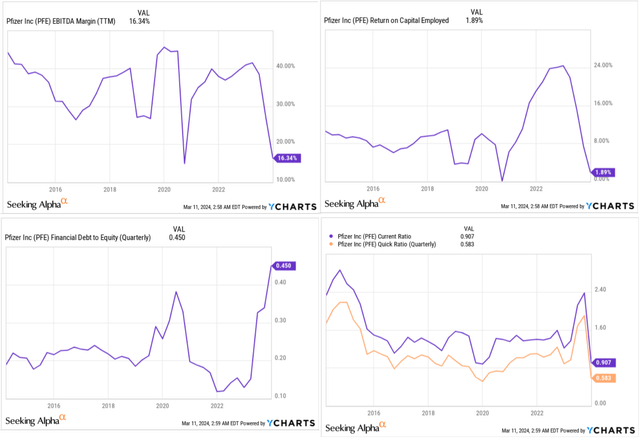

This stock price development is by no means surprising, as it follows a far-reaching deterioration in a number of key financial figures: EBITDA margin is back at a 10-year low, as is ROCE; at the same time, leverage is rising rapidly due to acquisitions, and liquidity on the balance sheet relative to liabilities is falling rapidly.

YCharts, author’s notes

In my opinion, the mere fact that PFE’s leverage has not increased further and that the company has been able to maintain positive profitability is something of a success under the current conditions.

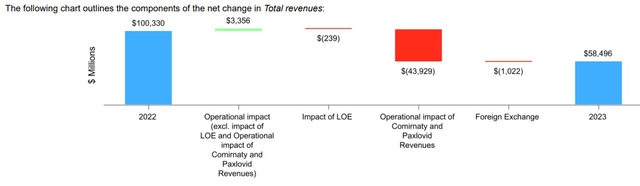

It’s clear to all market participants monitoring Pfizer’s business what exactly is causing such a rapid decline in financials. Sales of Comirnaty and Paxlovid fell by 70% and 93% (worldwide) respectively in FY2023 compared to the previous year. This is mainly due to the current insignificance of COVID. This means that PFE under-earned almost $44 billion in sales in 2023 because of these drugs. With at least some operating leverage, it should in any case have led to the deplorable dynamics of the bottom line, because such an adjustment in sales usually leads to a non-linear adjustment in costs.

However, if we take these two important drugs out of the equation, it shows that PFE’s sales would actually increase by around 3.7% year-on-year in FY2023.

PFE’s 10-K

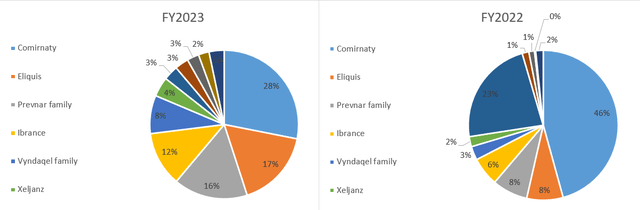

If we take PFE’s main sources of revenue and imagine that the company has nothing else apart from them, we can see, thanks to simple pie charts, that the importance of Comirnaty and Paxlovid is rapidly declining. At the time of the last report, none of these drugs reached 45%+ of the total “pie”, as was the case with Comirnaty last year:

Author’s work, based on Pfizer’s 10-K

If we now imagine that the sales figures of Comirnaty and Paxlovid decline by the same relative amount at the end of 2024 as in 2023 (-70% and -93% respectively), then the total impact on sales is only -$9.04 billion instead of -$44.24 billion (all other things being equal).

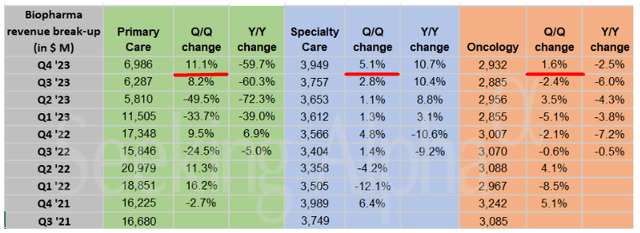

Other products are now coming onto the scene, which have shown much more stable momentum in recent quarters. In Q4 FY2023, for the first time in years, we saw three sub-segments of the company – Specialty Care, Oncology, and Primary Care – grow simultaneously QoQ:

Seeking Alpha, author’s notes

During the latest TD Cowen conference, Pfizer’s CFO David Denton underscored the firm’s focus on innovation, particularly in oncology following the acquisition of Seagen, and the implementation of a cost-saving program aimed at achieving $4 billion in savings by the end of 2024. In other words, this cost saving can overshadow the possible effects of the above-mentioned drop in sales. However, we must also bear in mind that the volume of direct costs will continue to fall in addition to that $4 billion.

Roughly speaking, it can therefore be assumed that the post-COVID slump has now been left behind due to small cost savings and the assumption that the Comirnaty and Paxlovid phases will continue at the same rate of decline.

However, I also see some upsides to that conclusion.

First, Comirnaty and Paxlovid will most likely not disappear completely from the market in 2024, despite the lightning-fast decline. As Seeking Alpha News team reported a few days ago, “a U.S. Centers for Disease Control advisory panel has recommended that adults aged 65 years and older get an additional COVID-19 vaccine shot this spring.” That is, the decline rate I assumed above may not be that severe. If so, PFE’s consolidated sales will then most likely be significantly higher.

Second, I’m not sure how Pfizer’s first Super Bowl commercial will help attract new sales for the Oncolgy sub-segment, but Padcev (an antibody-drug conjugate Pfizer added with the Seagen acquisition) and the newly launched RSV vaccine Abrysvo should provide new sales growth, as Guggenheim analysts recently noted.

As I have written before, I am generally very optimistic about “Pfizer’s oncology future”, and recent developments such as the FDA approval for the antibody-drug conjugate Besponsa in children confirm my opinion.

As I once wrote about Organon (OGN) in late November 2023, it is sometimes darkest before the dawn. I think we see a roughly similar picture in the case of Pfizer: A depressed past, albeit not as long as in the case of OGN, does not allow investors to see the forest for the trees. From an operational perspective, I think we have a strong recovery ahead of us. But how much is already priced in?

Pfizer Stock Is Now Even More Attractive – Valuation

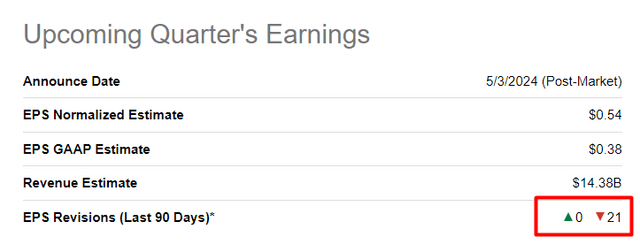

Assuming that the worst is over for PFE, I find it somewhat puzzling how Wall Street analysts reacted after the release of Q4 FY2023 results – they all lowered their estimates for Q1 FY2024 (and beyond):

Seeking Alpha, PFE, author’s notes

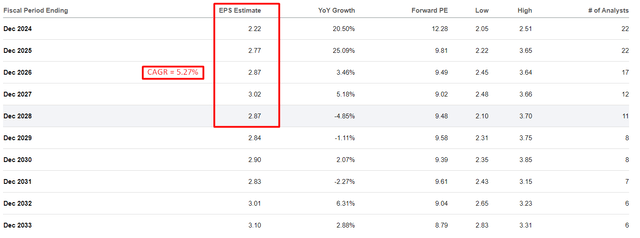

Even against the backdrop of this negativity, the consensus data shows an implied EPS CAGR of around 5.27% for the next 5 years with an exit P/E multiple in FY2028 of only 9.48x:

Seeking Alpha, author’s notes

Sales are expected to grow at a CAGR of around 0.67% in the same period, which I believe is too low a forecast given the existing tailwinds from the Oncology. In any case, let’s suppose the consensus is correct – what does it tell us? First of all, the discrepancy between earnings per share and sales growth rates tells us something about the potential for margin expansion. The market believes that PFE’s EBITDA margin will start to recover shortly, but apparently not reaching the COVID peaks. The fact is, however, that we don’t need the old peaks for the stock to also grow.

As history and financial theory show, a company’s valuation premium is usually explained by either its growth potential or consistently high-profit margins. In other words, the profit margin plays a big role when it comes to forecasting the potential price/earnings ratio in 3-5 years.

If even depressed earnings estimates predict an increase in EPS over sales after a spate of negative revisions, then the likelihood of margin expansion is very high indeed. We need to see at least some improvement on this front and the stock price should follow this improvement, as the current assumption of 9x for FY2028 P/E probably becomes too low under this condition.

No matter what conspiracy theorists write, Pfizer is actually one of the world’s leading pharmaceutical companies. Even after a disgusting share price performance in recent quarters, PFE has a market capitalization of ~$153 billion and nearly $12.7 billion in cash on its balance sheet. Yes, debt has increased significantly recently, causing valuation issues, but the debt-to-equity ratio is still below 1, which is usually fine for such a large company, in my view.

I think PFE’s price/earnings ratio should be around 20x in 4–5 years, which is slightly below today’s median norms for the healthcare sector. If we assume a conservative consensus EPS of $2.87 (SA data), this results in a price target of $54.7 by the end of 2028 (100%+ from the latest close price).

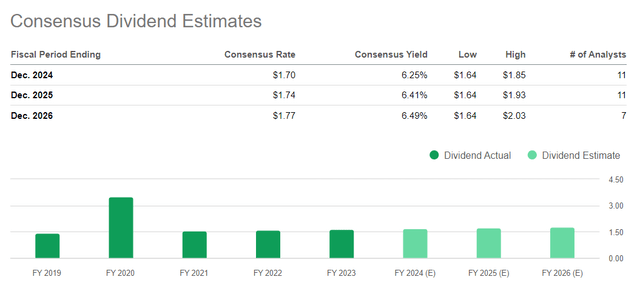

Agree – that’s good growth potential considering PFE pays a 6.25% dividend. Also, this yield is going to stay above 6% for the next 3 years, which is illogical if we assume the Fed cuts rates soon (i.e. the yield should fall due to the rise in the stock).

Seeking Alpha, PFE

Where I Can Be Wrong?

First of all, I should note that my thesis runs the risk of overestimating the company’s operational recovery. I mean, I assumed that Pfizer’s recovery from the COVID slump is imminent and that the worst is over. However, healthcare spending and consumer behavior are unpredictable. The continuation of the Comirnaty and Paxlovid slump may continue to impact Pfizer’s financial performance beyond my current expectations.

Furthermore, my bullish thesis is based on optimistic assumptions about the growth potential of Pfizer’s product portfolio outside of COVID-19, particularly in oncology. While there are indeed growth opportunities in these areas, there are also risks related to competition, regulatory challenges, and the pace of innovation that could impact sales and EPS estimates.

It is also important to note that market sentiment – which I expect to improve – and investor behavior can be unpredictable and not always in line with fundamentals. Therefore, my assumptions about a multiple expansion by 2028 are perhaps too optimistic.

The Verdict

Despite the risks, I’m still inclined to believe that Pfizer stock has become even more attractive now that the market has risen recently without it.

Yes, perhaps pundits have questions about PFE from a technical analysis perspective, but I look at the 3-5-year medium-term outlook and clearly see growth points in the non-COVID businesses. The Wall Streetanalysts’ current forecasts also point to this, but in my opinion, their estimates are somewhat underestimated. I calculate the growth potential at 100%+ in 4-5 years – and this doesn’t even include the dividend yield of 6%+ that a potential investor can secure at today’s prices.

I’ve therefore decided to upgrade PFE stock to “Strong Buy” today.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!