Summary:

- Pfizer’s share price struggles despite a strong asset portfolio and $10 billion annual R&D investment, with significant Seagen acquisition integration ongoing.

- Q3 2024 results show 32% YoY revenue increase, driven by COVID-19 products and 14% growth excluding one-time impacts, with improved margins.

- Oncology revenue up 31% YoY, promising pipeline advancements, and strong vaccine portfolio, including potential Lyme disease vaccine and promising Cachexia treatment.

- Strong shareholder returns with over $7 billion in dividends YTD, $4.4 billion debt reduction, and potential for increased share repurchases in 2025.

georgeclerk

Pfizer (NYSE:PFE) is one of the largest pharmaceutical companies in the world. However, its share price has continued to struggle since our last recommendation here, where we discussed the continued strong assets. The company isn’t a part of the GLP-1 craze. However, that doesn’t mean it doesn’t have an incredibly strong portfolio of assets. On top of this, the company is integrating the large Seagen acquisition, while investing more than $10 billion annualized into R&D, which will support future growth.

Pfizer Q3 2024 Financial Results

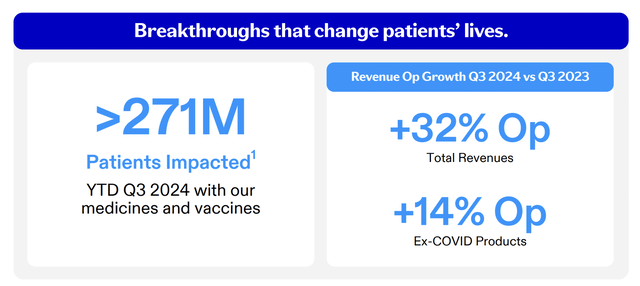

Pfizer continues to be one of the largest pharmaceutical companies in the world with more than a quarter billion patients impacted YTD 2024.

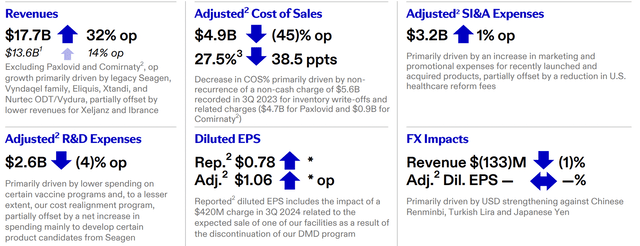

The company increased revenues by 32% YoY, although there were a number of one-time impacts. Not counting a boost in COVID-19 product sales, where the company remains a leader, it saw a 14% expansion in revenue, which is still quite impressive. As we’ll discuss in further detail below, the company also continues to do a fantastic job in its focus on shareholder returns and cleaning up its balance sheet.

The company continues to see revenue primarily driven by legacy products, and it does need to show an ability to maintain and grow revenue with its pipeline. However, the company did achieve strong YoY revenue growth, while improving margins. The company’s annualized EPS moves it into a single-digit P/E ratio including the company’s 2024 FY guidance which indicates how far its share price has fallen.

Pfizer Oncology

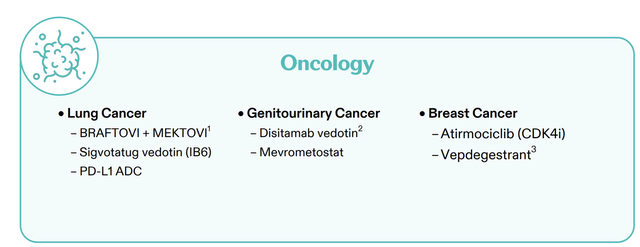

Pfizer saw a 31% increase in YoY Oncology revenues, which is quite impressive for the company, as the 3rd largest biopharma company in the U.S. by revenue.

The company has continued to see substantial growth in a number of drugs all of which have substantial peak sales estimates that could support the company’s continued revenue growth. The company is targeting 8 blockbuster oncology drugs by 2030. The company’s strong Oncology portfolio will be a key factor in its ability to continue its strong revenue growth going forward.

Across Oncology, the company has had a number of pipeline advancements. Of course, taking these drugs all the way through to commercialization is expensive, and a fraction of candidates ever make revenue. However, these drugs have passed most of the initial hurdles with promising results, and we’re optimistic given the company’s overall expertise it’ll be able to continue its success.

Pfizer Overall Assets

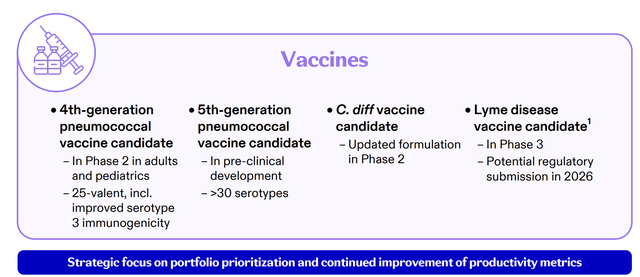

Pfizer also maintains one of the strongest vaccine portfolios in the world, which it’s including to improve.

While vaccines, by nature of their operation, don’t have the same pricing power and revenue potential, the company does have a number of exciting items that show its vaccine expertise. Among these is a potential vaccine for Lyme disease, which could hit regulatory submission in 2026, and be another major successful vaccine that helps the company to prevent what can be a devastating disease.

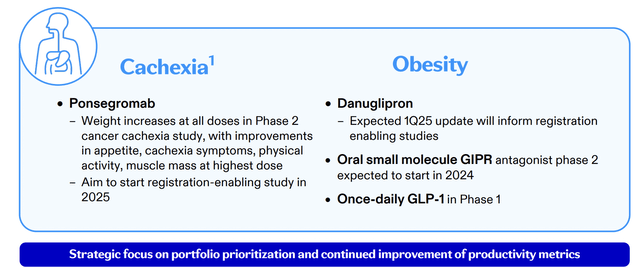

In internal medicine, the company’s Ponsegromab could be a game changer for Cachexia, one of the most harmful side effects of cancer and cancer treatment. Registration-enabling study is expected to start in 2025, moving the candidate into Phase 3, and the Phase 2 data here was incredibly promising. We’re optimistic that this life-saving drug can continue to move forward and succeed.

The company also does have a number of obesity candidates now that that’s the most exciting market. It’s working hard here but whether it can build up the portfolio enough to get substantial revenue in time for the craze remains to be seen.

Pfizer Financial Review

Pfizer, as we discussed above, had strong Q3 earnings and the company’s commitment to overall shareholder returns remains strong.

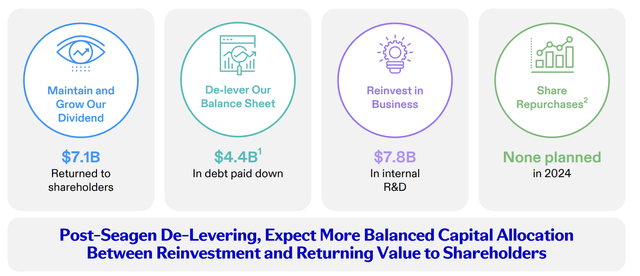

Pfizer has one of the strongest dividends in the pharmaceutical industry whose yield has gone up as the company’s share price has declined. The company YTD has managed to not only provide more than $7 billion in shareholder returns through its dividend, but it’s also paid down $4.4 billion in debt. As the company’s balance sheet improves the company expects to drive further shareholder returns.

For perspective, the company’s dividend yield is the highest in its peer group of the 5 largest pharmaceutical dividends. Its 6.6% yield compares to 3.4% for Johnson & Johnson, 3.8% for AbbVie, 3.2% for Merck, and 3.8% for Roche. Its yield is almost double the average.

The company has no share repurchases planned in 2024. However, we would like to see it change things up and ramp up shareholder returns in 2025 through repurchases, given its current lower share price.

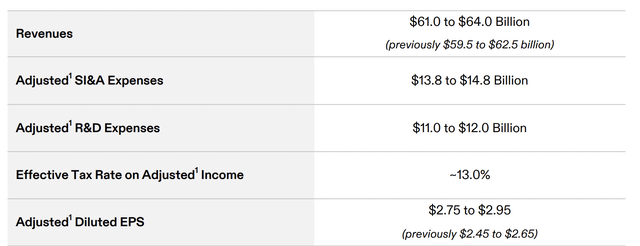

The company’s guidance indicates a strong year, partially supported by continued Paxlovid (COVID-19) drug revenue estimated as a $1.2 billion revenue one-time benefit for 2024. The company is now guiding for $62.5 billion of revenue at its midpoint, at the top end of its prior guidance, with adjusted diluted EPS now coming at $2.85/share, above its prior guidance.

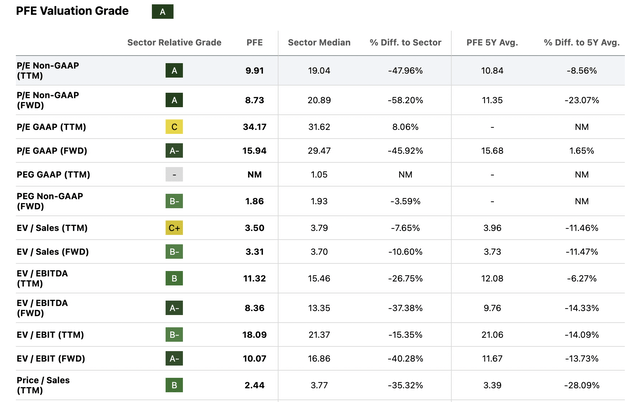

That puts the company at a P/E ratio based on adjusted diluted EPS of <10. While recent historic comparisons are difficult due to how much the company’s earnings fluctuated as a result of COVID-19, long-term S&P 500 returns are ~10%. Growing earnings, with a P/E of <10, means a comfortable ability to beat 10% returns and the market’s long-term returns.

For perspective on valuation, versus the company’s 5Y average, the company is lower valued based on nearly every single metric. This is despite the fact that the 5-year period consists of COVID-19 where the company had substantial one-time revenue and earnings from various treatments and drugs that are not long-term, hence a lower valuation multiple.

Thesis Risk

The largest risk to our thesis is that Pfizer operates in the incredibly expensive and complicated pharmaceutical industry that tends to also face more controversy due to its status of profiting off of health. Not only does the company have more government risk, but it spends $10+ billion on R&D per year and might regularly spend $100s of millions or even billions on a product that ends up worthless. At the same time, patent expirations limit the value of existing products.

That could hurt the company’s ability to continue its long-term shareholder returns.

Conclusion

Pfizer is in a tight spot with a number of major drugs hitting patent expirations, which has put the company at a single-digit P/E ratio and pushed its dividend yield past 6.5%. There’s simply not a lot of excitement around the company. However, the company is building an impressive portfolio of assets, with an oncology business twice as large as Seagen.

The company expects this pipeline to provide more than $10 billion in fresh revenue by 2030 and is now chasing the excitement of GLP-1 drugs. These should help to mitigate most of its revenue loss. The company’s cash-based Seagen acquisition helped its balance sheet, and the company is cleaning up its debt portfolio. That will help drive substantial shareholder returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.