Summary:

- I believe Pfizer should be rated as a “Buy” due to its strong non-COVID portfolio, cost control, promising pipeline, and current undervaluation.

- Recent financial performance shows 14% YoY operational growth excluding COVID sales, with improved gross margins and raised full-year revenue and EPS guidance.

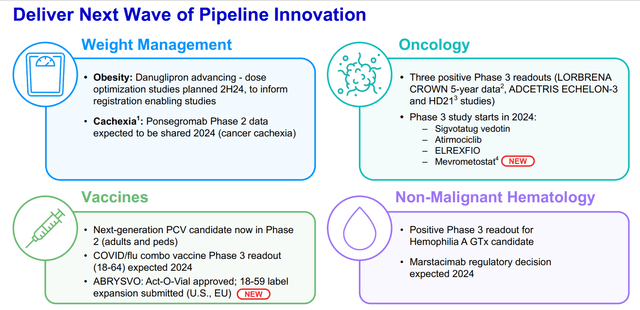

- The company’s R&D pipeline, including potential blockbuster drugs like danuglipron, is expected to offset losses from patent expirations between 2025-2030.

- Pfizer offers a high dividend yield of 5.66%, continues to invest in R&D, and is trading at a significant discount compared to sector norms.

- I believe that Pfizer is undervalued by ~28% today, which is my base scenario, and hence I confirm my “Buy” rating.

no_limit_pictures

Intro & Thesis

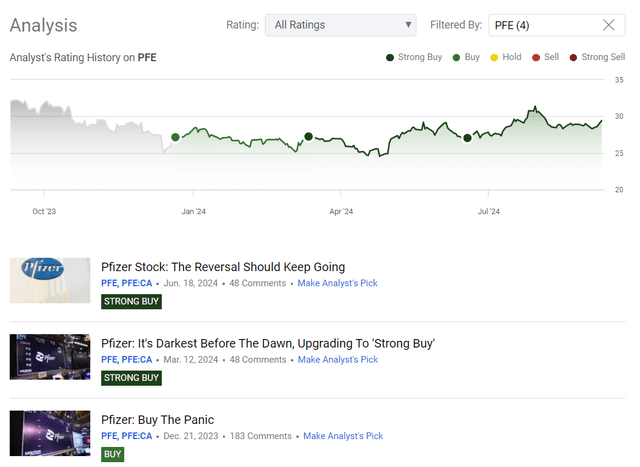

I reinitiated my coverage of Pfizer Inc. (NYSE:PFE) stock at the end of December 2023 with a “Buy” rating, when the stock was trading at $27.86 apiece. Since then, I have published 3 more articles, which, ultimately, have proven effective in terms of relative and absolute performance: PFE’s total return outpaced the S&P 500 index (SP500) (SPX) quite meaningfully. The index has remained stagnant, hovering around 0% over the past 3 months, while PFE gave a total return of over 10% over the same period.

Seeking Alpha, my coverage of PFE stock

Last time, my bullish stance was based on PFE’s non-COVID portfolio success, and also the fact that Wall Street earnings estimates indicated at the time that PFE’s EPS would bottom out in FY2024.

Looking at Pfizer’s recent performance in business turnaround, I think the recovery in PFE stock should continue in the medium term – the 10% total return since June 2024 may be just the beginning for PFE.

Why Do I Think So?

As I usually do, let’s begin the reasoning part with basic financial analysis.

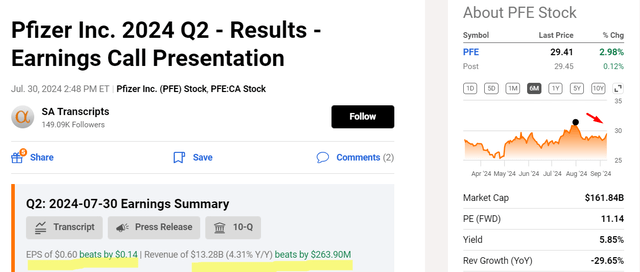

In Q2 FY2024, Pfizer’s latest reported quarter, the company showed $13.3 billion in total sales, reflecting operational growth of 3%; excluding COVID sales, the company’s top-line would result in 14% YoY operational growth in the quarter, which was quite solid, in my opinion because the company actually achieved year-over-year revenue growth for the 1st time since Q4 FY2022. I like the management’s commitment to cost control: PFE’s adjusted gross margin amounted to 79%, which was ~300 b.p. higher than last year, primarily due to a “favorable sales mix from non-COVID products and continued strong cost management across the manufacturing network,” the CFO noted during the Q2 earnings call. Given that the consolidated OPEX increased by just 5%, the created operation leverage helped PFE to show its adjusted diluted EPS at $0.60 (-10%, YoY), beating the consensus estimate by over 30%, according to Seeking Alpha Premium data.

Leaning on a quite strong performance for the past few quarters, Pfizer’s management raised the full-year revenue guidance range by $1 billion and its adjusted diluted EPS by $0.30: Revenues are now expected to be in the range of $59.5-62.5 billion, with operational revenue growth ex-COVID products projected to be 9-11%, so it’s something close to what we saw for Q2. The adjusted EPS is now expected to be $2.45-2.65, primarily “reflecting the increase to the top line and the revised tax rate among other items.”

Despite the guidance increase and double-beat of the consensus for Q2, we saw a muted reaction from market participants: first, the PFE stock soared 5-7%, but then gave up all the gains and kept moving sideways for the past couple of weeks.

Seeking Alpha, PFE, notes added

As we know, Pfizer continues to face the overhang of products that face patent expirations and loss of exclusivity (LOE) in the 2025-2030 period – the expectation of the LOE press hard on the stock’s price action. Anyway, I believe the pipeline PFE has under its belt is likely to offset most of the losses.

As Morningstar’s analyst Damien Conover recently noted (proprietary source), we should expect continued growth from several growth drivers such as rare disease drug Vyndaqel (up 71%, but with less than 50% market penetration), pain drug Nurtec (up 44%, with significant market potential remaining), and bladder cancer drug Padcev (recently launched with leading efficacy data). Also, Damien noted that the oral weight loss drug danuglipron is undergoing dose optimization studies and could enter pivotal studies in FY2025. The management noted during the earnings call that Pfizer expects to share efficacy data in Q1 2025. So within a projected $100 billion weight loss market, daniglipron’s potential may be underappreciated right now.

The global market for anti-obesity medications (AOMs) reached $6 billion on an annualized basis. By 2030, it could grow by more than 16 times to $100 billion.

Source: Goldman Sachs

At the same time, I believe that management has recently become more active not only in controlling costs – as far as I can see, the company is also actively trying to reduce its debt burden. In Q2 we found out that Pfizer has paid down ~$2.25 billion in maturing debt, including $1 billion in May of outstanding notes, “to de-lever its capital structure to a gross leverage target of 3.25x.” The operating cash flow was below typical levels recently due to “the timing of certain payments and one-time expenses”, but the management expects a heavily weighted revenue in Q4, which could result in a high level of cash collections that may carry over into Q1 FY2025.

Overall, I think the rally in PFE stock is just getting started because in 2025 Pfizer should begin to fully reap the benefits of its current labors. In addition to important updates regarding the weight loss drug danuglipron and potentially higher levels of cash collections, in 2025 the company plans to realize a significant portion of the savings coming from the manufacturing optimization program, which is estimated to “deliver ~$1.5 billion in savings by the end of 2027”.

Based on all the above, I believe the company is making the right moves, both in terms of investment participation, available funds, and in terms of balance sheet management and shareholder value distribution.

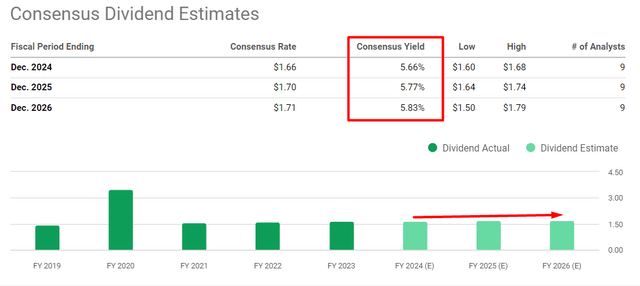

By the way, regarding shareholders’ returns as of today, I should note that Pfizer has returned ~$4.8 billion to shareholders via its quarterly dividend and also invested ~$5.2 billion in internal R&D. The current consensus estimates suggest a dividend yield of 5.66% for the current year. And, yes, the yield is forecast to grow for at least the next 3 years.

Seeking Alpha, PFE, the author’s notes

In my opinion, the absolute figure of this yield is already high enough to suggest that the stock is undervalued. Ahead of us, we are likely to see a decrease in the Fed fund rates, which could lead to a repricing of assets that offer increased dividend yields.

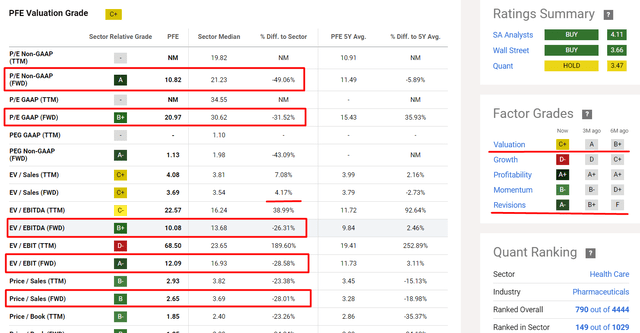

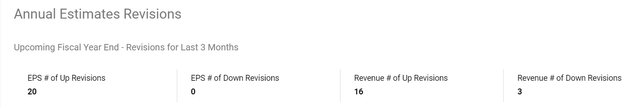

Regarding valuation, PFE is currently trading at 10.8x non-GAAP P/E, which is almost 50% lower than the median in the healthcare sector, according to Seeking Alpha Premium. However, based on the SA Quant rating, we see that the Valuation grade has decreased from “A” to “C+” over the past 3 months, indicating that the company’s valuation condition has only worsened. I respectfully disagree with this assessment, as it seems to me that this downgrade is primarily explained by just a few valuation multiples. On a forward basis, the valuation multiples remain critically low, 25-30% lower than sector norms. Additionally, we see that analysts have universally begun to raise their forecasts for EPS and revenue for the next periods. This explains the slight increase in individual multiples we’ve observed over the past three months.

Seeking Alpha, PFE, notes added Seeking Alpha, PFE

The current consensus assumes that after the phenomenal recovery growth in FY2024, Pfizer’s EPS growth will slow down significantly, with EPS expected to grow at a CAGR of just +0.7% from 2025 to 2033. I believe these are understated numbers that don’t account for the significant growth potential from the pipeline. There’s a discrepancy between the actual data and the consensus forecasts we saw in the past few quarters (i.e. earnings surprises), with a 20-30% on a quarterly basis. So I think that in FY2025, Pfizer can easily surpass today’s consensus by at least 10% in terms of EPS.

Additionally, to supplement the SA’s number above (PFE’s lag from the sectoral industry medians), it’s worth noting that, in the context of its historical multiples, Pfizer is also trading today at a very large discount. Argus Research analysts also noted (proprietary source, July 2024) that Pfizer stock is trading at a steep 51% discount to its historical average – now the gap is even wider.

PFE trades at 11.2-times our 2025 EPS estimate, compared to an average of 23.0 for our coverage universe of large-cap biopharma stocks.

Thus, if we assume that Pfizer will indeed beat the consensus EPS in FY2025 by at least 10%, and the current P/E multiple will rise to at least 12x against the backdrop of returning positive sentiment, then the fair value today, according to my calculations, would be $37.75 per share – this is 28.4% more than the current share price.

Given the undervaluation detected and the operational improvements I noted previously, I reiterate my “Buy” rating for PFE today.

Where Can I Be Wrong?

As Argus Research analysts noted, Pfizer has to generate from its R&D pipeline and from M&A “enough revenue to offset the loss of products that would have peak annual revenue of about $17 billion.” During the Q2 earnings call, we found out that Mikael Dolsten, the Chief Scientific Officer and President of Pfizer Research & Development, will be departing the company. As it was noted, Mikael actually transformed Pfizer’s R&D engine, achieving 35 drug approvals. Who will be the successor remains unclear at this point. This is a fairly important role for Pfizer: In light of the company’s risk of soon losing patents, there’s no room for error. If someone with insufficient experience comes to this role, there may be issues with FDA approvals, which could subsequently impact the monetization of the pipeline.

In my previous article, I cited BMO’s research paper (proprietary source, June 2024), where they noted that Pfizer’s vaccines segment could experience over 30% lower growth due to intensified competition from Merck (MRK) in the pneumococcal disease market, potentially slowing Pfizer’s overall vaccine growth significantly. I think this risk factor is still relevant today.

Indeed, Pfizer faces several risks, including patent expirations for key products, long product development cycles, and various political and regulatory hurdles. These risks clearly weigh on the current valuation, and it’s uncertain whether it will improve soon. Current forecasts may be overestimated and unrealistic – anyone considering buying Pfizer stock today should be aware of this.

The Bottom Line

Despite the numerous serious risks surrounding the company today, which are certainly worth keeping in mind, I still believe that Pfizer’s stock should be rated as a “Buy.”

I appreciate the operating performance and the managers’ continued adherence to their plan of gross costs and debt level reduction. The company’s pipeline, which we’ve seen consistently supplemented and improved, should theoretically mitigate a significant part of the headwind PFE should face from the loss of exclusivity for some of its drugs in 2025-2030. Moreover, many of the drugs in the company’s pipeline seem underappreciated and have significant market potential, in my view, supporting the growth of the firm’s sales & earnings for years to come.

Additionally, the stock currently offers a dividend yield above 5.5% and continues to invest in research. Meanwhile, the PFE stock is trading at only 10-11 times earnings today, which is relatively cheap compared to some other large pharmaceutical companies.

Based on all of the above, I believe that Pfizer is undervalued by ~28% today, which is my base scenario, and hence I confirm my “Buy” rating.

Thank you for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!