Summary:

- Analysts predict Pfizer’s Q2 2024 revenue to be around $13 billion.

- The EPS estimate for Q2 2024 is $0.22, reflecting challenges from decreased COVID-19 product demand.

- Investors are closely watching the performance of Pfizer’s core products, particularly in oncology and vaccines, excluding COVID-19 products.

- Significant focus is on how Pfizer manages upcoming patent expirations and the development of new drugs like Elrexfio for multiple myeloma.

- PFE stock is a “hold” due to patent cliff risks and modest growth, suitable for value-oriented investors.

Jacob Wackerhausen/iStock via Getty Images

Pfizer’s Second Act: Revamping Beyond COVID-19

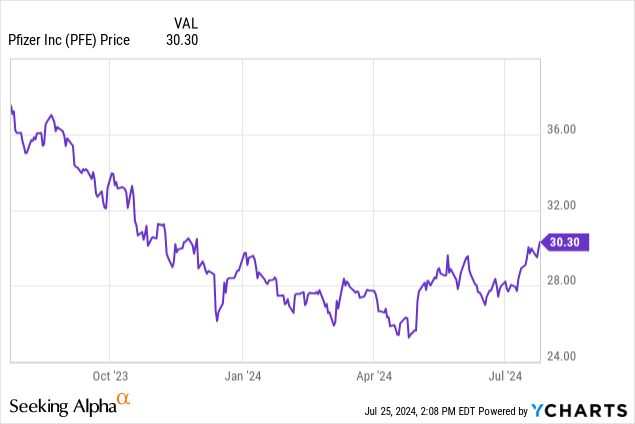

My last article on Pfizer Inc. (NYSE:PFE) saw the company just entering a recovery stage from the pandemic. Recall that Pfizer was one of two companies to pioneer an MRA vaccine for COVID-19. As the pandemic cooled off, COVID-related revenues dropped quickly and substantially, exposing the company to a lack of “core” growth. Noting this, I cautioned against adding (“hold”) and worried about their modest growth expectations and stock underperformance compared to the broader market. Since the article’s publication in October, Pfizer’s stock is off 10% compared to 27% gains from the S&P 500 (SP500).

On the flip side, the stock is up nearly 6% in the last month, leading into its Q2 earnings report on 7/30. Analysts are anticipating $13.02 billion in revenue, with EPS estimates of $0.22.

Pfizer’s stock has underperformed due to their lower revenue growth (YoY) of -41.08% versus a sector median of 6.61% per Seeking Alpha. While the pandemic, which is expected to heat up in the coming months, may boost earnings in the short term, the focus among investors is on the company’s core products (outside COVID-19-related products).

Pfizer’s Late but Great Leap into the Obesity Market

Pfizer continues to make clinical progress in obesity. Recall that obesity figures to be a $100-plus billion market within a few years. While companies like Novo Nordisk (NVO) and Eli Lilly (LLY) pioneered the GLP-1 weight loss market, a few others are anticipated to contribute soon.

Pfizer is a bit behind the competition with these efforts, but recall that atorvastatin, one of the most prescribed drugs in the world, entered the market nearly a decade after lovastatin was introduced. In July, a Seeking Alpha article highlighted Pfizer’s developments with an oral, once-daily GLP-1 agonist, danuglipron. These are very early developments, as danuglipron is first being tested in healthy adults. The company also revealed a “mystery” obesity drug without indication of what its mechanism of action is.

Elrexfio: The New Heavyweight in Multiple Myeloma

Pfizer’s Elrexfio, conditionally approved in August 2023 for multiple myeloma after at least 4 treatment regimens, dazzled in MagnetisMM-3. Elrexfio demonstrated “median overall survival of 24.6 months, with median progression-free survival of 17.2 months.” In the past, Pfizer has stated that they expected Elrexfio’s revenues to reach $4 billion. This is with the expectation that bispecifics, like Pfizer’s Elrexfio, will become the “standard of care” within the multiple myeloma market that is anticipated to eclipse $37 billion by 2031. So, this presents as a major growth driver for the company, although this market is very competitive with several drugs vying for share. Nonetheless, Elrexfio may soften the blow of Ibrance’s upcoming patent cliff.

Impact of CDC’s Stringent RSV Vaccine Guidelines

Last month, the CDC revealed its recommendations for RSV vaccines. Recall that Pfizer achieved approval last year for its RSV vaccine, Abrysvo. Other companies, like GSK (GSK) and Moderna (MRNA), have also recently entered this market. The CDC’s recommendations were more stringent than what big pharma would like to see, limiting RSV vaccinations for “all adults ages 75 and older and adults ages 60-74 who are at increased risk of severe RSV.”

I discussed GSK’s RSV vaccine, Arexvy, back in November. Arexvy, despite being in May 2023, was already netting $865.98 million in revenues Q3 2023. This demonstrates the multi-billion-dollar potential for Pfizer’s Abrysvo. However, the CDC recommendation diminishes the market for RSV vaccines. US adults over 75 made up nearly 23 million in 2020. The market for “adults ages 60–74 who are at increased risk of severe RSV” is challenging to define. Surely, both of these populations no longer meet GSK’s original estimate of 83 million at-risk adults. Both GSK and MRNA have traded poorly since this development, reflecting the potential loss of revenue.

Pfizer’s Patent Cliff

Zooming out, the pharma landscape is under a cloud of major patent cliffs. In an interesting note, Morgan Stanley rated Pfizer as having an “intermittent risk” for patent cliff, with about 1/3 of their product revenue facing loss of exclusivity in the near future. To contrast, companies like Bristol-Myers Squibb (BMY), primarily with Keytruda, and Biogen (BIIB), primarily with Lucentis, bear the most risk, with 63% and 56% of their products at risk, respectively. Blockbuster drugs from Pfizer, like Eliquis and Ibrance, figure to lose their exclusivity within three or four years. This, undoubtably, places pressure on the company to come up with new blockbuster drugs.

Q1 Earnings: Core Growth and Strategic Cost Reductions

In Q1, Pfizer’s revenues of $14.9 billion were down 19%, due primarily to decreased COVID-related product revenue. The company pointed out that core revenues (excluding COVID-19 products) were up 11%. Pfizer is undergoing cost-saving measures, intending to save $4 billion in expenses by the end of the year. Subsequently, Pfizer increased their full-year EPS guidance to $2.15 to $2.35. They anticipate between $58.5 and $61.5 billion in full-year revenue. Pfizer’s Eliquis experienced modest growth in Q1, with revenues of $2.04 billion, up from $1.874 billion.

Vyndaqel (tafamidis), approved in 2019 for transthyretin-mediated amyloidosis (ATTR), continues to experience robust growth. Product revenues grew 66% YoY to $1.137 billion in 2023. Vyndaqel, considered a disease-specific therapy, is strongly recommended in cases of ATTRwt or ATTRv cardiac amyloidosis and NYHA functional class I to III HF symptoms due to its ability to lower mortality. Although Pfizer’s position in this market could be challenged by companies like BridgeBio Pharma (BBIO), their tafamidis franchise is believed to be “entrenched,” supporting many years of $1-billion-plus product revenues.

Prevnar-related revenues remained stable in Q1, totaling $1.691 billion. Pfizer’s market position in pneumococcal vaccines may be challenged by new entrants such as Merck’s Capvaxive. Pfizer’s oncology portfolio growth is particularly impressive, with total oncology revenues increasing 18% year-on-year to $3.549 billion in Q1. This is due to products such as Xtandi and Lorbrena, and despite modest revenue declines from their blockbuster breast cancer therapy, Ibrance.

Pfizer’s Q2 Expectations: Core Products Under the Microscope

Investors can expect challenging YoY comparisons to continue in next week’s Q2 earnings report, as Q3 2023 revenue was still boosted by products such as Comirnaty. So, instead, focus on Pfizer’s “core” product growth, particularly its oncology performance and strategic position in the vaccine market (COVID-19/influenza combination, RSV, and pneumococcal). Because the company is facing numerous challenges, multiple breakthroughs are required, particularly in fields such as oncology and rare diseases. Investors should also expect updates on the obesity front. Finally, we should have some early numbers on Elrexfio and how it is being used in MM.

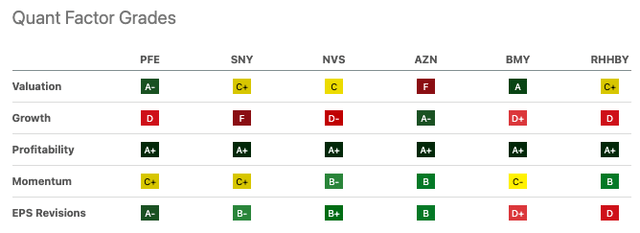

PFE Stock Vs. Peers

Pfizer’s stock appears to be cheap because it has fallen by more than 20%. However, when we zoom out, we can see that it has essentially traded flat over the last ten years.

According to Seeking Alpha, PFE has an “A-” valuation based on its underlying measures, such as a P/E Non-GAAP (forward) of 12.63, which is 38% lower than the sector median of 20.39. However, valuation must be considered in light of a company’s growth prospects, and Pfizer falls far short of this standard. Pfizer’s forward revenue growth of -14.47% is significantly lower than peers such as Sanofi (SNY) and AstraZeneca (AZN), which are up 5.44% and 7.76%, respectively.

As previously stated, these poor revenue comparisons are primarily due to COVID-19 waxing and waning, which Pfizer is not necessarily to blame for. Pfizer is simply trading where it has been for decades, and with good reason. Pfizer investors benefit from a 5.69% dividend yield. However, this must be weighed against Pfizer’s risk profile, which is higher than risk-free assets such as Treasury bonds, which have yields comparable to Pfizer’s (e.g., 10-year bills offer rates of more than 4%).

Financial Health

As of March 31, Pfizer reported $719 million in cash and cash equivalents. Short-term investments totaled $11.209 billion. Total current assets amount to $42.415 million, while total current liabilities equal $40.497 million. This implies a current ratio of 1, which is tight, but adequate to cover short-term expenses. Pfizer’s long-term debt was $61.307 billion. This is relatively unchanged from last year.

Pfizer is profitable. The company recorded a net income of $3.123 billion in Q1 ’24, considerably lower than the $5.556 billion recorded the previous year. Due to financing activities (such as $2.372 billion in dividends paid and $1.25 billion in payments towards long-term debt), net cash provided by operating activities totaled $1.09 billion.

Risk/Reward Analysis and Investment Recommendation

In conclusion, four of Pfizer’s top five drugs in revenue face some kind of existential threat.

| Drug | Existential Threat |

|---|---|

| Paxlovid | Dependency on COVID-19 activity |

| Eliquis | Loss of exclusivity (2028) |

| Prevnar | Emerging competition (Merck’s Capvaxive was approved in June) |

| Ibrance | Loss of exclusivity (2027) |

Collectively, those four products made up ~45% of Pfizer’s global total revenues. So, there is a critical need for diversification and Pfizer must hit on this in their upcoming Q2 earnings report.

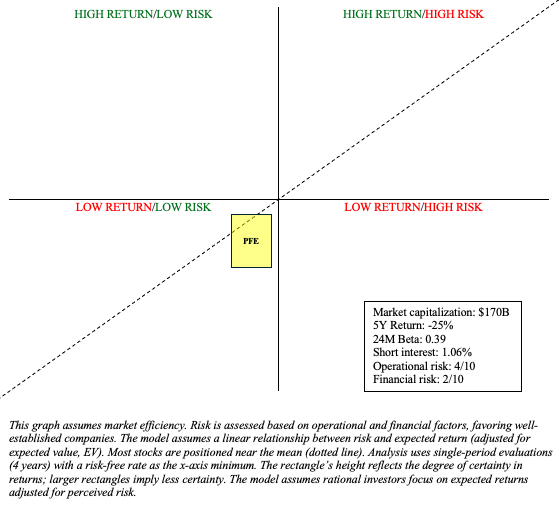

Author

Pfizer Inc.’s core market positions are being challenged, posing significant operational risk, particularly given the company’s $170 billion market capitalization. The company maintains a strong balance sheet and generates approximately $2 billion in cash from operating activities each quarter.

PFE stock is only a good investment for value-oriented investors, as it is difficult to imagine Pfizer’s stock returns changing course over the next five years compared to the previous five. Pfizer stock remains a “hold.”

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is intended to provide informational content and should not be viewed as an exhaustive analysis of the featured company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions presented are based on the author's analysis and reflect a probabilistic approach, not absolute certainty. Efforts have been made to ensure the information's accuracy, but inadvertent errors may occur. Readers are advised to independently verify the information and conduct their own research. Investing in stocks involves inherent volatility, risk, and speculative elements. Before making any investment decisions, it is crucial for readers to conduct thorough research and assess their financial circumstances. The author is not liable for any financial losses incurred as a result of using or relying on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.