Summary:

- Pfizer’s stock initially showed signs of recovery, but then stagnated while the rest of the market continued to grow. However, I expect a recovery in the medium term.

- The Company’s Q1 results showed strong performance in non-COVID products and cost-saving measures, leading to analyst sentiment improvement.

- The recent Wall Street earnings estimates indicate that the Street expects PFE to bottom out in FY2024 in terms of EPS and that fundamentals will then rebound.

- Despite risks like patent expirations, Pfizer’s undervaluation by at least 36.7% and growth opportunities make it a good long-term investment.

- The reversal should keep going, hence my “Strong Buy” rating.

no_limit_pictures

Into & Thesis

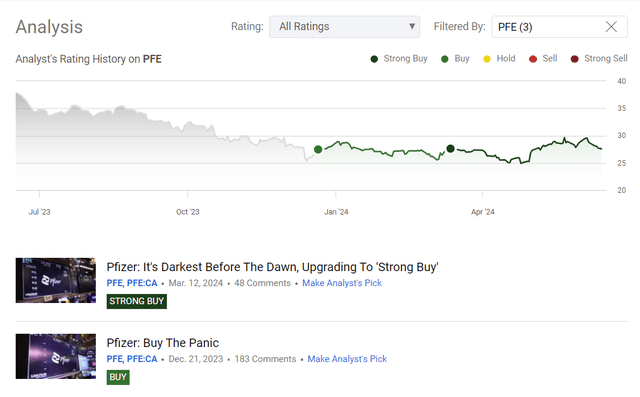

I reinitiated my coverage of Pfizer Inc. (NYSE:PFE) stock at the end of December 2023. Since then, I have published only two articles, which, unfortunately, haven’t proven effective in terms of performance: PFE’s total return has remained stagnant, hovering around 0% over the past few months, while the S&P 500 index (SP500) (SPX) has reached new all-time highs.

Seeking Alpha, my coverage of PFE stock

Despite another attempt by the stock to go back down after bouncing off the lows of ~18% since late April 2023, I think the recovery in PFE stock should continue in the medium term.

Why Do I Think So?

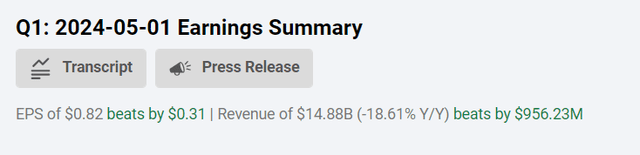

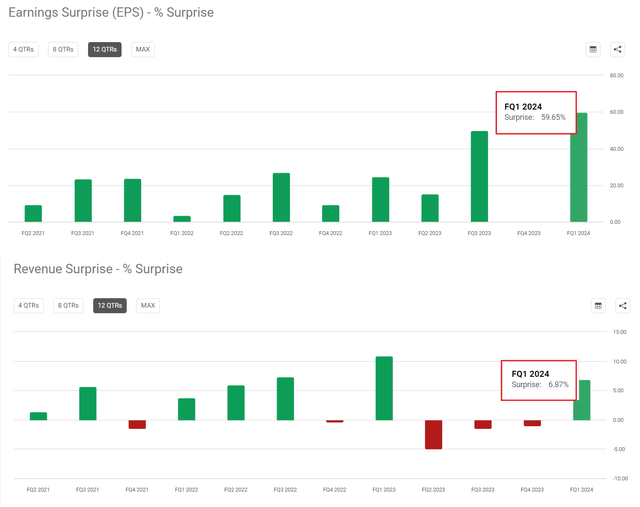

Pfizer’s Q1 FY2024 results came out on May 1, 2024, revealing revenues of $14.9 billion, which was a 19% YoY decline primarily due to lower revenues from its COVID-19 products (Comirnaty and Paxlovid). As a result, the company’s adjusted diluted EPS came in at $0.82, that’s 33.3% lower than in Q1 FY2023. However, on the bright side, I should say that PFE actually beat both the top-line and bottom-line consensus estimates, and the amount of the beats was exceptional in both cases.

Seeking Alpha, PFE Seeking Alpha, notes added

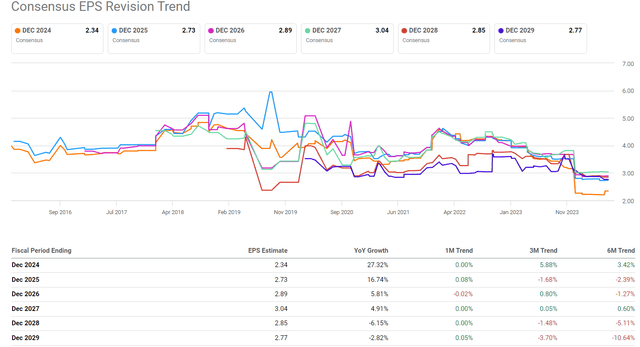

What caught my eye is that Pfizer’s non-COVID portfolio showed strong performance, growing 11% YoY operationally. The drop in EPS was also not as bad as many expected, thanks to the favorable impact from a final revenue adjustment related to Paxlovid (this adjustment boosted the overall earnings, highlighting the successful transition of Paxlovid into the commercial marketplace in the U.S.) What I really wanted to see is that Pfizer clearly showed it was making good progress on its cost realignment program, aiming to achieve at least $4 billion in net cost savings by the end of 2024. Yes, revenue fell by 19.5% YoY, but the cost of sales fell by 30.8% against this backdrop, which significantly mitigated the decline in EBIT in the period under review. Of course, PFE still has a lot of work to do in this area, but recent Wall Street earnings estimates indicate that the Street expects PFE to bottom out in FY2024 in terms of earnings per share and that fundamentals will then rebound.

Seeking Alpha, PFE’s EPS revisions

During Q1, Pfizer also restructured its commercial organization to better integrate the recent acquisition of Seagen and improve operational focus (changes included the creation of separate divisions for the oncology and international commercial operations). This restructuring is aimed at streamlining Pfizer’s operations and improving the company’s ability to execute its growth strategy more effectively, and I think that thanks to this the cost management process will be smoother and more stable going forward.

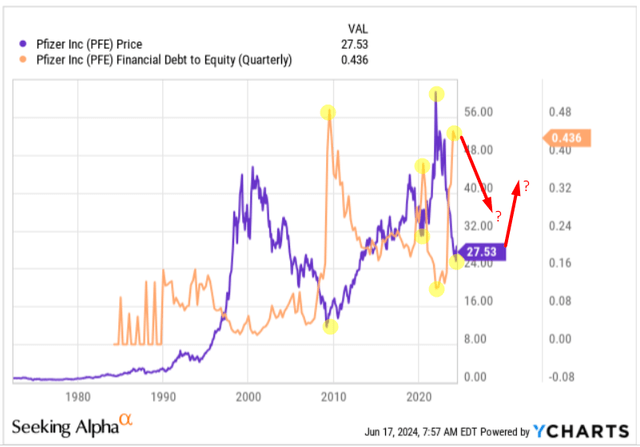

PFE’s balance sheet looks solid to me, although cash and short-term investments were down ~6% in the first quarter and cash flow from operations was down 10%. The company’s debt-to-equity is currently at a long-term high, but if we take a look at history, this high has typically coincided with PFE’s low:

YCharts, the author’s notes added

Why so? I can only assume that with the acquisition of large targets (such as Seagen), PFE’s leverage increased slightly, which in the eyes of market participants represented a greater risk due to uncertainty, which in turn led to sell-offs. However, as the acquired companies were integrated into a consolidated new ecosystem, Pfizer repeatedly emerged from this situation as a larger and more powerful company, forcing the market to reconsider its view. Now, it seems to me, we are in the midst of a similar story: the integration of Seagen’s assets into the PFE structure has only just begun, which has increased the existing risks of losing a significant portion of revenue from declining COVID-related drug sales. I expect this market anxiety to stabilize over time because, in addition to the cost savings and growth opportunities resulting from the Seagen deal, Pfizer is doing a lot to expand its pipeline across the board.

As shown in PFE’s first quarter operational data, the company’s non-COVID product portfolio showed impressive growth, with the Vyndaqel product family standing out with 66% operational growth and Eliquis with 10% growth. The Prevnar product family also recorded operational growth of 7% YoY, driven by “strong demand in both the pediatric and adult markets.” Some recently acquired products like Nurtec and Oxbryta had modest performance, but it was mainly due to seasonal declines in net sales. Also, despite initial challenges with its RSV vaccine Abrysvo capturing market share, Pfizer expects this product to become a significant contributor in 2H FY2024 (Abrysvo vaccine shows promise with positive phase 3 results for adults aged 18 to 59, potentially expanding its market and driving revenue growth in 2025 and beyond).

Also, important to note: Pfizer is focusing on its obesity candidate, danuglipron, which can potentially bring a lot of value to shareholders like Eli Lilly’s (LLY) famous drug did recently. Despite the disappointing results of the twice-daily formulation, Pfizer is developing a once-daily version and expects to release an update soon. Another Seeking Alpha analyst, ONeil Trader, recently wrote that although expectations are low given past issues with efficacy and tolerability, there’s potential for market uptake if the new formulation proves to be well tolerated. In addition, Pfizer is exploring external collaborations, such as its recent partnership with ProFound Therapeutics, to identify new protein therapeutics, demonstrating its commitment to expanding its pipeline and exploring new therapeutic avenues.

As Seeking Alpha reported recently, Flagship Pioneering’s units, Pioneering Medicines, and Profound Therapeutics will collaborate with Pfizer to identify next-generation obesity drug candidates, marking the first project under their strategic partnership, with Pfizer having the option to advance selected programs. So I believe that Pfizer’s efforts in this particular area will ultimately be successful at some point.

Having said all that, let’s see how the valuation of Pfizer stock supports my overall optimistic view.

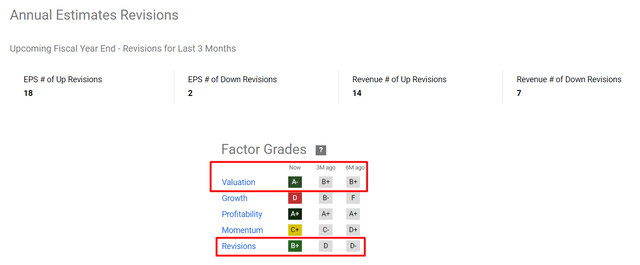

As I mentioned earlier, a relatively strong first quarter has led Wall Street analysts to raise their estimates. According to Seeking Alpha Quant System, the Revisions rating has improved to ‘B+’ from a ‘D’ rating 3 months ago – this shift indicates that analyst sentiment has started to improve.

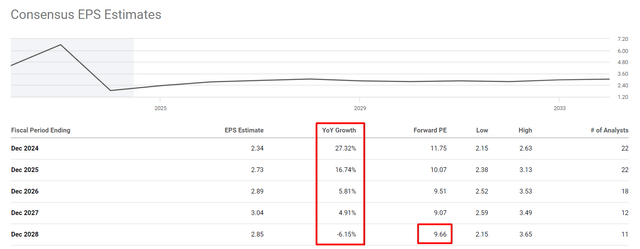

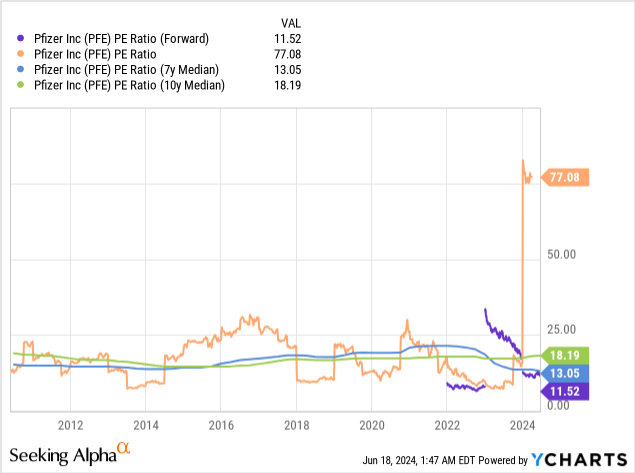

The consensus data now shows an implied EPS CAGR of +4.02% for the next 5 years, with an exit P/E multiple in FY2028 of only 9.66x. However, this growth rate is lower than 3 months ago, although the first quarter was better and with a higher margin than analysts had expected.

Is this 9.66x P/E multiple high or low for a company in 5 years from now? In my opinion, Pfizer stock looks incredibly cheap right now: Even if we consider 2024 as the bottom year for the company in terms of its earnings dynamics, this multiple remains extremely low. In fact, it’s approximately 36.7% lower than the company’s ten-year median.

Even the most pessimistic Wall Street forecast gives an implied P/E ratio of 12.55 for FY2024, which is still very low. In my opinion, the market just needs confirmation from the company that its cost optimization efforts are really taking off and that revenues are moving in the right direction. If this is the case, I believe PFE will return to its average historical valuation level of 13-18x P/E. If my conclusion of an average multiple of 15.5x holds true until the end of FY2025, then even with the most pessimistic current forecast of EPS at $2.38 (for FY2025), we arrive at a target share price of $36.90. This represents a 36.73% upside potential from the current price.

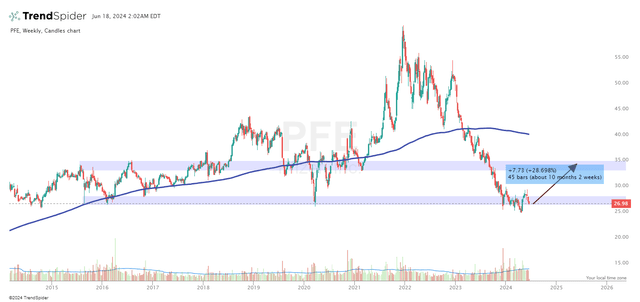

My technical analysis supports the above conclusions, albeit in a somewhat more modest form. The weekly chart shows that the price is consolidating around a very strong support zone and has recently tried to break out to the downside. However, given Pfizer’s cheap valuation and improving business indicators, I expect the stock to hold its position within this support zone and possibly rise to the nearest resistance zone (at least), which is about 25% to 30% above current levels.

TrendSpider Software, PFE weekly, notes added

The reversal should keep going, in my view.

Where Can I Be Wrong?

I regularly read investment banks’ research reports on various companies, and Pfizer, as one of the industry leaders, is often the subject of analysis. BMO (proprietary source), for example, while coming to similar conclusions as me and seeing upside potential of ~39% from the current price, also notes that Pfizer stock could fall to $22 if the company’s oncology business grows 20% less than they expect, driven by greater-than-expected erosion from loss of exclusivity (LOEs) and weaker uptake of new products. They additionally fear that the vaccines segment could experience over 30% lower growth due to intensified competition from Merck (MRK) in the pneumococcal disease market, potentially slowing Pfizer’s overall vaccine growth significantly.

Indeed, Pfizer faces several risks, including patent expirations for key products, long product development cycles, and various political and regulatory hurdles. According to Argus Research (proprietary source), between 2025 and 2030, the company will face patent expirations and loss of exclusivity on products that generate peak sales of around $17 billion, which is a lot. This risk clearly weighs on the current valuation, and it’s uncertain whether it will improve soon. Current forecasts may be overestimated and unrealistic – anyone considering buying Pfizer stock today should be aware of this.

The Verdict

Despite the many risks I mentioned above, such as competition, patent expirations, and the cyclical decline in demand for certain vaccines, I still believe Pfizer remains one of the most important biopharmaceutical companies in the world. Pfizer’s valuation is currently near its historical lows, but past performance since the 1990s shows that such moments are often ideal entry points for buyers. The company is charting a new path to recovery by improving operational efficiency, reducing leverage, and exploring new growth opportunities.

According to my calculations, the stock is undervalued by at least 36.7%. Given the recent acquisitions, management plans, and the stock’s valuation, I believe those looking to buy and hold Pfizer stock for longer than 5 years have little to worry about. Today, I remain optimistic about Pfizer’s long-term future, expecting the continuation of PFE’s reversal.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PFE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!