Summary:

- Despite Wall Street’s continued conservatism regarding its business prospects, Pfizer beat analysts’ expectations for the second quarter of 2024.

- In addition to the raised full-year 2024 guidance, the company’s remaining share repurchase authorization is $3.3 billion.

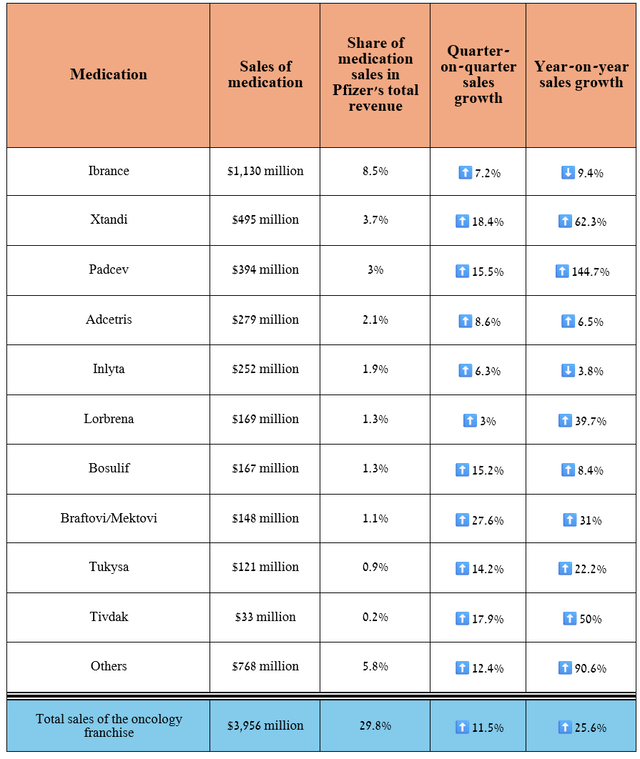

- Pfizer’s oncology franchise sales reached $3.96 billion in the second quarter of 2024, up 25.6% year-on-year.

- So, sales of Padcev, approved for the treatment of urothelial cancer, amounted to $394 million for the three months ended June 30, 2024, an increase of 144.7% year-on-year.

- Having said all of this, I continue to cover Pfizer with a ‘Buy’ rating.

ilona titova/iStock via Getty Images

Over the past month, Pfizer Inc.’s (NYSE:PFE) share price has risen by more than 7%, and I believe that the bull run that has begun will continue, including due to the formation of one of the strong technical chart patterns called the “golden cross,” as well as a breakout of strong resistance, which was in the range of $29.50-$29.60.

This article will present not only an analysis of the company’s financial results for the second quarter of 2024 but also its achievements in the development of the oncology and vaccine franchises in recent months, thanks to which I believe that pessimism on the part of financial market participants regarding Pfizer’s prospects is unjustified.

After a wave of large M&A deals made during the COVID-19 pandemic, the company’s operating margin and revenue continue to grow, which, together with a high dividend yield, expansion, and strengthening of its pipeline of experimental drugs, Pfizer is becoming an increasingly attractive stock in the healthcare sector.

Pfizer’s financial results for the second quarter and 2024 outlook

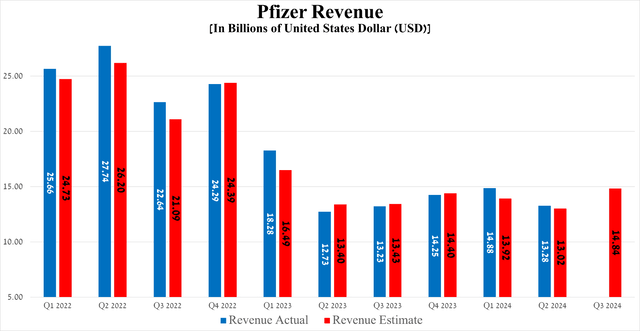

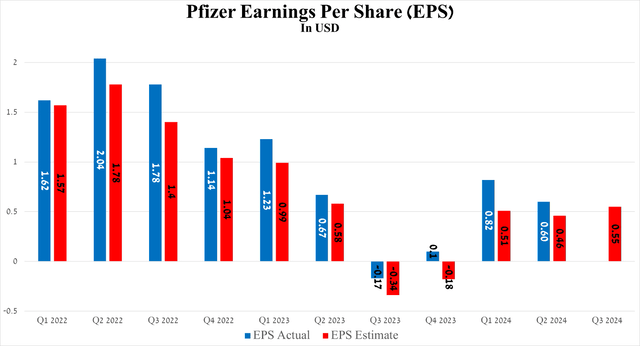

The New York-based company’s revenue reached $13.28 billion in the second quarter of 2024, down 10.8% quarter-on-quarter but beating the consensus estimate by $160 million.

Simultaneously, the results of another equally important financial metric, earnings per share, pleasantly surprised me, although it fell slightly short of the value achieved in the second quarter of 2023, mainly due to a drop in sales of its COVID-19 products. So, for the three months ended June 30, 2024, it amounted to $0.60, exceeding analysts’ expectations by $0.14.

The logical question is: which of Pfizer’s medications and vaccines exactly contributed to beating Wall Street analysts’ expectations?

To fully answer this question, I will draw your attention to the sales of key products included in its Oncology, Specialty Care, and Primary Care business units, as well as the successes and failures in the development of its pipeline.

Let’s dive into Pfizer’s financial results with an analysis of sales of the oncology franchise since I believe that its development will be crucial in the company’s return to the Olympus of the pharmaceutical industry in the long term.

So, its revenue amounted to $3.96 billion for the three months ended June 30, 2024, increasing by 25.6% year-on-year and 11.5% quarter-on-quarter.

Source: graph was made by Author based on 10-Qs and 10-Ks

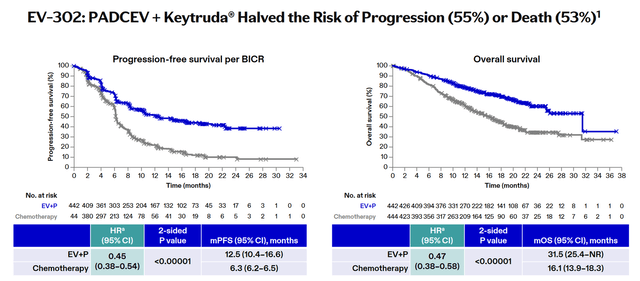

However, on July 26, the European Medicines Agency’s CHMP announced an opinion recommending approval of the combination of Merck & Co., Inc.’s (MRK) Keytruda with Padcev for the treatment of patients with unresectable/metastatic urothelial carcinoma. The decision was based on promising data from the Phase 3 KEYNOTE-A39 trial, in which the risk of death in patients taking the combination of the two medications was 55% lower than in those receiving chemotherapy alone.

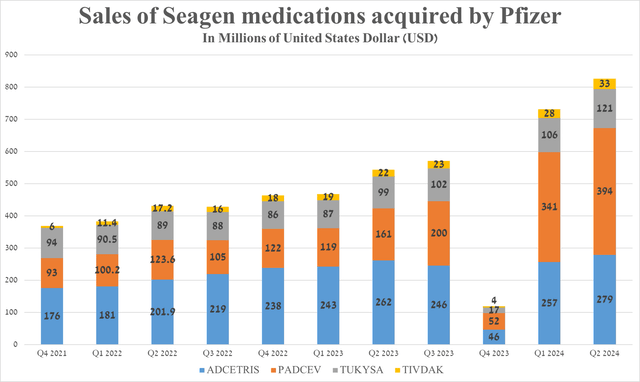

Overall, sales of the drugs developed by Seagen and later acquired by Pfizer were $827 million in the second quarter of 2024, up 52% year-on-year and 13% quarter-on-quarter, driven primarily by the FDA’s approval of Padcev and Keytruda for people with locally advanced/metastatic urothelial cancer in December 2023, Adcetris’ wider adoption into routine medical practice, and full approval of Tivdak (tisotumab vedotin-tftv) for the treatment of adults with recurrent/metastatic cervical cancer in late April 2024.

Source: graph was made by Author based on 10-Qs and 10-Ks

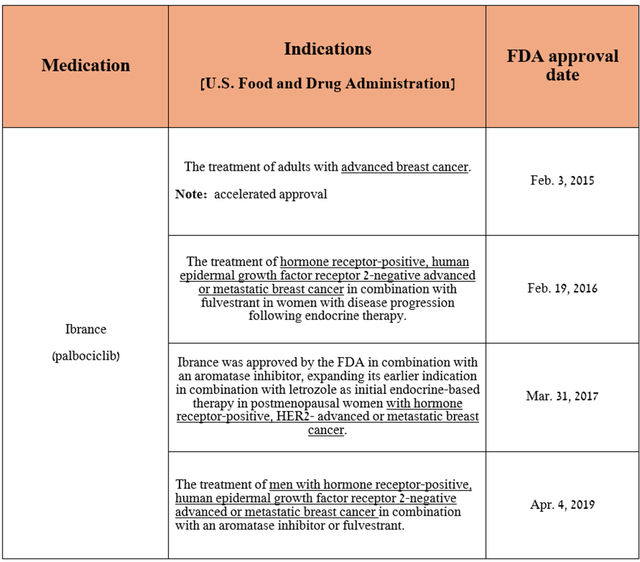

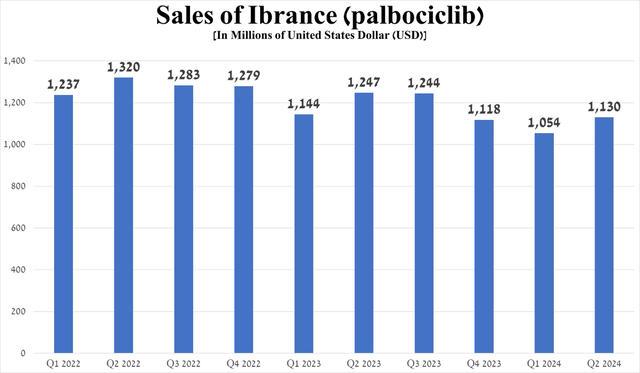

It is equally important to discuss the successes and failures in the commercialization and development of Ibrance (palbociclib), Pfizer’s best-selling drug, approved by the FDA to treat patients with various types of breast cancer, which in turn will affect more than 310,000 women in 2024, while about 42,000 will die.

Source: table was made by Author based on Pfizer press releases

The mechanism of action of Ibrance is similar to Novartis AG’s (NVS) Kisqali, a detailed analysis of which was presented in the article “Why Novartis Deserves Your Attention After Q2 2024 Results.” It is based on the inhibition of two proteins, the first of which is called cyclin-dependent kinase 6 [CDK6], and the second is cyclin-dependent kinase 4 [CDK4], which plays a crucial role in the development of breast tumors.

However, because Ibrance is the first approved selective cyclin-dependent kinase 4/6 inhibitor, the FDA has approved more effective drugs in this class over time, including Eli Lilly and Company’s (LLY) Verzenio. Ultimately, this is one of the main reasons that, in my opinion, answers the question of why its sales have continued to decline in recent years.

Source: graph was made by Author based on 10-Qs and 10-Ks

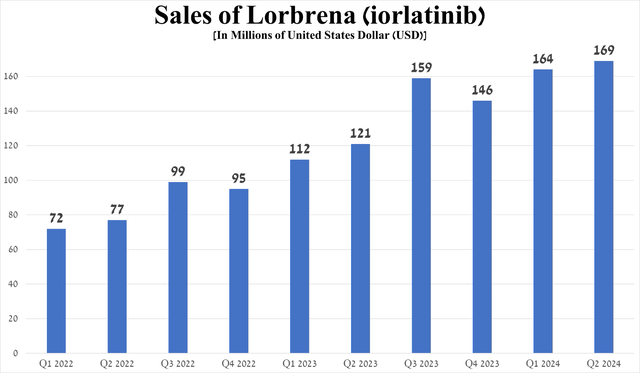

However, in addition to the rich portfolio of experimental drugs, of which I mainly highlight atirmociclib, sasanlimab, and sigvotatug vedotin, Lorbrena (lorlatinib) is capable of offsetting the loss in demand for Ibrance.

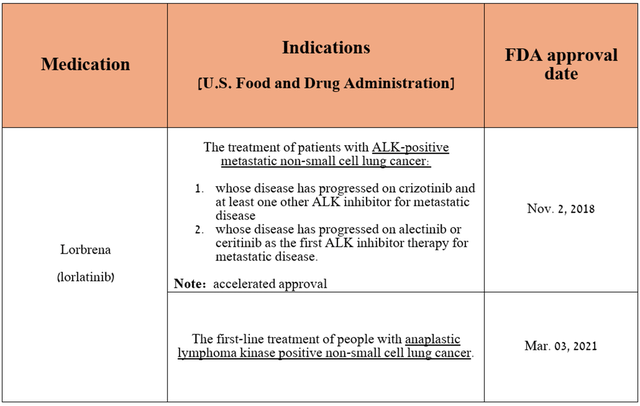

Lorbrena is an ALK tyrosine kinase inhibitor that is FDA-approved to treat patients with certain types of lung cancer.

Source: table was made by Author based on Pfizer press releases

Its sales were $169 million in the second quarter of 2024, up 39.7% year-on-year, driven partly by expansion of the ALK-positive lung cancer treatment market and promising results from the Phase 3 CROWN trial published on May 31, 2024. In addition to a favorable safety profile, about 60% of people taking Lorbrena were alive without disease progression after five years, compared to only 8% of those taking Xalkori.

Source: graph was made by Author based on 10-Qs and 10-Ks

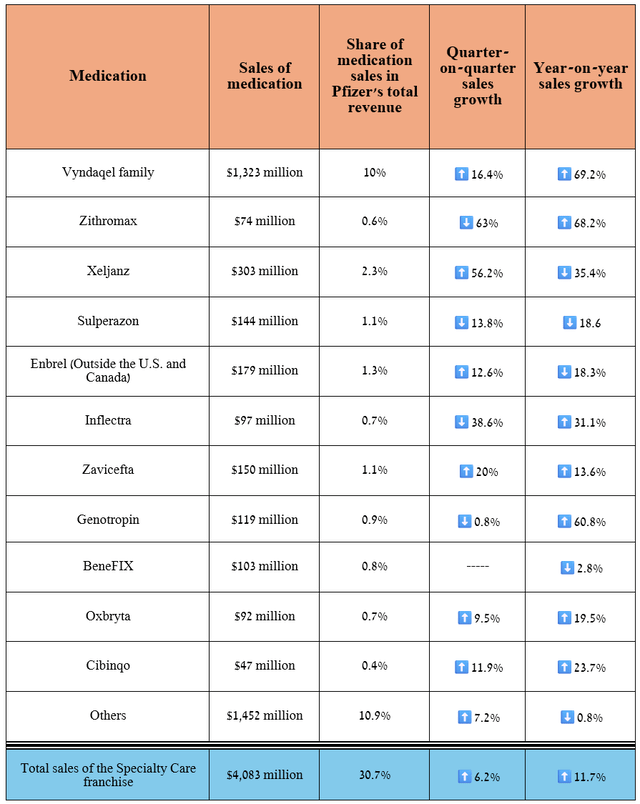

Let’s move on to discussing Pfizer’s Specialty Care franchise, which, in my opinion, will continue to have a significant impact on its financial position. The medications in this business unit are aimed at treating inflammatory, autoimmune, and rare diseases, as well as combating various germs.

Overall, its total revenue was $4.08 billion in the second quarter of 2024, up 11.7% year-on-year, despite falling demand for Xeljanz due to lower prices for it, as well as increased competition in the autoimmune disease therapeutics market, including from Johnson & Johnson’s (JNJ) Stelara, AbbVie Inc.’s (ABBV) Skyrizi/Rinvoq, Bristol Myers Squibb Company’s (BMY) Sotyktu, Novartis’ Cosentyx, and Eli Lilly’s Taltz.

Source: graph was made by Author based on 10-Qs and 10-Ks

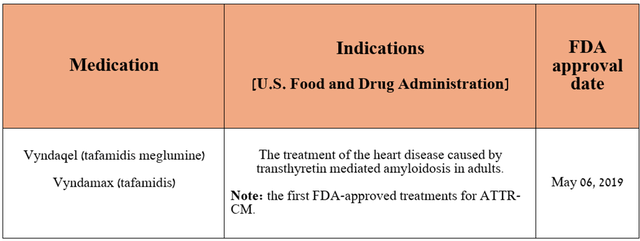

As you can see from the table above, 10% of Pfizer’s total revenue comes from the tafamidis franchise, which includes Vyndamax, Vyndaqel, and Vynmac. These medications are approved by regulators to treat transthyretin amyloid cardiomyopathy [ATTR-CM], a disease of the heart muscle.

Source: table was made by Author based on Pfizer press releases

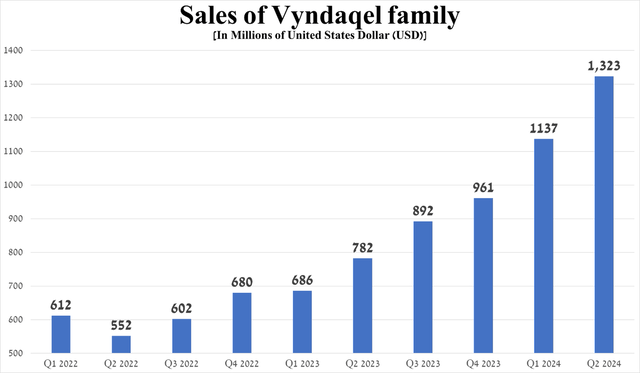

Vyndaqel family sales continue to beat my most optimistic expectations, even though ATTR-CM remains an underdiagnosed disorder. Overall, to get down to specific numbers, its revenue was $1.32 billion for the three months ended June 30, 2024, up 16.4% quarter-on-quarter and 69.2% year-on-year, driven by solid demand in North America and Japan.

Source: graph was made by Author based on 10-Qs and 10-Ks

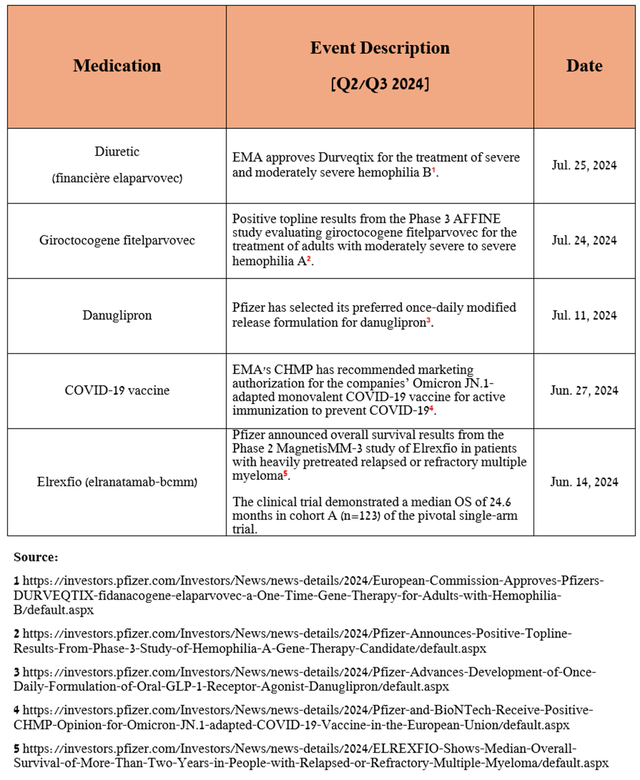

I also want to highlight the latest successes in the development of drugs within Pfizer’s business unit, including encouraging pharmacokinetic data for the once-daily formulation of danuglipron being developed for the treatment of type 2 diabetes, positive Phase 3 AFFINE study results evaluating the efficacy of giroctocogene fitelparvovec, being developed in partnership with Sangamo Therapeutics, Inc. (SGMO) for the treatment of hemophilia A, the EMA’s approval of Durveqtix for the treatment of hemophilia B, and the submission of an application for approval in the European Union for Ngenla, which is being developed in partnership with OPKO Health, Inc. (OPK) for the treatment of adult patients with growth hormone deficiency.

Source: table was made by Author based on Pfizer press releases

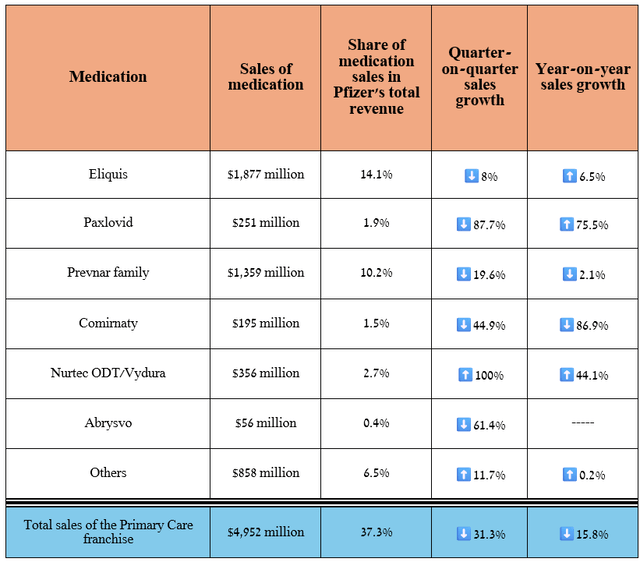

Before discussing the risks, I would like to highlight the progress of Pfizer’s Primary Care franchise.

Its total revenue was about $4.95 billion in the second quarter of 2024, down 15.8% year-over-year, mainly due to a sharp drop in demand for Comirnaty, a vaccine that protects against the COVID-19 virus.

Source: graph was made by Author based on 10-Qs and 10-Ks

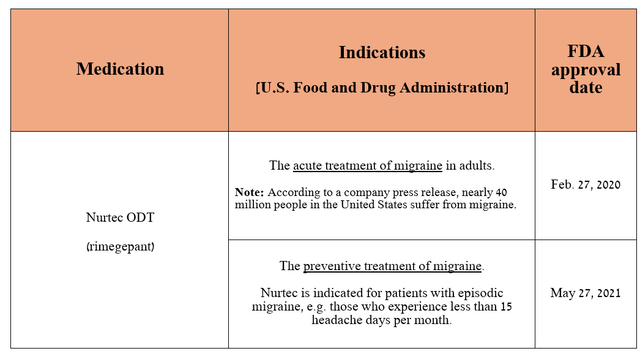

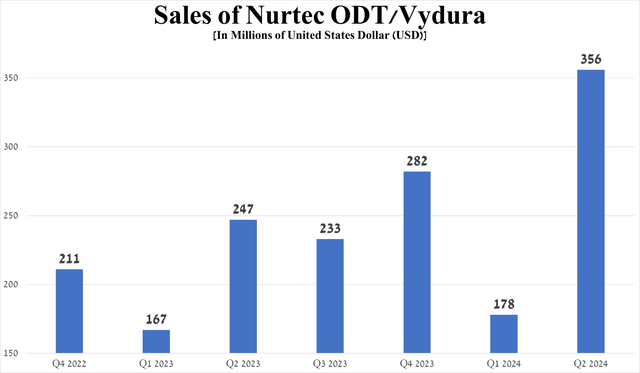

On the other hand, in addition to the year-on-year growth of Eliquis and Paxlovid, I would like to point out Nurtec ODT/Vydura (rimegepant), which remains Pfizer’s gem. It is a CGRP receptor antagonist used to prevent or treat migraines.

Source: table was made by Author based on Pfizer press releases

Its sales were $356 million for the three months ended June 30, 2024, up 100% quarter-on-quarter, due to the start of its commercialization in international markets, continued strong demand in the United States, expansion of the global migraine therapeutic market, and its oral route of administration, which makes it more attractive to patients than injectable CGRP inhibitors such as Eli Lilly’s Emgality, Amgen’s Aimovig, and Teva Pharmaceutical Industries Limited’s (TEVA) Ajovy.

Source: graph was made by Author based on 10-Qs and 10-Ks

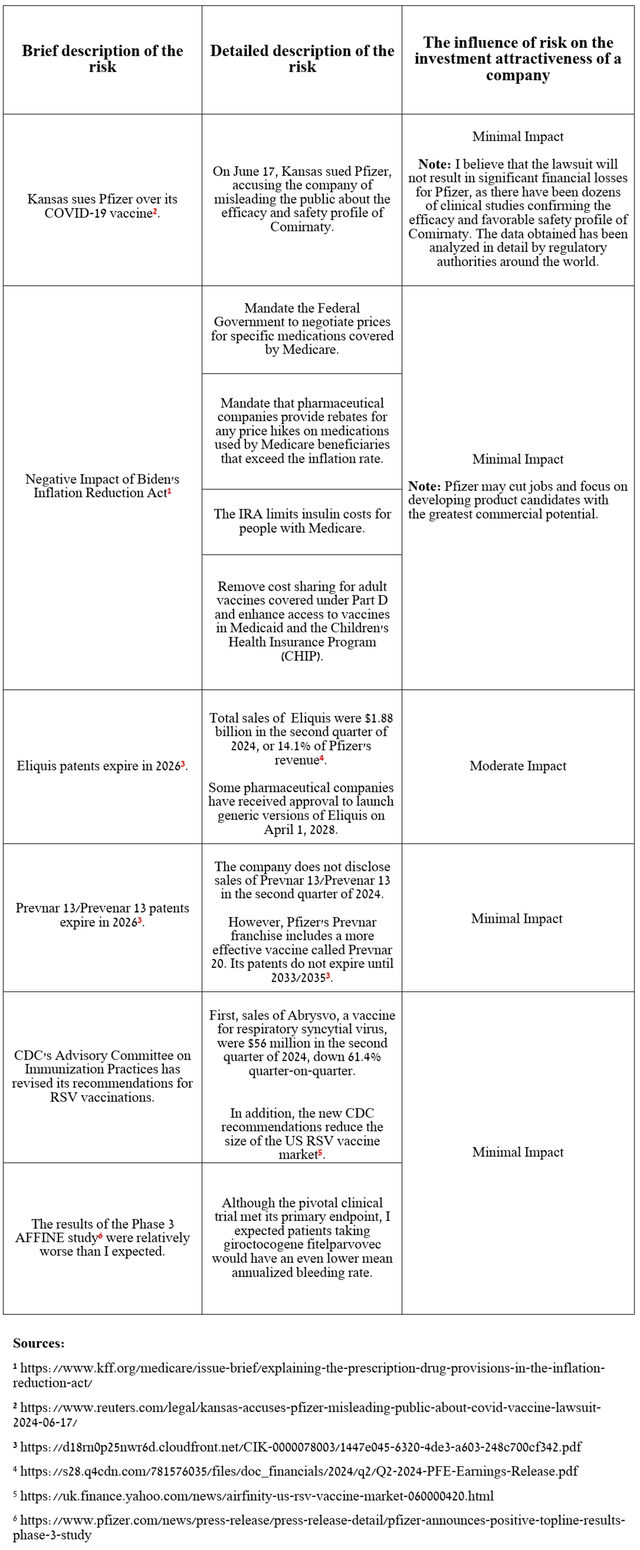

Risks

In addition to the risks outlined in my last article, I also want to point out that the narrowing of the CDC’s guidance regarding who should be vaccinated against respiratory syncytial virus [RSV], as well as weaker-than-expected data on the efficacy of its gene therapy in treating hemophilia A, are factors that may limit the long-term commercial potential of Abrysvo and giroctocogene fitelparvovec.

Source: table was made by Author

Takeaway

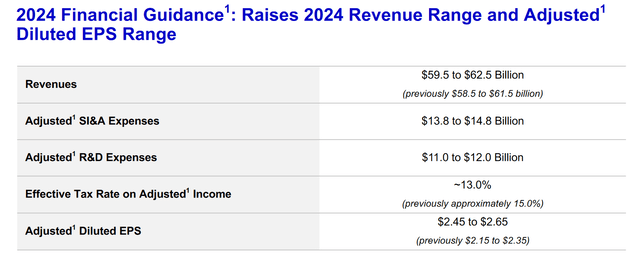

On July 30, Pfizer, which continues to excite the public mind even after the end of the COVID-19 pandemic, published financial results for the second quarter of 2024. The company, led by Albert Bourla, was able to not only beat analysts’ expectations, but also raised its full-year 2024 guidance. The results were helped due to the cost realignment program and stronger sales of its portfolio of antibody-drug conjugates, Lorbrena, Bosulif, Nurtec ODT, and the Vyndaqel family.

Additionally, I believe the company’s stock will continue to rally due to the progress made in the development of its pipeline of experimental drugs, including encouraging pharmacokinetic data for the once-daily formulation of danuglipron being developed for the treatment of obesity and type 2 diabetes, as well as the potential approval of Ngenla, a long-acting recombinant human growth hormone, by the EMA.

As a result, I continue to cover Pfizer with a ‘Buy’ rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.