Summary:

- I upgrade Pfizer to “Strong Buy” due to its undervaluation, strong pipeline, and operational growth despite recent stock price declines.

- Pfizer’s Q3 FY2024 earnings showed significant revenue and EPS growth, driven by COVID-19 therapies and oncology products, indicating robust strategic execution.

- The company’s diversified portfolio, including successful vaccines and promising new drugs, positions it for long-term success and potential stock price re-rating.

- In the coming 2–3 years, I expect a 30-60% upward re-rating of PFE stock price to close the undervaluation that has developed over the last few months.

georgeclerk

Intro & Thesis

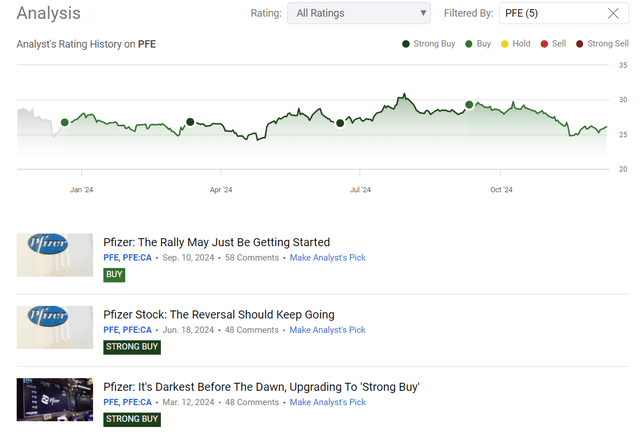

I reinitiated my coverage of Pfizer Inc. (NYSE:PFE) (NEOE:PFE:CA) stock at the end of December 2023 with a “Buy” rating, when the stock was trading at $27.86 apiece. Since then, I have published 4 more bullish articles, stating that PFE’s operational growth (excluding COVID sales) was getting better so amid rising margins and management’s guidance the stock looked like a steal. Unfortunately for my bullish calls, Pfizer stock kept falling – now it’s trading at just $26.1/share, significantly underperforming the broader market:

Seeking Alpha, my coverage of PFE stock

Despite the disappointing performance of Pfizer’s stock price as of late, I believe that the continued decline in the nominal price makes the stock increasingly attractive, as the company’s fundamentals give hope for an improvement shortly. The steep decline in COVID-related peak sales appears to be stabilizing, setting the stage for a potential rebound as the business recovers, leaning on the lower base already formed. For this reason, I view the more than 9% year-to-date decline in Pfizer’s nominal stock price as a golden buying opportunity for value-oriented investors. I upgrade my “Buy” to “Strong Buy”.

Why Do I Think So?

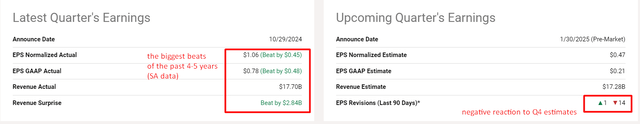

Pfizer actually had an upbeat Q3 FY2024 earnings report showing total revenues of ~$17.7 billion (>$2.8 billion more than was expected by Wall Street) with operational growth of 32% compared to last year thanks to robust demand for its COVID-19 therapies Paxlovid and Comirnaty, as well as strong contributions from its oncology pipeline and other major offerings, according to the press release. PFE’s adjusted EPS was $1.06, $0.45 higher than the consensus estimate, and a significant improvement from $0.78 last year. I believe this performance was a piece of clear evidence that Pfizer can deliver on key strategic priorities – cost reduction, pipeline development, and commercial excellence. However, the analysts lowered their estimates, seemingly anticipating continued pressure on consolidated revenues from COVID-19 vaccines and upcoming patent expirations for some key drugs.

Overall, however, I think the company’s drug portfolio looked more than solid in Q3 2024.

The oncology division was the breakout star with 31% YoY growth, driven by demand for old Pfizer products and those acquired in the Seagen merger. XTANDI, which grew 28% YoY, and TALZENNA, which increased by 77% YoY, showed statistically significant overall survival benefits in metastatic castration-resistant prostate cancer and made Pfizer the leader in the treatment. What’s more, the release of PADCEV with pembrolizumab for advanced bladder cancer has gone viral and is the most common first-line therapy for metastatic urothelial cancer in the US. Other notable contributors were LORBRENA, with a 31% YoY operational increase in thoracic cancer, and ELREXFIO, with 80% sequential growth in revenue due to the good take up in multiple myeloma treatment.

Also, some good news came from Pfizer’s vaccine portfolio, with Prevnar 20 taking both pediatric (83% share) and adult (97% share) market leadership. The Advisory Committee on Immunization Practices’ proposal to broaden the adult pneumococcal vaccine to all 50-year-olds and older will also spur expansion, the management said on the earnings call. And so has ABRYSVO, Pfizer’s RSV vaccine, with large market share gains in the U.S. and exciting potential in the international market. The FDA approval for ABRYSVO in patients 18-59 with a high risk of RSV-associated disease should help the firm extend its market reach as well. So I think all of these developments point to how Pfizer is able to use its vaccine know-how to grow its market leadership in this field.

Pfizer’s non-COVID portfolio expanded operationally by 14% thanks to strong results from Nurtec, Eliquis, and Vyndaqel. Particularly, Nurtec increased total prescriptions by 28% as the company is at the top of the oral CGRP class for migraine. Vyndaqel drove 63% operational growth thanks to “more healthcare provider adoption and greater patient reach.” But a suspension of Oxbryta (a treatment for sickle cell disease) caused a $0.30 headwind to Pfizer’s full-year EPS guidance, demonstrating the difficulties of operating a broad portfolio – that’s primarily the reason for the Q4 Wall Street revisions as far as I understand.

As of note, Oxbryta has been a significant addition to Pfizer’s portfolio after it acquired Global Blood Therapeutics in 2022, but in reality, it brought in just $328 million last year, which is 0.52% of the sales projected for FY2024. The overall impact of the suspension seems to be minimal, in my view, especially taking into account the fact that Pfizer has a large list of new drugs to add in the next few years – they’re likely to offset this headwind relatively quickly, in my opinion.

PFE’s pipeline, IR materials [Q3 FY2024] ![PFE's pipeline, IR materials [Q3 FY2024]](https://static.seekingalpha.com/uploads/2024/12/10/49513514-1733820453859935.png)

Talking about Paxlovid and Comirnaty – PFE’s COVID-19 medicines – the firm made ~$2.7 billion and $1.4 billion in revenues from them in Q3, respectively. So these two drugs are still huge revenue generators, but their numbers have stabilized in a new predictable endemic market – this stability allows Pfizer to get to work on its portfolio and pipeline I presented above.

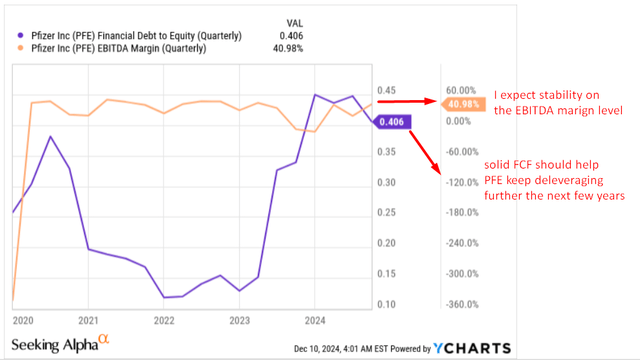

I like Pfizer’s balance sheet: the firm has reduced gross leverage by roughly $4.4 billion in the first half of the year and sold some of its Helion shares for $6.9 billion in net cash proceeds. This systematic capital allocation keeps Pfizer able to fund R&D, sustain its dividend, and seek opportunities, as the management noted. However, there will be no share repurchases this calendar year as the company is looking at debt reduction and investing back into its business. I think this is one of the main reasons why the stock kept falling – it had no support from buybacks. On the other hand, Pfizer’s FCF generation is still an important strength, as it can fund its bold R&D program and bolster shareholder returns once it’s done with deleveraging.

The company has spent over $75 billion in its own R&D so far since 2018, so the drugs pipeline under its belt should be extremely moaty. Lately, they started Phase III trials for multiple oncology assets, including PD-L1 ADC and next-generation ADC candidates for lung cancer. There is also the Pfizer obesity portfolio with danuglipron, an oral GLP-1 receptor agonist, and other late-stage options looking at solving the obesity crisis (a huge market to operate on).

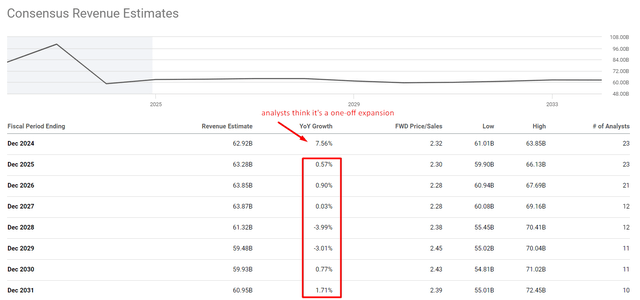

Pfizer’s management now estimates FY2024 revenue of $61-64 billion (previously $59.5-62.5 billion) and adjusted EPS of $2.75-$2.95 (up from $2.45-$2.68 previously), which comes from the excellent performance of its COVID-19 products and modest upside in the non-COVID business. Management is also continuing to focus on its late-stage pipeline, cost optimization, and therapeutic expansion for FY2025 and beyond. Surprisingly, analysts are much more pessimistic about PFE’s prospects than management – the increase in sales in FY2024 is priced in as it’s a one-off event:

Seeking Alpha, PFE, notes added

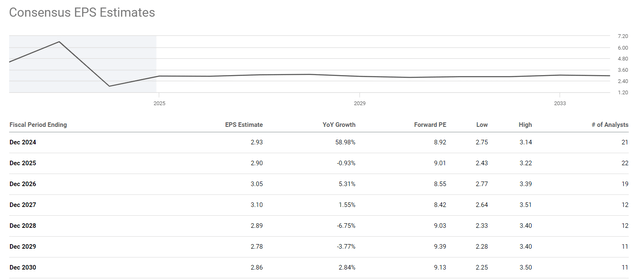

PFE’s EPS estimates look similarly pessimistic – Wall Street believes that cost-cutting is complete this year and will not have a positive impact on earnings in the coming years:

Seeking Alpha, PFE’s EPS estimates

Analysts grilled Pfizer on the obesity pipeline, the effects of the IRA, and the acquisition of Seagen during the earnings call Q&A. Executives said that PFE is “committed to expanding its obesity portfolio” and that danuglipron was seen as “a second-to-market oral GLP-1 agonist”. In terms of the IRA, Pfizer recognized the potential headwinds but also mentioned that it is taking measures to mitigate those risks via cost savings and portfolio diversification. The Seagen integration is, they told us, going well, commercially delivering and the pipeline progressing well.

In my opinion, the analysts are exaggerating. In reality, Pfizer’s FCF-generating capacity appears to be able to continue deleveraging for at least the next few years. As the current pipeline nears monetization, we will likely see PFE’s EBITDA margin remain stable, which will only bolster the company’s FCF strength.

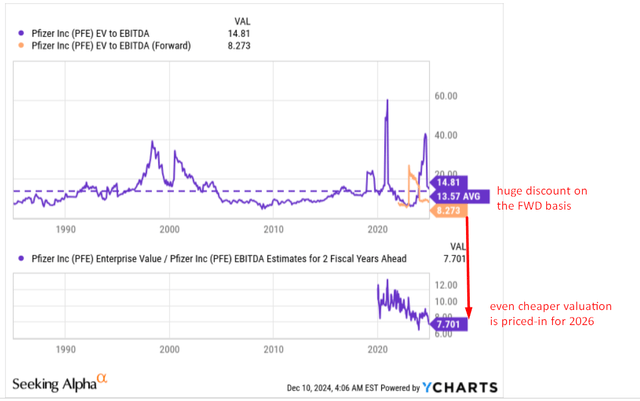

If my assumptions are correct, then the current valuation of PFE makes no sense. Pfizer currently trades at less than 9 times next year’s EV/EBITDA ratio, which is about 37% below the median value of the entire healthcare sector. Pfizer is one of the largest pharma companies in the world, yet it doesn’t carry any valuation premium, which is usually typical of sector leaders (see Exxon Mobil (XOM) in the oil and gas industry or Microsoft (MSFT) in the technology industry as prime examples). At the same time, we see an even deeper undervaluation compared to Pfizer’s own history, reaching almost 40% on an FWD basis (compared to the long-term average multiple). At the same time, PFE’s valuation should decline even further considering the expected EBITDA figures for FY2026. In other words, it seems that Pfizer should become even cheaper over the next 2 years, according to the current consensus.

If I’m correct in my reasoning that the ongoing cost-cutting and deleveraging combined with new pipeline drugs coming to market in 2025, then I think PFE offers value investors a truly golden opportunity to get a good risk/reward ratio at its current price. We can only guess what a fair stock price would look like. However, PFE’s dividend yield of 6.53% (FWD) seems sustainable to me, meaning the stock is undervalued by at least 30%, assuming it returns to the 4-5% range shortly, amid potentially falling interest rates on risk-free assets.

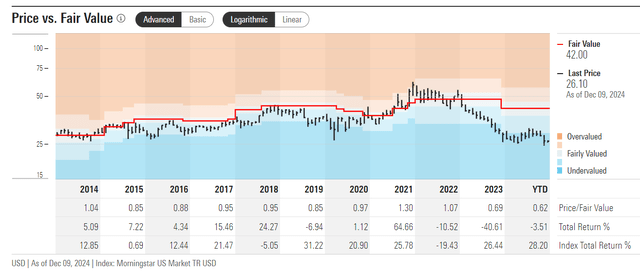

The analytical fair value model calculated by Morningstar Premium (proprietary source) agrees with me. Moreover, it shows an undervaluation of 61% at the current price:

Morningstar Premium, proprietary source, PFE

So, based on different valuation methods, I conclude that PFE stock may be 30-60% undervalued – hence my rating upgrade to “Strong Buy” on the recent stock price dip.

Where Can I Be Wrong?

All the virtues I described above aren’t without challenges for Pfizer, of course. For instance, the activist investor pressure from Starboard Value, which has attacked the company’s use of capital and R&D efficacy, poses a major risk today. Why? Starboard is worried that Pfizer has failed to make the most of sales generated by COVID-related sales for better long-term growth. So such scrutiny could put the managers and shareholders at risk of losing their way, and make strategic decisions less stable.

And of course, the biggest risk factor remains the drop in sales of Pfizer’s COVID-19 vaccine Comirnaty and the antiviral drug Paxlovid. This decline in revenue from a once-promising area has put the company in question as to whether it can sustain overall revenues and profitability, and investors have become concerned about it.

While I expect the resulting lower base to boost bottom-line growth as new drugs come to market, the loss of patents on drugs that have generated stable revenues so far and the decline in COVID-19 vaccine sales could hit Pfizer hard. This could impact both financials and valuation multiples, which could remain at low levels for as long as desired.

The Bottom Line

Despite the above risks, I’m still with the bulls regarding Pfizer’s recovery opportunity in the next 2–3 years.

Pfizer’s latest financial results and corporate developments continue to show its resilience in an environment where financial and operational performance are strong. The diversification of the portfolio, its solid pipeline, and conservative capital use set it up for long-term success.

If the expectations I outlined in my article today – which are far from the market consensus – materialize, then I expect a 30-60% upward re-rating of PFE stock price to close the undervaluation that has developed over the last few months.

Based on all that, I’m upgrading PFE to “Strong Buy” today.

Thank you for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!