Summary:

- Pfizer stock is at its lowest price in over 11 years, presenting a potential buying opportunity.

- The company’s valuation is near historically low levels, and consensus analysts expect earnings to stabilize.

- The structure of price on the chart suggests that Pfizer may see a bounce and potentially reach the $36-$44 range.

ChainGangPictures

By Levi at Elliott Wave Trader; Produced with Avi Gilburt

Pfizer (NYSE:PFE) stock has not seen its price this low in more than 11 years. Yes, you read that right – 11 years. But, does that mean that it’s a “Buy” here? Let’s take a look at some fundamental evaluations with Lyn Alden and then what the structure of price on the chart is telling us. Could this be a fantastic buying opportunity or just a value trap that will be dead money for some time to come?

What Is The Current Valuation Of The Stock?

Lyn Alden is world-class in her ability to discern the macroeconomic picture and to separate the wheat from the chaff in multiple companies across varied sectors. Note one of her recent articles to the readership regarding investment strategy. We’re privileged to have her as one of our lead analysts on staff. PFE presents an interesting conundrum though. It is really beyond the scope of most fundamental analysts since one would need a deep understanding of their drug and vaccine pipeline. And yet, we are not left in the lurch. First, let’s examine the company’s current valuation for starters. Here are Lyn’s most recent comments.

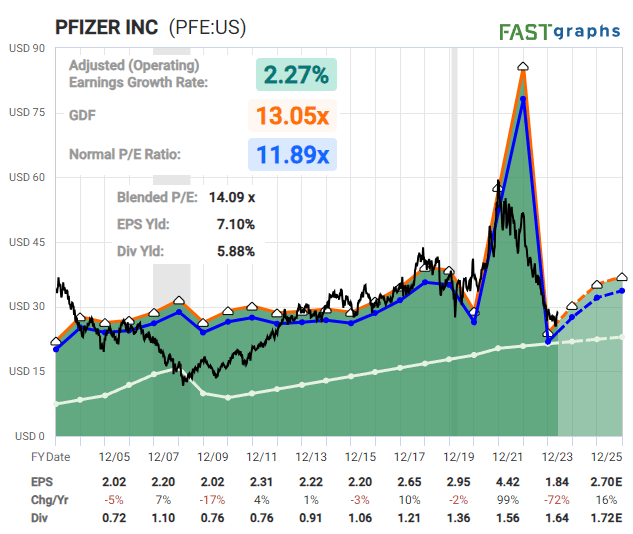

“PFE is interesting in the sense that it’s near the historically low end of its valuation range, which means if they stabilize earnings, this could very well be looked back on as a buying opportunity. However, it would take a deep understanding of their drug and vaccine pipeline to make a fundamental call on that. Consensus analysts indeed expect that their earnings will be finding a bottom around these levels, which if true should be constructive for the long-term price at these valuation levels.” – Lyn Alden

Chart by Lyn Alden – FastGraphs

So, where does this actually leave us?

How Does The Structure Of Price Speak?

Those acquainted with our methodology will know that we use the structure of price on each chart to help us project the most probable path going forward. There is also an alternative path to keep in mind with specific levels that would turn this into the primary scenario. Avi Gilburt writes extensively to the readership about this methodology, explaining the how’s and why’s of what we do. Note a brief excerpt from the recent article penned by Avi entitled, “Sentiment Speaks: The End Of Objectivity In Market Analysis And Potentially The Bull Run Too”.

“As an investor, your job is to objectively understand the market in order to maintain on the correct side of the market action. Unfortunately, most investors follow specious market theories because it makes them feel as though they have a certain amount of control over the market if they can come up with a reason for the market move, no matter how contorted that reasoning may be. Yet, you must come to the conclusion that such control is an illusion, in the same way that much of the analysis leading to such false sense of control is intellectually dishonest.

As for me, I simply apply a mathematically-based approach to the market price action, which tells me rather objectively if my analysis is right or wrong and allows me to adjust rather quickly when I am wrong so that I am not adopting and trading false beliefs of the market.” – Avi Gilburt

How does this help us? Well, let’s apply the mathematics to the PFE chart and let the structure of price speak.

What Is The PFE Chart Telling Us?

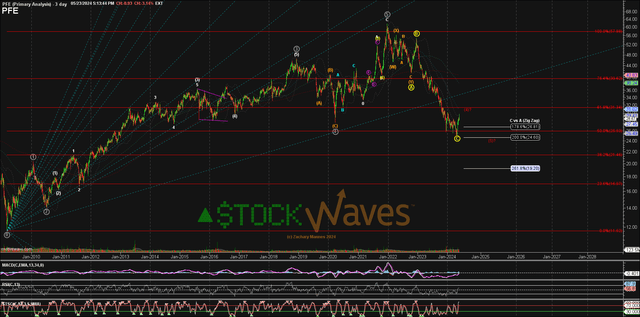

Chart by Zac Mannes – StockWaves – Elliott Wave Trader

If we are indeed at an important low, then we should see price take out the $30 – $33 zone overhead, which is current resistance. Note on this chart produced by our lead analyst, Zac Mannes, that there is also the alternative path which shows a corrective bounce higher followed by one more nominal new low in price.

So, how can we use this information to make a trading/investing decision? Whilst PFE makes up its mind about an important low being in place already or not, keep in mind that it also pays a 5.7% dividend yield at the moment.

Suppose that an investor entered at today’s price in the $28-$29 region. Price could see a corrective bounce into the $30-$31 area before turning back down. If the alternative path plays out, then that would mean a 5th wave down to perhaps the $23-$24 area before finally striking that multi-year bottom it is searching out at the moment.

Or, price has already struck that multi-year low last month at $25.20 and it will break through the resistance at the $30-$33 zone mentioned. In either scenario, we find it likely that PFE will find its footing soon and will bounce to the $36-$44 area or higher.

Conclusion

We view the markets through a probabilistic lens. This means that given the structure of price on the chart, we then display and project what is most probable. However, we also keep in mind that the markets are not linear in nature, rather dynamic and fluid. As such, our view must also update as the price fills in each respective chart.

Please also recognize that this in no way is to say that we do not have strong opinions about the direction we see a chart like PFE is headed. It simply is to acknowledge the changing tides of sentiment. What we really need is a methodology that will rapidly speak to us about the best way to adapt to something that is beyond our control.

I would suggest giving this methodology a fair shake. Why? If you have heard of Elliott Wave Theory, what was the source? Surely, you would want to consult someone who has performed an in-depth study of the how’s and why’s of the method. As well, this comprehensive investigation would be backed up with published studies on the matter and a body of work that shows the utility of said methodology in real-time.

There are many ways to analyze and track stocks and the market they form. Some are more consistent than others. For us, this method has proved the most reliable and keeps us on the right side of the trade much more often than not. Nothing is perfect in this world, but for those looking to open their eyes to a new universe of trading and investing, why not consider studying this further? It may just be one of the most illuminating projects you undertake.

(Housekeeping Matters)

If you would like notifications as to when our new articles are published, please hit the button at the bottom of the page to “Follow” us.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

STOCK WAVES: Where fundamental analysis meets technical analysis for highest-probability investment opportunities! Get leading Elliott Wave analysis from our team, along with fundamental insights and macro analysis from top author Lyn Alden Schwartzer.

“Stockwaves is my bread and butter, and that’s only catching maybe 10% of the charts they throw out! I had 7-10x+ trades with SW last year, and dozens more that were “slackers” (LOL) with “only” 3-4-5x returns. Amazing!” (Nicole)

Click here for a FREE TRIAL.