Summary:

- Pfizer’s Q1 2023 results beat market forecasts, with strong revenue growth and cost management improvements. I think it’s the turning point for PFE stock – read on.

- The company expects continued growth from non-COVID drugs and anticipates significant revenue from Comirnaty and Paxlovid.

- Pfizer’s stock is undervalued compared to its peers, offering a higher-than-average dividend yield and attractive valuation metrics.

- The anticipated dividend stability, recent revenue growth, and effective cost-cutting initiatives may lure back major investors, potentially igniting a resurgence in Pfizer’s stock.

- I have opted to maintain my previous “Buy” rating on the stock.

Massimo Giachetti

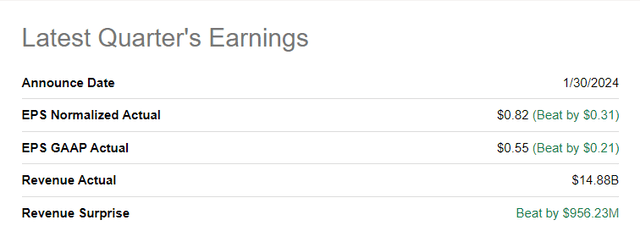

About 3 months ago, I initiated coverage on Pfizer Inc. (NYSE:PFE) stock with a “Buy” rating, stating that the company’s low valuation and strong product pipeline make it the ultimate buying opportunity for income investors in the healthcare sector. Unfortunately, PFE didn’t move much in the first quarter of the year – until the company published its results for Q1 2023 on April 30, 2024, and significantly exceeded consensus estimates:

Strong Q1 results and management comments, which I will discuss in more detail in today’s article, sent PFE up 6% yesterday amid a falling market. I think this move could potentially indicate a breakout and medium-term trend change according to my technical analysis. Please note: The price broke through the 50-day exponential moving average and the downtrend line after forming a classic head and shoulders setup:

TrendSpider, PFE stock, Oakoff’s notes

The market seems to be waking up on Pfizer’s recovery prospects, in my opinion. But most importantly, the main thesis on the potential growth of PFE stock comes primarily from fundamental factors. I propose to discuss them in more detail.

Pfizer’s Q1 2023 Results Review

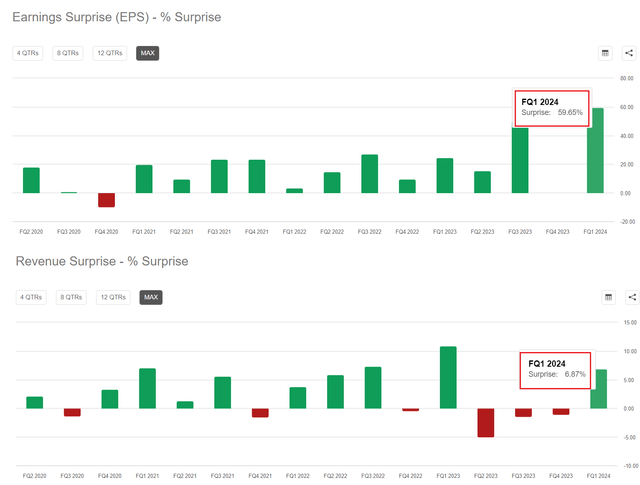

As I showed above, PFE beat market forecasts for earnings per share and revenue – the surprises were 59.65% and 6.87%, respectively, which turned out to be one of the strongest beats in recent years:

Pfizer’s Q1 2023 consolidated revenues amounted to $14.9 billion – that’s a 20% YoY decrease, which was primarily driven by the deterioration in revenues from COVID-19 products such as Comirnaty and Paxlovid. But on the bright spot we see that excluding the impact of these 2 products, the company experienced an 11% operational revenue growth in Q1, showcasing the strength of PFE’s non-COVID product portfolio. Among the key contributors to revenue growth in Q1, we see the recent commercial launches and established brands like the Vyndaqel family, Eliquis, and the Prevnar family. Additionally, strong revenue contributions were observed from oncology products such as Ibrance, Xtandi, Padcev, and Adcetris.

I can’t say exactly how much each of these products contributed to Pfizer’s total revenue in Q1 – as at the time of writing I only have the press release and the latest transcript of the earnings call on hand – but the mere fact that revenue was up 11% without the COVID-related drugs may not make you happy.

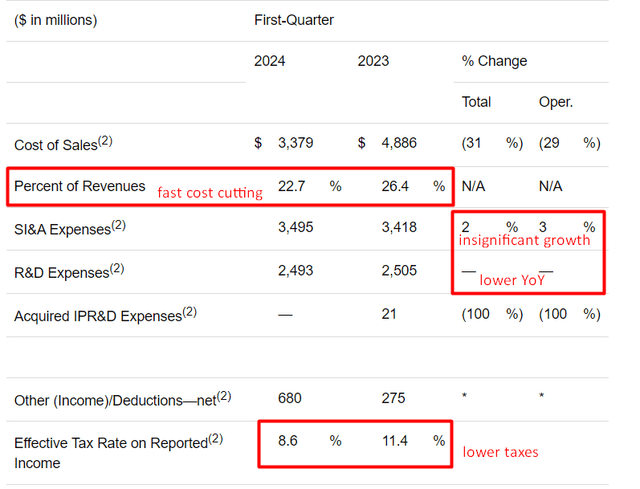

What impressed me most in the Q1 2024 report is the progress the company has made in terms of cost management. We can observe significant improvements in several areas: The ratio of direct costs to sales fell from 26.4% last year to just 22.7% this year – a whopping 370 basis points decline for just 1 single year. In addition, the most important operating costs either fell or experienced minimal increases.

Seeking Alpha, PFE’s press release, Oakoff’s notes

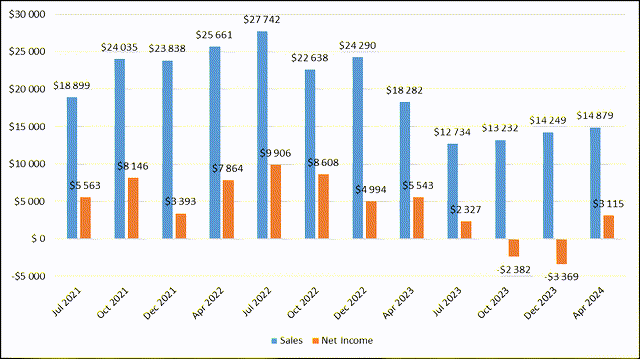

The effective tax rate also fell, which had a positive impact on net profit. So thanks to successful cost reduction initiatives and a more favorable tax rate, Pfizer has finally turned the corner from the losses experienced over the past two quarters:

Oakoff’s work, based on Seeking Alpha, Pfizer data

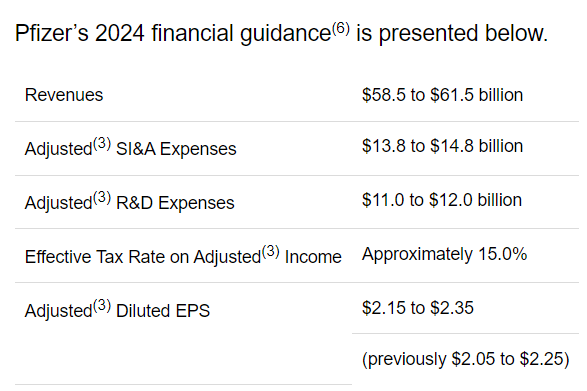

Looking ahead, Pfizer believes that its non-COVID drugs such as Vyndaqel, Eliquis, and Prevnar will continue to gain traction – due to the effective commercialization of these drugs and the continued demand for important treatments in various medical areas, they’re likely to remain popular with patients and healthcare providers. What’s also important: Comirnaty and Paxlovid drugs should together account for ~$8 billion in anticipated revenues for FY2024, according to the press release. With Comirnaty revenues expected to largely occur in 2H 2024, particularly in Q4 due to anticipated seasonality in COVID-19 vaccination demand, Pfizer remains optimistic about achieving its full-year revenue guidance of $58.5 to $61.5 billion. Another crucial point to highlight is that while the company has maintained its initial revenue projections, it has raised guidance on adjusted EPS. This may signal, in my opinion, that PFE’s efforts to control costs are yielding better results than anticipated, surpassing both market expectations and the company’s own projections a few quarters ago.

Seeking Alpha, PFE’s press release

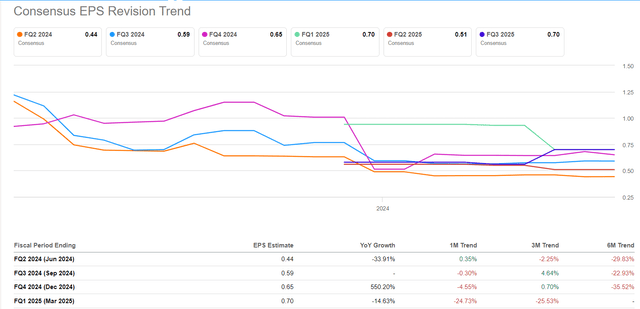

I think this forecast underlines the potential for further cost reductions, which is a good sign for both potential and existing shareholders. With more cost-cutting initiatives in place, I believe Pfizer has a greater chance of exceeding the current market expectations for FY2024 and probably beyond – especially when you consider that Wall Street has been refusing to be more positive on EPS figures for the past few quarters, based on the EPS revisions:

Seeking Alpha, PFE’s EPS revisions

As a preliminary conclusion from my analysis of the latest financial data, I can say that Pfizer has achieved stronger results than many had expected and has thus surprised the market. I anticipate that Pfizer will either succeed in convincing the market or that the company will continue to exceed current consensus estimates for EPS. In both cases, I expect a significant increase in the PFE stock price in view of the oversold conditions formed in Pfizer stock in recent months.

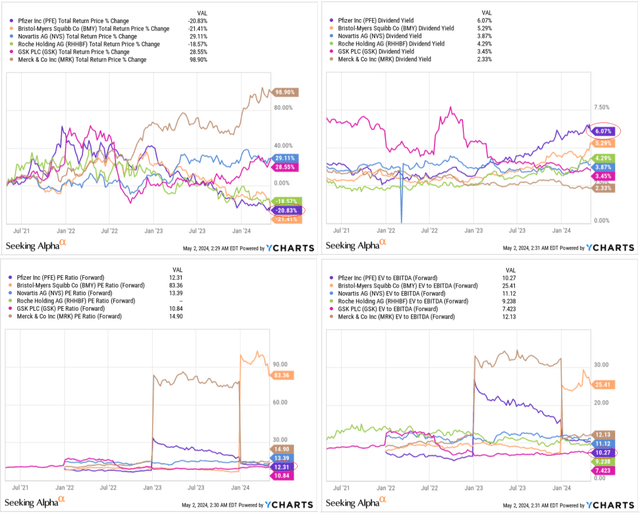

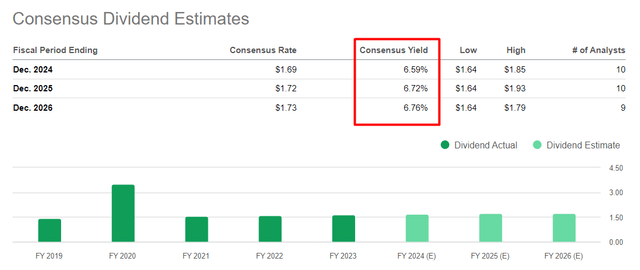

However, predicting stock growth without taking current valuations into account would involve a significant and potentially risky assumption, which I’ll not make in this article. Instead, I suggest you look at how the stock is performing compared to its direct peers. Over the past 3 years, Pfizer’s total return has been similar to that of Bristol-Myers Squibb (BMY) – both companies are considered outliers within the large-cap healthcare sector. But in comparison to BMY, Pfizer boasts a dividend yield ~203 basis points higher when we look at the FWD dividend yield rather than focusing solely on the TTM yield. Another noteworthy aspect is the forward P/E ratio: Pfizer emerges as one of the most attractively priced companies among its peers by this measure. This observation is further reinforced by the EV/EBITDA ratio, where Pfizer trades at approximately 10x, significantly lower – by about 60% – compared to Bristol Myers Squibb:

Buying Pfizer stock today presents a potential investor with the opportunity to secure a dividend yield of >6.5% – this yield is also expected to gradually increase over the next 3 years at least, as estimated by the consensus. Considering the EPS upon which these forecasts are likely based, it’s plausible to suggest that these projections may underestimate the real potential future dividend payouts.

Seeking Alpha, PFE’s projected dividends, Oakoff’s notes

For a variety of reasons, including the company’s persistently low valuation and its improving growth prospects – particularly evidenced by its recent quarter performance – I think that the stock should continue to be rated as a “Buy”.

Risk Factors To Consider With Pfizer Stock

Every potential and existing investor should be very careful with risks surrounding Pfizer to date. One significant concern I have is the impending expiration of patents for key products, which could expose Pfizer to competition from cheaper generic alternatives, resulting in revenue declines. Looking ahead to 2025-2030, Pfizer will confront patent expirations and the loss of exclusivity for products that collectively generated ~$17 billion in peak revenue, according to Argus Research data (proprietary source). This loss of exclusivity could lead to a significant revenue hit unless Pfizer can successfully innovate and bring new blockbuster drugs to market. Also, as you may know well, the pharmaceutical industry operates on long product development cycles, and setbacks in clinical trials or regulatory approvals could delay the commercialization of new drugs, impacting Pfizer’s growth prospects.

Furthermore, like its peers, Pfizer faces risks related to reimbursement coverage for its drugs: Insurers in the U.S. and national health agencies in overseas markets may impose restrictions or deny coverage for certain high-cost drugs, limiting patient access and impacting Pfizer’s revenue streams.

Your Takeaway

I believe that the resurgence of Pfizer’s stock hinges greatly on the shifting market sentiment. Without significant interest from large buyers and institutional investors who would recognize the company’s undervaluation, the stock may struggle to keep the positive momentum we saw yesterday. The return of these major Wall Street players is essential for the stock to initiate a sustained upward trajectory. The combination of attractive dividends, (amid forecasted dividend stability), recent revenue growth in the last quarter, and management’s successful cost-cutting efforts should ideally attract these investors back. I remain hopeful that these factors will indeed catalyze the return of large buyers, which is why I have opted to maintain my previous “Buy” rating on the stock.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.