Summary:

- Pfizer’s fundamentals are improving, with solid Q3 earnings, upgraded 2024 guidance, and a strategic pivot towards the fast-growing oncology market.

- The stock is undervalued with a 32% upside potential based on a $33.39 intrinsic value per share, using the dividend discount model.

- Despite recent share price weakness, Pfizer offers a compelling forward dividend yield, supported by strong revenue growth and aggressive R&D spending.

- Short-term market sentiment and competition in the oncology space pose risks, but long-term prospects remain strong, with significant pipeline catalysts expected from 2025.

Alexandros Michailidis

My thesis

Pfizer’s (NYSE:PFE) share price continues falling, which might mean that my September 5 bullish call did not age for some readers. On the other hand, Pfizer’s fundamentals are improving, and the stock price might move in the opposite direction over the short term. Pfizer’s financial performance is improving, I see promising initiatives from the management, and there are positive developments around the pipeline. An 11% pullback since September 5 made the stock even more attractively valued, and it still offers a compelling dividend yield. I think all these positive factors are sufficient to reiterate a Strong Buy rating for PFE.

PFE stock analysis

According to the recent report from Jefferies, most institutional investors are quite bullish on the MSCI World Health Care Index. I think that such an expectation is especially true for the largest healthcare companies, and Pfizer is certainly one of them.

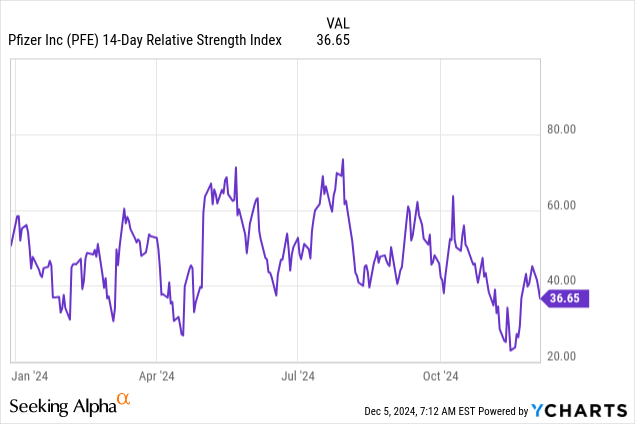

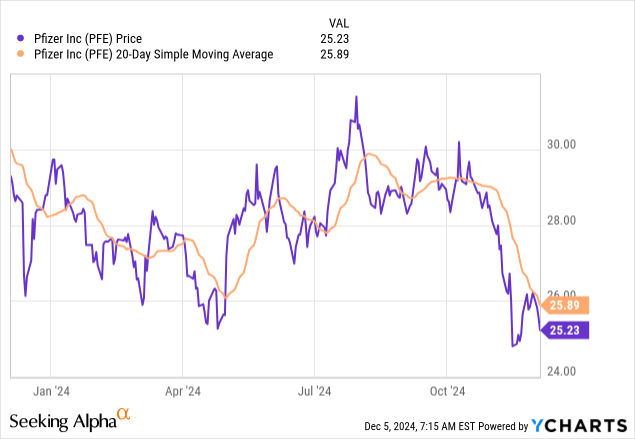

The technical setup looks good, which I see from two crucial indicators. The 14-day RSI indicator is as low as just 37. The stock is also currently notably lower than the 20-day SMA, which also looks positive from the technical analysis perspective.

Pfizer’s fundamentals are improving as well. The Q3 earnings release was accompanied by a solid dual beat against consensus forecasts. Pfizer’s $17.7 billion revenue grew by around one-third on a YoY basis. The adjusted EPS demonstrated solid growth both YoY and QoQ.

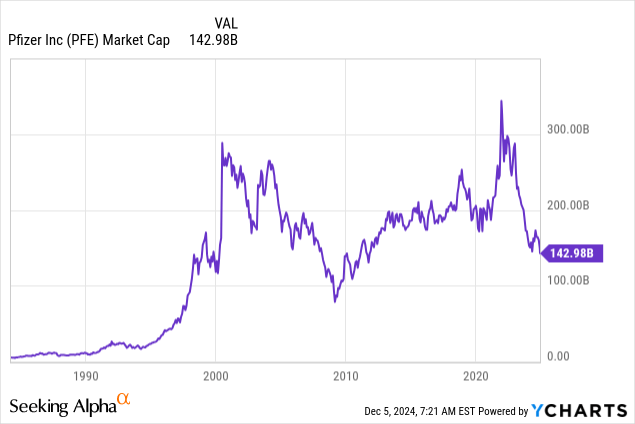

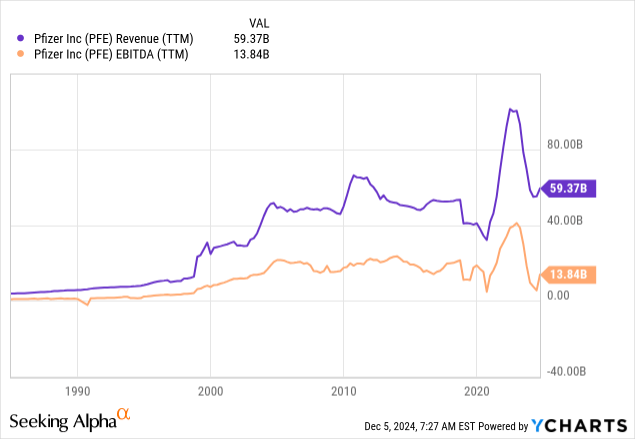

The management is confident in the company’s near-term prospects, which is seen from an upgraded revenue and adjusted EPS guidance for the full-year 2024. The company expects full-year revenue to be between $61 billion and $64 billion, with the adjusted EPS guidance range of $2.75 -$2.95. These numbers are much higher compared to FY2018 performance. Though, the current market cap is around $60 billion lower compared to pre-pandemic levels.

Moreover, the company’s current TTM revenue and EBITDA levels are also at pre-pandemic levels, meaning that the current market capitalization is unfairly low compared to 2018-2019 levels. The company’s sales and EBITDA are currently substantially lower than a couple of years ago. However, this is explained by the global ‘black swan’ event (the pandemic), which was a temporary but very powerful tailwind for Pfizer.

Now the company is pivoting more towards the oncology drugs market, which looks like a sound move. This looks like a very reasonable strategic move as this niche is one of the fastest growing ones in the global pharmaceutical industry with a projected long-term CAGR of 13.2%.

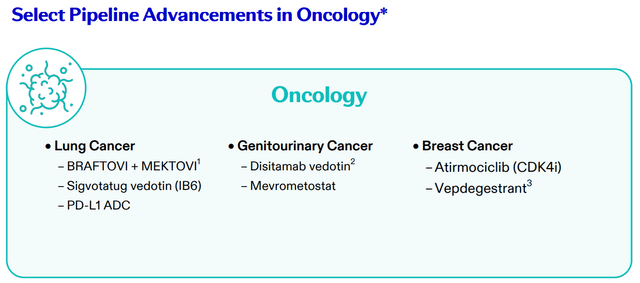

This does not look like a risky bet because Pfizer already has a solid footprint in this area. Pfizer’s revenue from its Oncology segment accounted for almost 20% of its FY2023 sales. The company also acquired Seagen to improve its positioning in the oncology drugs niche. This focus on driving growth in the Oncology segment is already paying off, as the segment’s Q3 2024 revenue was 31% up on a YoY basis.

IR

There are various potential assets in the Oncology pipeline aimed to cure various cancer types, which will also likely help PFE to expand its reach. Moreover, the management expects ‘significant catalysts’ starting in 2025. These include seven Phase III readouts including results for vepdegestrant in second-line estrogen receptor positive metastatic breast cancer and the data from trials involving Braftovi.

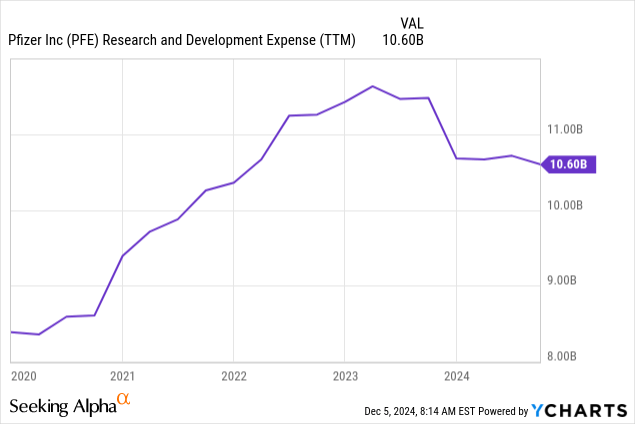

Pfizer has spent $10.6 billion on R&D (TTM), which also increases chances for new positive developments around the company’s pipeline. Such an aggressive R&D spending aligns with Pfizer’s target to launch eight blockbuster cancer drugs by 2030.

Last but not least, Pfizer’s forward dividend yield is 6.7%, which is by far more attractive compared to the sector median. Pfizer has a strong dividend consistency record, and the last five years’ 4.25% dividend CAGR was ahead of long-term historical inflation averages. The dividend looks sustainable as Pfizer’s revenue returned to a growth path and the management aims to deliver at least $4 billion in net cost savings by year-end.

Intrinsic value calculation

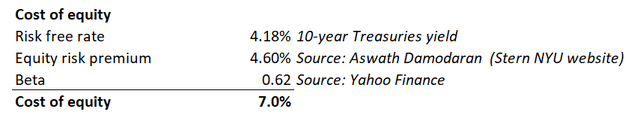

For a dividend stock like Pfizer, the dividend discount model (DDM) looks like a preferable choice to figure out the stock’s intrinsic value. I have to start with calculating the cost of equity, which will be the discount rate. The discount rate is figured out using the CAPM model. Pfizer’s cost of equity is 7% and the logic behind is outlined in the below working.

DT Invest

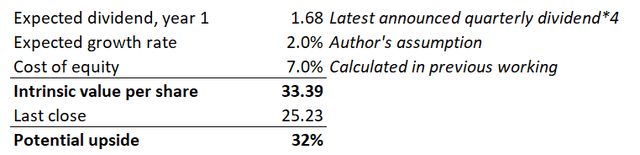

The expected dividend for year 1 is conservative, since it is the latest announced quarterly dividend multiplied by 4. The expected dividend growth rate is also very conservative, since it is in line with the Fed’s inflation target.

Incorporating all these variables into the DDM formula results in a $33.39 intrinsic value per share. This is 32% higher compared to the last close, indicating substantial undervaluation. This is very close to the average target price suggested by Wall Street analysts.

DT Invest

What can go wrong with my thesis?

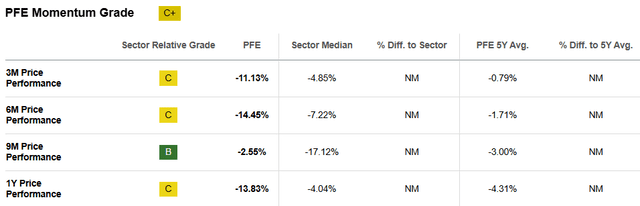

We see that the market is still not reacting to Pfizer’s improving financial performance and strategic pivot to expand its presence in the oncology drugs niche. The momentum is weak, and this might last for several months before PFE regains investors’ confidence.

Seeking Alpha

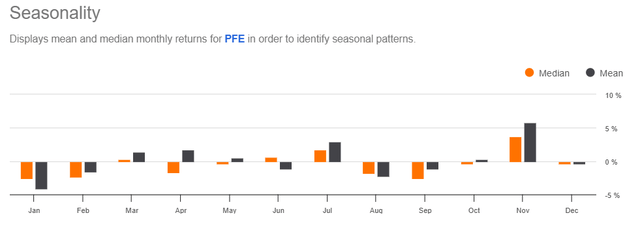

Moreover, seasonality trends suggest that January and February are historically the weakest months for PFE, with below 50% win rates. On the other hand, March has been historically good for PFE, meaning that the stock might start rallying after the FY2024 annual report release (usually released during the last week of February).

Seeking Alpha

From the business perspective, an aggressive pivot towards oncology drugs niche is a challenging task. There are several prominent players which have larger footprints in this space compared to PFE. According to this article, Pfizer’s market share is notably lower compared to leaders like Bristol-Myers Squibb or Merck. Therefore, competition risks are high. On the other hand, the niche is growing rapidly, which provides opportunities for all large players to benefit from tailwinds.

Summary

Despite the recent share price weakness, Pfizer’s fundamentals are steadily improving. Moreover, the valuation is very attractive, and the stock offers a compelling forward dividend yield.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.