Summary:

- Pfizer stock has been hammered as investors chased alpha in AI plays and the company’s COVID vaccine revenue hangover is affecting growth metrics significantly.

- Investors have also been rotating towards companies with significant exposure to weight-loss drugs, such as Novo Nordisk and Eli Lilly, which have outperformed their sector peers.

- Given relatively pessimistic analysts’ estimates, the market is likely positioned for a disappointing Q2 release for Pfizer.

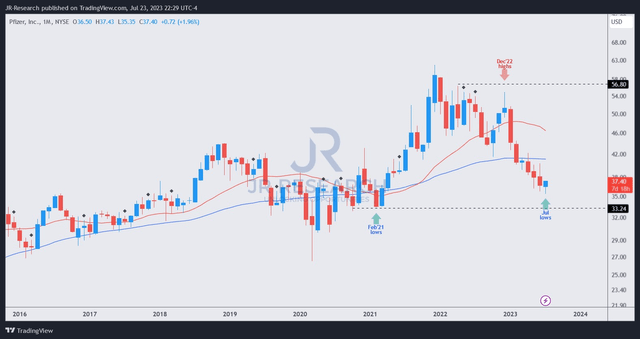

- I assessed that PFE could be at a critical long-term inflection point, suggesting that dip-buying sentiments could improve further, attracting more value investors.

- Investors keen to invest in a leading wide-moat biopharma company should find the current levels highly attractive.

JHVEPhoto

Pfizer Inc. (NYSE:PFE) investors have likely been baffled by the market’s battering as it fell toward lows last seen in early 2021. I gleaned that dip buyers attempted a mean-reversion opportunity in May 2023 but were rejected by sellers. Given the relative underperformance of PFE and its healthcare peers (XLV), underlying sector rotation occurred as investors chased alpha in the AI hype train.

As such, biopharma leaders like Pfizer aren’t expected to escape the rotation unscathed despite its wide economic moat. Moreover, investors are likely still pricing in its COVID vaccine revenue hangover, which affected its near-term growth metrics (Seeking Alpha’s Quant growth grade is an “F”). I also assessed that healthcare investors likely rotated to chase the surge in companies with significant exposure to weight-loss drugs, like Novo Nordisk (NVO) and Eli Lilly (LLY).

Both companies are reportedly “facing challenges in meeting the demand for their weight-loss medications,” as NVO and LLY outperformed their sector peers. These companies have robust growth grades rated highly by Seeking Alpha’s Quant, with both rated “A-.” However, their valuations are also no longer attractive for investors who didn’t add exposure late last year, receiving an “F” valuation grade.

With that in mind, weak dip buyers in PFE have likely been spooked, as it proved to be a falling knife over the past few months. However, investors must assess whether PFE is at or close to peak pessimism, even as these investors bailed out.

The company is slated to report its second quarter or FQ2 earnings release on August 1. Investors will also likely assess the operational impact as a result of the tornado that afflicted its Rocky Mount manufacturing plant recently. Initial assessment suggests that while its warehouse facilities were damaged, the company is “actively moving products to other nearby sites for storage and sourcing alternative manufacturing locations.” Furthermore, last week’s robust buying sentiments corroborate my view that buyers weren’t unduly concerned with the matter.

Despite that, the market’s pessimism over the company’s ability to replace the revenue from its products approaching patent cliffs is justified. The revised analysts’ estimates suggest that Pfizer’s 4Y revenue CAGR from FY23-27 is expected to be nearly flat to slightly negative. While its adjusted operating profit is expected to grow by a 4Y CAGR of 1.8%, it likely isn’t going to excite growth investors.

While PFE trades at a forward dividend yield of 4.41%, income investors have plenty of less risky choices currently, as the 2Y Treasury yield last printed at 4.86%. As such, I believe Pfizer will need to depend on value investors to return confidently in buying PFE’s significant battering.

Therefore, the critical question facing PFE holders is whether its price action has reflected such an opportunity?

PFE price chart (monthly) (TradingView)

I assessed that a possible long-term bottom in PFE could be validated by the end of July. It’s the first robust bullish reversal price action since it lost its mean-reversion opportunity in March 2023.

With PFE’s valuation graded “A-” by Seeking Alpha’s Quant, it isn’t aggressively configured. Therefore, the improved dip buying sentiments should help encourage more value investors to return. Moreover, with the Fed close to its peak rate hikes, a possible pivot moving forward should narrow the spread between PFE and other yield-driven products, attracting income investors back into the fray.

Despite the relatively pessimistic analysts’ estimates, the market seems to have positioned it for a disappointing Q2 release, lowering the bar for Pfizer to offer a more assured outlook. As such, PFE holders looking for an opportunity to buy more discounted shares should consider adding more at the current levels.

Rating: Maintain Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!