Summary:

- Pfizer’s RSI is trending upward, bouncing from the 50 support level, signaling potential stock strength and accumulation.

- Pfizer’s KP.2-adapted COVID-19 vaccine received FDA approval, positioning the company to capture significant market share in 2024-2025.

- Pfizer’s Q2 2024 revenue reached $13.3 billion, with 14% operational growth excluding COVID-related products, showing strong core portfolio performance.

- Eliquis, Vyndaqel, and Xtandi continue driving revenue growth, while Nurtec posted a 44% annual operational revenue increase.

- Pfizer’s Manufacturing Optimization Program aims to deliver $1.5 billion in savings by 2027, improving margins and operational efficiency.

georgeclerk/iStock Unreleased via Getty Images

Investment Thesis

Since our last coverage in February, Pfizer’s (NYSE:PFE) stock has delivered a total return of 6.5%, underperforming the broader market, which returned 7.3% over the same period. Despite the modest return, recent developments offer promising long-term prospects for the company.

Pfizer secured FDA approval this summer of its KP.2-adapted COVID-19 vaccine, setting it well for the 2024-2025 season. While COVID-19 products remain a contributor, core products such as Eliquis, Vyndaqel, newer oncology therapies, and those added with Seagen now drive the growth. The company’s expansion into obesity treatments and oncology through key R&D investments highlights its commitment to diversifying its pipeline.

On the technical side, momentum indicators suggest a potential shift. The RSI shows an upward trend, signaling possible stock strength as it rebounds from the 50 support level. While the Volume Price Trend (VPT) remains flat, there are early signs of accumulation, indicating that the stock may experience renewed buying interest.

Pfizer is a classic stalwart investment, offering reliable returns with lower risk, making it an ideal choice for conservative investors seeking stability. As I hold a relatively small position in Pfizer within my portfolio, I am currently waiting to realize medium-term gains as the company continues to capitalize on its product developments and market strength.

Pfizer Is Heading Towards 2024 Technical Price Target Of $31?

Pfizer’s current stock price of $28.5 aligns closely with its pessimistic price target for 2024 that is based on the 0.382 Fibonacci level. This suggests that the market may already be pricing in a conservative outlook. The average price target of $31, that is corresponding to the 1.0 Fibonacci level, represents a modest upside. Meanwhile the optimistic target of $33, in line with the 1.618 Fibonacci level, suggests potential for stronger gains if positive catalysts emerge.

Moreover, the RSI is at 51.84 that indicates a neutral market sentiment without clear bullish or bearish divergences. However, the RSI is on an upward trend, suggesting that the stock might be gaining strength. This is particularly vital as it bounces back from the 50 level that is a common support point for long setups.

However, the Volume Price Trend (VPT) line is moving sideways, but shows signs of upward reversal pointing that accumulation might be occurring. The VPT line is slightly below its moving average that is a potential signal for a long setup if it crosses above.

Yiazou (trendspider.com)

Given that August, the current month, has a 46% historical probability of positive returns based on 50 years of seasonality data, the timing might not be the most favorable for entering a new position. September has a moderate 47% likelihood of positive returns, making it a relatively neutral month for the stock. However, moving into October, the probability of gains increases significantly to 62%, indicating stronger performance during this period. November historically performs even better, with a 70% chance of positive returns, marking it as the best-performing month in this stretch.

Yiazou (trendspider.com)

Pfizer Strengthens Market Position with FDA-Approved KP.2-Adapted COVID-19 Vaccine, Driving Growth Beyond the Pandemic

Pfizer excels in COVID Vaccine market with a recent FDA approved Omicron KP.2-adapted COVID-19 vaccine. The company’s partnership with BioNTech has led to this lead. The KP.2-adapted vaccine holds another vital mark in this collaboration. The FDA’s guidance indicates KP.2 is preferred for the 2024-2025 season that reflects the demand for vaccines tailored to emerging variants.

Financially, the KP.2-adapted vaccine could significantly impact Pfizer’s revenue. The COVID-19 vaccine market has previously generated billions in sales and Pfizer expects the KP.2 vaccine to capture a substantial market share as the FDA’s recommendation for the 2024-2025 season supports this expectation.

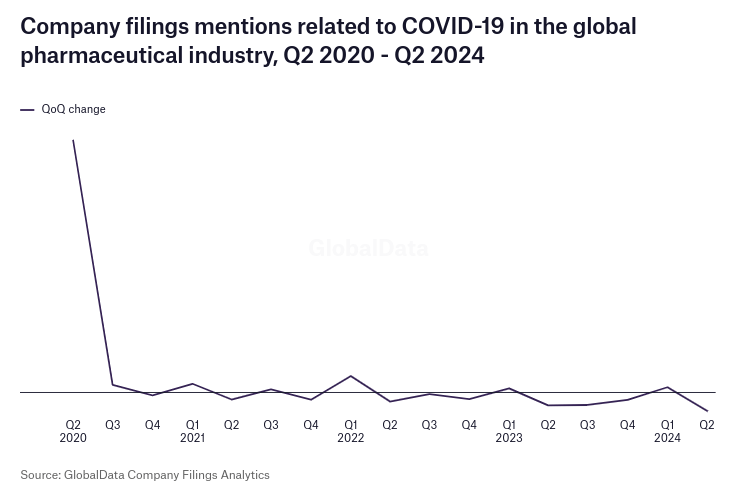

The COVID-19 vaccines market may hit a substantial level in revenue. The projections indicate that it will reach a staggering $25.6 billion by the year 2024. However, the market is facing a compound annual growth of -17.64% (2024-2029). The vaccine may propel the market volume for Pfizer as the US holds a projected revenue of $4.39 billion (in 2024).

statista.com

Pfizer’s total revenue for Q2 2024 reached $13.3 billion that marks a 3% annual operational growth. Excluding COVID-related products, the company attained a 14% operational revenue growth. With that, Pfizer has the ability to derive growth in its core product portfolio. Attaining this growth in the post-pandemic environment is significant. As a result, the adjusted gross margin for Q2 was 79% that is an improvement from last year’s 76%. This increase is based on a favorable sales mix of non-COVID products. Further, strong cost management across Pfizer’s manufacturing network contributed to this improvement.

A major driver of Pfizer’s revenue growth in Q2 2024 was its core products like Eliquis, Vyndaqel, and Xtandi (performed strongly). Eliquis continues to capture a growing share of the oral anticoagulant market that contributes significantly to Pfizer’s revenue. Similarly, Nurtec experienced a 44% annual increase in global operational revenue based on high demand and Pfizer’s market expansion efforts. Pfizer is expanding in both acute and preventive usage and success of these products highlights Pfizer’s ability to launch and scale new therapies.

Pfizer’s oncology segment, with the acquisition of Seagen, products like Padcev are becoming standard for frontline metastatic urothelial cancer. This illustrates the impact of the Seagen acquisition on Pfizer’s revenue. Continued growth of other oncology products, such as Xtandi, Lorbrena, and Braftovi-Mektovi, is notable. The full FDA approval for Tivdak and positive CHMP opinions for Braftovi-Mektovi and Padcev in Europe are critical milestones. These approvals may contribute to top-line growth. Pfizer’s breakthroughs in oncology and the growing demand for cancer therapies are fundamental strengths.

Focusing on research investments in innovative therapies, the company’s R&D expenses increased by 2% operationally in Q2 2024 that reflects Pfizer’s focus on advancing its pipeline. Key areas of focus include obesity and Pfizer is developing danuglipron, an oral GLP-1 receptor agonist. Progressing this candidate to the next development phase is critical to capture a share of the growing obesity treatment market.

Moreover, Pfizer’s oncology pipeline also saw significant advancements in Q2 2024. Multiple Phase 3 studies are progressing for various candidates. For instance, the positive results from the Phase 3 CROWN study of Lorbrena in ALK-positive metastatic non-small cell lung cancer are vital. This study showed 60% of patients living beyond five years without disease progression. Such advancements strengthen Pfizer’s position in the oncology market.

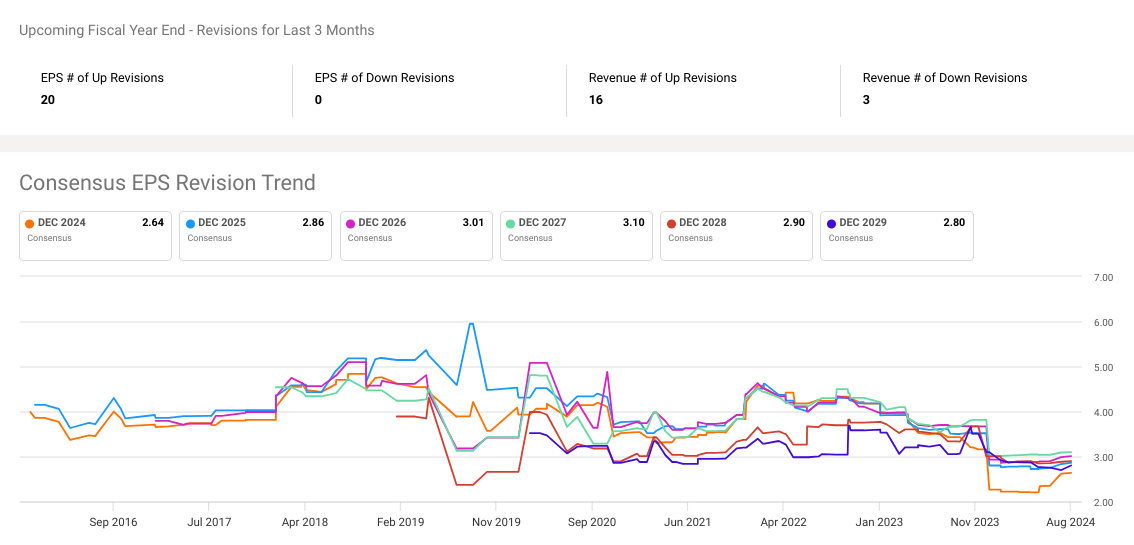

Finally, Pfizer’s Manufacturing Optimization Program may deliver $1.5 billion in savings by 2027. This program is designed to improve operational efficiency and the first phase is underway, with savings expected to start in 2025. Optimizing manufacturing processes and realigning the cost base may lead Pfizer to hit pre-pandemic operating margins. This will be done on a mix-adjusted basis (excluding COVID products) with a focus on efficiency that enhances profitability. Therefore, the potential can be observed in the fiscal year-end revisions that show 20 EPS upward revisions and none downward. Whereas, for revenue, there are 16 upward revisions and 3 downward revisions.

seekingalpha.com

Pfizer’s COVID-19 Dependency: Revenue Risks and Market Competition

Pfizer still relies on COVID-19 vaccines for revenue. In Q2 2024, despite strong performance elsewhere, Pfizer remains partially dependent on COVID-related sales. The forecast for COVID-19 products in 2024 is $8.5 billion with Comirnaty may bring in $5 billion. Similarly, Paxlovid is projected to derive $3.5 billion that exposes Pfizer to risks from fluctuating vaccine demand. The market for COVID-19 vaccines is increasingly competitive with companies like Moderna (MRNA) and new entrants are developing alternatives. Vaccine market saturation limits Pfizer’s growth potential. As the pandemic shifts to an endemic phase, demand may decrease for sure.

Constant updates for new strains, such as KP.2, add complexity with Pfizer’s adaptation to KP.2 shows advancement with challenges to sustain market share. Evolving virus strains and competitor advancements create hurdles with any safety issues or adverse reactions can lead to challenges. The street is integrating these factors in performance estimates. For December 2024, revenue is estimated at $60.99 billion with annual growth of 4.27% and price-to-sales (P/S) ratio is 2.70. By December 2025, the revenue may hit $63.11 billion (3.46% annual growth) that will lead the forward P/S ratio to be 2.60. For 2026, revenue may reach $63.63 billion with a stable growth of 0.83% and the forward P/S ratio will be 2.58. Hence, dropping sales growth with forward P/S ratio points to short-to-mid-term underperformance of the stock price.

pharmaceutical-technology.com

Takeaway

Pfizer faces near-term challenges with fluctuating COVID-19 demand and increased market competition, but its strong core portfolio and strategic pipeline investments present a solid growth narrative in the long term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.