Summary:

- Pfizer’s share price has stabilized since the company provided 2024 revenue and EPS guidance in late 2023.

- The success of Adcetris in a trial for relapsed/refractory DLBCL is a positive step for Pfizer’s oncology pipeline and the first win since the Seagen acquisition closed.

- Pfizer’s long-term growth strategy in oncology, including the Seagen acquisition, is expected to contribute significantly to revenue growth in the coming years.

Love Employee/iStock via Getty Images

Shares of Pfizer Inc. (NYSE:PFE) are little changed since my early December 2023 update where I covered the obesity pipeline setbacks and how my earlier call for a late summer bottom was not playing out as expected. Since then, the company lowered expectations for 2024 by guiding below Street expectations, and this may have been a kitchen-sink event that could allow the stock to start to recover and for forward estimates to stabilize and potentially start trending higher.

The closing of the Seagen acquisition in mid-December 2023 is one of the key steps for Pfizer’s return to growth. The $43 billion price tag set high expectations and today’s news of Adcetris’ success in relapsed/refractory diffuse large B cell lymphoma (‘DLBCL’) patients is one step in the right direction that could lead to this drug’s expansion into a very decently sized market.

In today’s article, I will analyze the Adcetris news and provide thoughts on the Oncology Innovation Day from late February.

Adcetris delivers a first win since the closing of the Seagen acquisition

Pfizer needed some good news, and it got it from the ECHELON-3 trial of Adcetris (brentuximab vedotin), the lead commercial asset from Seagen where Pfizer now owns the commercial rights in the United States and Canada and receives royalties from ex-U.S. territories from partner Takeda Pharmaceutical Company Limited (TAK).

The ECHELON-3 trial enrolled patients with relapsed/refractory diffuse large B cell lymphoma, or DLBCL, regardless of CD30 expression, and tested Adcetris in combination with lenalidomide (Revlimid) and rituximab (Rituxan) versus these two agents and placebo, and it showed a significant improvement in overall survival which was the primary endpoint of the trial and also on secondary endpoints of progression-free survival and overall response rate.

Other than the safety being in line with the known safety profile of Adcetris, there were no additional details, and we will have to wait for data to be presented at a medical conference to get a better picture of its potential.

Pfizer will engage with regulators to discuss the data and a potential regulatory submission, and this is a potentially significant update for this asset as it would allow Adcetris to expand from the smaller markets such as classical Hodgkin lymphoma.

There are more than 25,000 diagnosed cases of DLBCL each year in the United States alone and 40% of patients relapse or have refractory disease after frontline treatment. Without seeing the data and how well the Adcetris combination compares to lenalidomide and rituximab, my best estimate is a peak annual topline contribution of several hundred million dollars.

For a company of Pfizer’s size, this is a drop in the bucket, but this is good news and represents a step in the right direction for the oncology pipeline and is required to justify the very high price tag for Seagen.

Oncology Innovation Day

Pfizer held its Oncology Innovation Day in late February, outlining its long-term growth strategy for this business segment and how it wants to deliver value through expertise, innovation, and scale.

Oncology is becoming one of Pfizer’s most important business segments. It has generated $11.6 billion in revenue in 2023, or 20% of the total. The addition of Seagen’s expected $3.1 billion contribution this year should bring the segment to approximately 25% of total revenue based on the mid-point of the $58.5-61.5 billion guidance range.

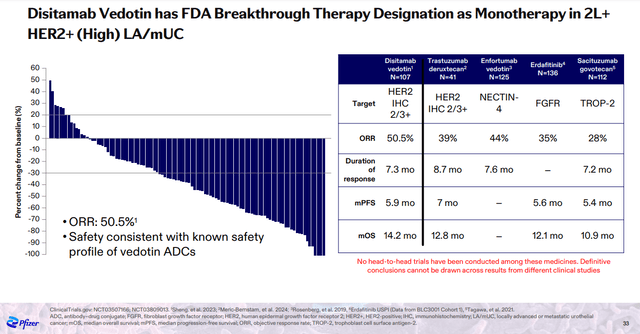

Among Seagen’s assets, Padcev (enfortumab vedotin) and disitamab vedotin were prominently featured at the Oncology Innovation Day.

Padcev is already on the market with the potential to expand the set of approved indications, while disitamab vedotin is a HER2 antibody-drug conjugate (‘ADC’) with competitive data to AstraZeneca PLC’s (AZN) and Daiichi Sankyo Company, Limited’s (OTCPK:DSKYF) blockbuster ADC Enhertu.

Pfizer Oncology Innovation Day presentation

ADCs also have synergistic effects with immune checkpoint inhibitors and this should further support the expansion potential of Seagen’s pipeline. Pfizer also plans to develop an ADC candidate targeting PD-L1 versus the current standard antibody approach of market leaders Keytruda, Opdivo, and others.

The ADC treatment landscape is evolving rapidly and Pfizer wants to lead the market with next-generation candidates with improved specificity, potency, and safety. TOPO1 inhibitor payload seems to be the way to go in the near- and medium-term and the first candidate PF-08046050 is now in the clinic with two more expected to start treating patients this year.

The mentioned products and candidates are approved or in development for solid tumors. The previously covered Adcetris represents a valuable addition to Pfizer’s hematological malignancy portfolio where the company has high expectations of the recently approved bispecific BCMA-directed CD3 T-cell engager Elrexfio (elranatamab), albeit for late-line multiple myeloma. This is how drugs for multiple myeloma are being developed – from the sickest late-line patients to frontline treatment and Pfizer has an extensive development plan that goes all the way to frontline multiple myeloma and multiple readouts are expected through 2028.

Going back to solid tumors, these will be the last two oncology candidates I will mention today.

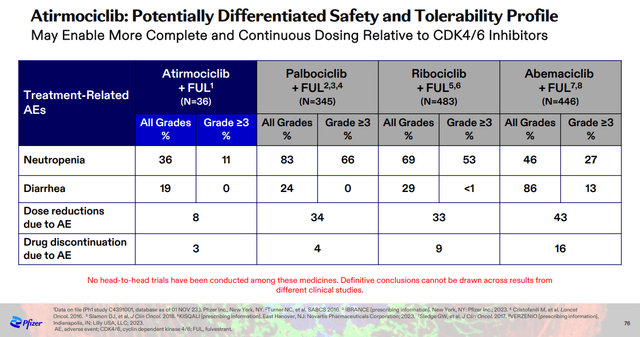

The first is the CDK4 inhibitor atirmociclib. This candidate looks promising as a potential improvement over Pfizer’s approved CDK4/6 inhibitor Ibrance and competing CDK4/6 inhibitors. CDK4 inhibition instead of dual CDK4/6 inhibition could have a significant safety advantage that could allow for continuous dosing and improved efficacy. The clinical data to date support the theory with much lower rates of neutropenia and diarrhea with fewer dose interruptions and discontinuations.

Pfizer Oncology Innovation Day presentation

Pfizer has an aggressive development plan for atirmociclib with parallel trials to treat metastatic breast cancer patients post-CDK4/6 inhibitors and frontline patients, and the company is also searching for an efficacy signal in early breast cancer to support further development. The problem here is that atirmociclib will initially cannibalize Ibrance which generated $4.7 billion in net sales in 2023. However, Ibrance could also face generic competition in the late 2020s, and atirmociclib should act as an improved replacement.

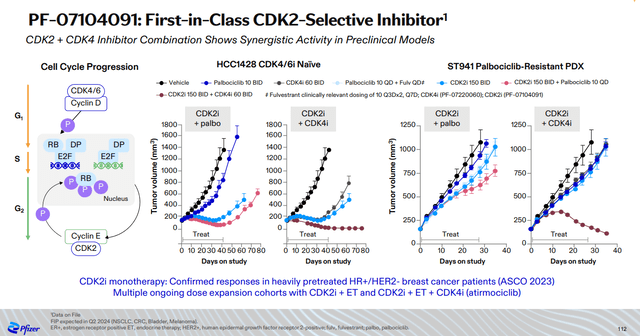

The second candidate is a first-in-class CDK2 inhibitor PF-07104091. Preclinical data show that CDK2 inhibition plus CDK4 inhibition are synergistic and the combination of atirmociclib and PF-07104091 could further enhance their efficacy and peak sales potential.

Pfizer Oncology Innovation Day presentation

Overall, a lot is going on in Pfizer’s oncology division and I expect both absolute revenues and revenues as a percentage of total revenues to grow considerably in the second part of the decade.

2024 guidance – kitchen sink or is there still room for disappointment?

In December 2023, Pfizer provided 2024 revenue and EPS guidance that was below Street expectations and the company reiterated the guidance when it reported Q4 2023 results in late January. The revenue guidance of $58.5-61.5 billion looks appropriate and potentially conservative at the low end of the range. The key unknown is the COVID-19 franchise with combined revenue guidance of Comirnaty and Paxlovid of $8 billion, and I still expect it to be the key swing factor this year, but it can no longer have as significant negative impact on Pfizer’s revenues as it did last year.

Conclusion

The recent share price stabilization is good news for Pfizer, driven partly by the recent biotech rally but also by the company finally not experiencing one setback after another. The expansion of the oncology pipeline was given a significant boost after the Seagen acquisition finally closed, and I expect the oncology side of the business to be one of the major growth contributors in the second part of the decade.

One long-term upside driver that is still unaccounted for is Pfizer finding a way to participate in the rapidly growing obesity market, but based on the limitations of the internal pipeline and recent failures, it seems more than likely that the company will need to find the solutions at other companies through in-licensing deals or acquisitions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article reflects the author's opinion and should not be regarded as a buy or sell recommendation or investment advice in any way.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.