Summary:

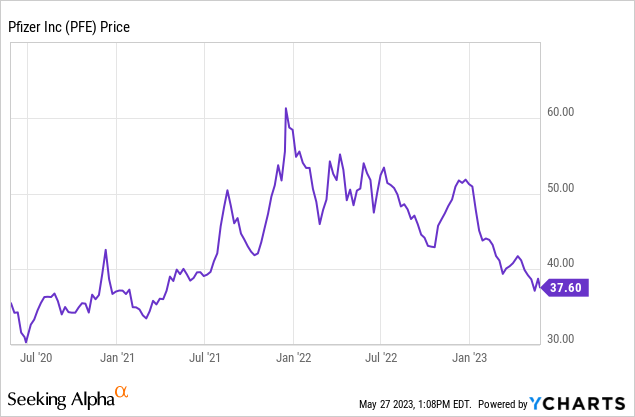

- Pfizer has declined over 36% in the past two years, as investors worry about the company’s growth post-COVID.

- The company’s new oral weight loss therapy recently showed positive phase 2 data and could be a game changer as it targets the massive diabetes and obesity market.

- The current valuation is discounted on a historical basis and should present meaningful upside potential if the new therapy continues to make encouraging progress.

Dan Kitwood

Investment Thesis

Pfizer (NYSE:PFE) has dropped over 36% since reaching its all-time high in late 2021, as investors start to question the company’s future growth prospect after the unprecedented boom of its COVID vaccine. I believe the company’s oral-based weight loss therapy may be the game changer they are searching for. Both diabetes and obesity present massive potential and the success of capturing a meaningful market share should be able to drive solid long-term growth. PFE stock’s current valuation is also very cheap and should present strong upside potential if the new therapy continues to show encouraging progress.

The New Oral Weight Loss Therapy

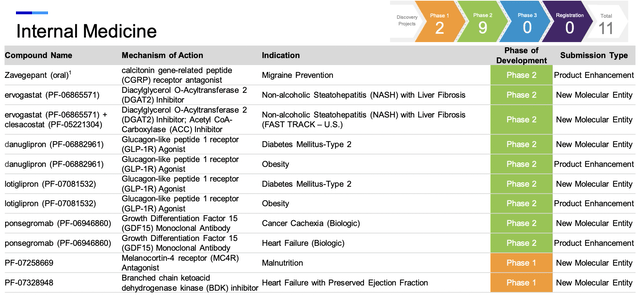

Last week, medical publication JAMA Network published the phase-2 data of Pfizer’s oral small-molecule GLP-1 receptor agonist danuglipron, and the results were pretty encouraging. Type-2 diabetes patients saw a ~2.7% and ~4.9% weight loss following a 120 mg and 80 mg twice-daily regimen at Week 16. According to Reuters, the magnitude of the effect is largely in line with the mid-stage data from Novo Nordisk’s (NVO) injection-based semaglutide, also known as Ozempic when used for diabetes and Wegovy for obesity. The findings are huge as Ozempic and Wegovy are currently the leaders in their own market, with a market share of 44% and 89%, respectively.

The success of Pfizer’s oral GLP-1 receptor agonist danuglipron could potentially grab solid market share as most patients prefer oral-based therapy over injection-based therapy. There will likely still be meaningful competition in oral therapy, as companies continue to try to monetize the massive diabetes and obesity market. For instance, Novo Nordisk is soon launching an oral version of the semaglutide, while Eli Lilly (LLY) is also entering the first Phase 3 trial for its oral GLP-1 agonist orforglipron. Considering the size of the market, I believe there should be more than enough room for 3 players.

Pfizer

Huge Market Opportunities

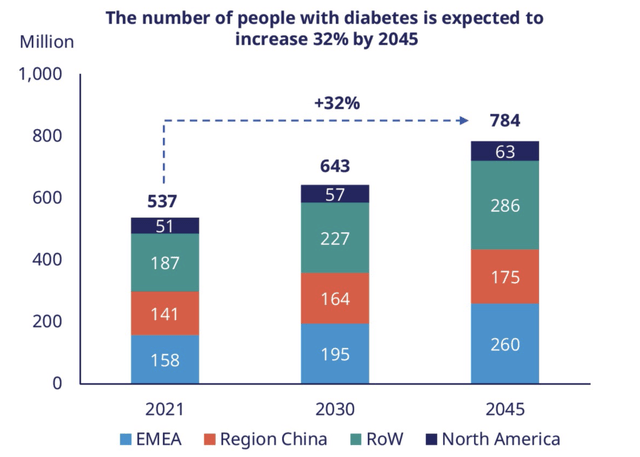

Pfizer’s new drug is targeting diabetes and type-2 obesity, which are two markets with massive growth opportunities. According to Precedence Research, the market size of type-2 diabetes is forecasted to grow from $29.8 billion in 2021 to $61.6 billion in 2030, representing a solid CAGR (compounded annual growth rate) of 8.4%. The market for obesity is slightly smaller but it is expanding at a much faster rate. According to Vantage Market Research, its market size is estimated to grow from $11.6 billion in 2022 to $39 billion in 2030, representing a strong CAGR of 16.3%.

The market expansion is mainly driven by the ongoing increase in obesity cases, which subsequently drive the increase in diabetes cases. Obesity and Diabetes are closely related. For instance, 90% of adults with type 2 diabetes are overweight or obese, according to the Public Health England. People with obesity are also much more likely to have diabetes. The number of obesity cases will likely continue to rise rapidly in the coming decade, mostly due to the lack of physical activity and the wide adoption of high-sugar food. The increasing popularity of trends such as gaming and eating out is only going to further worsen the situation.

Given the deteriorating situation, therapies for obesity and diabetes are highly demanded. The growth potential is clearly demonstrated in Novo Nordisk’s earnings earlier this month. The company’s revenue from obesity care increased by a whopping 131% to DKK 7.8 billion, already accounting for 14.6% of total revenue. The growth is mostly driven by the strong momentum of Wegovy in the US. Sales from GLP-1 diabetes were also extremely strong, up 54% year over year. This was driven by a 60% volume growth in the US GLP-1 market.

Novo Nordisk

Cheap Valuation

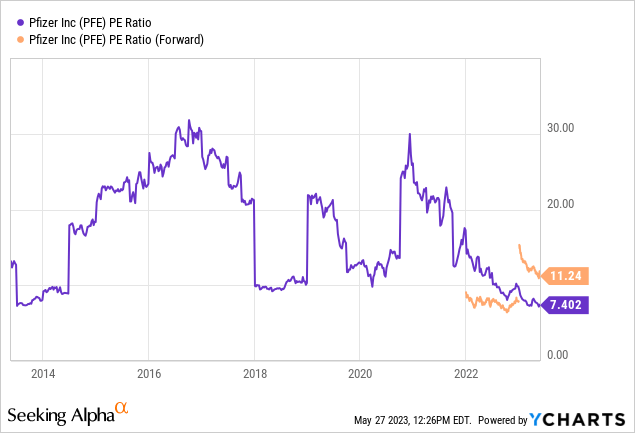

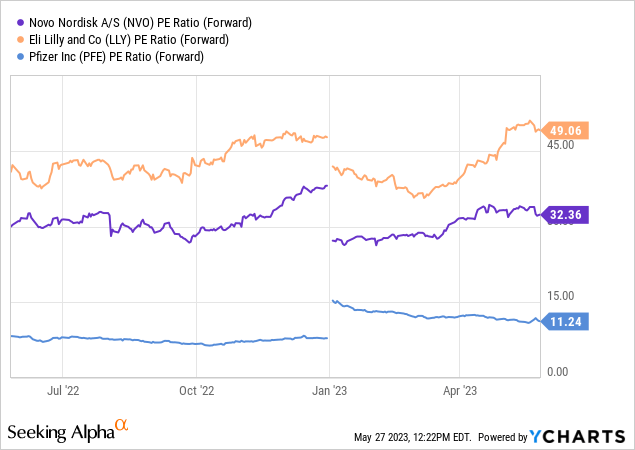

Pfizer’s valuation has come down significantly after the massive drop in share price. The company is now trading at a fwd. P/E ratio of 11.2x, which is very cheap in my opinion (I am using the fwd. P/E ratio in order to account for the huge drop in earnings this year). As you can see in the first chart below, the current multiple has dropped to near the bottom of its historical range, which should offer an ample margin of safety even if the upside does not materialize.

The potential success of its blockbuster drug could also translate to a massive upside revision in its multiples. For instance, major players in the space such as Novo Nordisk and Eli Lilly have seen their multiples expand drastically. As shown in the second chart below, they are currently trading at a fwd. P/E ratio of 32.4x and 49.1x, which represent a premium of 189% and 338% compared to Pfizer. This demonstrates the upside potential Pfizer could see if it continues to make meaningful progress in the space.

Investor Takeaway

There are always risks in relying on the success of a single therapy, but I believe Pfizer’s current risk-to-reward ratio looks compelling. Other than the danuglipron, the company also has another oral GLP-1 in the pipeline called the lotiglipron, which diversifies the risks. With the market still discounting their potential, the success of either therapy should generate explosive upside as the market rerates the company’s valuation to levels closer to Novo Nordisk and Eli Lilly.

Besides, the company pays a solid 4.4% dividend while investors wait for the upside to materialize. It has grown its quarterly payout by 70.8% from $0.24 to $0.41 in the past decade, and I expect the annual raise to continue given the strong cash flow it generates. As mentioned above, the depressed valuation should also provide great downside protection. Therefore, I believe Pfizer is an attractive buy at the current price level.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.