Summary:

- Pfizer, a multinational pharmaceutical and biotechnology corporation, is now a $159 billion (by market cap) healthcare giant.

- With business and stock excess seemingly totally wrung out, and with expectations now about as low as ever, long-term investors holding or buying from this starting point could be positioned well, as Pfizer has recently shown exciting signs of bouncing back into growth.

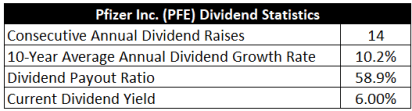

- Pfizer has increased its dividend for 14 consecutive years, with a 10-year dividend growth rate of 10.2%.

- Pfizer increased its revenue from $49.6 billion in FY 2014 to $58.5 billion in FY 2023, a compound annual growth rate of 1.9%.

georgeclerk

Pfizer Inc. (NYSE:PFE) is a multinational pharmaceutical and biotechnology corporation. Founded in 1849, Pfizer is now a $159 billion (by market cap) healthcare giant that employs approximately 88,000 people.

The company’s FY 2023 revenue is broken down into the following three operating segments: Primary Care, 52%; Specialty Care, 26%; and Oncology, 20%. The remaining 2% is derived from a newer operating segment, Business Innovation, which includes contract manufacturing and strategic guidance activities.

Geographically, the US is Pfizer’s largest single market and accounted for 46% of 2023 revenue. Europe accounted for another 20%. Other international markets accounted for the remainder. Pfizer has a diverse drug portfolio, with top sellers including Eliquis (~11% of revenue), a treatment for stroke and embolism, Ibrance (~8% of revenue), a breast cancer treatment, and the Prevnar family of vaccines (~11% of revenue).

An investment in a Big Pharma company like Pfizer is, essentially, a bet on the continued path for global healthcare. That path is one of rising demand for high-quality healthcare, due to simple demographics.

Our global human population is growing larger, older, and wealthier… simultaneously. And what will more older people with more money likely demand? High-quality healthcare, of course. The human condition leads to physical deterioration as one ages, which can involve all sorts of health issues.

More human beings walking around, who are older and more affluent, is almost a straight line to more demand for great healthcare. While this bodes well for the likes of Pfizer over the long run, it’s fair to say that this company has had its share of wild ups and downs over the last several years.

The company co-developed Comirnaty, a vaccine for COVID-19, which caused a huge (but temporary) spike in sales and the shares. Between FY 2020 and FY 2022, revenue more than doubled. This bonanza helped Pfizer to build up a war chest and go on an acquisition spree (which I’ll touch on later).

However, between FY 2022 and FY 2023, revenue nearly halved. This business volatility has unsurprisingly led to stock volatility. Whereas, the stock flew to all-time highs in late 2021, it’s been on a near-constant slide ever since. The stock is now down more than 50% from its all-time high.

With business and stock excess seemingly totally wrung out, and with expectations now about as low as ever, long-term investors holding or buying from this starting point could be positioned well, as Pfizer has recently shown exciting signs of bouncing back into growth. And that’s before getting into the fact that Pfizer has demonstrated an ability to grow its revenue, profit, and dividend over a very, very long period of time.

Dividend Growth, Growth Rate, Payout Ratio and Yield

Indeed, Pfizer has increased its dividend for 14 consecutive years. The 10-year dividend growth rate is 10.2%, which is very solid, although more recent dividend growth has been in a low-to-mid single-digit range.

For decades, Pfizer has been as staid and steady as one would expect for a pharmaceutical company founded before the US Civil War. But that boringness gave way to volatility over the last few years as the pandemic took hold, and the volatility impacted what was otherwise fairly consistent dividend growth. This volatility also impacted the stock in a very large and direct way.

The stock’s price is currently more than 50% lower than it was at its 2021 peak, and it’s actually quite a bit lower than where it was in early 2020 – knocking out all pandemic-related gains. This has, of course, had the effect of raising the stock’s yield rather significantly.

Price and yield are inversely correlated; all else equal, a lower price results in a higher yield. The stock now yields 6%. That’s yield territory usually reserved for high-yield entities like telecoms and certain REITs. It’s extraordinary. This yield is nearly five times higher than the broader market’s yield, and it’s also 200 basis points higher than its own five-year average.

While Pfizer has often offered a nice yield, 6% is way beyond what’s normal and indicates a severe suppression in the stock’s pricing (and possible explosive move higher as the business and stock normalizes). This kind of yield almost immediately signals a contrarian, reversion-to-mean opportunity to me.

The payout ratio of 58.9%, based on midpoint guidance for this year’s adjusted EPS, shows a sustainable dividend, even while Pfizer straightens things out and gets back to a more regular environment. While I wouldn’t be enthusiastic about the idea of large dividend raises over the next year or so, the starting 6% yield, possibility of decent near-term dividend growth, and likelihood of better dividend growth over the longer term is a very appealing setup on the whole.

Revenue and Earnings Growth

As appealing as it may be, though, many of these numbers are backward-looking dividend metrics. However, investors must always have a forward-looking perspective, as today’s capital gets put on the line and risked for tomorrow’s rewards. Thus, I’ll now build out a forward-looking growth trajectory for the business, which will be highly useful when the time comes later to estimate intrinsic value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth. I’ll then reveal a professional prognostication for near-term profit growth. Lining up the proven past with a future forecast in this way should give us the kind of detail we need to make an informed call on where the business may be going from here.

Pfizer increased its revenue from $49.6 billion in FY 2014 to $58.5 billion in FY 2023. That’s a compound annual growth rate of 1.9%. Meanwhile, earnings per share grew from $1.42 to $1.84 (adjusted) over this period, which is a CAGR of 2.9%. I used adjusted EPS for FY 2023 because of so many impacts to GAAP results for the year, including substantial non-cash COVID product inventory write-offs. Far from the best showing, but this period is so noisy and messy.

It’s difficult to draw too many conclusions from this. Pfizer has never been the kind of business to grow at a rapid pace, and pre-pandemic growth rates were still pretty anemic. But 2% to 3% growth is barely getting ahead of inflation, even factoring out recent inflationary pressures.

In the end, we invest in where a business is going, not where it’s been. We can’t make new money on yesterday’s growth, and so it’s much more important and informative to game out future growth scenarios. To paraphrase the great Wayne Gretzky, we want to invest in where the puck is going.

Moving forward, CFRA is forecasting an 8% compound annual growth rate for Pfizer’s EPS over the next three years. That’s more like it and surely a lot better than ~3%. Offering up more perspective on this is Pfizer’s own adjusted EPS guidance for this year, which is calling for $2.85 at the midpoint. That would represent a 54.9% YOY improvement.

CFRA calls out Pfizer’s diverse portfolio, augmentation by acquisitions, and valuable pipeline assets (including new vaccine candidates, as well as a once-daily oral GLP-1 receptor that can compete in the lucrative weight-loss space). The company’s pipeline has 108 candidates in development, with 30 in Phase 3.

Circling back around to the acquisitions, which I briefly touched on earlier, Pfizer has used COVID-19 vaccine success to finance a number of sizable acquisitions over the last few years. Notably, Pfizer acquired Seagen, Inc. in 2023 for approximately $43 billion, bringing into Pfizer Seagen’s transformative ADC technology that is enabling the development of new cancer drugs designed to preferentially kill cancer cells and limit off-target toxicities (i.e., designed to be safer and more effective cancer treatments).

There have also been a number of smaller, bolt-on acquisitions, but Seagen is the real needle-moving event. The acquisition of Seagen was a major move further into oncology for Pfizer, but time will tell just how well this pays off.

To me, when I look at Pfizer, the thing that strikes me is just how much pessimism there is surrounding this business against what is a viable, pipeline-rich core franchise which has been bolstered by acquisitions. There has been bloat, acquisitions are still new, and Pfizer just isn’t as “sexy” as some alternatives. However, in my view, it wouldn’t take much to shake the pessimism.

In fact, the company’s most recent quarter, which included a double beat and guidance raise, may have shown the tide finally turning. That Q3 FY 2024 report showed 31.2% YOY revenue growth, a huge move higher on adjusted EPS (which was negative a year ago), progress on $5.5 billion in cost savings, and overall solid execution. Furthermore, because of the promise that Pfizer has, it’s attracted Starboard Value, an activist investor that is pressuring management to execute as well as possible.

With the acquisitions in place and the pipeline filled out, Pfizer is in a great position to move past the epic ups and downs of COVID and enter a new era. If the business can grow its EPS at 8%/year over the near term, that easily opens up the dividend for low-single-digit growth, and things can improve from there.

Meantime, one can start off with a 6% yield and get paid to wait. I think an investor could do a lot worse than that.

Financial Position

Moving over to the balance sheet, Pfizer has a financial position that initially appears poor but isn’t bad at all. The long-term debt/equity ratio is 0.7, while the interest coverage ratio is just over 2. That latter number is shockingly and concerningly low, but this is mostly because of messy GAAP results over the last year or so (including write-offs and acquisition charges).

Pfizer finished FY 2023 with net long-term debt (after backing out cash) of approximately $49 billion, which isn’t all that massive for an enterprise of Pfizer’s size. Furthermore, Pfizer has excellent, investment-grade credit ratings on its long-term debt: A2, Moody’s, and A, S&P.

Profitability for the firm is usually quite robust, although last year was a low point (because of the impacts to GAAP results). Return on equity has averaged 20.5% over the last five years, while net margin has averaged 21.6%. While profitability was boosted by extraordinary growth during FY 2021 and FY 2022, the averages include FY 2022’s epic drop.

If we back up to before the pandemic, Pfizer was putting up high returns on capital and fat margins – ROE in FY 2019 was over 25% – and I’d expect this to return on a go-forward basis. Pfizer has a great self-help story, and low expectations gives management lots of room to operate and improve execution. And with patents, IP, inelastic demand for products, R&D, economies of scale, technological know-how, and global relationships, the company does benefit from durable competitive advantages.

Of course, there are risks to consider. Competition, regulation, and litigation are omnipresent risks in every industry. I see all three of these risks as elevated for this particular business model relative to a lot of other business models.

Pfizer, like all of its Big Pharma brethren, faces constant patent cliff concerns as legacy drugs come off patent protection and face new competition, which puts pressure on the large pipeline to consistently develop new blockbuster drugs. Building out a successful pipeline involves lots of upfront R&D spending, with uncertain outcomes and returns on investments.

Any large-scale changes to the US healthcare system would almost certainly impact Pfizer. The company’s international footprint exposes it to currency exchange rates, geopolitics, and foreign regulatory bodies.

Pfizer has recently been very acquisitive, introducing execution and integration risks. Its large acquisitions must produce results in order to prove out management’s adeptness at capital allocation and prudent stewardship of shareholders’ capital.

Pfizer’s scale is an advantage, but the law of large numbers may limit growth. Many of these risks are general to the business model, but Pfizer’s recent acquisition of spree does add specific risks around capital allocation. However, what’s not usual here is the valuation, which looks absurdly low after a 50%+ drop in the stock’s price…

Valuation

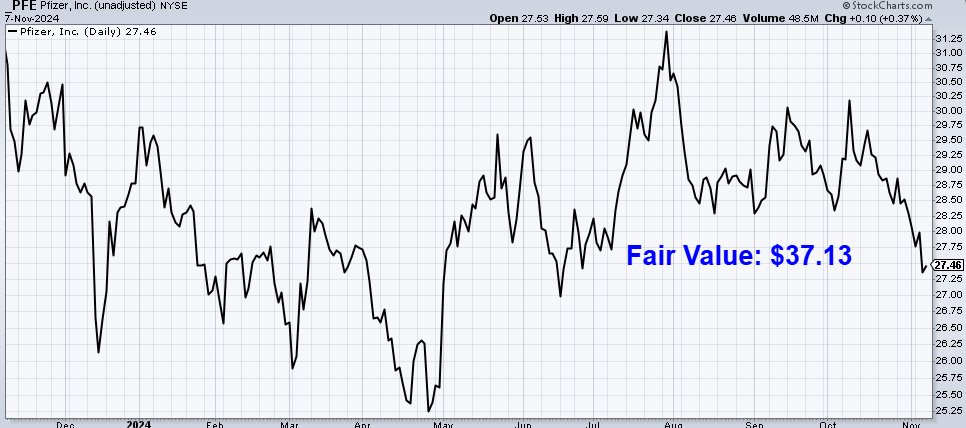

The forward P/E ratio is only 9.6, based on midpoint guidance for this year’s adjusted EPS. That is an extremely low earnings multiple. The P/S ratio of 2.6 is also very low and well off of its own five-year average of 3.3.

The stock’s price is currently at multiyear lows. To put a fine point on it, the stock’s price is right now lower than it was in March 1998. And the yield, as noted earlier, is significantly higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis. I factored in a 10% discount rate and a long-term dividend growth rate of 5.5%. I’m setting the bar super low here, modeling in a long-term dividend growth rate that is about half of Pfizer’s demonstrated dividend growth over the last decade. This is also much lower than the near-term forecast from CFRA for EPS growth.

Pfizer has a messy situation on its hands, and the flashy acquisitions need time to work out. I think it makes sense to be very cautious with Pfizer. That said, the caution, which has resulted in multiyear lows on the stock, seems a bit overdone.

Pfizer only needs to do decently well in order to become a very good investment over the coming years, as any signs of pipeline and acquisition successes will likely garner much attention. I wouldn’t be surprised to see Pfizer do better than 5.5% over the longer term, but the next year or two could see fairly small dividend raises (since the business is still digesting acquisitions).

The DDM analysis gives me a fair value of $39.39. The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide. The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth. It then discounts those future dividends back to the present day, to account for the time value of money, since a dollar tomorrow is not worth the same amount as a dollar today. I find it to be a fairly accurate way to value dividend growth stocks.

Even with a cautious approach, the stock still looks very cheap. But we’ll now compare that valuation with where two professional stock analysis firms have come out at. This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system. 1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value. Morningstar rates PFE as a 5-star stock, with a fair value estimate of $42.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line. They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold. CFRA rates PFE as a 3-star “hold”, with a 12-month target price of $30.00.

I’m somewhat close to where Morningstar is at. Averaging the three numbers out gives us a final valuation of $37.13, which would indicate the stock is possibly 26% undervalued.

Bottom line: Pfizer Inc. is one of the oldest and largest pharmaceutical firms in the world, and it’s embarking upon a new era of exciting change and growth as it digests major acquisitions and works its large pipeline. With the stock priced lower than it was in 1998, expectations are in the basement. And that’s where the go-forward opportunity could be. With a market-smashing yield, inflation-beating dividend growth, a reasonable payout ratio, nearly 15 consecutive years of dividend increases, and the potential that shares are 26% undervalued, long-term dividend growth investors who like a contrarian, reversion-to-mean play have a prime candidate here.

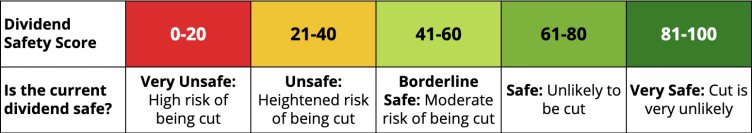

Note from D&I: How safe is PFE’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 75. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, PFE’s dividend appears Safe with an unlikely risk of being cut.

Disclosure: I’m long PFE.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.