Summary:

- Pfizer’s revenues were declining prior to the pandemic, but the success of its COVID vaccine and antiviral brought in unexpected additional revenues of >$55bn over 2 years.

- The company has been on a major M&A spending spree, investing approximately $27bn in under 2 years, with a potential total spending of $70bn.

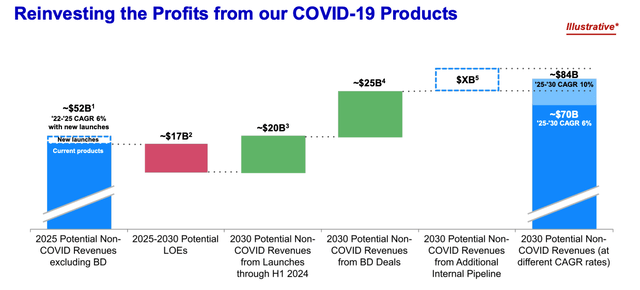

- Pfizer aims to drive $45bn in new product revenue by 2030 through its in-house pipeline and business development, with a projected CAGR of 6%.

- Pfizer stock is down 35% this year alone – I have been long-term bearish on the company, but I believe shares are now undervalued.

- There is a near 5% dividend yield and management has set itself the target of driving >$80bn in revenues by 2030 – if it comes close to achieving that, Pfizer stock must finally realise some deserved upside.

JHVEPhoto

Investment Overview

In my last note on Pfizer’s prospects for share price growth released in June, I gave the company a “Hold” recommendation. I praised the company for its generous dividend – currently yielding >5% – but suggested that after a decade of flat growth, Pfizer’s share price was still “going nowhere”.

Since then, the Pharma’s stock price is down a further 10%, and I have decided to give the stock an upgrade and a “Buy” recommendation. In this post I discuss my reasons for the change of heart, but to summarise, the additional losses since my last note make Pfizer shares look almost laughably cheap given the company is, even with falling COVID revenues and product patent expiries factored in, still a global pharmaceutical powerhouse.

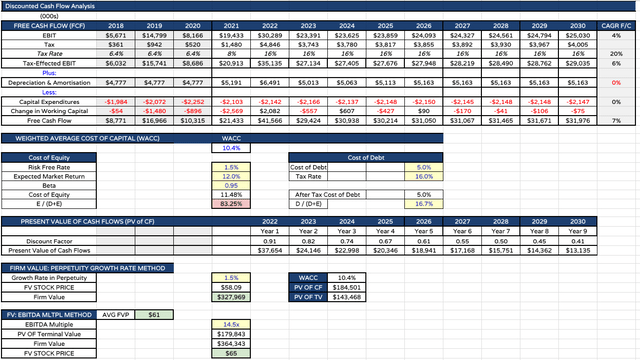

The recent spate of product approvals Pfizer has secured for pipeline products, and for products acquired in its mega-money post COVID M&A spree also points to good revenue growth opportunities, offsetting projected patent expiry losses, and should the company achieve its stated target of driving ~$84bn revenues by 2030, my discounted cash flow analysis suggests the company is worth closer to $60 per share, than $30.

I am not necessarily optimistic $60 per share can be reached, but in this post I lay out the reasons why, at long last, I believe Pfizer shares are due a period of solid growth.

How Pfizer Miraculously Found The Cash Needed For Business Turnaround

Prior to the pandemic, Pfizer (NYSE:PFE) was a company in need of major surgery. Its revenues were falling year-after-year – from $52.8bn in 2016, to $41.7bn in 2020 – and several of its best-selling drugs – the blood thinner Eliquis, prostate cancer therapy Xtandi, pneumococcal vaccine Prevnar, anti-inflammatory Xeljanz, cardiomyopathy treatment Vynqadel, and breast cancer therapies Inlyta and Ibrance – were all set to lose patent protection shortly after 2026.

Pfizer’s ability to generate net income was actually impressive – between 2018 – 2020 the company reported net income of $11.2bn, $16bn, and $9.2bn – profit margins of ~27%, ~40%, and ~23% respectively – and although GAAP EPS was low – $1.9, $3, and $1.65 respectively – shares were cheap, so the historical price to earnings ratios were respectable, at ~17x, 11x, and 19x – but, clearly heading in the wrong direction, with the very real threat of patent expiries ahead, and limited cash to do anything about it – at the end of 2020 Pfizer reported cash of $12,2bn, against current liabilities of $26bn, and long term debt of $37bn.

Then COVID arrived, and Pfizer was first out of the blocks with a highly successful COVID vaccine, Comirnaty, given Emergency Use Authorisation (“EUA”) in December 2020, followed by a best-in-class COVID antiviral, Paxlovid, approved one year later. Comirnaty sales in FY21 and FY22 were $36.7bn, and $36.8bn respectively, whilst Paxlovid sales in 2022 were $18.93bn.

It’s important to remember Comirnaty revenues were split 50/50 with development partner BioNTech (BNTX), but nevertheless, in 2021 and 2022, Pfizer earned an additional $55.7bn of revenues that nobody – the market, analysts, or even the company itself – had seen coming. Net profit margins improved to 27% and 25% in 2021 and 2022 respectively, and by the end of 2021, Pfizer’s cash position had risen to >$31bn, and total current assets had risen >$60bn.

Miraculously, Pfizer suddenly had the money it needed to future proof the business against the looming patent expiries of many of its key assets.

Pfizer’s M&A Spending – Smart Business, Or Building Frankenstein’s Monster?

In November 2020, Pfizer completed the spin-out of its “Upjohn” legacy brands division, merging it with generics giant Mylan to create a new entity, Viatris (VTRS). Some of the brands the company let go of were amongst its most successful – pain med Lyrica, erectile dysfunction therapy Viagra, and statin Lipitor, for example, but with patents long since expired, revenues from these products were falling – although the division still accounted for $10bn of revenues in 2019.

Arguably, this was the first step taken by the Big Pharma on a path to a re-imagination, and reinvention of its business. Like its fellow Big Pharma companies Johnson & Johnson (JNJ), which is also spinning out its consumer health division into a new entity, Kenvue, and Merck & Co (MRK), which span out its women’s health and legacy brand division into a new entity, Organon (OGN), in 2020, Pfizer management wanted to prioritise its drug development business, which, thanks to patent protections, and control over drug pricing, is amongst the lucrative business model there is. It’s no coincidence that the average net profit margin amongst the US’ 8 largest pharmaceutical companies is >20%.

Using its COVID vaccine and antiviral cash windfall, since 2021 Pfizer has been on a major M&A spending spree – to recap from a former note I wrote about the company:

Since mid-2021 Pfizer has completed: a $2.3bn deal for Trillium Therapeutics and its 2 CD-47 targeting blood cancer drug candidates; a $7bn deal for Arena Pharmaceuticals and its late stage autoimmune candidate Etrasimod; an $11.6bn deal for Biohaven and its lead candidate Nurtec, indicated for migraine treatment; a $5.4bn deal for Global Blood Therapeutics and its ~$200m per annum commercial stage drug Oxbryta, indicated for Sickle Cell Disease (“SCD”), and lead candidate GBT601, which may offer a functional (permanent) cure for SCD; a $525m deal for Reviral and its antiviral therapeutics targeting respiratory syncytial virus (“RSV”).

That’s an outlay of ~$27bn in under 2 years, and Pfizer is also hoping to complete a $43bn deal for Seagen – the antibody drug conjugate (“ADC”) specialist with 4 approved drugs which drove ~$2bn of revenues last year. If that deal completes soon as Pfizer hopes it will, that will bring the Pharma’s spending to a colossal ~$70bn.

As a result of such heavy spending – primarily on non-revenue generating assets that are either recently approved, or close to approval – perhaps it isn’t surprising that Pfizer’s share price has been falling – from a December 2021 all-time high of ~$60, to $52 at the end of 2022, and since then, a further 36% loss, to a value of $32.5 at the time of writing.

Pfizer shareholders may well have preferred to see Pfizer spend its cash on share buybacks – the company’s float of 5.65bn shares is the eighth largest of any listed company, and >2x larger than the float of any other US Big Pharma – or on paying down its long term debt, which rose from $32.8bn, to $61.4bn between Q123 and Q223 (albeit current assets rose from $51.3bn, to $73.3bn) – but ultimately Pfizer’s decision to spend on M&A, with biotech valuations having fallen significantly during a tough bear market in 2022 – may prove to be the right decision, even if it has a “scattergun” feel to it.

Pfizer’s oncology division was worth $13.9bn in revenues in 2022, therefore the Seagen acquisition is arguably complementary to its existing business, but the Pharma is less experienced in auto-immune – where it plans to pitch Etrasimod into highly competitive markets in which the likes of AbbVie (ABBV), Sanofi (SNY), and Johnson & Johnson have entrenched positions, whilst prior to the acquisition of Nurtec, Pfizer did not have a neuroscience division to speak of, nor dis it have experience of hemoglobinopathies prior to the acquisition of Global Blood Therapeutics.

As such, the M&A spree sees Pfizer attempting to create something of a Frankenstein’s monster of a drug development business, with money having been spent on non-complementary assets, but perhaps deals were targeted based on what kind of return on investment Pfizer believed it could earn, rather than whether the products were complementary to existing business divisions.

Pfizer’s End Game – Combine In-House Pipeline & Business Development To Drive ~$45bn In New Product Revenue By 2030

What Pfizer does have in its favour – proven by its global rollout of Comirnaty and Paxlovid – is an enviable global manufacturing, marketing, and logistics infrastructure, and >80k employees to help extract the maximum benefit from its M&A and in-house pipeline activities. The company’s plan is to extract $20bn in peak revenues by 2030 from its current non business development pipeline, and further $20bn from its recently acquired assets by 2030, as shown below.

Pfizer commercial launch progress (Q223 earnings presentation)

This slide taken from Pfizer’s Q2 2023 earnings presentation first of all illustrates how many products Pfizer has successfully gained approval for, in a short space of time.

Nurtec – a member of the calcitonin gene-related peptide (“CGRP”) inhibitor drug class, was approved prior to Pfizer’s purchase of Biohaven, and is pegged in some quarters for peak sales of ~$6bn per annum, while Oxbryta has been approve since December 2021, earnings >$200m of revenues last year.

Otherwise, however, Pfizer secured approval for a fast acting nasal spray for migraines Zavzpret in March this year – part of the Biohaven portfolio, and from its own pipeline, won approval for growth hormone deficiency med Ngenia in June this year, the fifth of five approval in five weeks, after alopecia drug Litfulo, RSV vaccine Abrysvo, Zavzpret, and Paxlovid, which finally had its EUA upgraded to a full approval.

Atopic Dermatitis med Cibinqo is another new launch, while PARP inhibitor Talzenna has secured approval in prostate cancer alongside Xtandi, pediatric Prevnar has made it to market, and Pfizer’s latest COVID vaccine, targeting the SARS-CoV-2 XBB.1.5 strain, has been approved ahead of the fall vaccine season. Switching from a public to a private COVID vaccine market, in which Pfizer will likely charge >$100 per dose, as opposed to <$35 per dose when selling to governments, Pfizer is projecting ~24% of the US population will opt to receive a COVID vaccine booster, and analysts at Barclays are projecting ~$5bn in COVID vaccine sales this fall.

A Humira (AbbVie’s >$20bn per annum selling autoimmune drug which has just lost its patent protection, allowing copycat drugs to be launched) biosimilar has been approved, and still to come is a pentavalent menigoccal vaccine, a flu vaccine, lung cancer drug – lung cancer is the most prevalent of all cancers – as well as etrasimod, an autoimmune drug and member of the highly thought of sphingosine 1-phosphate (“S1P”) receptor modulator class, that can compete against Bristol Myers Squibb’s S1P modulator Zeposia in a multi-billion-dollar market.

Pfizer growth to 2030 (Q223 earnings presentation)

Shown above is another slide from Pfizer’s latest earnings presentation, illustrating how the Pharma believes it can grow revenues – ex-covid – from $52bn in 2025, to $84bn by the end of the decade. We can see the $17bn of revenues expected to be lost to patent expiries being easily offset by the introduction of new revenue generating assets, and an attractive ex-COVID product sales CAGR of 6%.

Of course, on paper the ascent in revenues looks straightforward, when in reality it will be anything but. As mentioned, auto-immune markets are fiercely contested, whilst as well as being an opponent in autoimmune, AbbVie is attempting to establish supremacy in the neuroscience markets, with a particular focus on migraine, and Boston based Vertex (VRTX) may well win approval for a “one and done” gene therapy for Sickle Cell Disease this year, which if successful, makes the $5.4bn Pfizer spent on Global Blood Therapeutics look like a risky bet.

Nevertheless, despite these concerns I would contend that Pfizer has spent relatively well, whilst the succession of approvals gained in 2023 suggests that the market has been underestimating Pfizer’s in-house pipeline. Plus, let’s not forget the likely addition of the Seagen portfolio to this outlook – ADC drugs have a powerful MoA, and may well have a major role to play in oncology over the next decade – and let’s also remind ourselves that when the pandemic arrived, asking the toughest of questions of the Pharma industry, it was Pfizer that responded first, and most emphatically.

Concluding Thoughts – I’ve Been Bearish On Pfizer – But <$35 Per Share Is Too Low & The Buy Opportunity Is Clear

When we consider Pfizer’s target to drive revenues of ~$84bn by 2030 – and take management at its word that this can be achieved, my own discounted cash flow analysis – suggests shares ought to be valued closer to $60 today than the $32.5 they are currently trading at.

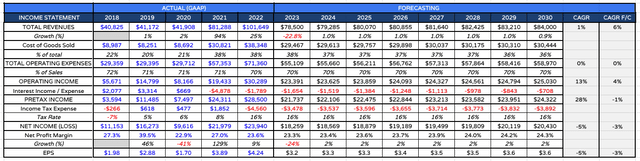

Pfizer forward income statement projection (my table and estimates) Pfizer – discounted cash flow analysis (my table and assumptions)

The above tables are for illustrative purposes only, although they track Pfizer management’s own guidance, and use historical figures such as opex as a percentage of revenues, interest expense payments, tax, depreciation etc. to provide as accurate a picture as possible.

Granted, Pfizer stock has only approached $60 per share once in its history as a listed company, and Pfizer stock today trades at the same value as 10 years ago, but Pfizer as a company is changing. As well as jettisoning its legacy brands division, the company has made it clear it also expects to sell its ~32% stake in GSK spin-off Haleon over time, effectively ending its interest in consumer health, and realising perhaps as much as $10bn in additional cash in the process.

It is not unusual for Pharmas to have high levels of debt, but Pfizer’s is solidly investment grade, and there is still cash to spare. There are challenges ahead – not least the government’s targeting of Eliquis pricing via the inflation reduction act (“IRA”), and the management of so many new businesses acquired over the past couple of years, plus the shrinking COVID revenues – which has resulted in the company narrowing its FY23 revenues expectations to $67 – $70bn, with EPS of $3.25 – $3.45, implying a forward PE of ~10x – but in actual fact, many numbers now seem to be working in Pfizer’s favour.

Pfizer is not capable of the kind of explosive share price growth experienced by e.g. rival Pharma Eli Lilly (LLY), whose share price growth is based on the back of its supposedly revolutionary weight loss / diabetes franchise, but Pfizer offers a handsome dividend of $0.48 per quarter, yielding nearly 5%, and if management’s plans come to fruition, the company looks almost ludicrously undervalued at a forward price to sales ratio of <2.5x – far lower than any other Pharma. Even if management falls well short of its targets, the case for share price upside remains positive to compelling in my view.

I have been a long-term Pfizer bear, but I believe we have now reached the point – with the stock price down >35% this year alone, and while management sensibly future-proof’s the company against patent expiries and targets high margin business opportunities – where the buying opportunity begins to look derisked, and almost irresistible.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.