Summary:

- Pfizer’s depressed valuation and strong product pipeline make it the ultimate buying opportunity for income investors in the healthcare sector.

- Despite a decline in sales of COVID-19 drugs, Pfizer’s operating sales grew by 7% in 2023, driven by new product launches and continued growth.

- Pfizer’s projected EPS growth and anticipated rise in EBITDA margins suggest a positive trajectory for the company’s stock, in my view.

- I calculate a growth potential of 20.8% by the end of 2024 and 50.2% by the end of 2025, based on conservative estimates.

- So I believe investors should consider adding PFE into their long-term portfolio today at the current dividend yield of 6.19% (FY2024 estimate).

Future Publishing/Future Publishing via Getty Images

My Thesis

In my opinion, Pfizer Inc. (NYSE:PFE) stock is the ultimate buying opportunity for income investors seeking exposure to the healthcare sector. This is due to the depressed valuation of the company, which comes from negative market sentiment surrounding PFE. With Pfizer’s product pipeline getting stronger and older drugs continuing to generate good FCF, I believe investors should consider buying PFE for their long-term portfolio today at the current dividend yield of 6.19% (FY2024 estimate).

My Reasoning

In its latest financial report, Pfizer reported sales of $58.5 billion for the full year 2023, a significant decrease of 41% compared to the previous year. This was primarily due to the decline in sales of the COVID-19 vaccine, Comirnaty, and the antiviral drug Paxlovid. Excluding the contributions of these two products, Pfizer actually recorded operating sales growth of 7%, driven by new product launches and continued product growth.

However, reported diluted EPS decreased 93% year-over-year to $0.37 for the full year 2023. This decline was significantly impacted by non-recurring events. Adjusted diluted earnings per share were slightly better, falling 72% year-on-year to $1.84, also due to these one-off events.

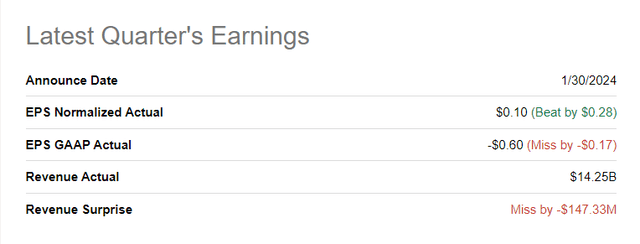

In Q4 FY2023, Pfizer’s revenues amounted to $14.2 billion, a decrease of 41% compared to the same period in FY2022. Again, this decline was mainly due to lower sales of Comirnaty and Paxlovid. Excluding these products, operating revenue increased by 8% YoY in Q4.

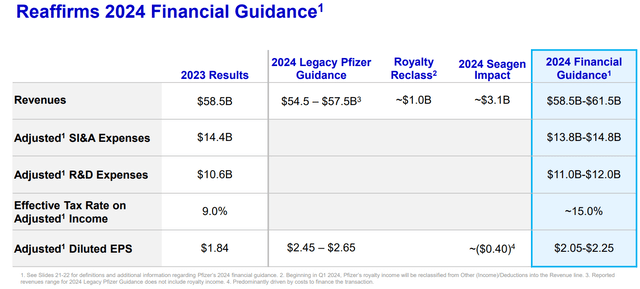

What was a key message in the report, in my view, is the fact that Pfizer confirmed its full-year 2024 guidance and said it expected sales to be between $58.5 billion and $61.5 billion and adjusted diluted EPS to be between $2.05 and $2.25. The company sets a goal to achieve annual net cost savings of at least $4 billion by the end of FY2024 through its cost realignment program.

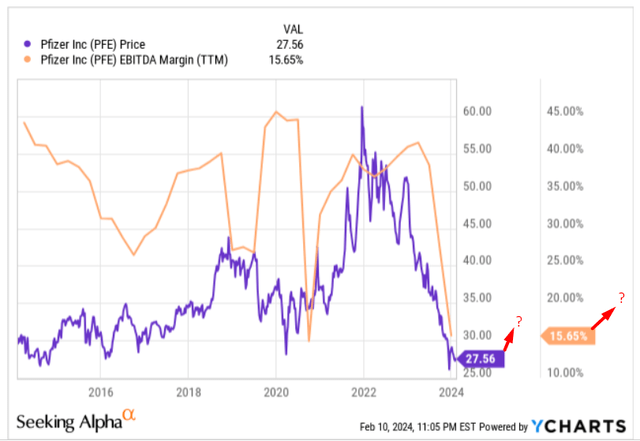

To grasp the potential impact of this development on PFE’s stock performance, one need only examine the relationship between Pfizer’s profit margins and its historical stock price trends. During the height of the COVID-19 pandemic, when Pfizer’s products were in high demand and its margins were robust, investors readily poured funds into PFE. However, as the significance of these drugs diminished, there was a noticeable decline in EBITDA margins, closely paralleling the fluctuations in the stock price. This correlation underscores the critical role that profit margins play in shaping investor sentiment toward Pfizer’s stock.

Hence, regardless of skeptics’ opinions, the projected EPS growth (even if deemed “insignificant” by some people presently) hints at potential improvements in business margins shortly. Currently, we’re hovering at the minimum levels observed since 2020 within the context of the last decade. Therefore, it would require an extraordinary event for PFE to regress further downward – at least, that’s my perspective. With the anticipated rise in EBITDA margins, I believe PFE’s trajectory is inevitably upward-bound.

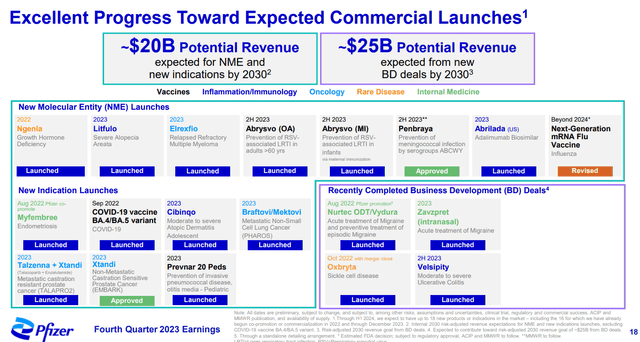

Coming back to the latest reports and news. On the corporate front, Pfizer completed the acquisition of Seagen in December 2023 to strengthen its presence in the oncology sector. I think this acquisition is expected to add four new medicines to Pfizer’s portfolio and strengthen the company’s position in the oncology market.

In addition, Pfizer has made strategic changes to its commercial organization, creating three new divisions to integrate Seagen and increase operational efficiency. These changes are expected to improve focus, speed, and quality of execution and align with Pfizer’s vision for future growth, according to the management’s commentary.

In terms of pipeline development, Pfizer has achieved several milestones in its pursuit of innovative therapies. For example, the company received conditional approval for Elrexfio in the European Union for the treatment of relapsed and refractory multiple myeloma. In addition, Pfizer announced positive progress in the development of various candidates, including marstacimab for hemophilia A or B, Velsipity for ulcerative colitis and vepdegestrant in combination with palbociclib for breast cancer.

From what I see today, all these financial and strategic moves underscore Pfizer’s commitment to overcoming challenges, capitalizing on opportunities, and delivering innovative solutions to critical healthcare needs.

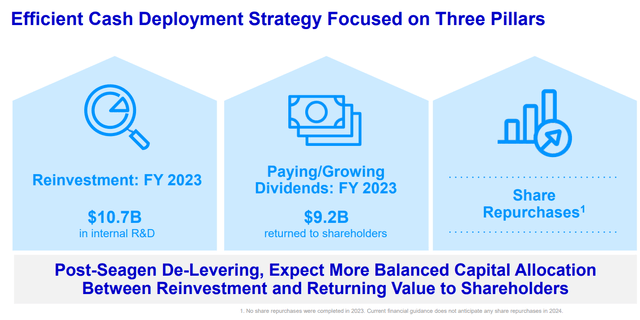

Removing the inevitably declining revenues from COVID-related drugs from the calculations results in a robust large-cap company with an impressive presence in the industry, a substantial moat, and a promising pipeline. Moreover, its shareholder return policy is likely to be the envy and vindication of most other companies in the sector.

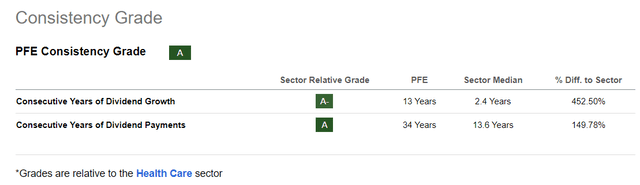

According to data from Seeking Alpha, Pfizer earns an A grade for its dividend consistency, outperforming sector norms. With 13 consecutive years of dividend growth, Pfizer outperforms the sector median by 452.50%. Furthermore, with 34 years of dividend payouts, Pfizer outperforms the sector median by 149.78%, highlighting its robust shareholder value approach and industry leadership.

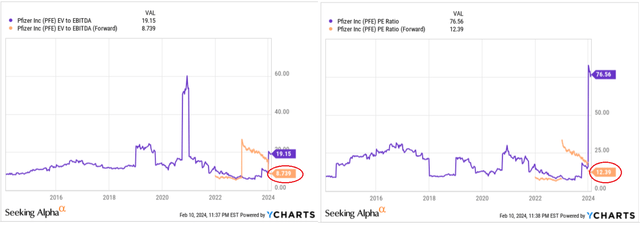

If we look at Pfizer’s valuation, we will see that on a forward basis, the stock is trading at the lower end of its key valuation metrics such as EV/EBITDA or P/E ratio. The TTM ratios seem to be misleading.

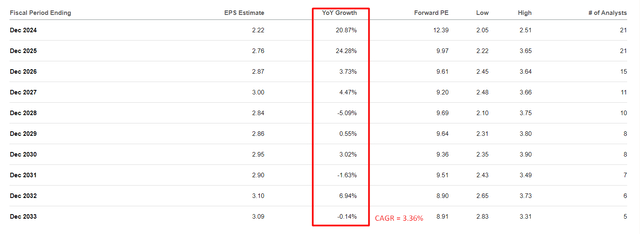

As per Seeking Alpha data, Pfizer is projected to achieve a compound annual growth rate (CAGR) of ~3.36% in EPS over the next decade, following a notable reversal period characterized by growth rates of >20% in FY2024 and FY2025.

Seeking Alpha, PFE’s Earnings Estimates, Oakoff’s notes

Perhaps these predictions are not far from the truth given the pre-pandemic EPS volatility, but in my opinion, the constant decline in the multiple that is priced in today looks overly negative. Assuming PFE continues to pay decent dividends as it has done for the last 30+ years, I don’t see the P/E below the 10-15x range in the next 5-10 years. At the same time, the number of shares outstanding has declined an average of 1.16% per year over the last 10 years, which is fast enough to hope for growth in the company’s multiples rather than contraction.

With a P/E ratio of 15, which is not a very high estimate for PFE in a historical context, the stock should reach $33.3 by the end of 2024 and $41.4 by the end of 2025, representing a growth potential of 20.8% and 50.2% on the current price. Adding dividends to this potential, I think the total return promises to be more than remarkable for income-seeking investors.

Risk Factors

I believe investing in PFE stock carries several risk factors to consider. Firstly, regulatory challenges and changes in healthcare policies can impact Pfizer’s operations and profitability. As an example: In 2009, Pfizer was fined $2.3 billion for illegal off-label marketing of Bextra and paid to resolve claims related to Geodon, Zyvox, and Lyrica. It’s impossible to be sure that this kind of thing won’t happen again.

Additionally, the pharmaceutical industry is subject to intense competition, patent expirations, and the risk of generic drug competition, which can erode market share and revenue. Clinical trial failures or delays in the development of new drugs can also affect investor sentiment and stock performance. In 2025-2030, Pfizer will face patent expirations and the loss of exclusivity for products with a total peak revenue of ~$17 billion, according to Argus Research (proprietary source).

Lastly, unexpected events like natural disasters or global pandemics can disrupt Pfizer’s supply chain and operations, affecting its financial performance.

So investors should carefully assess these risks before investing in PFE stock.

The Verdict

Despite the inherent risks associated with Pfizer, I consider the company to be one of the most financially robust of the major pharmaceutical companies out there. As the pressure of COVID-related drugs on earnings eases due to the high base effect, Pfizer’s growth prospects become increasingly clear. Anticipating the realization of the announced 2024 guidance, I expect Pfizer to attract a greater influx of potential investors drawn to its recovery growth trajectory. At the same time, the company’s ongoing initiatives to reduce the number of outstanding shares, implement post-acquisition deleveraging, and maintain attractive dividend payments increase the company’s attractiveness to investors. At the current valuation, I calculate a growth potential of 20.8% by the end of 2024 and 50.2% by the end of 2025, based on conservative estimates. I, therefore, rate the PFE stock as a “Buy”.

Good luck with your investments!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.