Summary:

- Pfizer’s Q3 earnings smashed analysts’ expectations, driven by a significant increase in COVID-related revenues, but the market remains skeptical about long-term growth.

- Despite strong financials and upgraded 2024 guidance, Pfizer’s stock is down 2% in trading today, reflecting concerns that COVID revenue gains are temporary.

- Non-COVID segments showed mixed results, with underwhelming performance in Primary Care and Oncology, and limited returns from recent M&A activities.

- PFE stock’s high dividend yield and low valuation metrics offer some investor appeal, but long-term growth prospects remain uncertain amid ongoing challenges.

Dmytro Aksonov/E+ via Getty Images

Investment Overview – Analysts Estimates Smashed, But Market Unmoved By Pfizer’s Q3 Earnings

Pfizer (NYSE:PFE), the beleaguered New York headquartered Big Pharma concern, released its Q3 earnings earlier today, sharing some – perhaps unexpectedly – positive results.

Revenues reached $17.7bn, up 32% year-on-year, and 14% if we exclude COVID vaccine and antiviral performance. Comirnaty vaccine revenues were $1.42bn, up from $195m in Q2, and antiviral Paxlovid revenues were $2.7bn, up from $251m in Q2.

On an adjusted basis, cost of sales was $4.9bn for the quarter, down 45% year-on-year, while margin was 27.5%, down 38.5 basis points year-on-year. Once again, COVID drugs were the difference maker, there being no non-cash charges last quarter, while a charge of $5.6bn for inventory write-offs and related charges related to Comirnaty/Paxlovid was imposed in Q3 2023.

SG&A expenses were $3.2bn, up 1% year-on-year, R&D expenses $2.6bn, down 4%, and reported diluted earnings per share (“EPS”) was $0.78, and adjusted EPS $1.06.

Revenue and EPS performance smashed analysts’ consensus estimates, and for good measure, management upgraded full year 2024 guidance, to $61bn-$64bn of revenues (formerly $59.5bn-$62.5bn), and adjusted diluted EPS of $2.75-$2.95 (formerly $2.45-$2.65).

After such a strong set of financials, we might have expected Pfizer’s share price – down 21% on a 5-year basis, and trading at more or less the same value as it did over a decade ago, to make an upward movement. We’d be wrong, however, as at the time of writing, Pfizer stock is down ~2% for the day, priced at $28.40 per share.

Analysis – A Genuine Return To Form, Or A COVID Mirage?

Pfizer’s share price performance today likely reflects the fact that the market feels the COVID revenue uplift is a one-off event that doesn’t provide any long-term reassurance for shareholders.

That is in some ways a fair observation – a once hotly anticipated private market for COVID vaccinations appears to have fallen flat, despite the approval in Europe and the US of a new vaccine targeting the strain KP.2, the target specified by the Vaccines and Related Biological Products Advisory Committee (VRBPAC) earlier this year.

With that said, Pfizer is guiding for $5bn of Comirnaty revenues in 2024, and $5.5bn of Paxlovid revenues. While it’s unclear exactly what is driving the Comirnaty revenues – government or private company stockpiling – and it should be noted that Pfizer’s partner BioNTech (BNTX) receives half of all net profits from sales of Comirnaty – this is still a figure of significance, and it may be all too easy to dismiss this as a one-off increase – who knows if new strains of COVID won’t create another round of mass-buying from both public and private sectors in 2025, 2026, or indeed in any year?

CEO Albert Bourla stated that “heightened demand for Paxlovid during the recent COVID-19 wave”, which included “$442 million related to delivering 1 million treatment courses to the U.S. Government Strategic National Stockpile”, helped drive Paxlovid revenues.

Again, it may have been premature to assume that Comirnaty’s blockbuster days were over in 2024, and that makes 2025 revenues harder to predict – could they top $5bn again next year?

The Ex-COVID Analysis – Crumbs Of Comfort For Wall Street

Pfizer breaks its drug product assets into three distinct divisions. Primary Care, which includes the COVID assets, delivered $9.1bn of revenues, which represents 44% year-on-year operational growth. Specialty Care delivered $4.3bn of revenues – up 15% year-on-year – and Oncology drove $4bn of revenues – up 31% year-on-year.

Ex-Covid, Primary Care performance was underwhelming. Eliquis, the anticoagulant that drove $6.7bn of revenues in 2023, saw revenues fall sequentially from $1.9bn, to $1.6bn. After the Inflation Reduction Act (“IRA”), Eliquis is now subject to government price controls, and while it looks set for its best ever revenue year in 2024, it is unlikely to repeat that performance next year, and will lose patent protection in 2026.

Prevnar streptococcus vaccine drove $1.8bn of revenues, up sequentially from $1.4bn in Q2, but its growth looks likely to be flat overall year-on-year, while sales of Nurtec, the migraine therapy acquired via Pfizer’s $11.6bn M&A deal for Biohaven, fell sequentially, from $356m to $337m.

Abrysvo, Pfizer’s recently approved RSV vaccine, drove $356m of revenues, but may not match its full-year revenue figure of $890m in 2023, owing to competition from rival vaccines developed by GSK (GSK) and Moderna (MRNA).

Within Specialty Care, Vyndaqel revenues were up over 60% year-on-year, to $1.45bn, and looks set to top $5bn in 2024, driving ~8% annual growth within the division. Vyndaqel faces some new challengers in its key indication of ATTR-cardiomyopathy, however, likely from next year onwards, such as Alnylam’s (ALNY) Onpattro, and BridgeBio’s acoramidis (subject to approval).

There were some ugly year-on-year comparisons, with immunology drugs Xeljanz and Enbrel seeing revenues falling 36% and 19% year-on-year, to $503m, and $169m, respectively.

Within Oncology, the $43bn Pfizer paid last year to acquire Seagen and its portfolio of antibody drug conjugate (“ADC”) drugs is not looking like good business. Adcetris, Padcev, Tukysa and Tivdak, approved for lymphoma, bladder, colorectal and cervical cancers respectively, generated $268m, $409m, $124m and $34m respectively, only $8m more than in Q2.

Breast cancer drug Ibrance saw revenues fall sequentially, to just under $1.1bn, while prostate cancer therapy Xtandi’s revenues crept up slightly, to $561m, with renal cancer drug Inlyta contributing $247m of revenues, and oncology biosimilar drugs $285m.

In summary, the 14% ex-COVID gain is something of a mirage as it includes sales of newly acquired drugs e.g. Nurtec, the Seagen assets, and in summary, across Primary Care, Specialty Care and Oncology, there was not much for Wall Street to cheer.

The Pipeline Prospects – So Much M&A Spending, So Little Return

I have reproduced the same paragraph covering Pfizer’s M&A spree, paid for with its massive COVID drugs windfall of 2021-2022, in which net income was $9.2bn, $22bn, and $31.3bn (it was $2.1bn in 2023, and $9.2bn in 2020), in several previous notes on Pfizer, and will do so again here.

Since mid-2021 Pfizer has completed: a $2.3bn deal for Trillium Therapeutics and its 2 CD-47 targeting blood cancer drug candidates; a $7bn deal for Arena Pharmaceuticals and its late-stage autoimmune candidate Etrasimod; an $11.6bn deal for Biohaven and its lead candidate Nurtec, indicated for migraine treatment; a $5.4bn deal for Global Blood Therapeutics and its ~$200m per annum commercial-stage drug Oxbryta, indicated for Sickle Cell Disease (“SCD”), and lead candidate GBT601, which may offer a functional (permanent) cure for SCD; a $525m deal for ReViral and its antiviral therapeutics targeting respiratory syncytial virus (“RSV”), and a $43bn deal for Seagen – the antibody drug conjugate (“ADC”) specialist with 4 approved drugs which drove ~$2bn of revenues last year.

There appears to be no news on the Trillium assets, while etrasimod is now approved to ulcerative colitis under the brand name velsipity, but no information on revenues seems to have been provided in Q3 earnings. Oxbryta has been voluntarily withdrawn from the market owing to safety concerns, and I have reported on the underperformance of Seagen above.

In summary, I would not go so far as to call Pfizer’s spending spree catastrophic, but it does not provide much comfort around the long-term growth of the company, either.

Within oncology, Talzenna in bladder, and lorbrena in thoracic cancers showed decent revenue gains in Q3, to $206m and $36m respectively, but by Big Pharma standards these are low revenue assets, while multiple myeloma therapy elrexfio, like velsipity, approved last year, does not get a mention in the Q3 earnings press release either, despite being pegged by management for peak revenues of over $4bn per annum.

Other pipeline “highlights” include a Lyme disease vaccine candidate, a fifth generation pneumococcal candidate, a “next-generation antiviral for COVID, ibuzatrelvir, and a potential label expansion for Litfulo into vitiligo. Litfulo is another asset expected to deliver over $4bn in peak revenues, whose revenues are not being quoted by Pfizer (so far as I can see) despite being approved (to treat alopecia) last year.

Turning to obesity, Pfizer has been hoping to join the GLP-1 agonist drug class revolution, and follow in the footsteps of Eli Lilly’s (LLY) tirzepatide, approved to treat Type 2 diabetes and obesity under brand names Mounjaro/Zepbound, and Novo Nordisk’s (NVO) semaglutide, approved in the same indications as Ozempic/Wegovy.

These two drugs are expected to drive over $100bn of revenues between them by 2030 and become all-time bestsellers. Pfizer’s danuglipron, its most advanced challenger, being an oral small-molecule GLP-1R agonist (semaglutide and tirzepatide are injectables), has not inspired much confidence to date, proving to be unsafe at a twice daily dose, but management has promised to move a once-daily version into later stage studies.

According to Pfizer’s Q3 earnings presentation, an “expected 1Q25 update will inform registration enabling studies”. Success in this field would be hugely significant for Pfizer, but the competition is intensifying, and even if approved, by 2030 there may be over 10 GLP-1 agonist drugs on the market, including next-generation oral drugs from Lilly and Novo that are blowing rivals away in terms of early-stage study data.

Pfizer Q3 Earnings Summary – Management Gets Revenue Boost It Needed, But Ex-COVID Business Still In Doldrums

To summarize today’s Q3 earnings report from Pfizer, the company has been saved by an unexpected bump in COVID revenues, but Wall Street appears to be nonplussed.

The additional COVID revenues should not be underestimated in my view, and underline the fact that the virus remains a threat, and that Pfizer was the leading force globally in developing therapies against the disease, for which it was richly rewarded, and could be again albeit likely on a much smaller scale.

If Pfizer has become something of a laughing stock since, or the “sick man” of the Pharma industry, this is due to some pretty poor M&A activity, low-key product launches, and a lack of assets generating “blockbuster” (over $1bn per annum) revenues today, or promising to generate blockbuster revenues tomorrow.

Activist investors are building stakes in Pfizer and demanding change, which is hardly surprising, but may not deliver the long-term outcomes shareholders want to see.

Pfizer also seems to be failing to address its debt, which stood at nearly $58bn as of the end of Q2, despite the massive financial windfall experienced in 2021 and 2022, and its pipeline looks surprisingly weak despite the money spent on M&A.

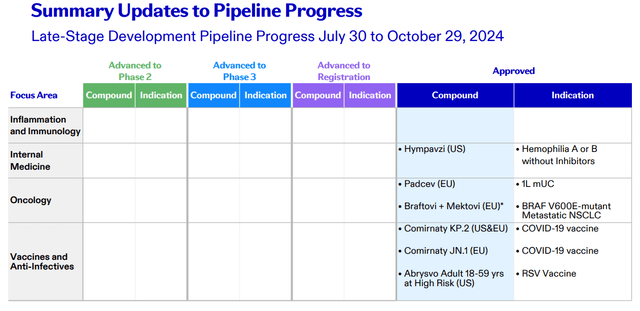

Consider the below slide from the Q3 earnings presentation for evidence of a cupboard that is sadly bare (whose idea was it to include an almost empty slide?).

Pfizer pipeline progress in Q3 (presentation)

I purchased Pfizer stock earlier this year on the basis that things could not get any worse at the company, and thinking the stock had likely reached its rock bottom price. Shares have increased in value by 5% on a 6-month basis, but today’s reporting has me questioning my own logic.

For all the bad news, however, Pfizer management is right to point out that it remains the third largest Pharma in the US by revenues generated. It pays a very handsome dividend yielding 5.8% at the time of writing, and its forward price to sales ratio is below 3x, while the forward price to earnings ratio is less than 10x. Both of those are the lowest in the Big Pharma sector, I believe.

Pfizer may be the Pharma that, ex-COVID, can’t stand up for falling down, and that has been the case for some years now. With its share count of over 5bn, its share price never seems to be moving in any particular direction, but all of this does not necessarily mean that its stock is a bad investment.

Today’s earnings, thanks to Paxlovid and Comirnaty, make it possible for Pfizer to meet or even exceed its own guidance in 2024, and even if Wall Street remains skeptical, perhaps it’s possible that in 2025, some of the new assets with “blockbuster” potential will begin to show their mettle, new products will be launched, value squeezed out of the Seagen deal (ADCs are considered amongst the promising cancer drugs developed), and analyst’s expectations met.

The consensus today on Wall Street seems to be that Pfizer was somewhat lucky to smash expectations, but all of the outperformance only means the company will narrowly meet expectations in Q4 and in the full year 2024, with no guarantees around performance in 2025.

I have little confidence that 2025 will be a strong year for Pfizer, but am happy to keep collecting the dividend, because despite all the woes, there is still a good news story within this business waiting to emerge, I believe.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.