Summary:

- Pfizer reported a record $100 billion in annual revenue in 2022 due to the development of Comirnaty and Paxlovid.

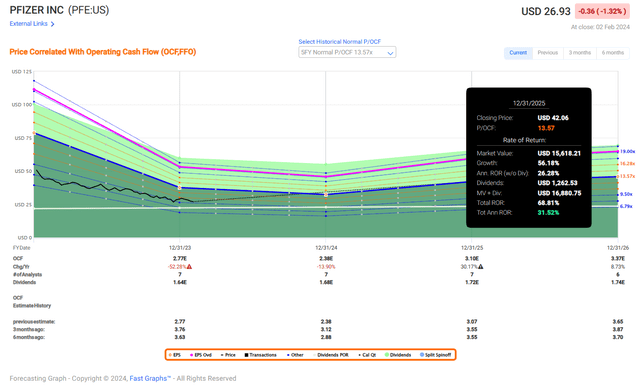

- COVID treatments no longer boost sales, causing the stock to trade near a ten-year low.

- Pfizer faces patent expirations and a drop in sales of COVID products but has strong pipeline and growth drivers.

Michael M. Santiago

This article was coproduced with Chuck Walston.

Pfizer’s (NYSE:PFE) development of coronavirus vaccine, Comirnaty, and COVID treatment Paxlovid contributed to the company reporting a record $100 billion in annual revenue in 2022.

But the days of COVID treatments boosting Pfizer’s sales are long gone, and investors that bought the stock in early 2022 at the mid $50s level had their investment halved.

Pfizer now trades near a ten-year low, and recent results held a variety of pros and cons.

However, the surge in revenue from the COVID crisis left the company with a hefty purse. In an industry where R&D and shots on goal often dictate long-term results, which provided Pfizer with an advantage over many competitors.

Furthermore, with the stock trading at these low levels, the company has suddenly emerged as a high-yielding stock.

Q4 2023 Earnings

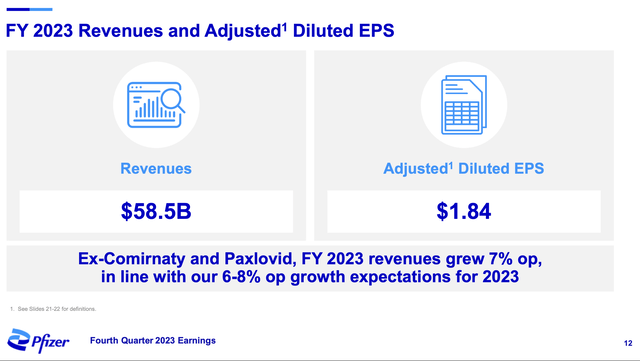

Pfizer reported Q4 revenue of $14.2 billion, well above the $13.3 billion consensus. However, that marked a 41% year-over-year decline.

The company posted a Q4 net loss of nearly $3.4 billion, with GAAP EPS of $0.60 per share. However, non-GAAP EPS of $0.10 was well above analysts’ forecast for negative $0.20 per share.

A significant positive lay in COVID-19 vaccine sales of $5.36 billion, as analysts had projected revenue from Comirnaty at just a hair below $5 billion for the quarter.

Management reaffirmed full-year revenue guidance in a range of $58.5 billion to $61.5 billion, with sales of Comirnaty and Paxlovid of approximately $8 billion.

Operational revenue growth is projected in a range of 8% to 10%, and adjusted EPS is expected to land in a range of $2.05 to $2.25 for FY24.

Pfizer IR

Pfizer boosted its forecasts for annual savings from ongoing cost-cutting measures in 2024 to hit $4 billion, up from the previous $3.5 billion.

The Bad News First

In addition to the drop in sales from COVID products, beginning in 2025, Pfizer is facing a slew of patent expirations. All told, the company forecasts $17 billion in lost revenue from patent expirations by the end of this decade.

The following is a list of major products with patent expirations in the next five years. Revenues are on an annual basis as of the end of 2022.

Vyndaqel/Vyndamax/Vynmac is now pending a US patent term extension. Depending on the outcome, the drug could lose exclusivity in the US as early as 2024 or as late as 2028. In the European Union, the patent is set to expire in 2026. Revenues from those products total $2.4 billion.

With $1 billion in revenue, Inlyta’s patent will expire in 2025.

Prevnar and Eliquis, which collectively generated over $12.8 billion in sales, will expire in 2026.

Xtandi’s patent will expire in 2027. That product generates $1.2 billion in sales.

With $5.1 billion in revenue, Ibrance will go off patent in the US in 2027 and in the EU in 2028.

Xalkori generates $455 million. It is set to lose exclusivity in 2029.

Pfizer’s GLP-1 agonist drug Danuglipron failed in clinical studies, as did lotiglipron, a pill designed to fight obesity.

Pfizer’s Growth Drivers

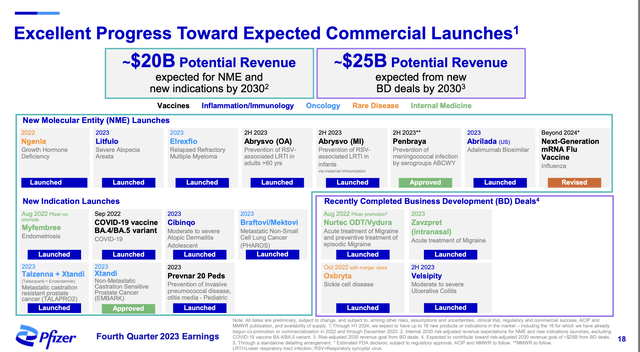

In 2023 the FDA approved seven new drugs for Pfizer. To put that into context, that’s more than double the approvals of any other company in each of the last three years. Analysts identify all but one of the newly approved drugs as potential blockbusters.

Currently, Pfizer has 112 projects in its pipeline with 26 in phase one trials, 34 in phase two, 31 in phase three, and 6 in the registration phase. This is up from 83 as of last October.

The company recently launched 19 new products or indications, and management projects $45 billion in revenues by 2030 for its commercial launches.

Pfizer’s acquisition of Seagen doubled the firm’s oncology research efforts, and management projects the deal will add $3 billion in revenue this year and $10 billion a year in sales by 2030.

Pfizer also forecasts non-COVID revenue as high as $84 billion in 2030. That translates into a 10% CAGR from 2025 through 2030.

Pfizer IR

Of course, it is wise to be skeptical regarding any company’s forecasts; however, Barron’s recently reported that CEO Albert Bourla invested his entire pension in Pfizer stock.

In December, Bourla invested $10 million from his Supplemental Savings Plan Pension in Pfizer stock. That transaction bought the CEO approximately 376,000 shares valued at $26.63 apiece.

All my pension I put into Pfizer stock. I’m all in.

Debt, Dividend, And Valuation

Pfizer’s debt is A rated by credit agencies.

Pfizer yields 6.20%. The payout ratio is nearly 90%, and the 5-year dividend growth rate is 4.77%.

Pfizer currently trades for $26.77. The twenty analysts covering PFE have an average price target of $32.87. The stock’s forward PEG is 1.73x.

Is Pfizer A Buy, Sell, Or Hold?

On top of the drop in sales in 2023, Pfizer had a $3.5 billion revenue reversal when the federal government returned 6.5 million unused treatment courses to the company, plus a non-cash write-off of $5.6 billion inventory for Paxlovid and Comirnaty.

Those negatives aside, the primary headwind facing Pfizer is the precipitous drop in sales of COVID-19 vaccine Comirnaty and the oral antiviral pill Paxlovid. With $37.8 billion in sales in 2022, management now projects just $8 billion in sales for 2024. That’s down from roughly $12.5 billion in 2023.

Even so, those sales qualify the two as blockbuster products.

More importantly, the associated surge in revenues provided Pfizer with a massive cash windfall. In an industry in which the numbers of shots on goals determine how many new products eventually go to market, which can easily translate into a real advantage. Evidence of that lies in the company’s recent acquisitions and the FDA’s record nine new molecular entity approvals of Pfizer products in 2023.

Another positive the market is missing is that despite the decline in COVID-related sales, through the first nine months of 2023, Pfizer was the top pharmaceutical company in terms of revenues from pharma-only products.

This represents a marked improvement over the firm’s fourth-place finish in 2019.

I believe Pfizer has good growth prospects, and I consider the stock to be trading at a reasonable valuation.

I rate PFE as a BUY.

I will add that it may take some time for what I view as the excessive pessimism surrounding Pfizer to dissipate. I would caution those who hope that shares of Pfizer will execute a rapid about-face to exercise patience.

I do not have an investment in Pfizer, but I intend to initiate a position in the stock within a week, as funds become available.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Introducing iREIT®

Join iREIT® on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Builders, and Asset Managers. Our iREIT® Tracker provides data on over 250 tickers with our quality scores, buy targets, and trim targets.

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.