Summary:

- PFE has dropped on concerns about post-COVID growth prospects.

- The company has an aggressive rollout plan for new products.

- With the recent share price decline, the consensus price target implies a 17.7% total return for the next year.

- The prices of options suggest a slightly bullish outlook for PFE over the next year.

JHVEPhoto

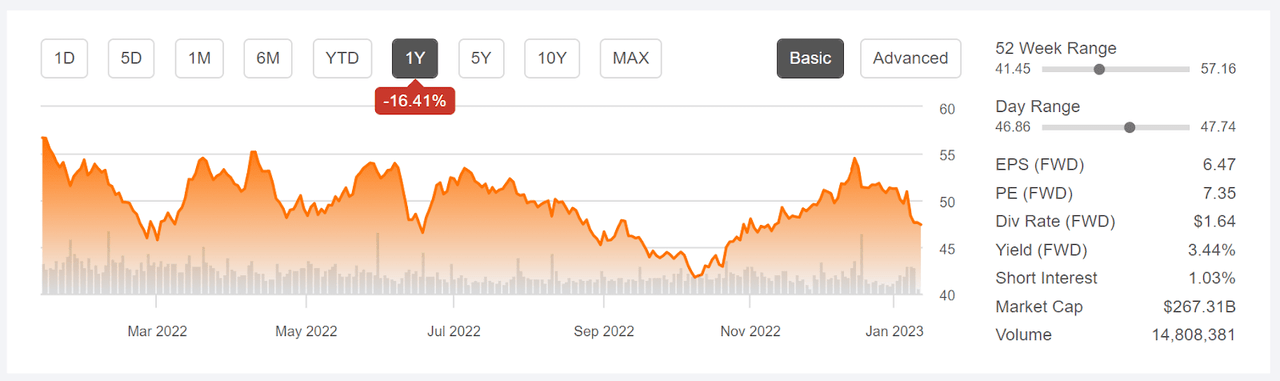

Pfizer (NYSE:PFE) has enjoyed enormous earnings from the sale of its COVID vaccine and oral COVID treatment, Paxlovid, but the company needs to convince the market of its forward trajectory. Pfizer’s CEO, Albert Bourla, is trying to bolster investor confidence that the company will thrive even as COVID recedes and notes that Pfizer anticipates launching 19 products in the next 18 months. The market appears less optimistic, however, and the shares have fallen 7.1% since the start of 2023, a period of less than 2 weeks. The iShares U.S. Pharmaceuticals ETF (IHE), in which PFE is the 2nd-largest holding, is down 0.1% over the same period. PFE’s 12-month return is -12.5% vs. -4.2% for IHE. On January 4th, Bank of America downgraded PFE from a buy to a neutral rating, citing the uncertainties as sales of COVID-related drugs decline.

Seeking Alpha

12-Month price history and basic statistics for PFE (Source: Seeking Alpha)

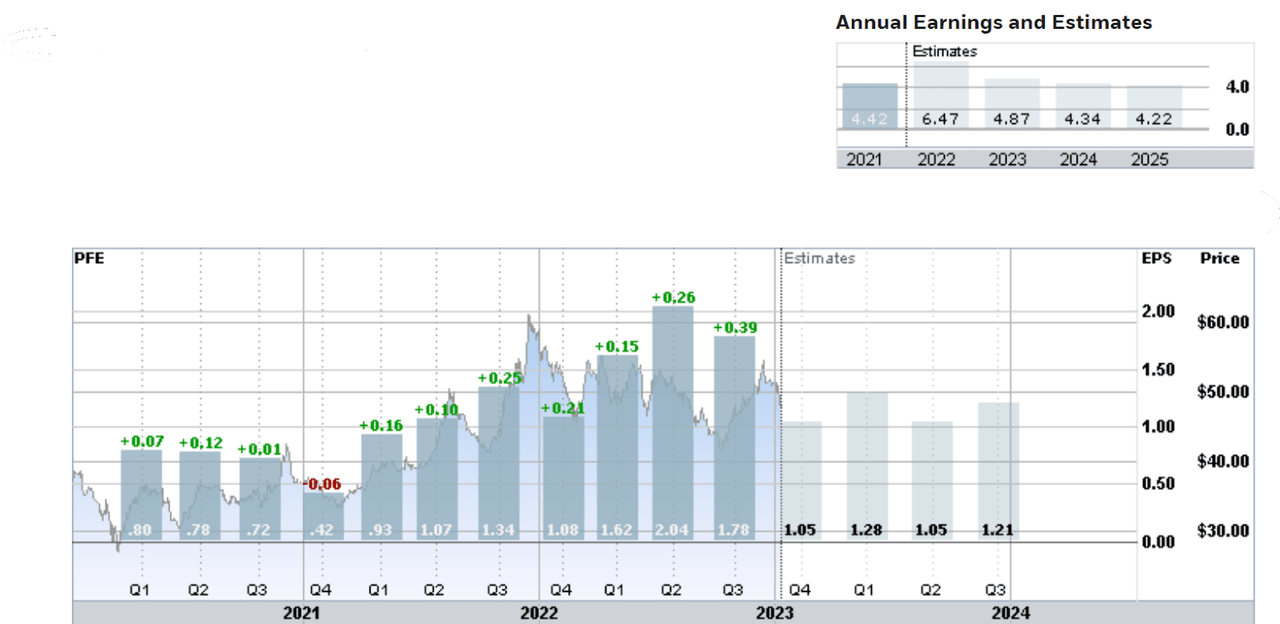

The earnings history and estimated future earnings for PFE lay out the basic narrative. Pfizer’s earnings shot up from Q4 of 2020 to Q2 of 2022 as the company sold hundreds of millions of doses of its vaccine. As of the start of 2023, around 400 million doses of the Pfizer vaccine have been administered. The U.S. government alone has purchased almost 24 million treatment courses of Paxlovid. The consensus outlook for Pfizer has full-year earnings in 2023 coming in 25% below the level for 2022, with further declines in 2024 and 2025 according to ETrade. The consensus expected EPS growth over the next 3 to 5 years is -3.9% per year.

ETrade

Trailing (4 years) and estimated future quarterly EPS for PFE. Green (red) values are amounts by which EPS beat (missed) the consensus expected value (Source: ETrade)

Pfizer reports Q4 results on January 31, 2023 and the consensus expected value for EPS is $1.05, slightly lower than in Q4 of 2021.

The value of a stock is based on the net present value of estimated future earnings. The value of Pfizer shares is highly uncertain because of the lack of continuity in the sources of earnings, with revenues from COVID drugs being replaced by growth in existing product lines and projected sales of new products. PFE’s valuation, as measured by P/E, is low compared to peers because of this uncertainty.

Pfizer’s forward dividend yield of 3.4% and trailing 3-, 5-, and 10-year dividend growth rates of 5.5%, 5.7%, and 6.7% per year, respectively, are reasonably attractive. These numbers, put through the Gordon Growth Model, suggest that expected total returns of 8%-9% are reasonable. For context, the trailing 3-, 5-, and 10-year annualized total returns for PFE are 10.7%, 9.1%, and 8.8% per year, respectively.

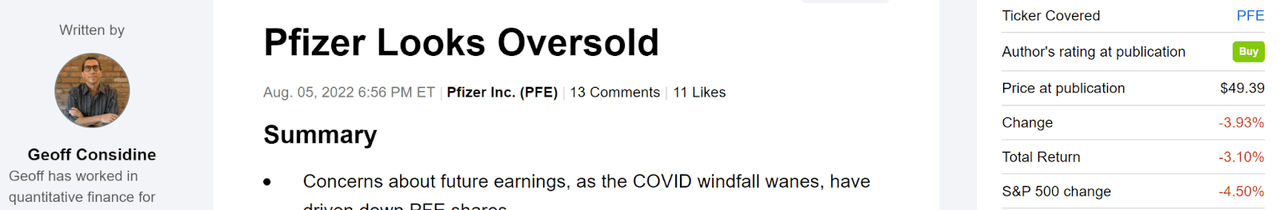

I last wrote about PFE on August 5, 2022, about 5 ½ months ago, and I maintained a buy rating. The company had reported its blowout Q2 results, with EPS at $2.04 per share, on July 28th. The share price was up 9.5% over the previous 12 months, but was 19.4% below the all-time closing price of $61.25 on December 16, 2021. At that time, the Wall Street consensus rating was a buy, with a consensus 12-month price target that corresponded to a total return of 19% over the next year. The forward P/E was 7.67. Along with looking at fundamentals and the Wall Street consensus, I also consider the market-implied outlook, a probabilistic price forecast that represents the consensus view implied by the prices of call and put options on a stock. The market-implied outlook was neutral to slightly bullish, with expected volatility of 28% (annualized). In the period since this post, PFE has declined but slightly outperformed the S&P 500.

Seeking Alpha

Previous post on PFE and subsequent performance vs. the S&P 500 (Source: Seeking Alpha)

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock reflects the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate the probable price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper discussion than is provided here and in the previous link, I recommend this outstanding monograph published by the CFA Institute.

I have calculated updated market-implied outlooks for PFE and compared these with the current Wall Street consensus outlook in revisiting my rating as we approach the Q4 earnings report on January 31st.

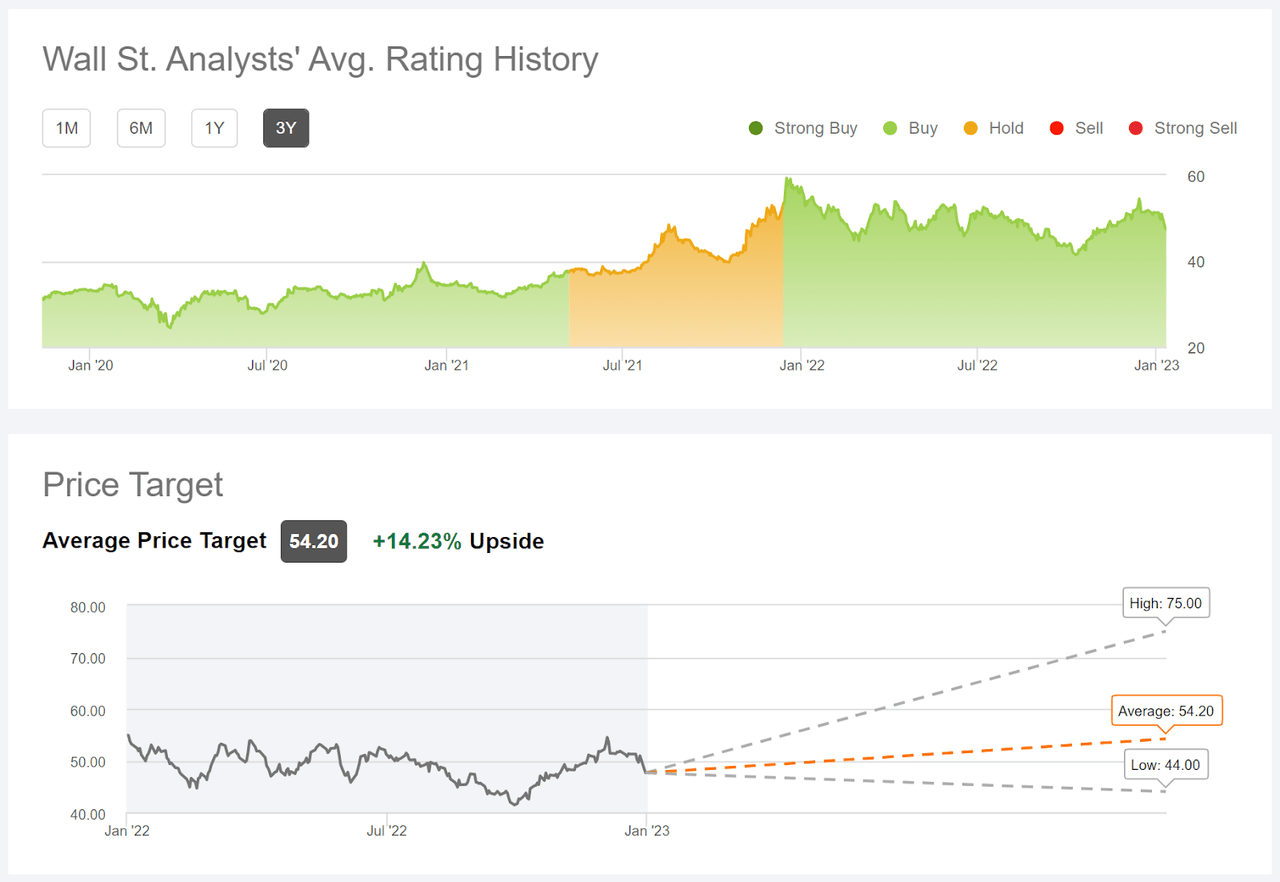

Wall Street Consensus Outlook for PFE

Seeking Alpha calculates the Wall Street consensus outlook for PFE by aggregating the views of 24 analysts who have published their views within the past 90 days. The consensus rating is a buy, as it has been since December 13, 2021, prior to which the rating was a hold. The consensus 12-month price target is $54.30, 14.23% above the current share price, which maps to an expected total return of 17.7% over the next year. Of the 24 analysts, 13 have a hold rating on PFE, while 4 assign a buy and 7 give PFE a strong buy.

Seeking Alpha

Wall Street analyst consensus rating and 12-month price target for PFE (Source: Seeking Alpha)

It is worth noting that the Wall Street consensus rating for PFE shifted from a buy to a hold (May 2021) and from a hold to a buy (December 2021) at inopportune times, with the shares rallying substantially when the rating was a hold and declining since the rating went to a buy. These are just a couple of anecdotal cases, but it seems reasonable to wonder whether the analysts, as a group, are missing something here.

The 17.7% expected total return implied by the consensus price target is quite high and is hard to reconcile with concerns over declining earnings unless we conclude that the market has overreacted.

Market-Implied Outlooks for PFE

I have calculated market-implied outlooks for PFE for the 5.1-month period from now until June 16, 2023 and for the 12.2-month period from now until January 19, 2024, using the prices of call and put options that expire on these dates. I selected these specific expiration dates to provide a view to the middle of 2023 and through the entire year.

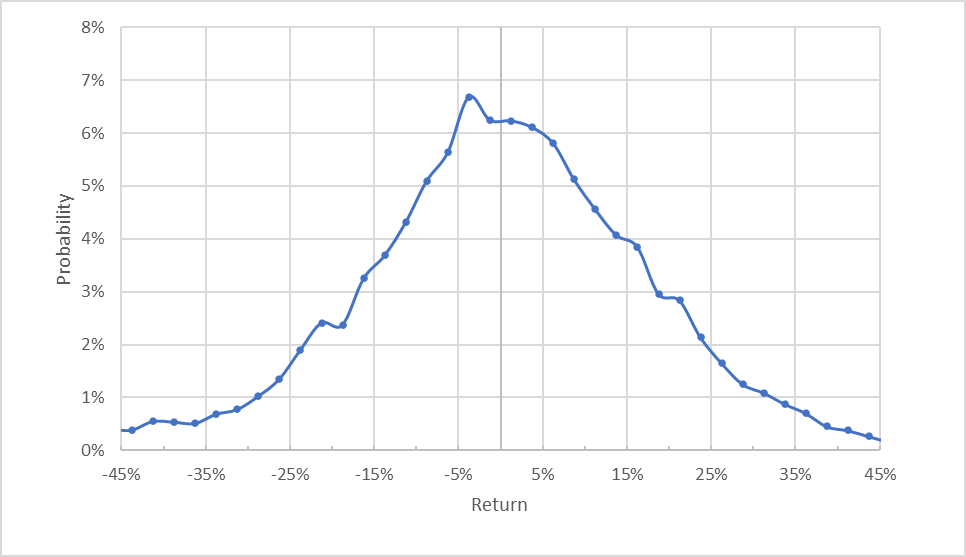

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Geoff Considine

Market-implied price return probabilities for PFE for the 5.1-month period from now until June 16, 2023 (Source: Author’s calculations using options quotes from ETrade)

The outlook for the next 5.1 months appears generally symmetric, with comparable probabilities of positive and negative returns of the same size, but the peak in probability is slightly tilted to favor negative returns, with the maximum probability corresponding to a return of -4%. The expected volatility calculated from this distribution is 27.5% (annualized), very close to the value I calculated in early August. ETrade calculates an option implied volatility of 28% for this expiration date.

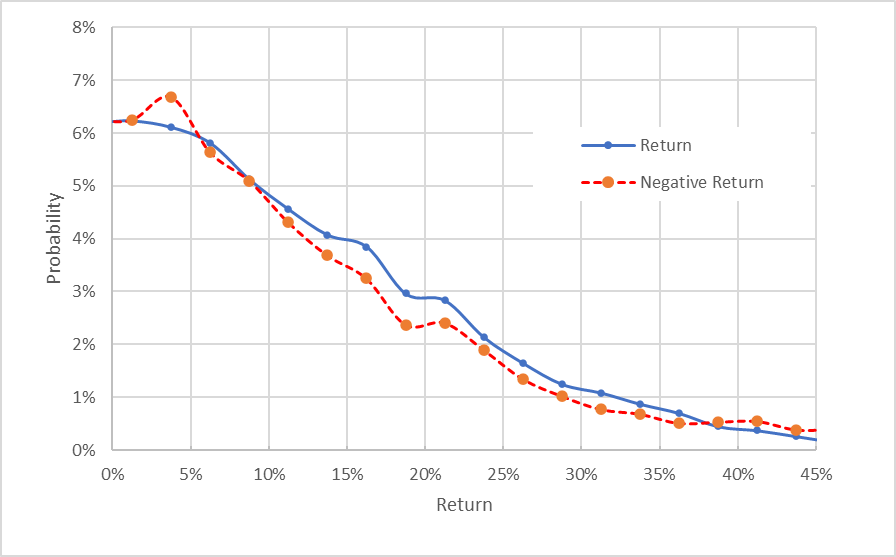

To make it easier to compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

Geoff Considine

Market-implied price return probabilities for PFE for the 5.1-month period from now until June 16, 2023. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

This view shows that, aside from the slightly elevated peak in probability at a return of -4%, the probabilities of positive returns tend to be at or above those for negative returns, across almost all of this distribution (the solid blue line is above the dashed red line over most of the chart above), suggesting a slight bullish tilt in the outlook from the options market.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. The expectation of a negative bias supports an interpretation of this outlook as slightly bullish.

This outlook is certainly not significantly bullish, but neither does it suggest that the market is pricing an elevated relative potential for bad news. This outlook for the next 5.1 months is mildly more bullish than the 5.5-month outlook from my previous post.

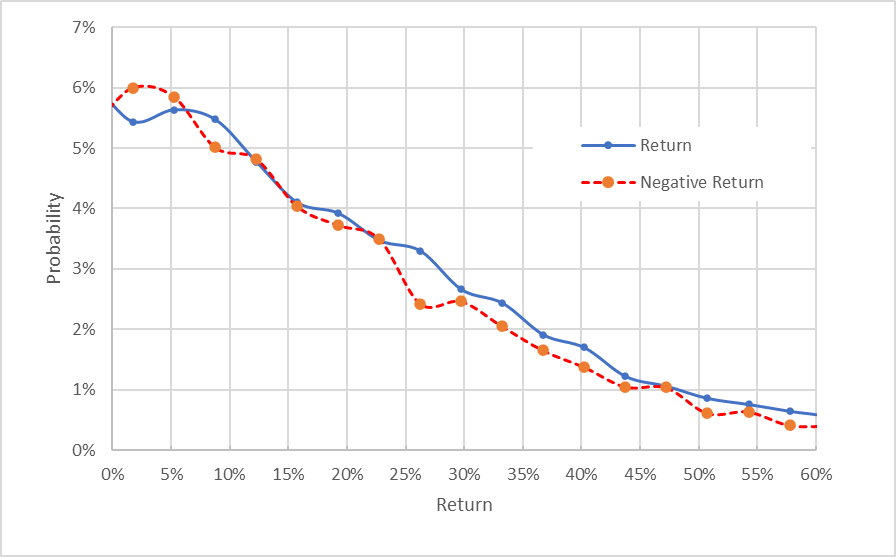

The market-implied outlook for the 12.2-month period to January 19, 2024 is qualitatively similar to the view to mid-2023 and exhibits a slight asymmetry in probabilities that favors positive returns. In light of the expectation of a negative bias, I interpret this outlook as very slightly bullish. The expected volatility calculated from this distribution is 27.2% (annualized).

Geoff Considine

Market-implied price return probabilities for PFE for the 12.2-month period from now until January 19, 2024. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

There is a large amount of open interest in options on PFE, making these results even more interesting. Buyers and sellers of call and put options are implicitly assigning very similar probabilities to a wide range of the possible outcomes to the middle of 2023 and for 2023 as a whole. There is a prevailing slight elevation in the probabilities of positive returns. This type of distribution does not suggest widespread concern about an unexpected drop in earnings.

Summary

Pfizer investors are, in effect, betting that the company can replace a sufficient amount of COVID-related earnings to justify PFE’s current valuation. How well this works out depends on both the rate of decline of COVID and the firm’s ability to sell current and new products. The Wall Street analyst consensus rating is a buy and the consensus 12-month price target corresponds to a total return of 17.7% over the next year. The prevailing view among analysts is that PFE will do just fine over the next year. The market-implied outlook is slightly bullish to the middle of 2023 and to the start of 2024. Even with the concerns about the revenue and earnings outlook, PFE has a lot going for it. The company has a deep and well-diversified pipeline of products. The current price reflects a fair amount of negativity, so the valuation is very reasonable. The company’s history of paying its shareholders with dividends and buybacks is respectable. I am maintaining a buy rating on PFE.

Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.