Summary:

- Pfizer will acquire Seagen for $43 billion or $229 per share.

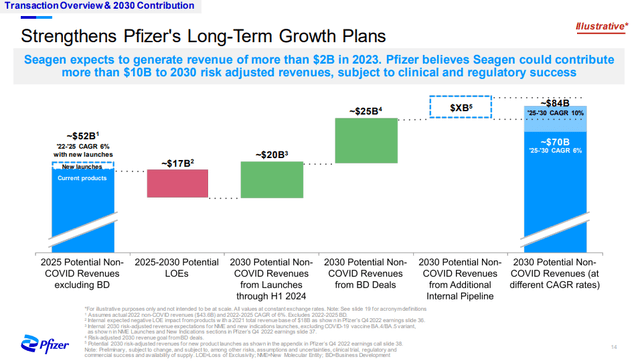

- The deal will significantly expand Pfizer’s oncology presence and the company expects to generate more than $10 billion in risk-adjusted revenues by 2030.

- The deal also brings Pfizer a lot closer to its goal of adding $25 billion in annual revenues through business development.

- The price is somewhat higher than I expected.

cagkansayin

Pfizer (NYSE:PFE) announced today it will acquire Seagen (NASDAQ:SGEN) for $43 billion or $229 per share. It sounds like a lot for a company that has generated only around $2 billion in revenues in 2022 and no profits, but Pfizer is buying the future, not the past and it expects to generate more than $10 billion in risk-adjusted revenues by 2030 from the deal. This is a 33% premium to Friday’s closing price and a 42% premium to the unaffected share price as Seagen’s share price increased after rumors of this deal recently surfaced.

The price is slightly higher than I expected. In my late June 2022 article, I outlined various valuation scenarios and settled on $200 to $220 as the most likely price range in a potential buyout. The article mentions Merck (MRK) as the potential suitor at the time, but the deal value potential stands regardless of who the buyer is.

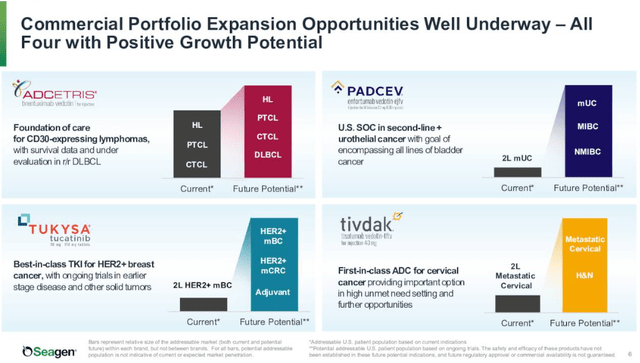

And in late September, I wrote that Seagen is starting to look attractive even as a standalone entity and I outlined the reasons why. Among them are the opportunities for three of four approved products still being largely untapped. The presentation slide by Seagen shows that the approved indications are just a small piece of the addressable market for Padcev, Tukysa, and Tivdak.

And beyond the four approved products and the market expansion opportunities, there is a healthy pipeline with additional promising candidates and potential enhancements of the underlying technology to improve efficacy and safety.

However, since there is no earnings accretion before the third or fourth full year post-close, and since the revenue potential that could validate the price tag is way into the future, Pfizer is taking on a lot of risk, especially considering the deal value.

That said, the positives are Pfizer becoming a more formidable player in the oncology market with an expanded commercial presence with four approved products, and what the company says is an effective doubling of the oncology pipeline. Pfizer also expects to generate approximately $1 billion in cost-synergies by the third full year of the deal, but by eliminating duplication rather than reducing R&D and SG&A expenses.

Financially, Pfizer expects to fund the acquisition by raising $31 billion in long-term debt and the rest by using cash on hand and short-term financing. It is a big acquisition to execute and brings a lot of debt, but the company anticipates no significant changes to its credit rating.

The deal is expected to close in late 2023 or early 2024 and we should expect some FTC scrutiny given the size of the deal and the uncertain timing and the size of the deal are reflected in the spread between Seagen’s current share price and the acquisition price of $229 per share. However, there is no significant overlap between the product portfolios and pipelines of the two companies and I believe this deal will go through.

Overall, I view the deal as incrementally bullish for Pfizer stock given the clear long-term potential and considering the high price tag and the associated risks.

The deal pushes the company a lot closer to its goal of adding $25 billion in revenues through business development. Last year’s deals got it to an estimated $10.5 billion and Seagen now doubles that with more than $10 billion in revenues expected by 2030.

The share price of Pfizer has declined 25% since I wrote about it in December, but the long-term outlook has incrementally improved after this deal. There was no expectation that the company would not buy something to get it closer to its long-term revenue goal from business development, and this acquisition puts it a lot closer to reaching that goal. In December, I expected Pfizer to be able to deliver 7% to 10% in annual share price gains, and now, I expect that to be 10% or more.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article reflects the author’s opinion and should not be regarded as a buy or sell recommendation or investment advice in any way.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.