Summary:

- When I saw Pfizer Inc. stock settling below pre-pandemic levels, I knew the deterioration of investor sentiment has a lot to do with declining Covid vaccine sales. This was expected.

- A deep dive into Pfizer’s financial performance in 2021 and 2022 reveals its non-Covid businesses have failed to meet market expectations.

- Excluding the impact of Comirnaty and Paxlovid sales, Pfizer’s revenue has gone nowhere between 2020 and 2022.

- Pfizer’s core businesses are showing signs of recovery today, but the lack of a catalyst may keep the stock under pressure.

JHVEPhoto

I am not a pharma investor. However, when an opportunity presents itself, I do not hesitate to invest in pharmaceutical companies that I can understand and that I believe are fairly or cheaply valued in the market. Vertex Pharmaceuticals Incorporated (VRTX) is the only large-cap pharma stock in my portfolio today, and I believe the company has a long runway to grow aided by its leadership in the cystic fibrosis treatment market. Pfizer Inc. (NYSE:PFE), arguably the biggest pharma winner of the pandemic, caught my attention recently, with PFE stock falling below pre-pandemic levels.

A close look at Pfizer’s pipeline, recent financial performance, and its valuation suggests the company is cheaply valued today. However, this does not necessarily mean that investing in Pfizer stock today will lead to blockbuster returns in the foreseeable future. In the absence of a major catalyst to improve the market sentiment toward the company, I expect PFE stock to remain under pressure for now.

Is Mr. Market Reasonable To Punish Pfizer?

When I saw PFE stock settling below pre-pandemic levels, I knew the deterioration of investor sentiment has a lot to do with declining Covid vaccine sales. This was to be expected all along, but Mr. Market seems to have punished the company regardless. The first step in this analysis is to identify whether Mr. Market has been fair to push PFE stock below pre-pandemic levels.

For 2020, Pfizer reported revenue of $41.6 billion, which I will use as a reference point for pre-pandemic revenue for the company. We first learned of Covid-19 in December 2019 when China’s Wuhan province reported an outbreak. Almost a year later, Pfizer’s Covid vaccine was approved by the FDA and other relevant authorities across the world. From a financial performance perspective, Covid vaccine sales had a major impact on Pfizer’s revenue since 2021.

Pfizer’s revenue grew exponentially in 2021 and 2022 aided by Comirnaty and Paxlovid sales. For those of you who are not familiar with Pfizer, the company recognizes revenue generated by the Pfizer-BioNTech Covid-19 vaccine, Bivalent, and other earlier versions of the vaccine under Comirnaty. Paxlovid is the trade name for a co-packaged medication that contains antivirals to fight Covid symptoms. The below table summarizes the financial impact of Comirnaty and Paxlovid.

| Year | YoY Increase in revenue | Reported YoY revenue growth | Comirnaty and Paxlovid revenue | YoY revenue growth excluding Comirnaty, Paxlovid sales |

| 2021 | $39.64 billion | 95.16% | $36.78 billion | 6.87% |

| 2022 | $19.04 billion | 23.43% | $56.74 billion | (46%) |

Source: Company filings.

This looks alarming, as the data suggests Pfizer would have gone nowhere in the last couple of years if not for the success of its Covid-19 treatments. To put things into perspective, let’s look at pre-pandemic and post-pandemic revenue. In 2020, Pfizer’s revenue was $41.6 billion. In 2022, Pfizer reported revenue of $100.3 billion, including Covid-19 treatment revenue of $56.74 billion. Excluding the impact of COVID-19-related revenue, Pfizer would have reported revenue of $43.56 billion in 2022, a little over $2 billion compared to 2020.

Now, a rational investor may want to raise an important question. Pfizer’s objective, as a pharmaceutical company, is to develop treatments for illnesses and diseases that threaten humanity. Since Pfizer did nothing wrong by developing a treatment to curb the spread of Covid-19, how is it fair that the company is punished for its success? The answer is simple. The market is forward-looking, and Mr. Market tends to – rightly so – reward companies that generate predictable revenue. This is why subscription businesses often attract premium valuation multiples. There is no denying that Pfizer’s Covid-related revenues are not sustainable, and the market is punishing the company for Pfizer’s lackluster growth in other areas of the business. The company’s performance in 2023, so far, has proved the market correct.

| Reporting period | YoY revenue growth (decline) |

| Q1 2023 | (28.76%) |

| Q2 2023 | (54.1%) |

| Q3 2023 | (41.55%) |

Source: Seeking Alpha.

Given that Pfizer’s revenue is continuing to fall off a cliff and that its core businesses, until recently, did not outperform market expectations, I believe Mr. Market’s reaction is justifiable. I am not saying Pfizer stock will indefinitely trade at these levels, though. The company’s recent performance, as discussed in the next segment, highlights how the core business is now trending in the right direction.

Progress And Risks

To solve the Pfizer puzzle, we need to understand the prospects for both Covid and non-Covid businesses of the company.

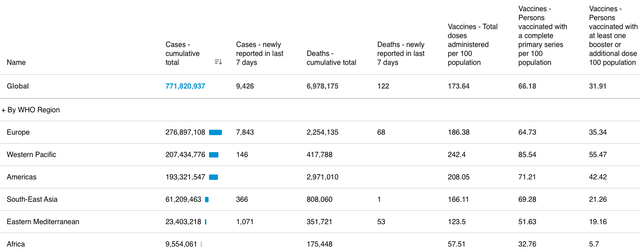

While it is true that Covid-related revenue has declined sharply this year, Pfizer will continue to generate revenue from Comirnaty and Paxlovid in 2024 and potentially beyond. As illustrated below, data from WHO reveals new Covid cases are continuing to grow albeit at a fraction of the pace they did a year ago, and the majority of the population in developing regions are yet to be vaccinated.

Exhibit 1: New Covid cases and vaccination stats

In September, Comirnaty transitioned to a commercially available product in the U.S. and Paxlovid is expected to make the transition by early 2024. Pfizer is yet to officially project 2024 revenues from these Covid drugs, but we do know that the demand is continuing to decline. The U.S. government’s decision to return approximately 7.9 million emergency use authorization-labeled Paxlovid treatment courses to Pfizer by the end of this year (which will force Pfizer to reverse approximately $4.2 billion in associated revenues) serves as a good indication of the diminishing need for Covid treatments at a national level. However, as investors, it is too early to write off Covid-related revenue as the company will generate revenue from these products throughout 2024 even in the worst-case scenario.

Pfizer, having lost more than 40% of its market value this year, is valued as if the company will generate zero revenues from Covid products in the future, which is not true. On the other hand, the massive cash windfall resulting from Covid drug sales deserves recognition too. Pfizer entered 2020 with less than $10 billion in cash, and today, the company carries $44 billion in cash and short-term investments even after aggressively spending on R&D efforts and boosting the quarterly dividend from 34 cents per share in 2019 to 41 cents today.

Moving on to the core therapeutic areas of Pfizer – cardiovascular diseases, rare diseases, vaccines, and oncology – the company is using the aforementioned cash windfall to channel R&D efforts to drive future earnings growth. Pfizer’s pipeline looks strong, with the company making progress on drugs to treat several conditions.

- Respiratory vaccines portfolio: Pfizer’s respiratory vaccines are built on three cutting-edge platforms: mRNA, subunit, and conjugate vaccine platforms. These platforms enable the company to address a range of pathogens, including viruses with relatively consistent season-to-season characteristics, and bacterial infections.

- mRNA flu vaccine candidate: Pfizer has achieved positive results with its first-generation mRNA flu vaccine candidate. In an ongoing Phase 3 trial, the vaccine demonstrated non-inferiority and superiority to a licensed flu vaccine for the 18 to 64-year-old cohort. This represents the first and only demonstration of efficacy and superiority for an mRNA-based flu vaccine candidate. The trial also showed that the vaccine’s efficacy was maintained through the end of the flu season.

- Pneumococcal vaccine: Pfizer is advancing a fourth-generation pneumococcal conjugate vaccine (PCV) candidate. This technology incorporates cutting-edge conjugation chemistry, carriers, and reformulations. In a Phase 1 study, the new proprietary vaccine technologies showed a significant improvement in select serotype immunogenicity. Pfizer plans to move this fourth-generation candidate into a first-in-human trial, expected to begin in the fourth quarter of 2023.

- Other recent approvals and launches: Pfizer has received regulatory approvals for several products, including VELSIPITY for ulcerative colitis and PENBRAYA, the first pentavalent meningococcal vaccine.

Exhibit 2: A snapshot of Pfizer’s pipeline

Pfizer’s core businesses reported 10% operational growth in Q3, which indicates a recovery of the non-Covid business. Investors, however, will have to curb their enthusiasm for continued strong growth in the foreseeable future with Pfizer’s Prevnar vaccine slated to come under pressure in 2024 with the FDA expected to approve pneumococcal vaccines.

A Catalyst Is Missing

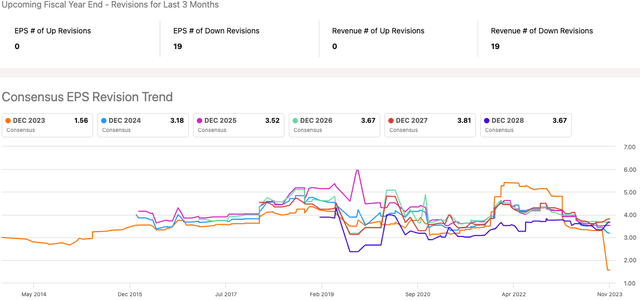

The ongoing weakness in PFE stock has pushed Pfizer into seemingly attractive territory at a forward P/E of 19 and a dividend yield of over 5.5%. However, the company is badly missing a catalyst that could improve investor sentiment. Earnings revisions, which are often predictive of future stock price movements, have trended dramatically lower recently. This is an ominous sign.

Exhibit 3: EPS revision trend

I do not expect a turnaround in the company’s short-term financial performance as well, with Pfizer likely to remain under pressure from worse-than-expected Covid-related revenue.

One potential catalyst is the expected data from phase 2 clinical trials for danuglipron, which is a drug developed for the potential treatment of adults with obesity and Type 2 diabetes mellitus. According to data published by the National Library of Medicine, the phase 2 study was completed on October 11, and analysts are expecting the findings to be published before the end of this year. The weight loss drug market is massive, and Pfizer will have the potential to grab a share of a market that would be valued at close to $100 billion in a few years if phase 2 trial results allow the company to progress to the final stages of the approval process.

For now, investors will have to wait for these trial results in the hopes they will boost PFE stock.

Takeaway

Pfizer’s disappointing market performance in 2023 should not come as a surprise considering the fallout from a two-year period in which the company delivered a blockbuster financial performance thanks to the success of its Covid treatments. In the aftermath of this success, growth challenges in Pfizer Inc.’s core businesses have come to light. Nonetheless, the company is moving in the right direction today and looks attractively priced. But, investors will have to be patient to enjoy meaningful returns as there is no catalyst to drive PFE stock higher.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VRTX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Unlock Alpha Returns With Our Comprehensive Investment Suite

Beat Billions offers a wide range of tools and resources to help you achieve superior investment returns. Our team of expert analysts uncovers undercovered and thinly followed stocks to supercharge your investment returns.

- Access our model portfolios and receive actionable ideas to build a successful portfolio.

- Join our community of like-minded investors and exchange ideas to maximize your investment potential.

- Keep track of the real-time activities of investing gurus.

Don’t miss out on our launch discount – act now to secure your subscription and start supercharging your portfolio!