Summary:

- Pfizer released a solid set of quarterly earnings last week, with $14.9bn topline revenues and adjusted EPS of $0.82.

- The Pharma giant earned >$100bn from its COVID vaccine and antiviral in 2021, 2022 and 2023, yet still maintains >$60bn of long-term debt.

- Pfizer has spent heavily on M&A and expects to generate >$45bn in new revenues from its current pipeline and product portfolio.

- The planned growth will help the company offset falling revenues from patent-expired products such as anticoagulant Eliquis.

- Management faces some tough challenges and may face questions around how it deployed its COVID cash bonus – these will likely keep the share price weighed down, with resolutions 2-3 years away potentially.

Studio4/E+ via Getty Images

Investment Overview – Where Pfizer Is Concerned, Metrics Don’t Tell The Whole Story

In July 2022, I shared a note with Seeking Alpha readers titled “Eli Lilly’s (LLY) Market Cap Is Higher Than Pfizer’s (NYSE:PFE) – This Anomaly Won’t Last”.

I based this thesis on some reasonably compelling metrics – Pfizer generating nearly four times more revenues than Lilly in 2022, yet enjoying a price to sales of ratio <4x, compared to Lilly’s >10x, and a price to earnings (“P/E”) ratio of ~11x, to Lilly’s ~48x, and with a higher yielding dividend of >3%, compared to Lilly’s 1.2% (at the time).

As most readers may know, however, the reality is that Lilly’s stock price has kept climbing, reaching the improbable heights of $735 per share – up >500% on a 5-year basis – and a market cap valuation of ~$700bn, while Pfizer’s stock price has been in steep decline, falling >25% on a 12-month basis, and reaching ~$25 per share last month – its lowest value since the end of 2012.

The point here is that, no matter how undervalued Pfizer stock may look, its share price seems to keep testing new lows – since achieving a high of >$50 in January 2023, it has been drifting downward and downward, losing half of its value. And, no matter how overvalued Lilly stock seems to be, based on metrics such as size, earnings, and profitability, its stock price keeps rising.

The difference between the two companies can be explained as follows – where Lilly is concerned, the market believes it is buying “jam tomorrow” – what it expects will be revenues in the high double-digit – or possibly even triple-digit – billions from Lilly’s diabetes and weight loss drug tirzepatide – approved to treat type 2 diabetes under the brand name Mounjaro, and obesity, under the brand name Zepbound. The drug’s miraculous ability to help patients lose weight has persuaded Wall Street that it will become an all-time best-selling drug.

Where Pfizer is concerned, it is more a case of “jam yesterday” as the New York based Pharma giant developed an effective vaccine for the pandemic period in Comirnaty that earned >$85bn of revenues in 2021, 2022 and 2023, and an antiviral COVID therapy, Paxlovid, that earned close to $19bn of revenues in 2022, however in 2024, these two therapies are expected to earn “just” $8bn of revenues – and almost certainly less in 2025 and subsequent years.

In Q1 2024 Pfizer reported $354m of Comirnaty sales, and $2bn Paxlovid sales, although the trend is likely to reverse, with Comirnaty expected to drive most of its revenues during the fall vaccination season, and Paxlovid’s unexpectedly strong performance in Q1 due to a favourable revenue adjustment related to US government stock. Pfizer expects comirnaty to earn ~$5bn of revenues in 2024, and Paxlovid, ~$3bn.

In Q1 2024, Lilly’s Zepbound – approved in December last year – earned $517m of revenues, and Mounjaro $1.8bn – which is more or less the same as comirnaty / paxlovid earned for Pfizer – yet the market knows the revenue trajectory of zepbound / mounjaro is only heading upward, and that of paxlovid / comirnaty – almost certainly downward, as demand for COVID vaccines and antivirals is nowhere near as high as during the pandemic, and may never be as high again.

Announcing Q1 2024 earnings, Lilly raised expectations by ~$2bn, to $42.4bn to $43.6bn, while Pfizer upheld its own guidance for $58.5bn – $61.5bn of revenues, and earnings per share (“EPS”) of $2.15 – $2.35. Lilly raised its own EPS estimate for 2024, to $13.50 to $14.

On a forward price to earnings basis, Pfizer’s p/e ratio of ~13x is a much better looking figure than Lilly’s ~54x, although conversely, it might also suggest that Wall Street has high hopes for Lilly’s long-term success, and much lower expectations when it comes to Pfizer.

In summary, after an upbeat set of Q1 earnings, which I will discuss in more detail below, Pfizer stock has finally found some upside – up ~10% across the past week.

That may persuade retail investors that the bear run has finally ended, and that the market has finally seen sense and is ready to buy Pfizer stock on its buy signal metrics, and perhaps sell Lilly stock, as expectations placed upon tirzepatide have become unreasonably high.

Unfortunately, having used this valuation prism in the past, and found it to be an unreliable guide to share price performance, my feeling is that this is not the beginning of the end of the Lilly bull run, nor the beginning of the end of the Pfizer bear run.

Pfizer still has multiple challenges to overcome before it can be considered to be worthy of a major valuation upgrade, and although I do believe these hurdles may be overcome in time, I am not sure there will be tangible enough signs of progress in 2024, or even 2025, to support a significant rise in Pfizer’s share price.

On the plus side, with its dividend yield now having risen >6%, being $0.42 per quarter, if you are holding Pfizer stock, there is a case for looking forward with optimism, while collecting the highest dividend in Pharma, with plenty of time to exit your position in good time if the company fails to meet its targets, which I will also discuss below.

Pfizer – Q1 2024 Earnings Overview – Strong Performance Undermined By Debt

Pfizer generated $14.9bn of revenues in Q1 2024, down 19% year-on-year including comirnaty and paxlovid, but up 11% otherwise. With adjusted cost of sales decreasing 34% year-on-year, to $3bn, adjusted SG&A up 3% to $3.5bn, and adjusted R&D flat at $2.5bn, Pfizer announced reported EPS of $0.55 for the quarter, and adjusted EPS of $0.82 – respectively down by 44%, and 32% year-on-year. A gain of $0.11 of EPS was attributed to the “favorable impact of final adjustment to Paxlovid revenue reversal recorded in Q4 2023”.

Discussing debt in the Q1 2024 earnings call with analysts, Pfizer CEO Albert Bourla commented:

We are committed to de-levering our capital structure with a gross leverage target of 3.25x, which we expect to achieve over time. In support of that goal, during the quarter we paid down approximately $1.25 billion in maturing debt and in May we will pay down another $1 billion of outstanding notes. And, importantly during the quarter, we began to monetize our Haleon stake through an initial sale of $3.5 billion which reduced our equity position in the company from 32% to approximately 23%.

Pfizer reported in its 2023 annual report / 10K submission that it owned 32% of Haleon (HLN), a consumer health business it jointly owned with UK based Pharma GSK (GSK), which has been spun out into its own entity. Haleon’s current market cap is ~$38bn, so Pfizer may well be able to pay down nearly $10bn of debt via this method, plus the company reported $12.7bn of cash and equivalents as of Q1 2024, although its debt pile is substantial – with $47bn of current liabilities reported, and long-term debt of $61bn.

According to the company’s annual report:

In October 2023, following the announcement of the amended Paxlovid supply agreement with the U.S. government and updated 2023 guidance, S&P changed its outlook on our long-term debt to Negative. In December 2023, following the release of 2024 guidance (i) Moody’s downgraded our long-term rating from A1 to A2 and changed its outlook on our long-term debt to Stable and (ii) S&P downgraded our long-term rating from A+ to A and changed its outlook on our long-term debt to Stable

If Pfizer were to default on its debt, it would be disastrous for the company and its valuation, but with the company earning >$3.1bn of net income in Q1 2024, such a default should be considered unlikely – although it ought to be closely monitored – while prospects for further M&A activity look slim. For a company to have earned an additional >$100bn of revenues during the pandemic era, and yet to still have long-term debt >$60bn is arguably a sign of poor financial stewardship.

Besides debt repayment, Pfizer says it returned $2.4bn to shareholders in Q1 2024 via its dividend, and invested $2.5bn in R&D. Management says no share buybacks are planned for 2024, which makes sense, given the generous dividend available.

Aging Product Portfolio Needs Complete Overhaul – Is Oncology The Answer?

The next problem Pfizer has is the patent expiries of several key products. In Q1 2024 its anticoagulant Eliquis earned >$2bn of revenues, while its Prevnar streptococcus vaccine earned $1.7bn of revenues, accounting for a 29% share of total revenues. Both drugs are set to lose their patent protections from 2026, however, allowing generic versions to be marketed and sold. A patent expired drug usually sees revenues decline at a rate of >25% per annum.

Pfizer’s Vyndaqel heart disease drug – which earned ~$1.13bn revenues in Q1 2024, is also facing expiring patents – in 2025 in the US – as is Xeljanz, a former $2.5bn per annum autoimmune therapy, breast cancer therapy Ibrance, from 2027, prostate cancer drug Xtandi, also from 2027, and kidney cancer therapy inlyta. Ibrance, Xtandi, and Inlyta earned respectively $4.7bn, $1.2bn, and $1bn in 2023.

Altogether, I calculate that including Comirnaty and Paxlovid, drugs likely to experience rapidly declining revenues in the latter half of this decade accounted for >70% of Pfizer’s total revenues in Q1.

In order to prevent its top line revenues declining, Pfizer has utilised much of the additional cash gained from Paxlovid and Comirnaty to fund a major M&A spree, and to add new drugs with long-term patent protection possibilities and “blockbuster” (>$1bn per annum) revenue prospects to its pipeline and product portfolio – as I have summarised in previous posts on the company:

Since mid-2021 Pfizer has completed: a $2.3bn deal for Trillium Therapeutics and its 2 CD-47 targeting blood cancer drug candidates; a $7bn deal for Arena Pharmaceuticals and its late-stage autoimmune candidate Etrasimod; an $11.6bn deal for Biohaven and its lead candidate Nurtec, indicated for migraine treatment; a $5.4bn deal for Global Blood Therapeutics and its ~$200m per annum commercial-stage drug Oxbryta, indicated for Sickle Cell Disease (“SCD”), and lead candidate GBT601, which may offer a functional (permanent) cure for SCD; a $525m deal for ReViral and its antiviral therapeutics targeting respiratory syncytial virus (“RSV”), and a $43bn deal for Seagen – the antibody drug conjugate (“ADC”) specialist with 4 approved drugs which drove ~$2bn of revenues last year.

In Q1 2024, the revenue contribution from all these acquisitions came to <$1bn, with Nurtec posting revenues of $178m, Oxbryta, $84m, and the four cancer drugs acquired from Seagen – Adcetris, Padcev, Tukysa, and Tivdak, earned $257m, $341m, $106m, and $28m. Velsipity – the brand name for newly approved etrasimod in ulcerative colitis – is expected to achieve “blockbuster” sales, but its launch is still in progress.

As such, Pfizer’s plan to offset declining revenues from historically lucrative products such as Eliquis, Prevnar, Xeljanz and its cancer drugs, with new revenue streams is a work in progress at best. Besides the acquired assets, Abrysvo, a newly launched respiratory syncytial virus (RSV) vaccine, earned $145m revenues last quarter, while Cibinqo, approved to treat atopic dermatitis last year, earned $42m.

Then there are the expected launches of Ngenla, for growth hormone deficiency, Litfulo, in alopecia, myfembree in endometriosis, a Humira biosimilar, next generation flu vaccine, and a meningococcal vaccine, Penbraya.

These can all be positive launches for Pfizer, but management has set the bar for success high, stating that it expects to drive ~$20bn from newly launched products developed in house, and $25bn from drugs acquired from its respective M&A deals.

A $45bn per annum revenue uplift from new products would more than off-set declining revenues from patent expired products, but the challenge is a tricky one for management to execute.

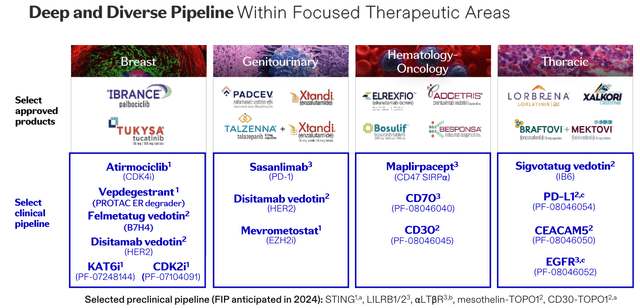

So far, however, we have not mentioned oncology, which is where Pfizer hopes to have the biggest impact over the next decade or so. During a recent Oncology Day, management outlined its plans to have at least eight blockbuster medicines in its oncology portfolio (currently, there are five), to have 65% of its oncology division revenues from biologic drugs, and to be reaching >2m patients (current figure is ~1m).

Pfizer oncology pipeline (oncology day presentation)

As we can see above, Pfizer has multiple pipeline opportunities, that complement existing assets and target large markets such as breast, lung, and leukemia. Each new approval confers a long period of patent protection, and one reason Pfizer may be investing so heavily in the cutting edge, antibody drug conjugate (“ADC”), is its complexity, making it harder for companies to develop biosimilar (generic) forms of the drug.

The likes of lung cancer drug lorbrena and melanoma therapy braftovi are already generating >$100m revenues per quarter, and through its Seagen buyout, Pfizer now has more ADC drugs on the market than any other company.

With that said, my estimate is that Pfizer would like to generate >$30bn in oncology revenues by the end of this decade, making it one of the industry’s biggest players, if not the biggest, and I would harbour doubts that this is achievable given a slight lack of product diversity and a huge spend on a relatively unproven approach in ADCs, albeit one that clearly has significant promise.

Weight Loss Miracle Drug Looking Unlikely

Although Pfizer will feel confident its massive investment in Seagen can pay off through numerous new drug launches and the creation of drug treatment franchises in areas such as breast or lung, the market to be in if you are looking for miraculous share price gains, like those of Eli Lilly, is evidently weight loss.

Pfizer has been attempting to develop its own weight loss drug to take on Lilly’s tirzepatide and Novo Nordisk’s semaglutide, otherwise known as Ozempic / Wegovy in its twin indications of Type 2 Diabetes and Obesity.

Pfizer’s solution is an oral pill, danuglipron, which the company believed could establish itself as a favourable alternative to the injectable Wegovy and Zepbound, however although the therapy showed signs that it could reduce weight, by -6.9% to -11.7%, compared to +1.4% for placebo at 32 weeks, in a Phase 2 study, it had poor tolerability, and when news broke in December last year that the twice-daily pill may be unsafe for medical use, Wall Street sold off Pfizer stock yet again.

Nevertheless, Pfizer’s CEO Albert Bourla remained defiant when challenged about this during the earnings call with analysts – he commented:

I said multiple times that first of all, metabolic is an area that we have traditionally very big strength in terms of research. And this is an area that we have the right to win. So we are strong and to keep investing in the whole area because we have the infrastructure. And obesity is a very big part of it, given the magnitude of the market. So we will be very active in the obesity with current mechanism of actions and new mechanisms of actions.

We said repeatedly that we had 3 agents right now in the clinic, and we have multiple that are pre-clinical that we are progressing. But we don’t have anything to say per se right now because on that you are waiting, some other data and for the other ones, it’s too early to speak about them.

Pfizer has also previously ended development of a once-daily obesity pill lotiglipron, with a similar mechanism of action (“MoA”) to tirzepatide and semaglutide (targeting receptors in the brain that control how full we feel), and it seems hard to believe that if management had some good news on the obesity front, it would be unwilling to share it. Therefore, it may be safest to assume this potentially lucrative avenue for Pfizer is closed, at least for the time being.

Concluding Thoughts – Signs Of Improvement, But Struggles Weigh Heavily On Share Price

Although it may seem surprising that a company such as Pfizer can realise a $100bn uplift in revenues across three years, and emerge from this period with a share price trading at a 10-year low, this is the reality shareholders and potential investors are confronted with.

The saving grace is the dividend, which is surely protected, but with >$60bn of debt to pay down, and having completed an $85bn buying spree, Pfizer must now show that its spent its money wisely and can rejuvenate its pipeline as its best-selling drugs – Eliquis, Prevnar, Vyndaqel, etc. – lose patent protection.

The key opportunity is within oncology, but with management demanding ~$45bn of new revenues from a pipeline and product portfolio that contributed <$1bn last quarter, this challenge may simply prove to be too great, even with the next-generation ADC assets coming through.

Realistically, Pfizer doesn’t look in the race to tackle obesity markets at this stage, with only a couple of high profile clinical study setbacks to show so far. Viking Therapeutics (VKTX) and its GLP-1 agonist candidate might make for an intriguing M&A target, but can Pfizer afford to spend another ~$10bn on a company based on limited, early clinical stage data? It could still be management’s best option.

As such, I’ll conclude this post by giving Pfizer a “hold” recommendation, downgrading my previous “buy” recommendation. There is major surgery going on at Pfizer as management attempts to sort out a Frankenstein’s monster of newly acquired businesses, and products, and to ensure the structure is in place to achieve its plans to maintain revenue and profitability growth. Such a state of affairs rarely makes for a good “buy” opportunity.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.