Summary:

- Pfizer has experienced a total return loss of nearly -40% so far in 2023, largely due to downshifts in demand for COVID-19 vaccines and antiviral products.

- Shareholders faced additional challenges, including a dilutive $43 billion deal for Seagen, a tornado destroying its North Carolina production plant, and trouble with its weight-loss drug development plan.

- Pfizer’s stock is now trading at a significantly lower valuation compared to peers, making it an attractive long-term investment with a high 5.7% dividend yield.

Massimo Giachetti

2023 proved a year to forget for Pfizer (NYSE:PFE), and one to lick your wounds for shareholders experiencing a total return loss approaching -40%. My personal brokerage account suffered as a result, owning shares all the way down.

Coming off the massive success story of lifesaving COVID-19 vaccines and related robust Paxlovid antiviral demand was not as easy as I expected in January here. Downshifts in demand from governments around the world for its revolutionary COVID-fighting products have caused earnings and sales results to miss analyst forecasts by a wide margin.

But that’s not all the bad news. Other problems hit shareholder worth during the past year. One negative issue for share pricing came when management decided to spend its industry-leading cash position on a largely dilutive $43 billion deal for Seagen (SGEN), announced in March. At the moment, Seagen is reporting income losses with only minor sales vs. takeover capitalization.

Access to and ownership of a new class of cancer-treatment research and development was the excuse. Yet, this deal was an obvious pronouncement to Wall Street that Pfizer’s organic pipeline of new drugs was lacking. I figure this merger decision cost existing shareholders at least 10% in upfront stock pricing, on the loss of cash earning interest on top of the downgrade to per share results immediately on the transaction’s closure (due shortly in weeks or months, according to the company).

Another bummer for owners, Pfizer’s important Nash County, North Carolina production plant was demolished by a major tornado in July. It’s as if the gods were against this corporation in 2023.

A final blow to the future of the company hit last week. The twice-daily dose development plan for weight-loss drug Danuglipron, a Glucagon-like peptide-1 receptor agonist (GLP-1RA) candidate (in the form of an oral pill, instead of weight-loss injections on the market) was dropped on higher-than-expected stomach side effects during testing. It leaves far less hope for the success of its once-a-day dose regimen still in trials.

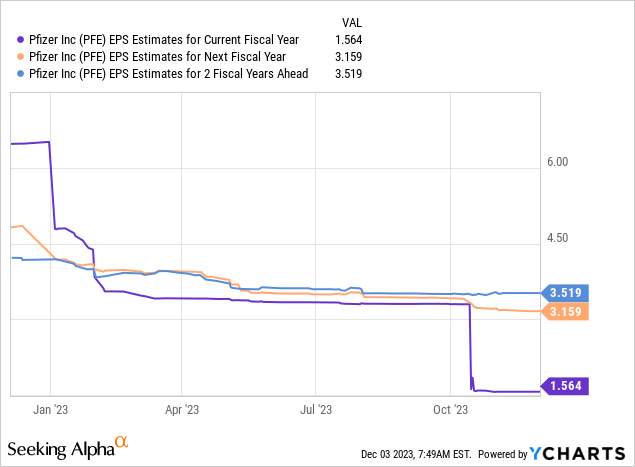

The net effect of COVID-inventory drug write-downs in value and unusual operating issues throughout the year have slashed cash-adjusted EPS by some -76% vs. 2022, while pushing GAAP income closer to breakeven during 2023. The good news is a shareholder disaster repeat will be difficult next year. The Seagen merger should be fully discounted in the stock quote. And, a refocus on Pfizer’s brighter long-term growth prospects should support a rebound in fortunes.

YCharts – Pfizer, Changes in Analyst EPS Estimates for 2023-25, 12 Months Seeking Alpha Table – Pfizer, Analyst Estimates for 2023-25, Made December 2nd, 2023

Today’s Inexpensive Business Valuation

Pfizer’s $30 stock quote today does offer significantly greater long-term value for new buyers than $45-50 a year ago. When you look at valuation data, this conclusion is hard to ignore.

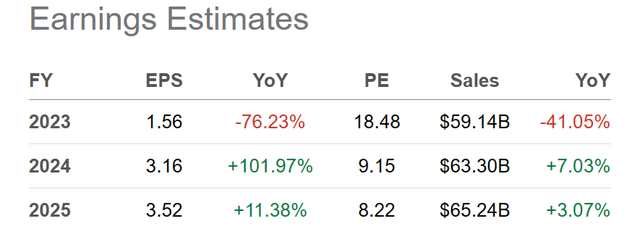

For example, reviewing basic financial ratio analysis of price to trailing earnings (adjusting GAAP income to cash results), sales, cash flow, and book value, PFE is trading between a decade-average setup to 10-year lows currently.

YCharts – Pfizer, Basic Fundamental Valuations, 10 Years

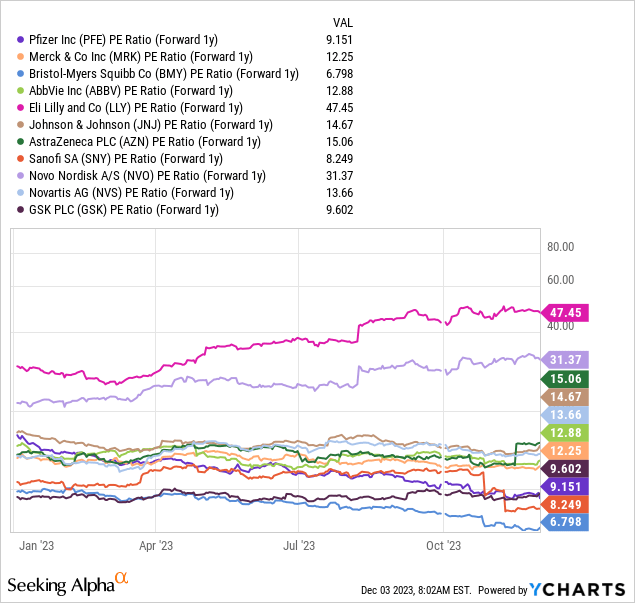

Remember, trailing numbers for earnings this year in particular have been horrifically bad. So, when we look forward to 2024 estimates, the Pfizer valuation really stands out as a bargain vs. Big Pharma competitors and peers. Below I have charted PFE vs. Merck (MRK), Bristol-Myers Squibb (BMY), AbbVie (ABBV), Eli Lilly (LLY), Johnson & Johnson (JNJ), AstraZeneca (AZN), Sanofi (SNY), Novo Nordisk (NVO), Novartis (NVS), and GlaxoSmithKlein (GSK). You will quickly notice Pfizer is one of the cheapest P/Es sitting at 9.1x estimated results.

YCharts – Pfizer vs. Big Pharma, Price to Forward 1-Year Earnings Estimates, YTD

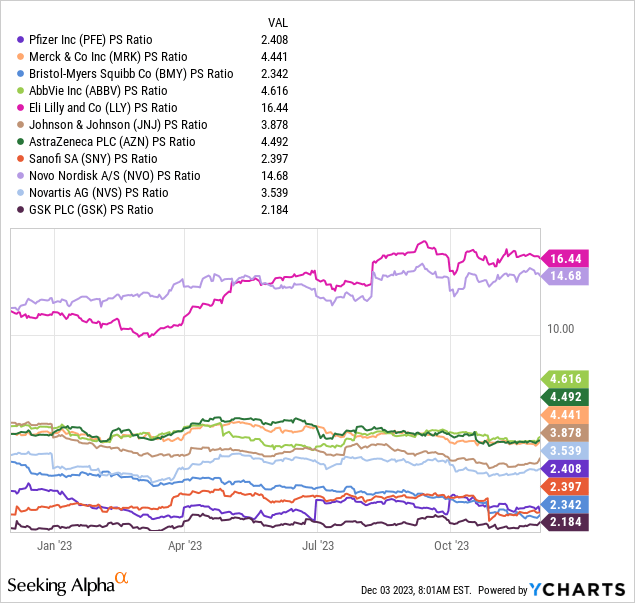

The 2.4x sales ratio is effectively the lowest in over a decade vs. company historicals, and again below the industry median of 3.7x.

YCharts – Pfizer vs. Big Pharma, Price to Trailing Sales, 12 Months

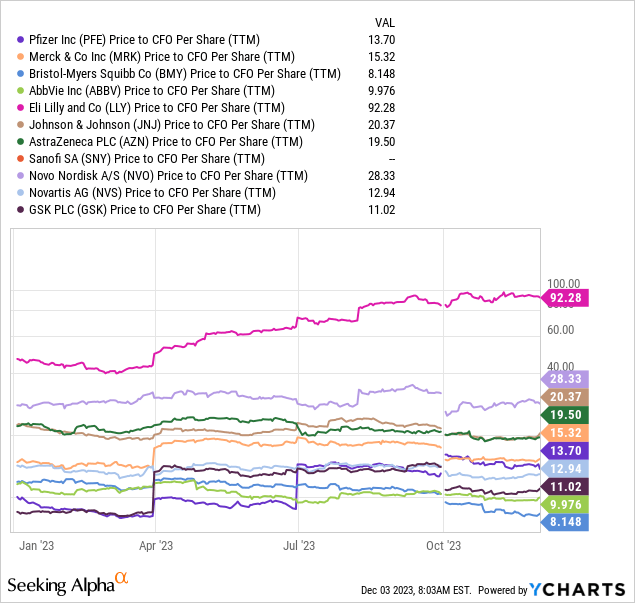

Operating cash flows have been substantially undercut during 2023 by COVID write-downs, but even weak results are now available at a slightly better ratio (13.7x) than peers (15x median average).

YCharts – Pfizer vs. Big Pharma, Price to Trailing Cash Flow, YTD

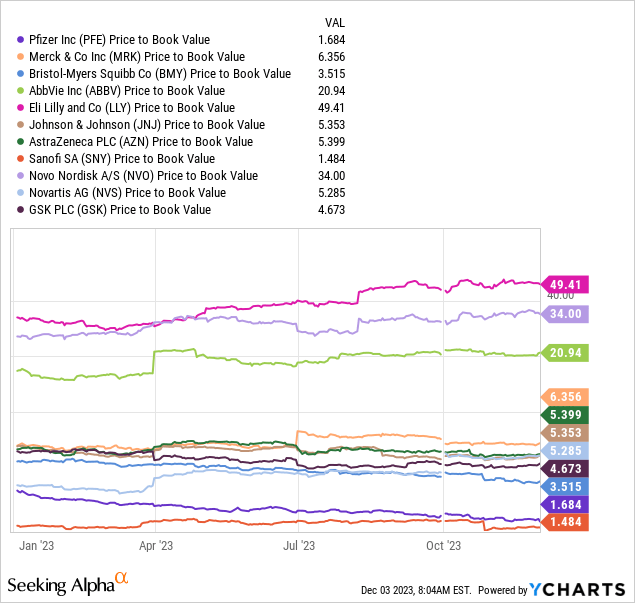

On price to book value, Pfizer has become one of the least expensive buys in the Big Pharma space at 1.68x. The typical large-cap drug maker is selling for 5x book value today.

YCharts – Pfizer vs. Big Pharma, Price to Book Value, 12 Months

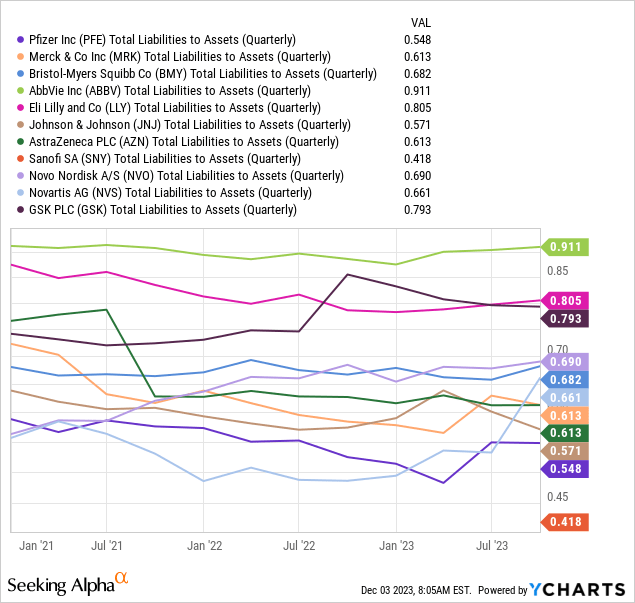

In terms of financial strength and flexibility, Pfizer remains one of the smartest conservative plays in the Big Pharma sector, as represented by total liabilities vs. assets.

Remember, Pfizer held $44 billion in cash at the beginning of October, after a major bond offering of $31 billion in May to finance the Seagen acquisition. Since the company will be exchanging cash assets for others ($3 billion in tangible assets, plus roughly $40 billion in goodwill and intangibles), the ratio presented below should not change much into early 2024.

YCharts – Pfizer vs. Big Pharma, Total Liabilities vs. Assets, 3 Years

A+ Dividend Yield Story

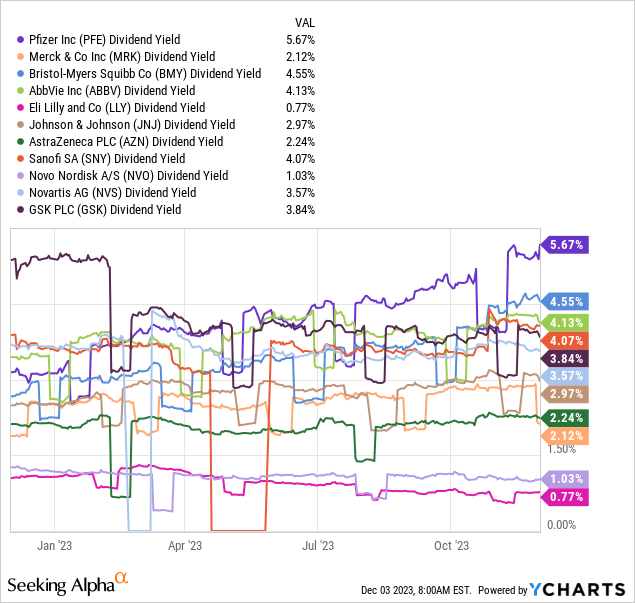

Perhaps the main reason to contemplate Pfizer ownership now is the dividend yield proposition continues to “improve” on share price declines. The current/trailing rate of 5.67% beats all Big Pharma names, hands down, plus risk-free cash-equivalent yields around 5%, or the S&P 500 yield of 1.5%.

YCharts – Pfizer vs. Big Pharma, Trailing Annual Dividend Rates, 12 Months

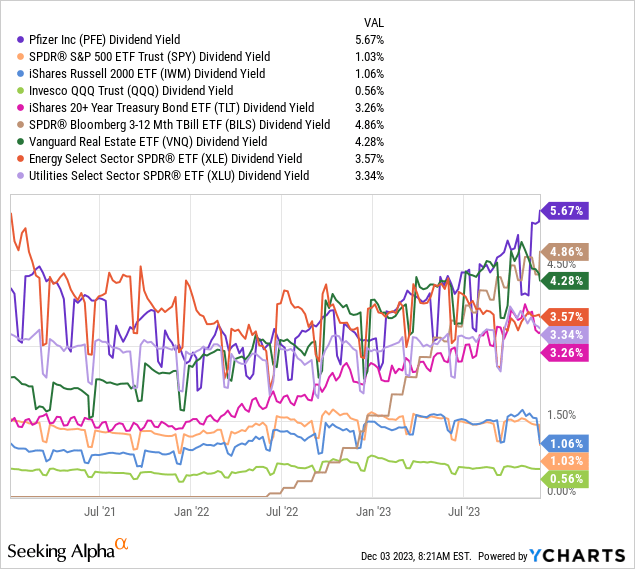

As a general rule, equity-traded yield alternatives are today delivering rates well beneath 5.67%. PFE has traditionally been a top yield/income choice for years, but the late November and early December rate is hard to pass up, especially after considering dividend payouts should increase markedly in future years as normalized earnings reappear. Compared to U.S. stock market indexes, bond-equivalents focused on Treasury securities traded as equities, or the typical income sectors of real estate, oil/gas/energy, and utilities, Pfizer stands out as the winning choice.

YCharts – Pfizer vs. Equity Yield Alternatives, Trailing Annual Dividend Rates, 3 Years

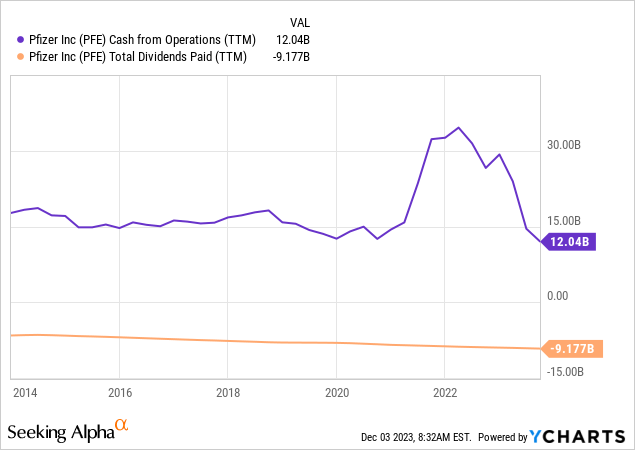

As a function of dividend coverage from cash flows, Pfizer remains a terrific option when looking at forward numbers. 2023’s wipeout for operating cash generation has still been able to cover the dividend ($12 billion in cash creation vs. $9.2 billion in dividends paid over trailing 4 quarters). The truly wonderful sustainability data point is an estimated $21-$24 billion in cash flow generation for 2024 should become reality (after goodwill amortization from the Seagen deal is added, and the lack of COVID one-time write-offs are gone). Such would more than double the amount necessary to keep paying its extraordinary yield available to new investors.

YCharts – Pfizer, Operating Cash Flow vs. Dividends Paid, 10 Years

Final Thoughts

2023 proved something of a Murphy’s Law year, where anything that could go wrong, did go wrong. I doubt the upcoming year will be so unfair/unkind to shareholders.

What else could trip up operations next year? It’s a question I ask myself daily. I do not believe 2024 will witness any large acquisitions, as the Seagen merger will be enough change to digest. Plus, I doubt management will want to risk another shellacking by Wall Street. Shareholders are already quite upset at management with the stock price dive in worth this year.

The most immediate investment risks include a likely recession in 2024 holding back sales to a degree, while another sizable downmove for Wall Street equities overall potentially keeps price around $30 a share. However, I have explained in past articles, Pfizer has been a top defensive play during recessions and bear markets for equities historically.

I am thinking the biggest long-term risk of ownership includes the possibility Medicare drug price-fixing negotiations in future years will persuade growth investors to look at sectors outside of Big Pharma.

Really, we are talking about macroeconomic risks that other pharmaceutical businesses will face the same as Pfizer. Of course, operating challenges, changing government regulations, and the like will always pop up for this global enterprise treating over 457 million people in 2023 for various illnesses and diseases.

Here’s my bottom line. We may be reaching for a lasting bottom on the disappointing weight-loss drug data/decision posted days ago. Investor sentiment is quite rotten – reading bearish mainstream articles on the internet and gauging the utter disgust by owners at 2023 share performance. In combination, all of the fundamental valuation stats describe a Big Pharma name both unloved and out of favor by Wall Street.

I am confident the horrible year we just experienced will flip into a nice turnaround for 2024, assuming a normalized operating environment, with COVID-related sales now a far smaller portion of the business. Comimaty vaccine and Paxlovid antiviral products accounting for less than 13% of total sales in Q3 2023 vs. the Q2 2022 peak of 64%. In addition, the nominal -40% YoY sales decline overall during Q3 masked the solid +10% sales gains outside of COVID-focused supplies.

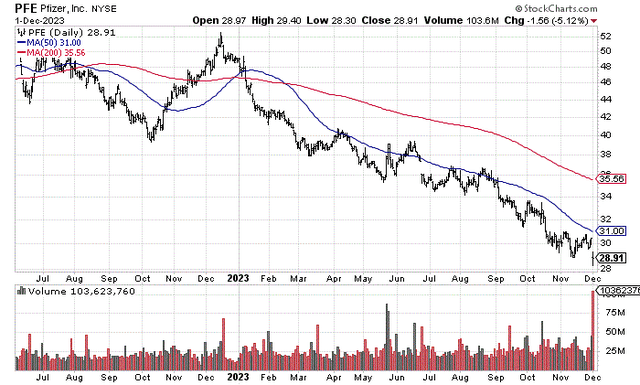

StockCharts.com – Pfizer, 18 Months of Daily Price & Volume Changes

I am using a peer group average of 14x next year’s EPS of $3.16 (still below the 10-year average ratio of closer to 15x for Pfizer), and a price to sales multiple of 4x (which is close to both the projected peer average and Pfizer’s long-term setting), to come up with a $45 “fair value” price target in 12 months. Such would be good for a +55% total return including dividends.

For sure, Pfizer is now “the” primary value and dividend pick in Big Pharma. If you have the stomach for buying a beaten down blue-chip name, PFE should be near the top of your research list going into the New Year.

I have a relatively small stake in the business vs. total portfolio size today, and am seriously considering upping my position size in December. I rate shares a Strong Buy for most investors, in particular for contrarians searching for yield/income.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE, BMY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.