Summary:

- Pfizer investors continue their scramble for the exit, forcing PFE into a two-year low, as investors turned highly pessimistic on Pfizer.

- Investors are increasingly worried about Pfizer’s ability to navigate life after COVID while facing the loss of exclusivity in the next few years.

- PFE’s valuation has reached highly attractive levels, despite the pessimism. Pfizer is a big pharma behemoth and has proved its ability to build its COVID vaccines franchise.

- Long-term investors are given another fantastic opportunity to buy the steep pullback, with the risk/reward tilted heavily toward the upside.

Robert Way

Pfizer Inc. (NYSE:PFE) investors continued their mad scramble out of the leading big pharma company after its recent earnings release. In my early March update, I discussed why PFE dip buyers could be attracted to return as it closes in against critical long-term moving averages or MA.

However, my upgrade turned out to be premature, as the momentary recovery was stunted by early April, as sellers rotated out of stocks with significant exposure to the COVID vaccine franchises.

As such, stocks of COVID vaccine leaders such as Pfizer, Moderna (MRNA), and BioNTech (BNTX) were not spared from the mayhem, as they continued their downward spiral.

PFE and BNTX dropped toward a two-year low, while MRNA looks primed to re-test the critical support of its consolidation range. In addition, they significantly underperformed the Healthcare Select Sector ETF (XLV) since the start of 2023, as investors worry about the revenue exposure from their COVID franchises.

Even though Pfizer performed well in Q1, surpassing the consensus estimates, market operators aren’t having it. As the market is forward-looking, the move to de-risk the contribution of their COVID revenues further has caused a “catching a falling knife” predicament for dip buyers.

Management prudently cautioned that the company “anticipates a decrease in Covid-19 vaccine utilization this year as the pandemic evolves.” However, it also expects a strong transition to the private commercial model, suggesting “higher sales for Comirnaty and Paxlovid in 2024.”

However, I assessed that Wall Street remains tentative over the company’s projections, given the execution risks of the model transition. In addition, Jefferies indicated that management’s outlook for its COVID vaccine revenue could be overstated. Coupled with the loss of exclusivity or LOE on “certain drugs” starting from 2026, investors are right to worry about whether Pfizer can recover from these headwinds.

Revised Wall Street estimates indicate that they concur with management’s guidance on full-year revenue and adjusted EPS. Analysts expect Pfizer to post revenue of $68.1B (down 32% YoY) and an adjusted EPS of $3.37 (down 49% YoY) for FY23.

As such, I don’t think investors had fully priced in the growth risks for 2023, as it fell dramatically from its December 2022 highs. Therefore, the continued slide in PFE hitting two-year lows is incredibly frustrating.

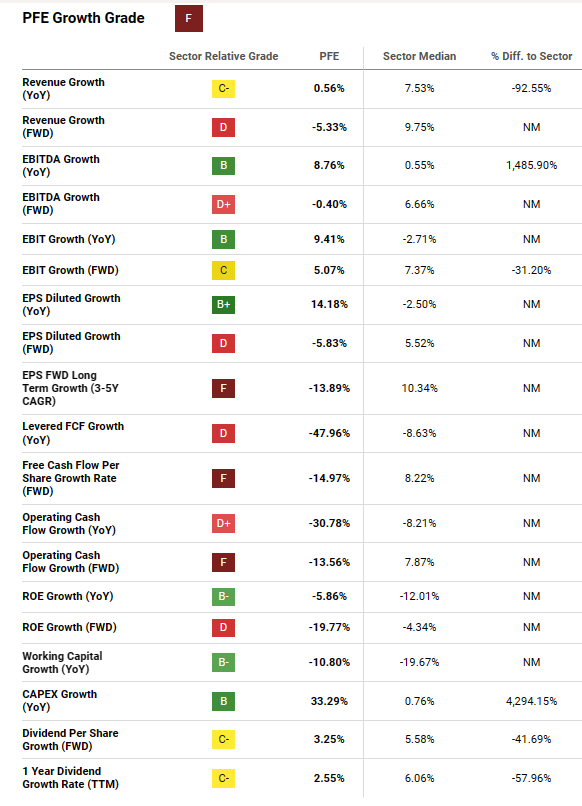

PFE quant factor ratings (Seeking Alpha)

However, a glance at PFE’s factor ratings could provide useful clues into the market’s intentions. Seeking Alpha Quant rated PFE’s growth ratings with an “F” grade, the worst possible.

Hence, the weak grade relative to its sector peers could have driven the rotation away from PFE, given the relative underperformance.

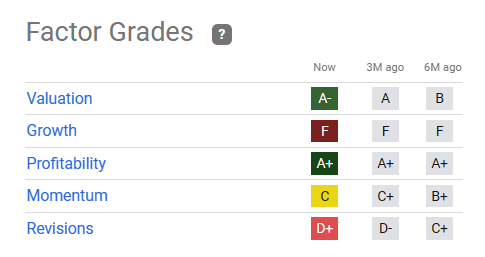

PFE quant factor ratings (Seeking Alpha)

Despite that, PFE’s “A-” valuation grade suggests that long-term dip buyers could still find it attractive to return if they have conviction over the performance of management to drive shareholder value.

Management attempted to shore up shareholder confidence at its recent earnings release. It highlighted a shift in capital allocation priorities moving forward, with a “focus towards dividends and share buybacks.”

However, with a forward dividend yield of 4.5% (Vs. 10Y average of 3.6%), it likely isn’t enough to placate income investors to pile in, with the 2Y Treasury still printing 4.17%.

Moreover, the company issued long-term debt worth $31B to finance its relatively expensive Seagen (SGEN) acquisition, increasing its execution risks on a deal some could still view as a “show-me story.”

With total debt falling to about $36.2B in Q1, management is under pressure to deliver the value proposition with its Seagen deal. However, market operators didn’t seem to like it, as PFE continued to decline over the past few weeks.

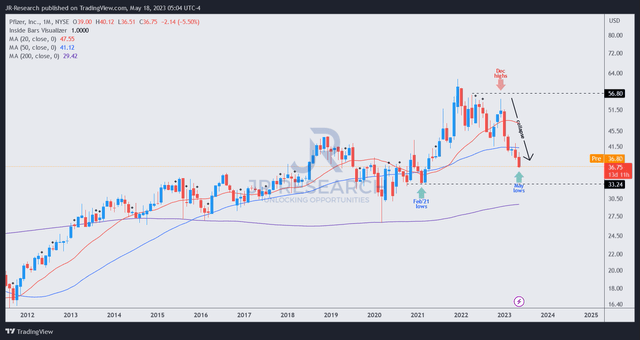

PFE price chart (weekly) (TradingView)

As seen above, the selloff has been brutal on investors, as PFE collapsed since forming its December 2022 highs.

It has also broken below its 50-month MA (blue line), which previously attracted long-term buyers to return. However, I have yet to glean constructive price action suggesting buyers are willing to lean in and bolster PFE at the current levels.

Despite that, I have confidence in Pfizer’s wide-moat business model and its ability to navigate its recent acquisitions as it attempts to create $45B in new long-term revenue streams by 2030, overcoming the loss of $17B from the LOEs.

I assessed that the risk/reward still points to the upside from here, with the next possible support zone close to the $33 level. Hence, investors are encouraged to keep some spare ammo to dollar-cost average if necessary.

Rating: Strong Buy (Reiterated).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!